Share this useful page:

The key rate is the interest rate on the main operations of the Bank of Russia (CB) to regulate the liquidity of the banking sector. It is the main indicator of monetary policy. It was introduced on September 13, 2013. Calculated in annual percentages.

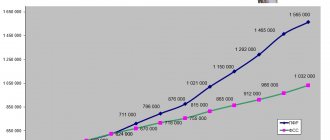

Key rate of the Central Bank of the Russian Federation – level in 2022

The last meeting of the Board of Directors of the Bank of Russia is dated December 18, 2022. It was decided to maintain the key rate. Thus, the key rate of the Central Bank of the Russian Federation for today 2020 is set at 4.25% .

It is important to note that the new parameter is valid not from the moment of its adoption, but from the next working day. Considering that June 25 and 26 are weekends, it can be applied from June 27. For example, to calculate penalties associated with taxation.

Key rate of the Bank of Russia from February 28, 2022

At an extraordinary meeting of the Board of Directors of the Bank of Russia, held on February 28, 2022, it was decided to increase the key rate to 20.0% per annum

This key rate will be valid until the date of the next meeting of the Board of Directors of the Bank of Russia.

The previous key rate of the Bank of Russia was 9.50% and its validity period lasted only 14 days (from 02/14/2022 to 02/27/2022).

When deciding to increase the key rate to 20.0% per annum, the Board of Directors of the Bank of Russia proceeded from the following:

External conditions for the Russian economy have changed dramatically.

An increase in the key rate will ensure an increase in deposit rates to the levels necessary to compensate for increased devaluation and inflation risks. This will help maintain financial and price stability and protect citizens’ savings from depreciation. The Bank of Russia will make further decisions on the key rate based on an assessment of risks from external and internal conditions and the reaction of financial markets to them and taking into account the actual and expected dynamics of inflation relative to the target, economic development over the forecast horizon.

The next meeting of the Board of Directors of the Bank of Russia, at which the issue of the level of the key rate will be considered, has not yet been scheduled. The time for publishing a press release on the decision of the Board of Directors of the Bank of Russia is 13:30 Moscow time

.

Key rate of the Central Bank of the Russian Federation - table of changes from 2013 to 2022

Previously, another single standard was in force in Russia - the refinancing rate. Key – implemented on September 13, 2013. It received its significance in January 2016. At this moment it was equated to the refinancing rate.

| Board meeting date | The established level of the key rate | Start date of the new level |

