The consignment note is one of the main primary accompanying documents and is issued whenever the goods are transferred from the seller to the buyer. It can be used both between two organizations and between a legal entity and an individual. The use of this document is widespread, since it is in use at many enterprises where goods are released.

- Form and sample

- Online viewing

- Free download

- Safely

FILES

Why do you need a bill of lading?

A consignment note is required for all participants in a purchase and sale transaction. Using this document, the buyer can check the unloaded products (quantity, volume, quality, etc.) with the information provided in it, and the seller can take into account the goods remaining in the warehouse.

In cases where the purchaser of a product is dissatisfied with its quality or other parameters, he can use this document to return the entire batch of goods or replace it with similar products. In the event of controversial situations that require resolution in court, the consignment note acquires legal force and serves as evidence in court.

Quite often, this type of document is used in their work by forwarding drivers and carriers of goods, for whom it is a kind of “safeguard”, certifying that the goods have not been stolen, but are being transported legally. At the time of shipment of products, drivers transfer the consignment note from the sender to the consignee.

Execution of documents for delivery at the end of the month is acceptable

Home → Articles → Execution of documents for delivery at the end of the month is acceptable

The supplier supplies materials within a month without issuing accounting documents. At the end of the month, he issues an invoice for the entire volume delivered for the month. The agreement does not establish the document flow procedure. Is the supplier obligated to issue a primary document for each delivery, or is it permissible to issue one document where all deliveries for the month will be taken into account?

The procedure for the actions of the purchasing organization upon receipt of goods from the supplier without documents and the accounting of the specified goods are regulated by paragraphs. 36-41 Guidelines for accounting of inventories, approved by order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n (hereinafter referred to as the Guidelines)

Thus, paragraph 36 of the Methodological Instructions provides that uninvoiced supplies are considered to be materials received by the organization for which there are no settlement documents (invoice, payment request, payment request-order or other documents accepted for settlements with the supplier).

Paragraph 39 of the Guidelines determines that uninvoiced supplies are accounted for in inventory accounts. Capitalization is carried out at the moment the goods arrive at the recipient's warehouse.

In practice, the document that serves as the basis for taking into account inventories for uninvoiced deliveries can serve, in particular, as an act of acceptance of goods received without a supplier’s account (form No. TORG-4, approved by Resolution of the State Statistics Committee of Russia dated December 25, 1998 No. 132 , or a document developed on the basis of this form).

After receipt of settlement documents for uninvoiced deliveries, their accounting price is adjusted taking into account the received settlement documents. At the same time, settlements with the supplier are clarified (clause 40 of the Guidelines).

At the same time, at construction sites, construction materials that arrive in significant quantities are, as a rule, delivered directly to construction sites, bypassing the organization’s central warehouse (clause 51 of the Methodological Instructions).

According to the general rule enshrined in Part 1 of Art. 9 of the Federal Law of December 6, 2011 No. 402-FZ “On Accounting” (hereinafter referred to as Law No. 402-FZ), each fact of economic life is subject to registration as a primary accounting document.

The receipt of inventories for the buyer (disposal for the supplier) is a fact of economic life within the meaning of Art. 3 of Law No. 402-FZ. Therefore, the recording (writing off) of inventories must be carried out on the basis of the corresponding primary document.

In paragraph 44 of the Methodological Instructions, it is determined that for materials received under purchase and sale, supply and other similar agreements, the organization receives from the supplier (shipper) payment documents (payment requests, payment requests-orders, invoices, waybills and etc.) and accompanying documents (specifications, certificates, quality certificates, etc.).

In accordance with paragraph 120 of the Methodological Recommendations, the sale of materials is formalized, among other things, by issuing an invoice for the release of materials to the party, on the basis of contracts or other documents.

Thus, we can conclude that, as a general rule, each release of materials by their supplier must be documented in a primary document. In this situation, this means that the supplier must provide the buyer with shipping documents (for example, an invoice) for each shipment of materials within a month.

We do not have any explanations from the authorized bodies regarding accounting. At the same time, issuing one document for several consignments of goods for tax purposes is considered possible.

Thus, in the letter of the Ministry of Finance of Russia dated January 13, 2012 No. 03-07-11/08, dedicated to the issues of calculating VAT, the position is expressed that the date of shipment of equipment should be considered the date of drawing up the primary document issued to the buyer (carrier) when shipping the last piece of equipment .

In the resolution of the Nineteenth Arbitration Court of Appeal dated July 20, 2017 No. 19AP-4090/17, the judges actually considered it permissible to issue one consignment note for several transportations of sand by a taxpayer.

Then, if we are guided by the logic of officials and judges, then, for example, in a situation where your organization and the supplier have agreed on such a volume of delivery that it is not possible to deliver it at once, the supplier’s presentation of one invoice when shipping the last batch does not contradict the current legislation.

