PBU 14/2007 “Accounting for intangible assets”

Appendix to the Order of the Ministry of Finance of the Russian Federation dated December 27, 2007 No. 153n

I. General provisions II. Initial valuation of intangible assets III. Subsequent valuation of intangible assets IV. Amortization of intangible assets V. Write-off of intangible assets VI. Accounting for transactions related to the granting (receipt) of the right to use intangible assets VII. Disclosure of information in financial statements VIII. Business reputation

I. General provisions

1. These Regulations establish the rules for the formation in accounting and financial statements of information on intangible assets of organizations that are legal entities under the legislation of the Russian Federation (with the exception of credit organizations and budgetary institutions).

2. This Regulation does not apply to:

- a) research, development and technological work that did not produce a positive result;

- b) research, development and technological work that has not been completed and not formalized in accordance with the procedure established by law;

- c) material media (things) in which the results of intellectual activity and equivalent means of individualization are expressed (hereinafter referred to as means of individualization);

- d) financial investments.

3. To accept an object for accounting as an intangible asset, the following conditions must be simultaneously met:

- a) the object is capable of bringing economic benefits to the organization in the future, in particular, the object is intended for use in the production of products, when performing work or providing services, for the management needs of the organization or for use in activities aimed at achieving the goals of creating a non-profit organization (including in business activities carried out in accordance with the legislation of the Russian Federation);

- b) the organization has the right to receive economic benefits that this object is capable of bringing in the future (including the organization has properly executed documents confirming the existence of the asset itself and the rights of this organization to the result of intellectual activity or a means of individualization - patents, certificates, other security documents , an agreement on the alienation of the exclusive right to the result of intellectual activity or to a means of individualization, documents confirming the transfer of the exclusive right without an agreement, etc.), and there are also restrictions on the access of other persons to such economic benefits (hereinafter referred to as control over the object);

- c) the possibility of separating or separating (identifying) an object from other assets;

- d) the object is intended to be used for a long time, i.e. useful life exceeding 12 months or normal operating cycle if it exceeds 12 months;

- e) the organization does not intend to sell the object within 12 months or the normal operating cycle if it exceeds 12 months;

- f) the actual (initial) cost of the object can be reliably determined;

- g) the object’s lack of material form.

4. If the conditions established in paragraph 3 of these Regulations are met, intangible assets include, for example, works of science, literature and art; programs for electronic computers; inventions; utility models; breeding achievements; production secrets (know-how); trademarks and service marks. The composition of intangible assets also takes into account business reputation that arose in connection with the acquisition of an enterprise as a property complex (in whole or part thereof). Intangible assets are not: expenses associated with the formation of a legal entity (organizational expenses); intellectual and business qualities of the organization’s personnel, their qualifications and ability to work.

5. The accounting unit for intangible assets is an inventory item. An inventory object of intangible assets is recognized as a set of rights arising from one patent, certificate, agreement on the alienation of the exclusive right to a result of intellectual activity or to a means of individualization, or in another manner established by law, intended to perform certain independent functions. A complex object that includes several protected results of intellectual activity (a movie, another audiovisual work, a theatrical performance, a multimedia product, a single technology) can also be recognized as an inventory item of intangible assets.

In which accounts should intangible assets be recorded?

The accounting account for an intangible asset depends on the right under which it was obtained.

| Right | Account | Example |

| Exclusive right | 0 102 XN 000 “Scientific research (research development)” 0 102 XR 000 “Experimental design and technological development” 0 102 XI 000 “Software and databases” 0 102 XD 000 “Other intellectual property” | Exclusive right to software - account 0 102 ХI 000; Exclusive right to a selection achievement - account 0 102 ХN 000; Exclusive right to a trademark - account 0 102 ХD 000; Exclusive right to an invention - account 0 102 ХN 000 |

| Non-exclusive right | 0 111 6N 000 “Rights to use scientific research (research developments)” 0 111 6R 000 “Rights to use experimental design and technological developments” 0 111 6I 000 “Rights to use software and databases” 0 111 6D 000 “Rights to use other objects of intellectual property" | Non-exclusive right to antivirus - account 0 111 6I 000; Non-exclusive right to a utility model - account 0 111 6N 000; Non-exclusive right to an electronic archive - account 0 111 6I 000; Non-exclusive right to a literary work - account 0 111 6D 000. |

Objects of intangible assets are grouped according to clause 37 of Instruction No. 157n. That is, objects received under exclusive right are accounted for in the corresponding account 102 00, where X can take the value 2 “Especially valuable movable property of the institution”, 3 “Other movable property of the institution” or 9 “Property in concession”.