| 07/24/2020 | 4.25 (current level) (down by 0.25%) | 07/27/2020 |

| 06/19/2020 | 4.5 (down 1.0%) | 06/22/2020 |

| 04/24/2020 | 5.5 (lowered by 0.50%) | 04/27/2020 |

| 02/07/2020 | 6.0 (down 0.25%) | 02/10/2020 |

| 12/13/2019 | 6.25 (down 0.25%) | 12/16/2019 |

| October 25, 2019 | 6.5 (down 0.50%) | October 28, 2019 |

| 09/06/2019 | 7.0 (down 0.25%) | 09.09.2019 |

| 07/26/2019 | 7.25 (down 0.25%) | 07/29/2019 |

| 06/14/2019 | 7.5 (down 0.25%) | 06/17/2019 |

| 12/14/2018 | 7.75 (increased by 0.25%) | 12/17/2018 |

| 09/14/2018 | 7.50 (increased by 0.25%) | 09/17/2018 |

| 03/23/2018 | 7.25 (down 0.25%) | 03/26/2018 |

| 02/09/2018 | 7.5 (down 0.25%) | 02/12/2018 |

| 12/15/2017 | 7.75 (down 0.50%) | 12/18/2017 |

| October 27, 2017 | 8.25 (down 0.25%) | 10/30/2017 |

| 09/15/2017 | 8.5 (down 0.50%) | 09/18/2017 |

| 06/16/2017 | 9.0 (down 0.25%) | 06/19/2017 |

| 04/28/2017 | 9.25 (down 0.50%) | 05/02/2017 |

| 03/24/2017 | 9.75 (down 0.25%) | 03/27/2017 |

| 09/16/2016 | 10.0 (down 0.50%) | 09/19/2016 |

| 06/10/2016 | 10.5 (down 0.50%) | 06/14/2016 |

| 07/31/2015 | 11.00 (decreased by 0.50%) | 08/03/2015 |

| 06/15/2015 | 11.50 (down 1.0%) | 06/16/2015 |

| 04/30/2015 | 12.5 (down 1.5%) | 05/05/2015 |

| 03/13/2015 | 14.0 (down 1.0%) | 03/16/2015 |

| 01/30/2015 | 15.0 (down 2.0%) | 02/02/2015 |

| 12/16/2014 | 17.0 (increased by 6.5%) | 12/16/2014 |

| 12/11/2014 | 10.5 (increased by 1.0%) | 12/12/2014 |

| 05.11.2014 | 9.5 (increased by 1.5%) | 05.11.2014 |

| 07/25/2014 | 8.0 (increased by 0.50%) | 07/28/2014 |

| 04/25/2014 | 7.5 (increased by 0.50%) | 04/28/2014 |

| 03/03/2014 | 7.0 (increased by 1.5%) | 03/03/2014 |

| 09/13/2013 | 5,5 | 09/13/2013 |

History of changes in the table

Meetings of the Board of Directors of the Bank of Russia on monetary policy issues are held on Fridays. And if a decision is made to change the key rate from Monday of the following week after the decision, the changed key rate comes into force (Letter of the Bank of Russia dated July 19, 2017 N 20-ОЭ/15938).

Accordingly, the table below shows all the effective dates of the changed key rate.

| Effective date | Bid % |

| from February 28, 2022 | 20 |

| from February 14, 2022 | 9.5 |

| from December 20, 2022 | 8.5 |

| from October 25, 2022 | 7.5 |

| from September 13, 2022 | 6.75 |

| from July 26, 2022 | 6.5 |

| from June 15, 2022 | 5.5 |

| from April 26, 2022 | 5 |

| from March 22, 2022 | 4.5 |

Central Bank meeting on the key rate in 2022 – schedule

The decision to change the key rate is made by the Board of Directors of the Bank of Russia. Its meetings are scheduled for all 12 months. That is, the schedule for 2022 has been developed in advance.

| Date of the meeting of the Board of Directors of the Bank of Russia | Note |

| 02/07/2020 | It was decided to lower the rate by 0.25% |

| 03/20/2020 | It was decided to leave it at 6.0% |

| 04/24/2020 | It was decided to lower the rate by 0.50% |

| 06/19/2020 | It was decided to lower the rate by 1.0% |

| 07/24/2020 | It was decided to lower the rate by 0.25% |

| 09/18/2020 | Maintained at the same level |

| 10/23/2020 | Maintained at the same level |

| 12/18/2020 | Maintained at the same level |

It is important to note that meetings of the Board of Directors do not always take place according to schedule. They may be unplanned. In particular, such a case was recorded in 2014. When the key rate was urgently raised by 6.5 percentage points.

After this, a gradual decline has been observed since 2015. The regulator reduced it without sudden jerks. Mostly by 0.25-0.5%. Although with a slight fluctuation at the end of 2022, the downward trend in rates continued through 2022.

What does the key rate affect?

Two main directions can be distinguished. The first is the monetary policy in the country. In fact, the key rate of the Central Bank of the Russian Federation for today 2022 determines the cost of funds for credit institutions. The price of debt obligations provided to consumers and the profitability of deposits opened in the country’s banks depend on this.

The second is regulatory regulation. For example, the compensation that the employer must pay for delayed wages is calculated based on the key rate. The level in effect at the time of the delay is applied.

It can be noted that the list of application of the key rate in regulatory regulation is quite extensive. It is also used in calculating late fees on mortgage loans. The level in effect at the time the agreement was signed applies. Therefore, depending on the situation, not only the size of the rate for today, but also for past periods has an impact.

Key rate - forecast

It is impossible to provide a forecast for the key rate of the Central Bank of the Russian Federation with pinpoint accuracy, not only for 2022, but also for the next meeting of the Board of Directors. The reason is the information evaluated when making a decision. It includes four main points:

- Current inflation.

- Monetary policy of banks. In particular, the conditions for their products (deposits, loans, etc.).

- Activity of individuals and legal entities in the country's economy.

- Forecast of inflation risks.

Considering that only the Board of Directors has access to this information, it is impossible to predict their decision with guaranteed accuracy. Plus, it is important to understand the presence of possible disasters.

