Not much more than a month has passed since changes to the Tax Code of the Russian Federation came into force on August 19 of this year, which mainly affect tax periods, or, more precisely, their timing. Our domestic accountant is so accustomed to the fact that “everything changes” here that even talking about it is already boring - tired. We have to take it for granted, period. However, not everyone agrees with our humble opinion on this matter. By an “amazing” coincidence, almost all of our clients expressed extreme indignation at the upcoming changes. Which ones exactly? The answer to this question in this context is not so important, because the very fact of change is the main irritant. Well, for the sake of decency and our own health, let’s save the remaining nerve cells at our disposal and take a quick look at what our Legislator changed.

Read the article: “Firefighters don’t let you relax. What has changed in 69-FZ?

Article 55 of the Tax Code of the Russian Federation came under attack

The article on tax periods has become the subject of not very pleasant discussions on accounting forums. Users actively expressed their opinion in favor of the groundlessness of the innovations, which primarily affected:

- Actions against legal entities (creation, reorganization, liquidation);

- Obtaining and losing the status of an individual entrepreneur;

- Fulfillment by the subject of taxation of its obligations.

At the beginning of the year, many accountants and entrepreneurs had questions about how the quarter is calculated and how to correctly determine it when it comes to paying insurance premiums and paying taxes. Previously, the Tax Code of the Russian Federation recorded that if a legal entity is formed, reorganized or liquidated on other than the 1st day of the next month, then the quarter must be calculated by agreeing on the terms with the territorial tax authority to which the company is assigned. From paragraph 3.1 of Article 55 of the Tax Code of the Russian Federation, we can understand the essence as follows: “If an organization is created at least 10 days before the end of the quarter, the first tax period for it is the period from the date of creation to the end of the quarter in which it was created. If an organization is created less than 10 days before the end of the quarter, its first tax period will be the period from the date of creation to the end of the quarter following the quarter in which it was created.” It reads a little askew, but, excuse me, that’s our Tax Code. As for those taxes and contributions for which a periodicity was determined in the form of a month, the same rules previously applied to them as for quarterly ones, i.e. There was a need to agree on payment terms with the Federal Tax Service. Now the Legislator simplifies, as it seems to us, the task and determines that the first tax period will be considered the month in which the company was created (even if it is not complete). For example, Armatura-Fura LLC was included in the Unified State Register of Legal Entities on September 4, 2022. Consequently, she will need to pay taxes and contributions for September, taking into account the incomplete working month.

Of course, in Article 55 the Legislator did not ignore a topic that is important for many - tax periods for companies subject to liquidation or reorganization. As one of our clients wrote: “We could have come up with something better, otherwise we’re tired of it!” It will be quite difficult to join this comment, because... in this case, the actions of the Legislator are quite logical. Thus, during the liquidation or reorganization of a company, the Tax Service rejects the initiative of taxpayers to clarify tax periods, and recommends making payments for the full months and quarters when the company existed. Moreover, partial months must also be taken into account. If the organization was created in the third quarter and is reorganized in the same quarter, then again all days for this period must be taken into account.

Tax Code of the Russian Federation Article 55 Tax period

1. A tax period is understood as a calendar year or another period of time in relation to individual taxes, at the end of which the tax base is determined and the amount of tax payable is calculated. A tax period may consist of one or more reporting periods.

2. If an organization was created after the beginning of the calendar year, the first tax period for it is the period from the date of its creation to the end of the given year. In this case, the day of creation of the organization is recognized as the day of its state registration.

When an organization is created on a day falling within the time period from December 1 to December 31, the first tax period for it is the period from the date of creation to the end of the calendar year following the year of creation.

The rules provided for by this paragraph do not apply to determining the first tax period for corporate income tax for foreign organizations that independently recognized themselves as tax residents of the Russian Federation in the manner established by this Code, and whose activities on the date of such recognition did not lead to the formation of a permanent establishment in the Russian Federation .

3. If an organization was liquidated (reorganized) before the end of the calendar year, the last tax period for it is the period from the beginning of this year until the day the liquidation (reorganization) was completed.

If an organization created after the beginning of a calendar year is liquidated (reorganized) before the end of this year, the tax period for it is the period from the date of creation to the day of liquidation (reorganization).