More on the topic: Accounting (budget) statements as of 05/01/2020: presentation features

For example, on account 102 91 “Software and databases in concession” information about programs for electronic computers, databases, information systems and (or) sites on the Internet or other information and telecommunication networks that are the objects of concession agreements is subject to reflection. which includes such computer programs and (or) databases, or about the totality of these objects, as well as about operations that change them.

The grouping by type of property, designated by the letters N, R, I or D, corresponds to the subsections of the classification established by OKOF *(3) (clause 67 of Instruction No. 157n, letter of the Ministry of Finance of Russia dated September 17, 2020 No. 02-07-10/81813). Namely, OKOF provides for the following groups of intellectual property objects (OKOF code 700):

- scientific research and development (OKOF code 710);

- software and databases (OKOF code 730);

- other objects of intellectual property (OKOF code 790).

For example, multimedia applications are named in the “Software and Databases” group - OKOF code 732.00.10.08. Consequently, the exclusive right to this object, related to other movable property, is taken into account in account 102 3I. And if an institution has a non-exclusive right to multimedia applications, then it will be reflected in account 111 6I.

II. Initial valuation of intangible assets

6. An intangible asset is accepted for accounting at its actual (initial) cost, determined as of the date it was accepted for accounting.

7. The actual (initial) cost of an intangible asset is recognized as an amount calculated in monetary terms, equal to the amount of payment in cash and other forms or the amount of accounts payable, paid or accrued by the organization upon acquisition, creation of the asset and provision of conditions for using the asset for the planned purposes.

8. Expenses for the acquisition of an intangible asset are:

- amounts paid in accordance with the agreement on the alienation of the exclusive right to the result of intellectual activity or to a means of individualization to the copyright holder (seller);

- customs duties and customs fees;

- non-refundable amounts of taxes, government, patent and other duties paid in connection with the acquisition of an intangible asset;

- remunerations paid to the intermediary organization and other persons through which the intangible asset was acquired;

- amounts paid for information and consulting services related to the acquisition of an intangible asset;

- other expenses directly related to the acquisition of an intangible asset and providing conditions for using the asset for its intended purposes.

9. When creating an intangible asset, in addition to the expenses provided for in paragraph 8 of these Regulations, expenses also include:

- amounts paid for the performance of work or the provision of services to third-party organizations under orders, contract agreements, author's order agreements or contracts for the performance of research, development or technological work;

- expenses for remuneration of employees directly involved in the creation of an intangible asset or in the performance of research, development or technological work under an employment contract;

- contributions for social needs (including the unified social tax);

- expenses for the maintenance and operation of research equipment, installations and structures, other fixed assets and other property, depreciation of fixed assets and intangible assets used directly in the creation of an intangible asset, the actual (initial) cost of which is formed;

- other expenses directly related to the creation of an intangible asset and providing conditions for using the asset for its intended purposes.

10. The following are not included in the costs of acquiring or creating an intangible asset:

- refundable amounts of taxes, except for cases provided for by the legislation of the Russian Federation;

- general business and other similar expenses, except when they are directly related to the acquisition and creation of assets;

- expenses for research, development and technological work in previous reporting periods, which were recognized as other income and expenses.

Expenses on loans and credits received are not expenses on the acquisition or creation of intangible assets, except in cases where the asset, the actual (initial) cost of which is formed, is classified as an investment asset.

11. The actual (initial) cost of an intangible asset contributed as a contribution to the authorized (share) capital (including in the case of contribution of state or municipal property as a contribution to the authorized capitals of open joint-stock companies), the authorized capital, the mutual fund of the organization is recognized its monetary value, agreed upon by the founders (participants) of the organization, unless otherwise provided by the legislation of the Russian Federation.

12. The actual (initial) value of an intangible asset accepted for accounting during the privatization of state and municipal property by transforming a unitary enterprise into an open joint-stock company is determined in the manner prescribed for the reorganization of organizations in the form of transformation.

13. The actual (initial) value of an intangible asset received by an organization under a gift agreement is determined based on its current market value on the date of acceptance for accounting as an investment in non-current assets. The current market value of an intangible asset is the amount of money that could be received as a result of the sale of the object on the date the current market value is determined. The current market value of an intangible asset can be determined based on an expert assessment.

