Purpose of maintaining an income book

The income book for individual entrepreneurs on a patent (KUD) is a tax register that is required to be maintained by every individual entrepreneur using a patent (PSN).

PSN can only be used by individual entrepreneurs. This tax system is not available to legal entities. It is characterized by the fact that the amount of tax does not depend on the income actually received by the businessman. It is calculated based on the potential income, the amount of which is fixed and established by the laws of the subjects.

The logical question becomes: why do we need a patent income book if the amount of tax does not depend on the amount of income?

The answer is given in paragraph 1 of Art. 346.53 Tax Code of the Russian Federation. We explain the purpose of maintaining a book of income on a patent.

The fact is that there are restrictions on the use of PSN. One of them is the limit on the income that can be received from applying a patent. The maximum possible income allowed under a patent is 60 million rubles from the beginning of the calendar year (subclause 1, clause 6, article 346.45 of the Tax Code of the Russian Federation). In this case, we mean the income actually received by the businessman.

Find out how to calculate the cost of a patent from the article “How to calculate the cost of a patent for 2021” .

To control the income limit, it is necessary to keep a book of income on a patent in 2022.

NOTE! The letter combination “KUDIR for individual entrepreneur on a patent” is well known. This is not entirely correct. KUDIR is a book for recording income and expenses; it is used under a simplified taxation system. For a patent, an income book is used under the patent taxation system. This is a completely different form.

From 2022, the patent can be reduced by insurance premiums. Many questions arise when filling out a notice for such a reduction. Sign up for a free trial access to the ConsultantPlus system and notifications filled out by experts.

How to fill out a ledger under the patent system

The patent tax system (PTS) is the most popular among individual entrepreneurs. It exempts individual entrepreneurs from filing reports, personal income tax, personal property tax, and paying VAT. All that is required of the entrepreneur is to buy the patent and keep a book of income. We tell you how to do it correctly.

The income ledger is the only document confirming that a person has the right to a patent. If the tax office records that the individual entrepreneur’s income has exceeded 60 million rubles since the calendar year, then the right to PSN will be lost.

The procedure for filling out the accounting book is described in Order of the Ministry of Finance of the Russian Federation No. 135 dated October 22, 2012. At the same time, another letter from this federal department (No. 03-11-11/62 dated February 11, 2013) allows individual entrepreneurs not to register an income book with the tax office. It is always kept by its “author”, that is, the entrepreneur, where he confirms his income with primary documents (cash receipt order, pay slips, etc.).

The law prohibits an entrepreneur on PSN only two things:

- extension of a started book under another patent: new patent - new book;

- lack of book. Tax liability is provided for in Art. 120 of the Tax Code of the Russian Federation. The fine can range from 10,000 to 30,000 rubles.

As specified in the above-mentioned letter of the Ministry of Finance of the Russian Federation No. 135, entries in the accounting book must be made strictly in chronological order, based on primary documents confirming the receipt of funds. It is advisable not to make mistakes or make blots. If this happens, the reason for each adjustment must be described and supported by a financial document.

All sections of the book must be filled out: in columns 1-3, details of primary documents confirming business transactions and their contents are entered. In the 4th column the amount of income from the type of business activity specified in the patent or patents is entered. Business income that does not fall under the PSN is not recorded in the book.

The law allows entrepreneurs to keep records both on paper and electronically. But even if the book is kept electronically, at the end of the tax period it must be “duplicated” on paper. Why do you need IP:

- print the book;

- number and sew the pages;

- on the last page indicate the number of pages;

- sign and, if available, stamp.

The income accounting book can be compiled in a single copy. The main thing is that it does not get lost: at the end of the tax period, the entrepreneur submits the register to the tax office for verification.

Nuances of maintaining CUD in the presence of several patents

A fairly common question from entrepreneurs is how to keep a book of income on a patent if a businessman has acquired several patents? Is it necessary to use a single book or is filling out the sole proprietor’s income book on a patent mandatory for each patent?

To answer the question of how to fill out a book of income on a patent if there are several patents, let’s turn to the purpose of filling it out.

The income limit for PSN is 60 million rubles for all types of business activities. And the book is needed precisely to control income! Therefore, if you have multiple patents, there is no need to maintain multiple books. The amount of income must be calculated in total for all activities transferred to the patent. Once the limit is exceeded, the right to all patents currently owned by the entrepreneur is lost.