However, if, based on the existing relationship between the parties, each supply of materials is considered as a one-time transaction, then the supplier should issue TORG-12 or another similar document when shipping each batch of inventories (see the definition of the Supreme Arbitration Court of the Russian Federation dated September 26, 2012 No. VAS-12342/12 ).

According to the judges, drawing up a consignment note indicates the conclusion of an agreement. In this case, the supply is not considered one-time (see resolution of the Federal Antimonopoly Service of the Moscow District dated 04/09/2013 No. F05-1282/13 in case No. A40-86581/2012).

Answer prepared by: Kirill Zavyalov, expert of the GARANT Legal Consulting Service, auditor, member of the RSA Response quality control: Elena Koroleva, reviewer of the GARANT Legal Consulting Service

Latest news of the digital economy on our Telegram channel

| Do you want to switch to EDI? We will help you organize legally significant document flow using an electronic signature. Leave a request >> |

Rules for issuing a consignment note

The responsibility for preparing a consignment note is usually assigned either to employees of accounting departments, or to storekeepers or other authorized employees of the enterprise.

There is no unified sample of a consignment note accepted for general use, so each organization can develop and approve its own form or use a template. The number of tables and rows in a document is not limited, so if necessary, the document can be expanded or narrowed, depending on the situation.

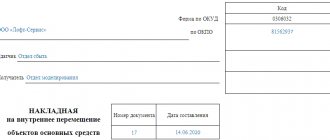

The invoice must always contain the following information:

- name and details of the organization that supplies the goods,

- buyer information,

- information about the product: name, quantity, price and total cost of the product.

If the selling company works with VAT, this is also indicated in the document. The delivery note must be signed by the responsible person. It is not necessary to put a stamp on it, since since 2016, legal entities (as well as individual entrepreneurs) have the right not to use seals and stamps in their work.

The consignment note may contain only one sheet, or it may contain several if it carries many different types of products. In cases where it is drawn up on several pages, this must be noted on its first sheet.

A delivery note is drawn up in two copies, one of which remains with the seller of the goods and subsequently serves as the basis for writing off inventory, and the second is handed over to the consumer and can be the basis for deducting VAT.

Separate annexes (for example, an act of transfer of goods) can be attached to the delivery note. If such applications take place, this must also be noted in the main document.

What is a waybill

From January 1, 2022, a waybill is a necessary document when delivering goods by car across the territory of the Russian Federation (Law No. 259-FZ dated November 8, 2007, Article 785 of the Civil Code, Rules for the transportation of goods by road, approved by Government Decree No. 2200 dated December 21, 2020 ). The driver must present this document to traffic police inspectors upon request; it is drawn up in triplicate and contains information about the cargo, its acceptance and delivery, and the persons responsible.

A correctly completed TN is the primary document that confirms cargo delivery services, the conclusion of a transportation agreement and the cost of delivery. So it is important for the company and is needed by an accountant, who, based on it, takes into account transportation costs.

It is also important to use the new invoice form, approved by Government Decree No. 2200 dated December 21, 2020, the form is in Appendix No. 4.

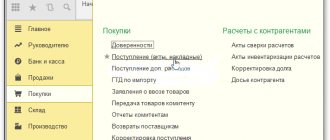

Instructions for filling out the delivery note

The registration of the consignment note begins with filling out the parties to the transaction. In the line “shipper organization” the full name of the enterprise distributing the goods is entered, indicating its organizational and legal status and bank details. Information about the buyer is entered in the same way in the “Consignee” line. Next, in the “Supplier” line, you need to duplicate the information entered in the “Consignor” item, and in the “Payer” line, respectively, about the consignee.

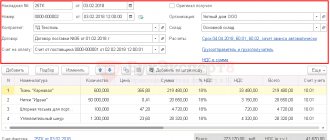

Next, you need to enter the document number for internal document flow, as well as the date of its preparation (it must coincide with the date of shipment of the goods). Then the invoice should include a special table in which you need to enter:

- a detailed list of transferred goods, indicating their names,

- units of measurement (pieces, kilograms, liters, etc.),

- quantities,

- prices,

- total cost.

If the company works with VAT, it needs to be highlighted; if not, then this cell can be left empty. Next, in the “Total invoice” line, you need to fill in the cells about the price of the goods.

Below the table you should indicate how many sheets the delivery note contains. Then, in the required line, note the full cost of the transferred products in words (here it is important to pay attention to the fact that the remaining free space in this line must be crossed out). In conclusion, the invoice must be signed by the responsible persons with the obligatory decoding of their signatures:

- employee dispensing goods

- Chief Accountant,

- the person who accepted it.