UPD form and its application

Federal Law No. 402-FZ “On Accounting” simplified the forms of primary accounting documents (PUD), but determined a list of mandatory details for them (Article 9 402-FZ), each fact of economic life is subject to mandatory registration.

The PUD details are:

- Name;

- Date of preparation;

- name of the economic entity of the compiler;

- content of the fact of the operation;

- the measurement value of the operation in physical and (or) monetary terms (indicating the units of measurement);

- the name of the position of the person who completed the transaction, operation and is responsible for the correctness of its execution;

- signatures of persons indicating last names and initials or other details necessary for their identification.

The form of the universal transfer document was developed by the Federal Tax Service based on the requirements of the accounting law No. 402-FZ and Government Decree No. 1137 and proposed for use by letter of the Federal Tax Service of Russia dated October 21, 2013 No. MMV-20-3 / [email protected] Rules for filling out UPD are relevant for the supply of goods and performance of work (services).

Taking into account the specifics of primary business papers, it is clear what forms the UPD combines - it is used instead of:

- waybill;

- invoices;

- act of acceptance and delivery of works (services).

IMPORTANT!

The form developed by the Federal Tax Service is recommended. The organization has the right to develop its own and approve it in its accounting policies. It is important to follow the rules for filling out the UPD in 2022 and use all the required details listed above.

In some Russian regions, there are special requirements for filling out a universal transfer deed established by local regulations. For example, in Bashkiria, as of December 1, 2020, it has been established that the parties to a transaction must fill out the UTD in a form that contains a special column 10b, which indicates the region of origin of the Russian product. If foreign products are supplied, column 10b is not filled in.

Is it possible to issue UTD in foreign currency?

The question of the possibility of reflecting transactions denominated in foreign currency in the UTD may raise serious doubts and lead the company to a complete refusal to use this form. Accounting legislation stipulates that primary accounting documentation is filled out in Russian currency. The Ministry of Finance has a strong opinion on this matter. At the same time, tax legislation establishes that filling out an invoice in foreign currency is acceptable.

Taking into account both of these facts, in practice it was decided that filling out the UTD in foreign currency is acceptable. But at the same time, the form should be supplemented with information about the cost of the transaction in rubles. To do this, you can supplement the table with the necessary columns.

Who uses UPD

Any organization, individual entrepreneurs, and even public sector employees have the right to use the universal primary system. It makes no difference which taxation regime an economic entity applies. The organizational and legal form, as well as the form of ownership, also does not matter. Use UPD when processing transactions:

- Sales (of goods, services, works).

- Transfer of property rights over the company's own assets.

- Registration of transactions regarding intermediary operations.

The list of operations and transactions is contained in the letter of the Federal Tax Service dated October 21, 2013 No. ММВ-20-3/ [email protected] UPD contains invoice details; organizations and individual entrepreneurs are allowed to use it on any form of taxation.

IMPORTANT!

Organizations and individual entrepreneurs that are not VAT payers are not required to pay this tax when applying the UTD form. For organizations that are on the general taxation system, the UTD, like an invoice, makes it possible to offset input VAT when paying to the budget.

It is important to use statuses “1” or “2” correctly:

- 1 - if it is necessary for the document to replace both the invoice and the primary document;

- 2 - the UPD invoice does not replace, it is only a replacement for the primary document.

IMPORTANT!

From 07/01/2021, if a seller sells a traceable product to an individual who purchases it for personal, non-business needs, he must still issue him an invoice or UPD with the details of the product sold.

UPD with status 1

Subsection with invoice

Line 1 Document number (in chronological order) and date of its preparation. The maximum period for issuing an invoice is five calendar days from the date of shipment of goods, provision of services, performance of work, transfer of property rights.

Lines 2, 2a and 2b Information about the seller: name, address, tax identification number and checkpoint.

Lines 3 and 4 Information about the shipper and consignee. The lines are filled in only when goods are sold. If the invoice is issued for services or work, a dash is added. If the organization is both a seller and a shipper, then write “aka” in line 3. If the consignee and the buyer are the same person, then indicate the name and address of the consignee (you cannot write “he”).