IMPORTANT! When controlling the income limit when combining the simplified tax system and the special tax system, it is necessary to take into account both the income received under the special tax system and the income of the simplified tax system, that is, in total for both taxation systems.

Read about combining PSN and simplified taxation system in the article “Is it possible to combine simplified taxation system and simplified taxation system (examples)” .

Maintaining a single CUD per year for all patents meets the requirements of the Tax Code of the Russian Federation. However, this path is not always convenient for management accounting purposes, for which it would be more clear to maintain a CUD for each patent. This approach is not prohibited by the Tax Code of the Russian Federation.

How to correct errors in a book

In an e-book that has not yet been printed, it is enough to simply correct an incorrect entry. In paper or printed electronic form - carefully cross out the incorrect data and enter the correct data next to it, confirm the edit with the signature of the individual entrepreneur and seal (if any) and put the current date.

Additionally, prepare an accounting statement explaining what was wrong in the book and why you made the adjustment.

An example of an accounting certificate about correction in KUDiR

Type of KUD for individual entrepreneurs on PSN

The form of a sample income book for an individual entrepreneur on a patent has been introduced by law. The CUD was approved by order of the Ministry of Finance of Russia dated October 22, 2012 No. 135n in Appendix No. 3.

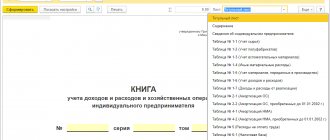

Download the patent income accounting book by clicking on the image below:

The KUD can be filled out both on a computer and on paper. But at the end of the tax period, the electronic version of the CUD is printed on paper, laced and the pages are numbered. The book must be certified by the taxpayer's signature.

KUD does not apply to registers submitted to the tax authority without fail at any frequency. But tax authorities may request the book during audits. What consequences are expected to arise if the entrepreneur does not have a sample book of income on a patent?

- fine under art. 120 of the Tax Code of the Russian Federation for a gross violation of the procedure for accounting for income and expenses (the lack of tax accounting registers is a gross violation) - 10,000 rubles (30,000 rubles if there is no CUD for several tax periods);

- the use by tax authorities of a calculation method for determining income to control the limit based on the data they have (subclause 7, clause 1, article 31 of the Tax Code of the Russian Federation)

We compare taxation systems when renting out an apartment in the article “Patent or personal income tax - which is more profitable when renting out an apartment?” .

What income and how to take it into account - we answer complex questions

The book itself looks simple, but there are still enough nuances to fill out. It is necessary to correctly determine when to take into account income, what documents to document them with, how to record advances, etc.

When to include income in the book

On the patent, the date of receipt of income is recognized (clause 2 of Article 346.53 of the Tax Code of the Russian Federation):

- for income in cash - the day the income is paid, including the transfer of income to a bank account or to the accounts of third parties on behalf of the individual entrepreneur;

- for income in kind - the day of transfer of income in kind;

- for other income - the day of receipt of other property (work, services), property rights, as well as repayment of debt (payment).

If the buyer pays by bill of exchange, the date of income will be the date of payment of the bill of exchange or the day the taxpayer transfers the bill of exchange under endorsement to a third party.

How often to make entries in the book

An entrepreneur must keep complete, continuous and reliable records of income (Order of the Ministry of Finance dated October 22, 2012 No. 135n). Untimely reflection will be considered a gross violation of the rules for accounting for income under Art. 120 Tax Code of the Russian Federation. Therefore, it is recommended to record income in the book on the date of actual receipt, but you can do this less often, for example, once a week. We do not recommend filling out the book once a month or quarter.

How to account for income in currency and in kind

Income in foreign currency is taken into account together with ruble income. In this case, income in foreign currency is recalculated into rubles at the official exchange rate of the Central Bank established on the date of receipt of income (clause 5 of Article 346.53 of the Tax Code of the Russian Federation).

If income is received in kind, take it into account at market prices. They are determined according to the rules of Art. 105.3 Tax Code of the Russian Federation.

How to take into account prepayments from buyers

Record the prepayment in the accounting book with the date on which you received the money. It is also taken into account to check compliance with the income limit for the application of PSN (Letter of the Ministry of Finance of Russia dated 02/03/2017 N 03-11-12/5800).

