All enterprises are required to formulate and apply in practice an accounting policy (AP), regardless of the taxation regime used. UP is a combination of rules and methods of tax and accounting that the company has chosen, decided to apply in its activities and secured by internal regulations.

As a rule, organizations draw up UE for accounting and tax purposes. They can be drawn up as two separate documents or as one document with two sections. The UP is approved by order of the manager and is valid for the period specified in it (if it is recorded in the order). This document should not only set out the methods and methods of accounting and tax accounting, but also provide descriptions of the types of assets and calculations used in production and management. The UE is accompanied by samples and forms of used primary accounting documents, tax registers, and document flow diagrams. Let's imagine what the accounting policy of the simplified tax system of 15% in 2022, formed for tax purposes, could be, and let us remind you what criteria such a document must meet.

Composition of accounting policies

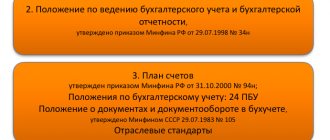

The concept of “accounting policy” (AP) is contained in Art. 8 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ and PBU 1/2008 “Accounting Policy of the Organization” (approved by Order of the Ministry of Finance dated October 6, 2008 No. 106n).

The form of the UE is not regulated, and therefore a set of accounting rules can be drawn up in two ways:

- an order, the body of which will set out all the rules for keeping records;

- accounting policy as an independent document, which is an annex to the order for its approval.

The UE can be in a full or simplified version (intended for small businesses, for example, accounting policies for simplified taxation system-income). Composition of the UE, i.e. points that must be present in both the full and simplified document:

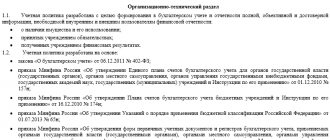

- General provisions. Legislative and accounting documents. General directions of the organization's activities.

- Organization of accounting (AC): indicate the basic principles of accounting, the organization of the accounting service, the procedure for document flow, etc.

- UE for tax purposes: indicates the taxation system used by the organization and all accounting features associated with it.

The UP may also contain separate applications with sample documents of the organization, a list of accounts used, etc.

What does the UE consist of?

For organizations using the simplified tax system “Income minus expenses,” the accounting policy consists of two parts: for taxation and for accounting.

For individual entrepreneurs, only the part about taxes is important, because they are exempt from accounting. If an individual entrepreneur decides to conduct accounting voluntarily, the entire accounting policy will be needed.

Both parts can be executed in one document or two separate ones.

The following appendices are usually attached to the UE: a working chart of accounts, forms of independently developed primary documents, accounting registers and a document flow schedule.

The procedure for approving and changing accounting policies

The accounting policy is drawn up by the chief accountant and approved by the manager. If we are talking about an organization that is already operating, then it is necessary to adopt the UE for the next year before December 31 of the current year.

There is no need to re-approve the UE every year if no changes have occurred. But you can do this too, by specifying such a requirement in the current UP.

If the organization has just been created, it is obliged to publish and approve the UP before the first reporting, but no later than 90 calendar days from the date of state registration.

Changes to an already approved UE are made in several cases. But whenever changes occur, they will come into force only from the new reporting year, unless the changes that occur require otherwise (clause 12 of PBU 1/2008) and are not related to the fact that:

- the legislation of the Russian Federation has changed;

- the organization intends to use new methods of accounting;

- The core activities of the organization have changed.

Organizations with a common accounting system make all changes related to changes in the management program retrospectively. But for organizations that use simplified accounting and accounting, there is a nuance. They can reflect in the accounting system the consequences of changes in the UE prospectively, unless otherwise required by law (clause 15 of PBU 1/2008).

Who develops it and when?

The UP is developed by the one who is responsible for accounting - the chief accountant or another responsible employee, an outsourcer. This may also be the director, if he has assumed the responsibilities of the chief accountant.

The UP is approved by the head of the organization or individual entrepreneur. To do this, issue an order in free form.

Terms of development and approval of the UE:

- in the tax part - no later than December 31 of the first calendar year;

- in terms of accounting - no later than 90 days from the date of state registration of the organization or individual entrepreneur.

It is not necessary to draw up a new UE for every year - its validity period is not limited. But if necessary, it can be changed or supplemented, for example due to innovations in legislation or the emergence of a new type of activity at the enterprise.

Accounting policy for an LLC using the simplified tax system “income” - sample

Using the example of Nadezhda LLC, let's look at what the accounting policy for 2022 should look like with simplified taxation system for income. Our UP will be as an annex to the order for its approval.