Line 5 Information about the payment order number. Filled out if there was an advance payment, i.e. in the invoice for the advance payment. If there was no prepayment or it was transferred on the day of shipment, a dash is added.

Lines 6, 6a and 6b Information about the seller. Fill in the same way as information about the buyer.

Line 7 Name and code of currency. An invoice is issued in foreign currency only if prices and calculations under the contract are expressed in it (Clause 7, Article 169 of the Tax Code of the Russian Federation).

Line 8 Government contract ID. Line 8 in the UPD is filled in only if you have the data. If not (that is, if you are not working with a contract, or your contract does not have an identifier), a dash is placed in the line.

Tabular part

A Table row number. You don't have to fill it out.

B Code of goods, works, services. For goods - article number, for work - code according to OKVED, for services - code according to OKUN. The code of goods, works, services in the UPD is given if you need to indicate tax benefits or other special conditions.

Columns 1, 1a and 2 Name of goods or description and units of measurement of work performed, services provided, property rights transferred. Column 1a contains the code of the type of goods according to the unified HS of the EAEU; from October 1, 2022, its completion is mandatory for goods exported from Russia to the EAEU states - to Belarus, Kazakhstan, Armenia or Kyrgyzstan (otherwise a dash is placed). The product code is taken from the reference book of HS codes (approved by decision of the Council of the Eurasian Economic Commission dated July 16, 2012 No. 54).

Column 3 Quantitative parameters of goods, works, services. If it is impossible to determine them, a dash is added.

Column 4 Price per unit of measurement (if it is possible to indicate it) without VAT.

Column 5 Cost of the total quantity of goods, work, services, transferred rights without VAT.

Column 6 Excise tax amount. To be completed only when selling excisable goods. Otherwise it is written “Without excise duty”.

Column 7 VAT rate. If the company is exempt under Article 145 of the Tax Code of the Russian Federation or in the case of issuing an invoice by companies that do not work with VAT, it is written “Without VAT”.

Column 8 VAT amount in rubles and kopecks without rounding. In the cases indicated above, it is written “Without VAT”.

Column 9 Cost of the entire quantity of goods (work, services, transferred rights) including VAT.

Columns 10, 10a, 11 Name of the country of origin and its OKSN code, customs declaration number. Filled out for imported goods. Attention! From October 1, 2022, the name of column 11 has changed. It is now called “Registration number of the customs declaration.”

Who signs the UPD? Find out by following the link >>

New requirements for UPD from July 1, 2022

From 01.07.2021, by Decree of the Government of the Russian Federation of 02.04.2021 No. 534, amendments were made to Government Decree No. 1137 on changing the form of the invoice. The UPD form now differs from the invoice in that a line is included in the invoice form for the purpose of tracking the goods. The invoice contains details that allow you to identify the document on the shipment of goods (on the performance of work, provision of services), on the transfer of property rights (subclause 4, clause 5, article 169 of the Tax Code of the Russian Federation).

The new procedure for issuing and receiving invoices is established by Order of the Ministry of Finance dated 02/05/2021 No. 14n. The update of the procedure is due to the introduction of a national system of mandatory traceability of goods.

If the UPD for July 2022 and subsequent months acts as an invoice (status “1”), it must be supplemented with page 5a “Shipment document No.”. Federal Tax Service specialists, in a letter dated June 17, 2021 No. ЗГ-3-3/ [email protected] , reminded that the UPD form is only recommended and taxpayers themselves make changes to it. But, for use simultaneously for the purpose of calculating income tax and settlements with the budget for VAT, it includes mandatory details.

On the new line indicate:

- number and date of the primary document (invoice or act);

- which lines this document belongs to (now in the invoice table the lines with different goods/services are numbered, column 1 with a serial number has been introduced).

If there are several lines in the tabular part of the UPD, all lines are indicated on page 5a and the details are repeated. With 10 pages of the document and number 1 dated 07/01/2021 in the UPD, page 5a is filled out as follows:

No. 1-10 N 1 dated 07/01/2021

IMPORTANT!