If an organization was created on a day falling within the time period from December 1 to December 31 of the current calendar year, and was liquidated (reorganized) before the end of the calendar year following the year of creation, the tax period for it is the period from the date of creation to the day of liquidation ( reorganization) of this organization.

The rules provided for in this paragraph do not apply to organizations from which one or more organizations are separated or joined.

4. The rules provided for in paragraphs 2 and 3 of this article do not apply to those taxes for which the tax period is established as a calendar month or quarter. In such cases, when creating, liquidating, or reorganizing an organization, changes in individual tax periods are made in agreement with the tax authority at the place of registration of the taxpayer.

5. Lost power

6. If a tax resident of the Russian Federation independently recognizes itself as a foreign organization, the activities of which on the date of such recognition did not lead to the formation of a permanent representative office in the Russian Federation, the determination of the first tax period for corporate income tax is carried out in the manner established by this paragraph.

If a foreign organization independently recognized itself as a tax resident of the Russian Federation from January 1 of the calendar year in which it submitted an application to recognize itself as a tax resident of the Russian Federation, the first tax period for corporate income tax for it is the period from January 1 of the calendar year in which the said application has been submitted by the end of this calendar year.

If a foreign organization independently recognized itself as a tax resident of the Russian Federation from the date of submission to the tax authority of an application for recognition of itself as a tax resident of the Russian Federation, the first tax period for corporate income tax for it is the period from the date of submission of the specified application to the tax authority until the end of the calendar year , in which the said statement is presented.

Moreover, if the application of a foreign organization, specified in paragraph three of this paragraph, to recognize itself as a tax resident of the Russian Federation is submitted on a day falling on the period from December 1 to December 31, the first tax period for corporate income tax for it is the period from the date of submission of the said application to the tax authority before the end of the calendar year following the year in which the said application was submitted.

What about self-employed people?

As we understand from all of the above, the state has placed emphasis in changing tax periods on legal entities and individual entrepreneurs. If we do not go far beyond Article 55 of the Tax Code of the Russian Federation, then we have the opportunity to find information that affects self-employed persons. The question is, what could be difficult about taxing their activities? Several months ago, we already wrote about this category of people engaged in entrepreneurial activities, and came to the conclusion that dressing their work in the clothes of legislative norms and procedures is, to put it mildly, a “naive” enterprise. And yet, the Legislator tells us that registered self-employed persons (independent lawyers, appraisers, home hairdressers, tutors, etc.) will have to pay a single tax on their activities once a year. Accordingly, based on the day on which a person was registered with the INFS, from the same day his activity will be considered active and this means that he will be recalculated as for an incomplete year worked. Is it really illogical? In our opinion, this is quite fair.

Clause 3 of Article 55 of the Tax Code of the Russian Federation

When an organization is terminated through liquidation or reorganization (termination by an individual of activities as an individual entrepreneur), the last tax period for such an organization (such an individual entrepreneur) is the period of time from January 1 of the calendar year in which the organization was terminated (the state registration of the individual as an individual entrepreneur became invalid). individual entrepreneur), until the day of state registration of termination of the organization as a result of liquidation or reorganization (loss of validity of the state registration of an individual as an individual entrepreneur).

If an organization is created and terminated through liquidation or reorganization (state registration of an individual as an individual entrepreneur has been completed and has become invalid) during a calendar year, the tax period for such an organization (such an individual entrepreneur) is the period of time from the date of creation of the organization (state registration of an individual as an individual entrepreneur) until the day of state registration of termination of the organization as a result of liquidation or reorganization (loss of validity of the state registration of an individual as an individual entrepreneur).

If an organization is created (state registration of an individual as an individual entrepreneur is carried out) during the period from December 1 to December 31 of one calendar year and is terminated through liquidation or reorganization (state registration of an individual as an individual entrepreneur has become invalid) before the end of the calendar year following after the year of creation of the organization (state registration of an individual as an individual entrepreneur), the tax period for such an organization (such an individual entrepreneur) is the period of time from the date of creation of the organization (state registration of an individual as an individual entrepreneur) until the day of state registration of the termination of the organization as a result liquidation or reorganization (loss of validity of state registration of an individual as an individual entrepreneur).