If you return the previously received advance payment to the buyer, then reduce the income of the tax period by the amount of the return (clause 4 of Article 346.53 of the Tax Code of the Russian Federation). To do this, make an entry in the income book for the date of return of the prepayment and enter the amount with a minus sign in column 4.

How to record transactions in the income book if there is no cash book

For individual entrepreneurs on a patent, a simplified procedure for cash transactions applies (clause 1 of the Central Bank Directive No. 3210-U dated March 11, 2014). Patents may not set a cash balance limit, not draw up cash receipts and expenses, and not maintain a cash book. But if you want to do it, then you can too - no one forbids it.

You can record income received through an online cash register in the accounting book in the following ways:

- on the basis of an accounting certificate for a day, a week or a month (quarter) based on revenue data from the OFD report;

- record each cash receipt in the book.

An accounting certificate is also a primary document if it contains all the details specified in Art. 9 of the Accounting Law.

Normative expert Svetlana Pyatovol believes that it is possible not to register every check in the accounting book: “All cash proceeds are recorded online through the OFD. In fact, with the introduction of online cash registers, registering checks in the accounting book only adds more work to the entrepreneur. What's the point? All OFD data still goes to the tax authorities. But since the Tax Code of the Russian Federation requires an entrepreneur to keep records of income on a patent in order to comply with the revenue limit, then, in my opinion, the reflection of income in the accounting book on the basis of an accounting certificate will not constitute a violation of the law.”

How to reflect income from non-cash payments in the book

If the buyer paid for the goods by bank transfer, he needs to be issued a cash receipt. The income will be the entire amount of the goods sold without reduction by the acquiring commission. For example, if you received a payment from a card in the amount of 10,000 rubles, but only received 9,800 into your account (minus the bank commission), then you still need to write down 10,000 rubles in the book.

Experts are divided on the date on which income should be reflected in the book. Some believe that this must be done on the date of receipt of money from the buyer to the account, referring to the letter of the Ministry of Finance dated 04/03/2009 No. 03-11-06/2/58. Another part believes that this position is outdated and does not apply to the patent in principle, therefore the date of issue of the cashier's check should be indicated in the book, regardless of what day the bank credits the proceeds to the account. But this only applies if payment for the goods has been made, a check has been issued to the buyer, and the money has been debited from his account.

In fact, many acquiring banks credit the proceeds to the current account on the same day on which the payment occurred, so there should not be a gap.

How to correctly enter data into the CUD for an individual entrepreneur on a patent

As we found out, it is better for entrepreneurs not to neglect the obligation to fill out the KUD, especially since this register does not cause any difficulties, since it is as simple as possible.

Below we will look at how to fill out the income book of an individual entrepreneur on a patent.

The register consists of two parts:

- title page;

- table showing income.

Title page

General information about the taxpayer is reflected here:

- Full name, TIN of the entrepreneur, his address and current account number.

- Subject where the patent was issued and its validity period (start date and end date). If there are several patents, we consider it correct to indicate the start date of the first patent and the expiration date of the last patent.

- Codes OKTMO and OKPO.

Income

Income is deposited in chronological order using the cash method, that is, as money is received at the cash desk, to the current account, or by the date of repayment of the debt in another way. The table reflects the following data:

- serial number;

- details of the primary document;

- Contents of operation;

- transaction amount.

At the end of the tax period, total income is calculated. The CUD does not reflect income received from activities subject to other taxes.

You will find a sample of filling out the income book of an individual entrepreneur on a patent at the link given above in the article.

How to fill out an income book on a patent

The income book for PSN is quite small. It consists of a title page and one table with information about income.

Please include the following information on the title page:

- about yourself - full name, tax identification number, address;

- patent - validity period and subject of the Russian Federation in which it was obtained;

- current accounts - account number and bank name;

- assigned codes - OKUD and the date for it do not need to be specified, and OKPO and OKATO can be quickly found out in the Kontur.Accounting service.

Find out OKPO and OKATO by INN

An example of the design of the title page of an income accounting book on a patent

Section I is the income table. Record in it all income from sales received from patent activities. So, you do not need to contribute the loan received or the advance payment returned by the buyer, or income from another business that you run on the simplified tax system or OSNO.