14. The actual (initial) cost of an intangible asset acquired under an agreement providing for the fulfillment of obligations (payment) not in cash is determined based on the value of the assets transferred or to be transferred by the organization. The value of assets transferred or to be transferred by an organization is established based on the price at which, in comparable circumstances, the organization usually determines the value of similar assets. If it is impossible to determine the value of assets transferred or to be transferred by an organization under such agreements, the value of an intangible asset received by an organization is established based on the price at which similar intangible assets are acquired in comparable circumstances.

15. If in relation to the intangible assets specified in paragraphs 11 - 14 of these Regulations, expenses specified in paragraphs 8 and 9 of these Regulations arise, then such expenses are also included in the actual (initial) cost.

Receipt of intangible assets to the enterprise

Non-current assets owned by an enterprise are divided into fixed assets and intangible assets.

The main difference between intangible assets and fixed assets is that the former do not have a physical form and are created as a result of intellectual activity. An intangible asset (IMA) is the exclusive right to the result of intellectual activity.

An example of an intangible asset is the exclusive right to:

- Computer programs, databases

- Inventions, models

- Topology of integrated circuits

- Breeding achievements

- Know-how

- Trademarks

- Brand names

- Commercial designations

- Business reputation of the organization

Intangible material is not the result of intellectual activity itself, but the exclusive right to it.

To be called an intangible asset, an object must simultaneously satisfy the 4 conditions below:

- Planned for use over a long period (over a year)

- Used for economic benefit

- Purchased for use and not for resale

- You can reliably determine its value.

Receipt of intangible assets to the enterprise:

First of all, we note that you need to accept the object on the basis of an acceptance certificate, after which you need to create an accounting card for it in the form of NMA-1 (similar actions are carried out when receiving fixed assets).

Documents that confirm the fact of acquisition of intangible assets may include documents such as patents, an agreement on the alienation of an exclusive right, certificates, a license agreement, etc.

An enterprise can buy an intangible asset (purchase for a fee), create it on its own or with the help of third-party organizations, receive it in the form of a contribution to the authorized capital from the founders, and also receive it as a gift (free of charge).

Let us dwell in more detail on each of these 4 methods of receiving an intangible asset, and consider what entries need to be made in accounting in this case.

Acquisition of intangible assets for a fee (purchase)

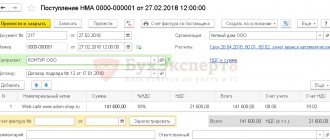

To account for intangible assets, accounting account 04 is used. Received intangible assets are recorded in the debit of this account at their original cost. Acceptance for accounting on account 04 is carried out through auxiliary account 08, the debit of which collects all costs for the acquisition of an object: the direct cost of the exclusive right to this object and the costs of its use in the future, payment of various duties, taxes, customs duties, consulting and information services, services of third parties.

As for VAT on all these costs, it should be noted that not all intangible assets are subject to this tax.

VAT does not need to be allocated for the following intangible assets - the exclusive right to programs and databases, inventions, models, know-how, integrated circuits.

For other assets, it is necessary to separate out the amount of VAT from the sum of all costs that form the initial cost and send it for deduction.

Postings when purchasing intangible assets:

On account 08 we open an additional sub-account 5 “Purchase of intangible assets”. Using the debit of this account, we will collect all expenses, after which we will send them in one transaction to the debit of account 04, thus we will form the initial cost of the intangible asset.

Postings:

| Debit | Credit | Operation |

| 08 | 76 | The cost of the exclusive right under the contract is reflected |

| 19 | 76 | VAT is allocated from the cost of intangible assets (if necessary) |

| 68.VAT | 19 | VAT is deductible |

| 08 | 76 | Payment of various duties and fees is taken into account |

| 76 | 51 | The cost of the exclusive right (duties, fees) has been paid. |

| 04 | 08 | The asset is accepted for accounting |

Creation of intangible assets

You can create an intangible asset yourself, with the help of employees of your own enterprise, or you can place an order with a third-party organization that specializes in this.

No matter how the intangible asset is created, it is also necessary to collect all the costs associated with its creation in the debit of account 08, and then transfer them to the debit of account 04.

If the process of creating an intangible asset occurs on your own, then the expenses may include the salaries of employees involved in this process, insurance premiums accrued and paid from this salary. Expenses also include depreciation on equipment used in research and other activities.

If third-party organizations are involved, then the cost is payment for their services.

After expenses are collected under debit 08, a posting is made to accept the object for accounting D04 K08.