(Clause as amended by Federal Law dated July 18, 2017 No. 173-FZ)

Why are we still indignant?

This question bothered us until we conducted a traditional short survey among our clients on . We started with a simple one: “Are you familiar with the essence of the changes in Article 55 of the Tax Code of the Russian Federation” and “How do you feel about them, if so”? Most, of course, are familiar with them, but only a few approve. The following clarifying question was answered approximately as follows:

“You see, they’re sitting there in their device and scribbling and scribbling some nonsense! Let people sit and work in peace. Well, this is some kind of nonsense! Why was it previously absolutely normal to call an inspector you know and find out in a human way when and what you need to pay? They told us! Everyone felt calm - them and us. But now they write, everything seems clear, but in reality questions arise again. For example, what is this “10 days before or 10 days after”? Fuck them! I’m retiring soon, I’m tired of all this.”

Read the article: “It’s time to rest. Sending an employee to retire"

Of course, it is difficult to take such an emotionally charged commentary, not supported by arguments, as the basis for all judgments, but it reflects the view of the majority of our colleagues on the essence of what is happening. And yet, is it worth it to “worry” so much, even with these innovations? Subjectively, let's say no. There are explanations for this. Firstly, the changes in Article 55 affect the non-standardized determination of tax periods when taxpayers are unable to determine them on their own or they are not sure of their own choice. The Tax Code of the Russian Federation actually tells all of us how exactly we need to act in the current situation, without allowing individual district inspectors to do this, whose opinions can vary not only within the region, but even within the same city. It is beneficial for the state, and simply necessary, that the procedure for paying taxes and contributions be as standardized as possible in principle. This time they found another loophole, and now it is closed. A month has passed, and negative comments have only just started pouring in. The most comical thing in this situation is that if we return to this topic, say, in a year, when additional changes to this article of the Code are possible, taxpayers will again criticize the Legislator. We assume it's all a matter of habit. Our respondent got used to calling the inspector, now he will get used (if he does not retire) to the new order. Innovation is still hard for us – that’s a fact.

Read the article: “1C on the server or in the cloud? Let's get to the heart of the matter."

Clause 3.1 of Article 55 of the Tax Code of the Russian Federation

If, in accordance with Part Two of this Code, a quarter is recognized as the tax period for the relevant tax, the start and end dates of the tax period are determined taking into account the provisions established by this paragraph and paragraph 3.2 of this article.

If an organization is created (state registration of an individual as an individual entrepreneur is carried out) at least 10 days before the end of the quarter, the first tax period for such an organization (such an individual entrepreneur) is the period of time from the date of creation of the organization (state registration of an individual as an individual entrepreneur) until the end of the quarter in which the organization was created (state registration of an individual as an individual entrepreneur was carried out).

If an organization is created (state registration of an individual as an individual entrepreneur is carried out) less than 10 days before the end of the quarter, the first tax period for such an organization (such an individual entrepreneur) is the period of time from the date of creation of the organization (state registration of an individual as an individual entrepreneur ) until the end of the quarter following the quarter in which the organization was created (state registration of an individual as an individual entrepreneur was carried out).

(Clause introduced - Federal Law dated July 18, 2017 No. 173-FZ)

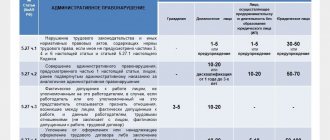

How will they be punished?

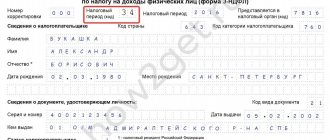

In the regulatory framework, we did not come across any separate footnotes that would relate specifically to current changes, however, regarding the issue of responsibility for the timely payment of contributions and taxes, companies need to focus on Articles 227, 214, 226, 228 of the Tax Code of the Russian Federation. In particular, they touch upon the topic of paying personal income tax. As for property tax, we recommend that you read the texts of Articles 75, 116 and 122 of the Tax Code of the Russian Federation. We dare to assume that any changes, even objectively positive for the taxpayer, may be aimed at obtaining benefits for the state in the form of imposing fines for violating new regulations. We advise our readers to focus on this position, so as not to waste their nerves, money and energy on the traps set by the Legislator. In any case, no one canceled the real possibility of calling your INFS department and not the same “well-known” inspector and asking him, as they say, “first-hand” how the tax period will now be determined. In particular, such consultation can be useful for young accountants who, having not had time to get used to one work pattern, are forced to switch to new settings.