Record all income in strictly chronological order - from earliest to latest.

The section includes 4 columns:

- Column 1 is the serial number of the line in which you record income data.

- Column 2 - date and number of the primary document that confirms income. These can be payment orders, statements, cash register receipts, BSO, shift closure reports. For non-monetary income - an act of acceptance of property or an agreement on offset.

- Column 3 - the contents of the transaction, for example, “Payment was received for the transportation of cargo from Moscow to Ivanovo from Lyutik LLC.”

- Column 4 - the amount of income from the operation in rubles.

When you finish the book, use the last line to calculate your total income.

An example of the design of Section I of the income accounting book on a patent

Some nuances of working with KUD

The exact frequency of entering data into the CUD has not been established. With a small number of transactions, it is best to enter data for each income received, that is, for each transaction.

If the activity is related to retail trade, then it is irrational to enter each check into the CUD, since this is too labor-intensive a process. In this case, it would be correct to enter the total amount of revenue at the end of each day.

IMPORTANT! The use of online cash registers does not relieve the patentee from maintaining the CUD.

The income book reflects the entire volume of revenue, without excluding expenses from these amounts. For example, the bank commission for acquiring should also be included in the CUD.

In this regard, patent entrepreneurs often have problems confirming income for the purpose of receiving benefits and subsidies. The individual entrepreneur does not submit any declarations on the patent. There are no fields or lines for indicating expenses in the CUD, so you cannot reflect your real profit in the CUD. Based on this, theoretically, an income book can be provided to confirm your income, but the data indicated there will be interpreted not in favor of the taxpayer. How best to confirm your real income as an individual entrepreneur on PSN, you need to find out from the territorial social security authority.

We described what kind of reporting an individual entrepreneur submits on PSN in the article “Individual entrepreneur reporting on PSN - pros and cons .

Features of filling out the income book

When maintaining a register of financial transactions, an individual entrepreneur must take into account the following nuances:

- The entrepreneur’s income on the PSN is recorded in the CUD on the day the funds are received into the account or cash is received at the cash desk. If an individual entrepreneur was forced, for example, to return funds for some product, then the transaction with the amount with a minus sign is recorded in the line.

- An individual entrepreneur, unlike an LLC, has the right to use the money received for personal needs, so replenishing an account with your own money is not considered income and is not recorded in the accounting book.

- When the buyer transfers funds to the individual entrepreneur’s account, the bank charges a commission, and the entrepreneur receives an amount less than what was sent. In this case, the amount actually paid by the buyer must be recorded in the CUD.

For example: on December 12, 25,000 rubles were received into the individual entrepreneur’s current account. The commission that the bank withheld from the sender is 650 rubles. Consequently, the entrepreneur for December 12 will need to reflect income in the amount of 25,650 rubles - money received + commission.

- In the column “Date and number of the primary document” you need to enter data from the “primary”, but if there are many such documents, then it is permissible to indicate the date and range. For example: “05.25.2019 Bank orders No. 2-12.”

- The data in the “Content of transaction” column should clearly reflect the economic essence of the income received.

For example: “Receipt of funds to the current account for the specified and so on.

- Entries in the last column “Income” need to be made only in rubles and without rounding amounts. For example: "585.45".

Upon expiration of the patent, it is necessary to sum up the income received and record them in the line “Total for the tax period.”

Results

KUD for individual entrepreneurs on PSN is a mandatory tax register. If, at the request of the tax authorities, the income book is not provided, this will entail a fine. CUD is necessary to control the income limit for the purpose of applying PSN. It includes all income received within the framework of patent activity for the tax period.

Sources:

- Tax Code of the Russian Federation

- Order of the Ministry of Finance of Russia dated October 22, 2012 No. 135n

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Is it possible to keep an income book electronically?

Entrepreneurs are allowed to maintain CUD in both paper and electronic versions. An individual entrepreneur can choose a program or a special service for maintaining such records, and at the end of the tax period the book must be completely printed, laced and numbered, the Book must be signed and sealed (if any) on the last page.

If you choose the paper option of maintaining the register of transactions, then you must affix the document with a signature and seal (if any) before making the first entries in the CUD. There is no need to register the document with the tax office, however, Federal Tax Service employees may require you to present the KUD for verification.