Entering intangible assets into the Criminal Code

If an intangible asset is contributed to the authorized capital in the form of a contribution from the founder, then we attract an account for accounting settlements with the founders and make the following entries:

D08 K75 – the initial cost of intangible assets is reflected

D04 K08 – the asset is accepted for accounting

Free receipt of intangible assets

When receiving an intangible asset under a gift agreement, it must be assessed at the average market value as of the current date in order to know at what value to accept it and from what to charge depreciation in the future.

Third-party assessment organizations may be involved in the assessment.

To account for gratuitously received intangible assets, you need to use accounts 98 “Gratuitous receipts.”

Postings for accounting for intangible assets received under a gift agreement:

D08 K98 – reflects the market value of the asset obtained after valuation.

D04 K08 – the object is accepted for accounting.

In the future, when calculating depreciation, it is necessary to write off the amount of depreciation deductions also from account 98 by posting D98 K91/1.

III. Subsequent valuation of intangible assets

16. The actual (initial) cost of an intangible asset at which it is accepted for accounting is not subject to change, except in cases established by the legislation of the Russian Federation and these Regulations. A change in the actual (initial) cost of an intangible asset at which it is accepted for accounting is allowed in cases of revaluation and impairment of intangible assets.

17. A commercial organization may, no more than once a year (at the beginning of the reporting year), revalue groups of similar intangible assets at the current market value, determined solely based on data from the active market of these intangible assets.

18. When deciding on the revaluation of intangible assets included in a homogeneous group, it should be taken into account that in the future these assets must be revalued regularly so that the value at which they are reflected in the financial statements does not differ significantly from the current market value.

19. Revaluation of intangible assets is carried out by recalculating their residual value.

20. The results of the revaluation are accepted when generating the balance sheet data at the beginning of the reporting year. The results of the revaluation are not included in the balance sheet data of the previous reporting year, but are disclosed by the organization in the explanatory note to the financial statements of the previous reporting year.

21. The amount of additional valuation of intangible assets as a result of revaluation is credited to the additional capital of the organization. The amount of revaluation of an intangible asset, equal to the amount of its depreciation carried out in previous reporting years and attributed to the account for retained earnings (uncovered loss), is credited to the account for accounting for retained earnings (uncovered loss). The amount of write-down of an intangible asset as a result of revaluation is charged to the account of retained earnings (uncovered loss). The amount of the writedown of an intangible asset is included in the reduction of the organization’s additional capital formed from the amounts of the additional valuation of this asset carried out in previous reporting years. The excess of the amount of depreciation of an intangible asset over the amount of its revaluation credited to the organization's additional capital as a result of revaluation carried out in previous reporting years is charged to the account of retained earnings (uncovered loss). The amount attributed to the account of retained earnings (uncovered loss) must be disclosed in the financial statements of the organization. When an intangible asset is disposed of, the amount of its revaluation is transferred from the organization’s additional capital to the organization’s retained earnings (uncovered loss) account.

22. Intangible assets may be tested for impairment in the manner prescribed by International Financial Reporting Standards.

Creation of intangible assets

If an intangible asset was created directly in your organization, then its initial cost is the sum of all costs associated with its creation and registration.

EXAMPLE has developed a new method for producing high-strength fabric.

Employees of the enterprise, Ivanov and Fokin, developed technical documentation, manufactured and tested a sample of the new fabric. The employees' wages accrued for the duration of this work amounted to 10,000 rubles. The amount of accrued contributions for compulsory pension insurance is 1,400 rubles, the amount of contributions for compulsory insurance against accidents at work and occupational diseases is 30 rubles. “Textile-Holding” sent an application to Rospatent for a patent for this invention. The company paid a patent registration fee in the amount of 1,150 rubles. and a fee for examination of an invention at the Federal Institute of Industrial Property in the amount of 5,000 rubles. The company received patent No. 2224592 from Rospatent for the invention “Method for producing high-strength fabric” for a period of 20 years. The accountant of Tekstil-Holding made the following entries: DEBIT 08 CREDIT 70

- 10,000 rubles.

– wages were accrued to employees who participated in the creation of the intangible asset; DEBIT 08 CREDIT 69 subaccount “Calculations for OPS”

– 1430 rubles.

(1400 + 30) – contributions for compulsory pension insurance and the amount of contributions for compulsory insurance against industrial accidents and occupational diseases are calculated; DEBIT 08 CREDIT 76

– 5000 rub.