Article 55 of the Tax Code of the Russian Federation. Tax period (current version)

1. A tax period is understood as a calendar year or another period of time in relation to individual taxes, at the end of which the tax base is determined and the amount of tax payable is calculated. A tax period may consist of one or more reporting periods, taking into account the features established by this article.

2. If, in accordance with part two of this Code, the tax period for the relevant tax is recognized as a calendar year, the start and end dates of the tax period are determined taking into account the provisions established by this paragraph and paragraph 3 of this article.

If an organization is created (state registration of an individual as an individual entrepreneur is carried out) during the period from January 1 to November 30 of one calendar year, the first tax period for such an organization (such an individual entrepreneur) is the period of time from the date of creation of the organization (state registration of an individual as an individual entrepreneur) until December 31 of this calendar year.

If an organization is created (state registration of an individual as an individual entrepreneur is carried out) during the period from December 1 to December 31 of one calendar year, the first tax period for such an organization (such an individual entrepreneur) is the period of time from the date of creation of the organization (state registration of an individual as an individual entrepreneur) until December 31 of the calendar year following the year of creation of the organization (state registration of an individual as an individual entrepreneur).

The rules provided for by this paragraph do not apply to determining the first tax period for corporate income tax for foreign organizations that independently recognized themselves as tax residents of the Russian Federation in the manner established by this Code, and whose activities on the date of such recognition did not lead to the formation of a permanent establishment in the Russian Federation .

3. When an organization is terminated through liquidation or reorganization (termination by an individual of activities as an individual entrepreneur), the last tax period for such an organization (such an individual entrepreneur) is the period of time from January 1 of the calendar year in which the organization was terminated (the state registration of the individual became invalid as an individual entrepreneur), until the day of state registration of termination of the organization as a result of liquidation or reorganization (loss of validity of the state registration of an individual as an individual entrepreneur).

If an organization is created and terminated through liquidation or reorganization (state registration of an individual as an individual entrepreneur has been completed and has become invalid) during a calendar year, the tax period for such an organization (such an individual entrepreneur) is the period of time from the date of creation of the organization (state registration of an individual as an individual entrepreneur) until the day of state registration of termination of the organization as a result of liquidation or reorganization (loss of validity of the state registration of an individual as an individual entrepreneur).

If an organization is created (state registration of an individual as an individual entrepreneur is carried out) during the period from December 1 to December 31 of one calendar year and is terminated through liquidation or reorganization (state registration of an individual as an individual entrepreneur has become invalid) before the end of the calendar year following after the year of creation of the organization (state registration of an individual as an individual entrepreneur), the tax period for such an organization (such an individual entrepreneur) is the period of time from the date of creation of the organization (state registration of an individual as an individual entrepreneur) until the day of state registration of the termination of the organization as a result liquidation or reorganization (loss of validity of state registration of an individual as an individual entrepreneur).

3.1. If, in accordance with Part Two of this Code, a quarter is recognized as the tax period for the relevant tax, the start and end dates of the tax period are determined taking into account the provisions established by this paragraph and paragraph 3.2 of this article.

If an organization is created (state registration of an individual as an individual entrepreneur is carried out) at least 10 days before the end of the quarter, the first tax period for such an organization (such an individual entrepreneur) is the period of time from the date of creation of the organization (state registration of an individual as an individual entrepreneur) until the end of the quarter in which the organization was created (state registration of an individual as an individual entrepreneur was carried out).

If an organization is created (state registration of an individual as an individual entrepreneur is carried out) less than 10 days before the end of the quarter, the first tax period for such an organization (such an individual entrepreneur) is the period of time from the date of creation of the organization (state registration of an individual as an individual entrepreneur ) until the end of the quarter following the quarter in which the organization was created (state registration of an individual as an individual entrepreneur was carried out).