For example, after the meeting on February 7, 2022, there were no prerequisites for a rate increase. It was even assumed that it could be lowered. At the already familiar 0.25%. At the same time, sharp changes in micro and macroeconomics by mid-March 2022 turned the situation radically in the opposite direction.

In particular, it was expected that after March 20, the key rate of the Central Bank of the Russian Federation for today 2022 would be increased. Moreover, at a relatively significant level – 0.5%. Perhaps even greater. At the same time, the forecast was not confirmed. The board of directors left it at the same level.

Based on this, it is impossible to predict the final decision. Not only a month or a couple of weeks before the meeting on revising the key rate, but literally a couple of days before this moment. The most accurate forecasts can be announced literally a few hours before the meeting of the Board of Directors.

Information sources:

Official website of the Central Bank of the Russian Federation:

- Link;

- Link.

5 / 5 ( 2 voices)

about the author

Dmitry Sysoev - higher education in economics from Sumy National Agrarian University with a degree in Organization Management. Analyst of the banking sector and microfinance market. Experience working in specialized commercial structures - both banks and microfinance organizations. For more than 5 years, he has been creating useful content for consumers of financial services and organizations - information and analytical articles on the banking sector and the microfinance market. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

The Central Bank raised the key rate to 20%. What could this lead to?

On February 28, the Central Bank at an emergency meeting decided to increase the key rate from 9.5% to 20% per annum. Such a measure should lead to financial stability, but for now Russians have to monitor the sharp increase in mortgage and loan rates in different banks. About the current economic situation - in the material of the Svoykirovsky portal.

What the article says:

- All-time high

- How did banks react?

- A temporary solution and an uncertain future

All-time high

As follows from the open statement of the Central Bank, the reason for the sharp increase in the key rate – by 10.5 percentage points at once – was the “geopolitical situation”. Due to the introduction of sanctions, the Central Bank decided to compensate in this way for the increased risks of ruble devaluation and price increases.

“This will help maintain financial and price stability and protect citizens’ savings from depreciation,” the Central Bank said.

As financiers noted, the increase in the key rate to 20% became a historical maximum for our country. Prior to this, the record value was recorded in 2014 – then the rate reached 17% per annum.

On this topic

A financial expert named ways to get money abroad if it is on the card of a sanctioned bank

538

With economic stability, the Central Bank rate should be increased step by step - at a time the Central Bank can rise by a value in the range from 0.25 to 1 percentage point. But the first “bells” appeared back in 2021, when the Central Bank increased the rate to the maximum value (in total, the rate changed eight times in a year). In March last year it was 4.25% per annum, and in 2022 it was supposed to reach 5-6%, taking into account inflation.

How did banks react?

After the key rate was raised, ordinary citizens first of all began to wait for news about changes in the conditions for deposits, loans and mortgages. Within 24 hours after the Central Bank’s statement, many banks repeatedly reassured clients that sharp increases in loans were not expected. But on February 28, another anti-record was recorded - the dollar reached 113 rubles, and the euro jumped to 127 rubles. And although the situation stabilized a little the next day, Russian banks affected by the sanctions still decided to increase rates on mortgage programs and loans.

On this topic

Sberbank said that clients can safely withdraw funds from brokerage accounts

546

They have every right to do this - the Central Bank has suspended regulation of the full cost of loans until June 30, 2022. Now Russian banks will not limit what rates they offer on loans to the population. Although, by law, marginal rates for various types of loans for individuals should not be increased by more than a third of the percentage level set by the regulator quarterly.

So, February 28 Sberbank

officially made only a statement that he was not introducing changes to existing consumer and mortgage loans. On March 1, the bank adapted retail loan rates to market conditions - the mortgage rate for housing under construction and finished housing increased to 18.6%. No changes will be introduced for already issued consumer and mortgage loans, Sberbank assured.

– Rates under state support programs remain within the current level: “Mortgage for families with children”, “Far Eastern mortgage”, “State support 2020” and a number of other programs. Let us remind you that Sberbank clients can reduce the mortgage rate with electronic registration of the transaction, a down payment of 20%, as well as confirmation of income or part of it with an extract from the Pension Fund of the Russian Federation. In addition, the bank has rates starting from 0.1% for subsidy programs with developers, Sberbank confirmed to the Svoykirovsky portal.

On March 2, the bank’s press service said that the maximum rate on a SberVklad Prime deposit for a period of 1 to 3 months had increased to 21%. Classic SberVlad for the same period amounted to 20%.