What reporting is submitted when combining PSN with simplified tax system

Legislation obliges an entrepreneur combining PSN with another special regime to maintain separate tax records. For example, if an individual entrepreneur works on a patent tax system and a simplified tax system (STS), he is required to maintain separately:

- Book of income and expenses according to the simplified tax system;

- PSN income book.

An entrepreneur must attribute income to one or another type of activity. But with income, as a rule, everything is clear. Questions arise with costs. It happens that an entrepreneur cannot attribute any type of expense to the corresponding type of activity, for example, employee salaries, office rent. Such expenses have to be distributed in proportion to the income received from each type of activity separately.

An entrepreneur, when combining the special modes of the simplified tax system and the PSN, must, in addition to other reporting, submit a declaration under the simplified tax system. And one more very important point! Individual entrepreneurs have no right to reduce the tax on PSN by paid insurance premiums. But he can reduce the tax according to the simplified tax system by the entire amount of insurance premiums (Letter of the Ministry of Finance of Russia No. 03-11-11/19849 dated 04/07/2016).

Fines for violating the rules of conducting CUD

The absence of a Book, as well as incorrect entries in it, are regarded as a gross violation of income accounting rules. The Tax Code provides for the following sanctions for these offenses:

- 10,000 rubles - if the violation occurred during one tax period;

- 30,000 rubles - if the violation was repeated in several tax periods.

If the individual entrepreneur did not provide the KUD to the inspectors, but the document was subsequently “found”, then the fine will be significantly less - 200 rubles.

How long should you keep an income ledger?

According to the law, the document must be stored for at least 5 years, and the starting point will be January 1 of the year following the date when the maintenance of the KUD was completed. Before this date, the tax inspectorate has the right to request the Book for verification, and the entrepreneur is obliged to provide the document no later than 10 days after receiving the request from the Federal Tax Service. A five-year storage period for the CUD is necessary in case disputes arise in the future with tax authorities regarding the legality of conducting business or on some financial issues.

Is it necessary to certify the Income and Expense Accounting Book and submit it to the Federal Tax Service?

As a general rule, persons who keep records of income and expenses using the appropriate books are required to submit them to the Federal Tax Service, but at the request of the tax authorities. This rule is established by subparagraph 5 of paragraph 1 of Article 23 of the Tax Code and applies to individual entrepreneurs, private notaries, and lawyers who have established a law office.

Therefore, individual entrepreneurs on PSN must submit a book of income and expenses to the Federal Tax Service only if such a request is received from them. There are no other provisions obliging individual entrepreneurs using PSN to submit an income accounting book to the Federal Tax Service. The Ministry of Finance drew attention to this in a letter dated July 26, 2021 No. 03-11-06/59496.

Just as there are no rules obliging the tax authorities to certify the Book of Income and Expenses (letter of the Ministry of Finance dated February 11, 2013 No. 03-11-11/62).

Read more about how individual entrepreneurs on PSN fill out a ledger for accounting income and expenses in the berator “Practical Encyclopedia of an Accountant”

Filling out KUDIR under the simplified tax system Income minus expenses

Income in KUDIR is reflected in the same way, regardless of the selected simplified tax system option. But expenses are reflected in section I only under the simplified tax system: Income minus expenses. The list of expenses that can be taken into account in KUDIR is in Appendix 2 to the order of the Ministry of Finance of the Russian Federation dated October 22, 2012 No. 135n and in Art. 346.16 Tax Code of the Russian Federation. Since expenses reduce the tax base under the simplified tax system, tax authorities carefully check the company’s expenses and regularly issue letters and explanations: which expenses can be taken into account and which cannot. The general principle is that expenses can be accepted only if they are economically justified, documented and will generate income for the taxpayer.

When calculating the single tax, the payer of the simplified tax system can take into account material costs, labor costs and compulsory social insurance of employees and some other expenses. Each listed category of costs has its own characteristics, for example, costs for the purchase of goods fall into KUDIR only after they directly entered the warehouse, were paid to the supplier and sold to the buyer. Insurance premiums for employees under the simplified tax system. Income minus expenses do not reduce the calculated tax itself, but are included in the tax base as expenses in full.

Please note that personal expenses of an individual entrepreneur on the simplified tax system. Income minus expenses not directly related to making a profit cannot be entered into KUDIR.