3.2. When an organization is terminated through liquidation or reorganization (termination by an individual of activities as an individual entrepreneur), the last tax period for such an organization (such an individual entrepreneur) is the period of time from the beginning of the quarter in which the organization was terminated (the state registration of the individual as an individual entrepreneur expired ), until the day of state registration of termination of the organization as a result of liquidation or reorganization (loss of validity of the state registration of an individual as an individual entrepreneur).

If an organization is created and terminated through liquidation or reorganization (state registration of an individual as an individual entrepreneur is carried out and becomes invalid) in one quarter, the tax period for such an organization (such an individual entrepreneur) is the period of time from the date of creation of the organization (state registration of an individual in as an individual entrepreneur) until the day of state registration of termination of the organization as a result of liquidation or reorganization (loss of validity of the state registration of an individual as an individual entrepreneur).

If an organization is created (state registration of an individual as an individual entrepreneur is carried out) less than 10 days before the end of the quarter and is terminated through liquidation or reorganization (state registration of an individual as an individual entrepreneur has become invalid) before the end of the quarter following the quarter in which an organization has been created (state registration of an individual as an individual entrepreneur has been carried out), the tax period for such an organization (such an individual entrepreneur) is the period of time from the date of creation of the organization (state registration of an individual as an individual entrepreneur) until the day of state registration of the termination of the organization as a result of liquidation or reorganization (loss of validity of state registration of an individual as an individual entrepreneur).

3.3. If, in accordance with part two of this Code, the tax period for the relevant tax is recognized as a calendar month, the start and end dates of the tax period are determined taking into account the provisions established by this paragraph and paragraph 3.4 of this article.

When creating an organization (state registration of an individual as an individual entrepreneur), the first tax period for such an organization (such an individual entrepreneur) is the period of time from the date of creation of the organization (state registration of an individual as an individual entrepreneur) until the end of the calendar month in which the organization was created (state registration of an individual as an individual entrepreneur has been carried out).

3.4. When an organization is terminated through liquidation or reorganization (termination by an individual of activities as an individual entrepreneur), the last tax period for such an organization (such an individual entrepreneur) is the period of time from the beginning of the calendar month in which the organization was terminated (the state registration of the individual as an individual became invalid entrepreneur), until the day of state registration of termination of the organization as a result of liquidation or reorganization (loss of validity of the state registration of an individual as an individual entrepreneur).

If an organization is created and terminated through liquidation or reorganization (state registration of an individual as an individual entrepreneur is completed and becomes invalid) in one calendar month, the tax period for such an organization (such an individual entrepreneur) is the period of time from the date of creation of the organization (state registration of an individual as an individual entrepreneur) until the day of state registration of termination of the organization as a result of liquidation or reorganization (loss of validity of the state registration of an individual as an individual entrepreneur).

3.5. For the purpose of fulfilling the duties of a tax agent for personal income tax and for the purpose of determining the calculation period for insurance premiums, the start and end dates of the tax (settlement) period are determined taking into account the provisions established by this paragraph.

When creating an organization (state registration of an individual as an individual entrepreneur), the first tax (settlement) period for such an organization (such an individual entrepreneur) is the period of time from the date of creation of the organization (state registration of an individual as an individual entrepreneur) until the end of the calendar year, in in which the organization was created (state registration of an individual as an individual entrepreneur was carried out).

When registering with the tax authority a lawyer, mediator, notary engaged in private practice, arbitration manager, appraiser, patent attorney and other persons engaged in private practice in accordance with the legislation of the Russian Federation, the first billing period for such persons is the period of time from the date of registration registered with the tax authority before the end of the calendar year in which such persons were registered with the tax authority.

When an organization is terminated through liquidation or reorganization (termination by an individual of activities as an individual entrepreneur), the last tax (settlement) period for such an organization (such an individual entrepreneur) is the period of time from the beginning of the calendar year until the day of state registration of the termination of the organization as a result of liquidation or reorganization ( loss of validity of state registration of an individual as an individual entrepreneur).

When a lawyer, mediator, notary engaged in private practice, arbitration manager, appraiser, patent attorney and other persons engaged in private practice in accordance with the legislation of the Russian Federation are deregistered with the tax authority, the last billing period for such persons is the period of time from the beginning of the calendar year. years before the date of deregistration of such persons with the tax authority.