From March 1, Pochta Bank also increased the maximum rate on the savings account balance to 18% per annum. From March 2, the rate on seasonal deposits will be significantly increased: up to 18% per annum for three months and up to 14% per annum for six months. Interest on the deposit will be paid at the end of the term; before that it will not be possible to withdraw or replenish the account.

Alfa Bank

in his telegram channel he also spoke about the increase in deposit rates from March 1.

– Starting tomorrow, we are raising rates on Alfa Deposit in rubles – immediately to 20% per annum. The minimum amount is only 10 thousand. A deposit can be opened anywhere – in the application, on the website and in branches,” the bank’s press service reported.

At the same time, several banks that fell under sanctions suspended accepting applications for loans due to a sharp increase in the key rate of the Central Bank. Among them are Gazprombank, Alfa-Bank, Otkritie, Sovcombank.

On this topic

VTB continues to service cards of foreign payment systems in Russia

438

the VTB press service

Back on February 28, they openly announced a sharp increase in mortgage rates. At the same time, bank representatives explained that for all previously issued loans, all conditions will remain unchanged, according to the agreements - “this is a legal requirement that applies to all banks in our country.”

– According to our own mortgage programs, the rate in new contracts rises by 4 percentage points, the minimum will be 15.3%, both for finished and for housing under construction. The validity period for a credit decision on new applications is now 30 days. For previously approved applications, decisions are valid until March 5 inclusive,” VTB clarified the Svoykirovsky portal. – We are keeping the conditions for preferential programs and the validity periods of decisions on them unchanged – the rate on mortgages with state support will still be from 5.75%, on “Far Eastern Mortgage” – 0.1%, on “Family” – from 4, 7%.

But the rate for approved loans will remain the same only if a loan agreement was concluded with the client before the Central Bank raised the key rate. The approved application cannot legally confirm and reserve the initial bid, Maxim Gomzyakov, the head of Svoykirovsky Legal, explained to the portal.

– An approved loan application is not actually a concluded agreement. This is only the bank’s consent to issue a loan - without signing and without accepting the conditions. That is, the bank’s right, not its obligation. The fundamental rate in this case will be the Central Bank rate that was set on the date of conclusion and signing of the loan agreement. Such conditions are placed in the documentation of each bank operating in the Russian Federation,” said Maxim Gomzyakov. – Only those borrowers with whom a loan agreement was concluded before the Central Bank established an increased rate will be able to receive loans at the lowest rate. Interest rates on previously issued loans can no longer rise.

A temporary solution and an uncertain future

As Kirov financier Konstantin Kropanev

, the current increase in the key rate in the economic climate is an inevitable decision, but what it may lead to in the future cannot yet be predicted.

– The current increase in the key rate has an exclusively short-term effect in terms of stabilizing exchange rates at current levels. If the Central Bank had not raised the key rate, we would now see the dollar exchange rate not at 100, but at 120-130 rubles,” says Konstantin Kropanev. “But to find out how this will affect our economy, we need to understand how long the Central Bank will keep the key rate at such a high level. If the general situation stabilizes (at least the panic in the dollar goes away), and in a month the key rate is reduced, then this will have virtually no effect on the economy. But if this key rate is left for a year, this will lead to an increase in rates on deposits and, accordingly, on loans.

At the same time, according to the forecasts of the Kirov financier, the increase in the Central Bank rate will primarily affect small and medium-sized businesses. If entrepreneurs are used to taking out loans at the level of 10-12%, then a rate of 25-30% will become almost unaffordable for their business.

The same opinion is shared by Igor Safonov

. He explained to Gazeta.ru journalists that the Central Bank’s decision will lead to an “inevitable adjustment” of rates across the entire line of credit and deposit products: rates on both deposits and loans will increase. It is still difficult to say whether the key rate will drop to its previous values, Safonov believes. The reaction of financial markets will be taken into account, as well as actual and expected inflation dynamics.

Photo: Svoykirovsky.rf

On this topic

753

Sberbank announced its withdrawal from the European market

Comments: 1

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article Dmitry Sysoev

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Alexey

01/18/2021 at 16:11 Cetelem Bank raised my interest rate on a car loan from 15% to 18.70% for refusing life insurance and intends to file a complaint with the Central Bank of the Russian Federation

Reply ↓