– the costs of paying for the examination of the invention at the Federal Institute of Industrial Property are taken into account; DEBIT 08 CREDIT 76

– 1150 rub.

– the costs of paying the fee for consideration of the application at Rospatent are taken into account; DEBIT 04 CREDIT 08

– 17,580 rub. (10,000 + 1430 + 5000 + 1150) – the intangible asset is accepted for accounting (after receiving a patent).

IV. Amortization of intangible assets

23. The cost of intangible assets with a certain useful life is repaid by calculating depreciation during their useful life, unless otherwise established by these Regulations. Intangible assets with an indefinite useful life are not subject to amortization.

24. Depreciation is not accrued for intangible assets of non-profit organizations.

25. When accepting an intangible asset for accounting, the organization determines its useful life. The useful life is the period, expressed in months, during which the organization expects to use the intangible asset for the purpose of obtaining economic benefit (or for use in activities aimed at achieving the goals of creating a non-profit organization). For certain types of intangible assets, the useful life can be determined based on the quantity of products or other natural indicator of the amount of work expected to be received as a result of the use of assets of this type. Intangible assets for which it is impossible to reliably determine their useful life are considered intangible assets with an indefinite useful life.

26. The useful life of an intangible asset is determined based on:

- the validity period of the organization’s rights to the result of intellectual activity or a means of individualization and the period of control over the asset;

- the expected life of the asset during which the organization expects to receive economic benefits (or use it in activities aimed at achieving the goals of creating a non-profit organization)

The useful life of an intangible asset cannot exceed the life of the organization.

27. The useful life of an intangible asset is annually checked by the organization for the need to clarify it. If there is a significant change in the duration of the period during which the organization expects to use the asset, its useful life is subject to clarification. The adjustments arising in connection with this are reflected in the accounting and financial statements at the beginning of the reporting year as changes in estimated values. For an intangible asset with an indefinite useful life, an entity must annually consider whether there are factors that indicate that the asset's useful life cannot be determined reliably. If these factors cease to exist, the organization determines the useful life of this intangible asset and the method of its depreciation. The adjustments arising in connection with this are reflected in the accounting and financial statements at the beginning of the reporting year as changes in estimated values.

28. Determination of the monthly amount of depreciation charges for an intangible asset is carried out in one of the following ways:

- linear method;

- reducing balance method;

- method of writing off cost in proportion to the volume of products (works).

The choice of method for determining the amortization of an intangible asset is made by the organization based on the calculation of the expected receipt of future economic benefits from the use of the asset, including the financial result from the possible sale of this asset. In the event that the calculation of the expected receipt of future economic benefits from the use of an intangible asset is not reliable, the amount of depreciation charges for such an asset is determined using the straight-line method.

29. The monthly amount of depreciation charges is calculated:

- a) with the linear method - based on the actual (initial) cost or current market value (in case of revaluation) of the intangible asset evenly throughout the useful life of this asset;

- b) with the reducing balance method - based on the residual value (actual (initial) cost or current market value (in case of revaluation) minus accrued depreciation) of the intangible asset at the beginning of the month, multiplied by a fraction, the numerator of which is the coefficient established by the organization (not above 3), and the denominator is the remaining useful life in months;

- c) with the method of writing off the cost in proportion to the volume of products (works) based on the natural indicator of the volume of products (works) per month and the ratio of the actual (initial) cost of the intangible asset and the estimated volume of products (works) for the entire useful life of the intangible asset.

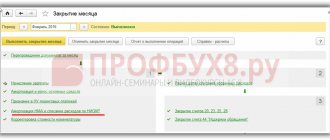

30. The method for determining the amortization of an intangible asset is checked annually by the organization for the need to clarify it. If the calculation of the expected flow of future economic benefits from the use of an intangible asset has changed significantly, the method of determining depreciation of that asset must be changed accordingly. The adjustments arising in connection with this are reflected in the accounting and financial statements at the beginning of the reporting year as changes in estimated values.

31. Depreciation charges for intangible assets begin on the first day of the month following the month in which this asset was accepted for accounting, and are accrued until the cost is fully repaid or the asset is written off from accounting. During the useful life of intangible assets, depreciation charges are not suspended.

32. Depreciation charges for intangible assets cease from the first day of the month following the month of full repayment of the cost or write-off of this asset from accounting.

33. Depreciation charges for intangible assets are reflected in the accounting records of the reporting period to which they relate and are accrued regardless of the organization’s performance in the reporting period.