If an organization is created and terminated through liquidation or reorganization (state registration of an individual as an individual entrepreneur has been completed and has become invalid) during a calendar year, the tax (settlement) period for such an organization (such an individual entrepreneur) is the period of time from the date of creation of the organization (state registration of an individual as an individual entrepreneur) until the day of state registration of termination of the organization as a result of liquidation or reorganization (loss of validity of the state registration of an individual as an individual entrepreneur).

If registration and deregistration with the tax authority of a lawyer, mediator, notary engaged in private practice, arbitration manager, appraiser, patent attorney and other persons engaged in private practice in accordance with the legislation of the Russian Federation were carried out during the calendar year, the billing period for such persons is the period of time from the date of registration with the tax authority until the day such persons are deregistered with the tax authority.

4. The rules provided for in paragraphs 2 - 3.4 of this article do not apply to taxes paid in accordance with the special tax regimes provided for in Chapters 26.1, 26.2 and 26.5 of this Code.

5. Lost force on January 1, 2007. — Federal Law of July 27, 2006 N 137-FZ.

6. If a tax resident of the Russian Federation independently recognizes itself as a foreign organization, the activities of which on the date of such recognition did not lead to the formation of a permanent representative office in the Russian Federation, the determination of the first tax period for corporate income tax is carried out in the manner established by this paragraph.

If a foreign organization independently recognized itself as a tax resident of the Russian Federation from January 1 of the calendar year in which it submitted an application to recognize itself as a tax resident of the Russian Federation, the first tax period for corporate income tax for it is the period from January 1 of the calendar year in which the said application has been submitted by the end of this calendar year.

If a foreign organization independently recognized itself as a tax resident of the Russian Federation from the date of submission to the tax authority of an application for recognition of itself as a tax resident of the Russian Federation, the first tax period for corporate income tax for it is the period from the date of submission of the specified application to the tax authority until the end of the calendar year , in which the said statement is presented.

Moreover, if the application of a foreign organization, specified in paragraph three of this paragraph, to recognize itself as a tax resident of the Russian Federation is submitted on a day falling on the period from December 1 to December 31, the first tax period for corporate income tax for it is the period from the date of submission of the said application to the tax authority before the end of the calendar year following the year in which the said application was submitted.

7. Lost power. — Federal Law of July 18, 2017 N 173-FZ.

Recommendations

By tradition, we would like to recommend our readers to closely monitor changes in legislation, as well as how this or that topic develops after the next changes come into force. It happens too often that the Legislator begins to “back down” when he realizes that the new order is “stalling.” One way or another, there is no point in giving employees of the Federal Tax Service and other government agencies a reason to convict you of violating the law. Here it’s better to come to terms and work under new conditions, which, unfortunately, cannot be avoided.

We wish you success! Good luck!

Clause 3.2 of Article 55 of the Tax Code of the Russian Federation

When an organization is terminated through liquidation or reorganization (termination by an individual of activities as an individual entrepreneur), the last tax period for such an organization (such an individual entrepreneur) is the period of time from the beginning of the quarter in which the organization was terminated (the state registration of the individual as an individual entrepreneur expired ), until the day of state registration of termination of the organization as a result of liquidation or reorganization (loss of validity of the state registration of an individual as an individual entrepreneur).

If an organization is created and terminated through liquidation or reorganization (state registration of an individual as an individual entrepreneur is carried out and becomes invalid) in one quarter, the tax period for such an organization (such an individual entrepreneur) is the period of time from the date of creation of the organization (state registration of an individual in as an individual entrepreneur) until the day of state registration of termination of the organization as a result of liquidation or reorganization (loss of validity of the state registration of an individual as an individual entrepreneur).

If an organization is created (state registration of an individual as an individual entrepreneur is carried out) less than 10 days before the end of the quarter and is terminated through liquidation or reorganization (state registration of an individual as an individual entrepreneur has become invalid) before the end of the quarter following the quarter in which an organization has been created (state registration of an individual as an individual entrepreneur has been carried out), the tax period for such an organization (such an individual entrepreneur) is the period of time from the date of creation of the organization (state registration of an individual as an individual entrepreneur) until the day of state registration of the termination of the organization as a result of liquidation or reorganization (loss of validity of state registration of an individual as an individual entrepreneur).