Organizations that, from July 1, 2021, carry out transactions with traceable goods, supplement the information in the UPD with the details contained in the invoice issued when carrying out transactions with goods subject to traceability.

In documents with status “2” a new line is not needed. When receiving an advance, you cannot use a universal transfer document, only an invoice.

replaces both the invoice and the primary document

How to start working with UPD?

You can start using UPD at any time during the year. The use of UPD will not affect the comparability of financial indicators and accounting methods, so there is no need to wait for the start of the next tax period (quarter or year) (Article 313 of the Tax Code of the Russian Federation, Part 7 of Article 8 of the Accounting Law).

If your accounting policy did not previously include UPD among the list of used forms of primary documents, you should supplement the accounting policy. To do this, it is necessary to issue an appropriate order. An addition is not a change in accounting policy, so you can add it at any time.

If the recommended form does not suit you, develop your own UPD form by analogy with it. In terms of invoice details, your UPD must correspond to the current invoice form. Do not change the composition and sequence of details of the invoice itself. For example, you should not add new columns between columns 1 - 11, change the names of columns and lines, or delete invoice details.

To avoid problems with the correct preparation of primary documentation, we recommend that you explain to responsible employees the procedure for filling out the UPD:

- who draws up the document and in how many copies;

- in what order and what fields of the document are filled in;

- in what time;

- What should the buyer's representatives fill out?

It is not necessary to warn counterparties about the use of UPD (with the exception of cases when the contract directly stipulates the list of primary documents used). As a rule, buyers do not object to UPD. If the document is drawn up correctly, there are no tax risks for them. But buyers may have questions when filling out your UPD form or other difficulties. We recommend that you resolve all issues in advance - before you begin to arrange the shipment of goods (delivery of work, services).

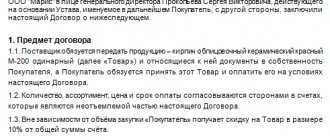

You can include a clause on the application of the UPD in the Supply Agreement. In this case, we recommend indicating how the UTD will be used: as an invoice and a primary document or only as a primary document.

The current legislation of the Russian Federation does not oblige the organization’s seal to be affixed to the UTD. You can stamp it as you wish. If you put a stamp that indicates your full name, then lines [14] and [19] of the UPD do not need to be filled in. The absence of a seal if all the required details are present in the UPD is not a violation, and also does not entail a denial of a deduction for a buyer under the UPD with status.

Electronic UTDs can be issued if the parties agree to their electronic exchange and have compatible technical means for this. UPD with status “1” is both a primary document and an invoice. And an electronic invoice can be issued only by mutual agreement of the parties if they have technical means (clause 1 of Article 169 of the Tax Code of the Russian Federation). UPD with status “2” is the primary accounting document. The exchange of primary electronic documents is not regulated by law. Since the buyer may not have the technical ability to process the seller’s documents, we recommend agreeing with the counterparty on the procedure for electronic document management, regardless of the UPD status. Consent to issuing electronic UPD can be issued in a similar way to consent to issuing electronic invoices: a clause in a contract, a separate agreement, by exchanging letters or in another way convenient for you. The electronic UPD must be compiled according to the Format approved by Order of the Federal Tax Service of Russia dated December 19, 2018 N ММВ-7-15/ [email protected]

Recommendations for filling out individual details of the form

The table shows the details, the use of which will ensure the correct completion of the UPD: pay attention to the column of recommendations and explanations.