First, we will draw up an order approving the accounting policy:

ORDER

on approval of accounting policies

No. 253 from 12/28/2020

Saint Petersburg

In accordance with the Law “On Accounting” dated December 6, 2011 No. 402-FZ and the Accounting Regulations 01/2008 “Accounting Policy of the Organization”, the Tax Code of the Russian Federation, as well as in accordance with other provisions and norms contained in the legislation on accounting and tax accounting and reporting

I ORDER:

- Approve the accounting policy for accounting purposes in accordance with Appendix No. 1.

- Approve the working chart of accounts in accordance with Appendix No. 2.

- Approve the forms of primary documents in accordance with Appendix No. 3.

- Approve the forms of accounting registers in accordance with Appendix No. 4.

- Approve the accounting policy for tax accounting purposes in accordance with Appendix No. 5.

- Approve the forms of tax accounting registers in accordance with Appendix No. 6.

- Apply this accounting policy with...

- Introduce accounting policies to... (whom)

- Heads of all departments must ensure correct and timely execution of the provisions of this accounting policy.

- Entrust control over the implementation of accounting policies to...

- Control over the implementation of this order is entrusted to...

I entrust control over the execution of this order to the chief accountant O. M. Komarova.

The order is signed by the head of the organization. The chief accountant must familiarize himself with the document against signature.

Next, in order, we draw up all the applications provided for by the order. Of the main ones, this is the accounting policy of the simplified tax system for income 2022 - a sample UE for accounting and a sample UE for NU can be viewed on our website at the link at the beginning of the article.

The UP for entrepreneurs will not contain an application with the UP on accounting. In all other respects it will be the same.

New accounting policies for 2022 according to FAS 6/2020

Small businesses that conduct accounting using simplified methods can:

- switch to new standards prospectively, that is, from January 1, 2022, without making changes to previously formed registers;

- formulate the initial cost of the OS in a simplified manner;

- not to adjust the initial cost of fixed assets due to changes in the value of the estimated liability for dismantling, recycling, and environmental restoration;

- refuse to test assets for impairment, i.e. evaluate fixed assets at book value as of the reporting date;

- disclose information about fixed assets in the financial statements to a limited extent.

In the accounting policy for 2022, the provisions for fixed assets can be formulated as follows:

- The organization applies FAS 6/2020 “Fixed Assets” prospectively.

- When purchasing fixed assets, the rights to which are subject to state registration, the costs of their acquisition are written off after the objects are put into operation based on the amounts paid to the sellers.

- In case of partial payment of fixed assets in section 2 of the Book of Income and Expenses

- write off each paid part as a separate item as expenses in equal quarterly shares until the end of the current tax period

- write off the entire initial cost of the fixed asset in equal quarterly installments, but within the limits of the paid amount

Earlier topic:

What should a company using the simplified tax system change in its accounting policies when switching to FAS 6/2020 and FAS 26/2020

***

For organizations using the simplified tax system, the UE can be approved in a simplified version in any of two ways: the UP for accounting and NU is in the body of the order for its approval or is an appendix to this order. Pay attention to the method of making changes to the UE and to the accounting itself after these changes - simplified accounting differs from regular accounting.

Please also note that failure to draw up the UE or inconsistencies in the accounting of the UE when audited by tax authorities will most likely be interpreted as a gross violation of record keeping, which may entail the imposition of fines (Article 120 of the Tax Code of the Russian Federation, Article 15.11 of the Code of Administrative Offenses of the Russian Federation).

Even more materials on the topic can be found in the “Accounting Documents” section.

For tax accounting purposes

Enter in the UE the selected object of taxation - “income minus expenses” and the tax rate.

Indicate who is responsible for tax accounting - the chief accountant, another authorized employee or the manager himself.

For tax purposes, the UP stipulates:

- how to keep a book of income and expenses (KUDiR) - on paper or electronically;

- how the cost of purchased goods is written off upon sale - at the cost of the first in time of acquisition (FIFO method), at the average cost or at the cost of a unit of goods;

- what relates to material costs;

- how to take into account losses from previous years when calculating tax on the simplified tax system.

There is no need to prescribe accounting methods in the UE for which there are no alternative options in the Tax Code of the Russian Federation. For example, on the simplified tax system for recognizing income and expenses there is only a cash method, and for writing off fixed assets a special procedure has been established - evenly on the last day of each quarter until the end of the calendar year.