(Clause introduced - Federal Law dated July 18, 2017 No. 173-FZ)

Tax Code of the Russian Federation, Article 55 of the Tax Code of the Russian Federation

1. A tax period is understood as a calendar year or another period of time in relation to individual taxes, at the end of which the tax base is determined and the amount of tax payable is calculated. A tax period may consist of one or more reporting periods.

2. If an organization was created after the beginning of the calendar year, the first tax period for it is the period from the date of its creation to the end of the given year. In this case, the day of creation of the organization is recognized as the day of its state registration.

When an organization is created on a day falling within the time period from December 1 to December 31, the first tax period for it is the period from the date of creation to the end of the calendar year following the year of creation.

The rules provided for by this paragraph do not apply to determining the first tax period for corporate income tax for foreign organizations that independently recognized themselves as tax residents of the Russian Federation in the manner established by this Code, and whose activities on the date of such recognition did not lead to the formation of a permanent establishment in the Russian Federation .

3. If an organization was liquidated (reorganized) before the end of the calendar year, the last tax period for it is the period from the beginning of this year until the day the liquidation (reorganization) was completed.

If an organization created after the beginning of a calendar year is liquidated (reorganized) before the end of this year, the tax period for it is the period from the date of creation to the day of liquidation (reorganization).

If an organization was created on a day falling within the time period from December 1 to December 31 of the current calendar year, and was liquidated (reorganized) before the end of the calendar year following the year of creation, the tax period for it is the period from the date of creation to the day of liquidation ( reorganization) of this organization.

The rules provided for in this paragraph do not apply to organizations from which one or more organizations are separated or joined.

4. The rules provided for in paragraphs 2 and 3 of this article do not apply to those taxes for which the tax period is established as a calendar month or quarter. In such cases, when creating, liquidating, or reorganizing an organization, changes in individual tax periods are made in agreement with the tax authority at the place of registration of the taxpayer.

5. Lost force on January 1, 2007. — Federal Law of July 27, 2006 N 137-FZ.

6. If a tax resident of the Russian Federation independently recognizes itself as a foreign organization, the activities of which on the date of such recognition did not lead to the formation of a permanent representative office in the Russian Federation, the determination of the first tax period for corporate income tax is carried out in the manner established by this paragraph.

If a foreign organization independently recognized itself as a tax resident of the Russian Federation from January 1 of the calendar year in which it submitted an application to recognize itself as a tax resident of the Russian Federation, the first tax period for corporate income tax for it is the period from January 1 of the calendar year in which the said application has been submitted by the end of this calendar year.

If a foreign organization independently recognized itself as a tax resident of the Russian Federation from the date of submission to the tax authority of an application for recognition of itself as a tax resident of the Russian Federation, the first tax period for corporate income tax for it is the period from the date of submission of the specified application to the tax authority until the end of the calendar year , in which the said statement is presented.

Moreover, if the application of a foreign organization, specified in paragraph three of this paragraph, to recognize itself as a tax resident of the Russian Federation is submitted on a day falling on the period from December 1 to December 31, the first tax period for corporate income tax for it is the period from the date of submission of the said application to the tax authority before the end of the calendar year following the year in which the said application was submitted.

7. The rules provided for in this article also apply to the calculation period for insurance premiums.

Clause 3.4 of Article 55 of the Tax Code of the Russian Federation

When an organization is terminated through liquidation or reorganization (termination by an individual of activities as an individual entrepreneur), the last tax period for such an organization (such an individual entrepreneur) is the period of time from the beginning of the calendar month in which the organization was terminated (the state registration of the individual as an individual became invalid entrepreneur), until the day of state registration of termination of the organization as a result of liquidation or reorganization (loss of validity of the state registration of an individual as an individual entrepreneur).

If an organization is created and terminated through liquidation or reorganization (state registration of an individual as an individual entrepreneur is completed and becomes invalid) in one calendar month, the tax period for such an organization (such an individual entrepreneur) is the period of time from the date of creation of the organization (state registration of an individual as an individual entrepreneur) until the day of state registration of termination of the organization as a result of liquidation or reorganization (loss of validity of the state registration of an individual as an individual entrepreneur).

(Clause introduced - Federal Law dated July 18, 2017 No. 173-FZ)