| № Rows, graphs | UPD details | Possible meanings, recommendations and explanations |

| lines (1) – (7) columns 1–11 | — | For UPD with status “1”, they are filled out in accordance with Appendix No. 1 to the Decree of the Government of the Russian Federation of December 26, 2011 No. 1137. If invoices in an organization are signed by another person authorized to do so by an order (another administrative document) for the organization or a power of attorney on behalf of the organization, then the administrative document is indicated in the invoice or the position of the authorized person who signed the specific invoice is indicated. In the document, the content of the transaction in the UPD corresponds to the invoice. It is acceptable to supplement the indicators on pages (3) and (4) with information about the TIN, checkpoint of the consignor and TIN, checkpoint of the consignee. For a universal transfer document with status “2”, it is permissible to fill out pages (1), (1a), (2), (6), (7), columns 1, 2 or 2a, 3 and 9 in order to fulfill the requirements of clause 1 Art. 9 of the Federal Law of December 6, 2011 No. 402-FZ on the presence in the document of detailed information about the content of the fact of economic life and the value of natural and (or) monetary measurement. The standard UPD does not provide for filling out column 12, but if necessary, it is added based on the specifics of the transaction. Indicators that clarify the conditions for the fulfillment of a fact of economic life are reflected in pages (2a), (2b), (3), (4), (5), (6), (6a), (6b), columns (4), (5), (6), etc. |

| line [10] | Goods (cargo) transferred/ services, results of work, license passed | The instructions tell you how to correctly sign the UPD - indicate the position of the person who made the shipment and (or) the one who is authorized to act on the transaction of transfer of work results (services, property rights) on behalf of the economic entity; his signature indicating his last name and initials. The person authorized to act in a transaction on behalf of an economic entity is determined by the norms of the relevant chapters of the Civil Code of the Russian Federation. An indicator that specifies the circumstances of the operation (transaction). If this person is the one who is authorized to sign invoices and signed the document on behalf of the manager or chief accountant (up to line [8]), then only information about his position and full name is filled in without repeating the signature. |

| Line [13] | Responsible for the correct execution of the transaction, operation | The position of the person responsible for the correct execution of the transaction, operations on the part of the seller, his signature indicating the surname and initials. An indicator that allows you to determine who is responsible for processing the transaction. If the person responsible for processing the transaction is the one who made the shipment and (or) is authorized to act on the transaction on behalf of the economic entity (page [10]), then if there is a signature in line [10], only information about the position is filled in and full name without repeating the signature. If the person responsible for processing the transaction is the person authorized to sign invoices and signed the document on behalf of the manager or chief accountant (up to line [8]), then only information about his position and full name is filled in without repeating the signature. If, due to the document flow established in an economic entity, several persons are simultaneously responsible for the correct execution of the transaction, then an additional line must be entered into the document, for example, [13a] to indicate the position, full name and signature of the second person in charge. |

| Line [15] | Goods (cargo) received/ services, results of work, rights accepted | It is permissible to indicate the position of the person who received the cargo and (or) authorized to accept services, work results, rights under the transaction of transfer of work results (services, property rights), who put mandatory signatures in the UPD on the part of the buyer indicating the surname and initials. The person authorized to act in a transaction on behalf of an economic entity is determined by the norms of the relevant chapters of the Civil Code of the Russian Federation. An indicator that specifies the circumstances of the operation (transaction). |

| Line [18] | Responsible for the correct execution of the transaction, operation | The position of the person responsible for the correct execution of the transaction, operations on the part of the buyer, his signature indicating the surname and initials. An indicator that allows you to determine the person responsible for processing the transaction. If the person responsible for processing the transaction is a person authorized to act on the transaction on behalf of the economic entity (line [15]), then only information about the position and full name is filled in without repeating the signature. If, due to the document flow established in an economic entity, several persons are simultaneously responsible for the correct execution of the transaction, then an additional line must be entered into the document - for example, [18a] to indicate the position, full name and signature of the second responsible person. |

| M.P. | Seals of economic entities who compiled the document. This requirement is not legally required. The absence of a seal in the presence of all the mandatory details provided for in Article 9 of Law No. 402-FZ is not a basis for refusing to accept a document for tax registration. |

A sample form will help us understand how to fill out the form. Let's consider 2 examples: the first - when performing work and providing services.

How to fix errors in UPD?

In the course of activities, situations inevitably arise when errors are made in the primary documentation. The procedure for adjusting the UPD is not standard and depends on many factors, since this is not a typical primary document.

| Status | Location of error | Nature of the error | Correction procedure | Features of the fix |

| 1 | Regarding the Federation Council and the primary document | Prevents identification | It is mandatory to create a new document with status “1” | The number and date assigned before the adjustment are saved (line 1). The number and date of the correction are indicated (line 1a). Signed by authorized persons. |

| Does not interfere with identification | If necessary, a new document is created with status “2” | The number and date assigned before the adjustment are saved (line 1). The number and date of the correction are indicated (line 1a). Doesn't re-subscribe. | ||

| Only in part of the primary document | — | Let's accept the previous option or by direct editing | The correction in the original document is certified by the inscription “Corrected”, as well as the signature of authorized persons indicating the date of correction. | |

| 2 | Only in part of the primary document | — | Only by directly editing the document | The correction in the original document is certified by the inscription “Corrected”, as well as the signature of authorized persons indicating the date of correction. |

Please note that the nature of the error made in the document is determined from the point of view of a tax audit. Thus, identification is hampered by errors that distort information about the parties, the content or value of the transaction, the tax rate or the amount of tax.

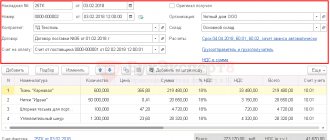

Examples of completed forms

When performing work and providing services

IMPORTANT!

Added line 5a “Shipping Document”.

When shipping goods

The second example of filling out the UPD is when shipping goods. To fill out a universal transfer document instead of a consignment note (TORG12), you need to change the status from “1” to “2” and leave the pages “Consignor and his address” (3) and “Consignee and his address” (4) blank.

IMPORTANT!

Line 5a is not added to such a document.

Document of the first status in the purchase/sales books, accounting journal

Knowing where the contract number is indicated in the UPD, what to write in the basis of the transfer, you should consider the rules for registering universal forms with the status value “1”.

On the selling side

When the transfer paper is drawn up during the delivery of commodity items, provision of services, re-registration of property rights, the moment of approval of the tax basis is considered the day of the business transaction.

Accounts are registered in the established chronological order in the first part of the ledger, according to the government decree of 2011. When generating the UTD document, the exact date is determined when the goods are to be received and transferred.

If the days of preparation and shipment coincide

In such a situation, when preparing the transfer documentation, the value of the first line is actual for sending and registering the invoice. They ship commodity items, provide services, or re-register rights to property at the same time. At the same time, the issuance of the s/f to the purchasing party is dated. The document is registered in the accounting book upon simultaneous delivery and the generation of documentary evidence in the form of an invoice.

When actions are performed at different times

In this case, the transfer paper is formed in a similar way. Line No. 1 indicates the day the UPD form was issued. In this case, the actual date of shipment is noted in the 11th. It is also the factual one, according to which the tax period is registered. The immediate moment of issuing a paper confirmation remains simply an indicator that simplifies identification.

Rules for filling out the UPD by the consignee (buying party)

Buyers also record invoices according to chronology. Only records are kept in the second part of the accounting journal. Registration is considered the day of signing an agreement for the supply of commodity items, provision of services, transfer of rights to property. The information is reflected in line No. 16.

In the purchase book, the consignee carries out registration actions in relation to accounts-f.

Is it necessary to put a stamp on the UPD?

Line 14 of the act indicates information about the business entity that took part in the preparation of documentation on the part of the seller or the executor of the contract. This may be the person keeping the accounting records on this side of the agreement, a commission agent, or an agent, if he fulfills his duties under the relevant agreements.

Line 19 indicates information about the business entity acting on the part of the buyer or customer, including information about who carries out accounting for it.

The answer to the question of whether it is necessary to put a stamp on the UPD is: no, this is not necessary for this accounting document. According to legal requirements, the moment when the UPD came into force is not determined by the presence of a seal on it. A correctly completed form is valid without it. Printing is optional for an invoice or primary accounting document. And its absence will not prevent either the deduction of VAT or the confirmation of expenses for income tax purposes.

However, the presence of a seal with the full name of the economic entity frees you from the need to fill out lines 14 and 19 of the UPD.