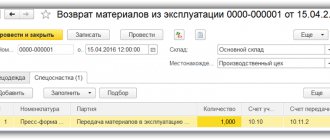

Disposal of intangible assets

The disposal of intangible assets, just like their receipt, must be correctly documented, and the correct entries must be reflected in the accounting department.

Intangible assets are retired in the following cases:

- If the asset has become obsolete or physically worn out, making it unsuitable for further use

- When transferring intangible assets to another company for a fee, that is, sale

- When transferring an asset free of charge to another enterprise, that is, donation

- Contribution to the authorized capital of another enterprise

In fact, intangible assets can leave the enterprise in the same cases as fixed assets.

Disposal of intangible assets upon write-off

If an intangible asset is damaged, its useful life has expired, the intangible asset has lost its functions and properties and is not suitable for further use for its intended purpose, then it must be written off from accounting.

A special commission evaluates the condition of the asset and makes a decision on the need to write off the asset. At the same time, an order is drawn up, which indicates which intangible asset is subject to write-off and for what reason. The write-off process itself occurs on the basis of the write-off act. When an object is deregistered, a note about this is made on the intangible asset registration card NMA-1.

When disposing of intangible assets, the residual value must be written off as an expense for the enterprise. The residual value is determined as the difference between the original cost and depreciation accrued on the write-off date.

If a separate account 05 was used to calculate depreciation of intangible assets, then the accrued depreciation is written off by posting D05 K04. After which the residual value identified on account 04 is written off as other expenses using posting D91/2 K04.

If a separate account was not opened for depreciation, and depreciation charges were written off directly from the credit of account 04, then you simply need to determine the residual value of the asset and write it off as expenses of the enterprise.

After this, you can determine the financial result of the write-off (loss).

Postings when writing off intangible assets:

| Debit | Credit | Operation |

| 05 | 04 | Accrued depreciation on intangible assets written off |

| 91/2 | 04 | The residual value of intangible assets is written off |

| 99 | 91/9 | Financial result from write-off (loss) |

Transfer of an intangible asset for a fee

The sale of intangible assets is also processed through 91 accounts (unless, of course, the sale of intangible assets is a normal activity of the enterprise). The debit of account 91 collects all costs associated with sales, and the credit collects proceeds from sales.

When transferring the exclusive right to an asset to another legal entity or individual, you must similarly write off the residual value of the asset in the debit of account 91. Postings are made similar to write-offs for wear and tear.

A number of intangible assets are exempt from VAT: the exclusive right to programs, databases, inventions, designs and models, to the topology of integrated circuits and know-how.

If the asset does not belong to the list of objects exempt from value added tax, then the selling price (revenue) must include the amount of VAT. The selling organization must pay this VAT to the budget. The entry for calculating VAT payable on the sold intangible asset has the form: D91.2 K68.VAT. Proceeds from the sale are reflected by posting D62 K91.1.

Based on the results of the sale, a financial result is displayed, which is reflected in account 99 (loss on debit or profit on credit).

Postings when selling intangible assets:

| Debit | Credit | Operation |

| 05 | 04 | Accrued depreciation on intangible assets written off |

| 91.2 | 04 | The residual value of intangible assets is written off |

| 91.2 | 68.VAT | VAT payable has been allocated |

| 62 | 91.1 | The sale price of intangible assets is reflected |

| 51 | 61 | Payment received from buyer |

| 91.9 | 99 | Financial result from sale (profit) |

| 99 | 91.9 | Financial result from sale (loss) |

Free transfer of an intangible asset to another person

When donating, the object is transferred at its residual value, which is formed under the loan account 04.

A gratuitous transfer is equivalent to a sale, so to complete this procedure you also need to use account 91 and do not forget to charge VAT on the market value of this intangible asset.

The debit of the account collects all expenses for the gratuitous transfer of an asset: residual value, VAT, other expenses. The sum of all these expenses will be the loss from the gift, which is reflected by posting D99 K91.9.

Postings when donating intangible assets

| Debit | Credit | Operation |

| 05 | 04 | Accrued depreciation on intangible assets written off |

| 91.2 | 04 | The residual value of intangible assets is written off |

| 91.2 | 68.VAT | VAT payable has been allocated |

| 99 | 91.9 | Financial result from gratuitous transfer (loss) |

Entering an intangible asset into the capital of another organization

Here the accounting is reflected somewhat differently. In this case, the contribution of intangible assets to the authorized capital is considered a financial investment with the aim of receiving profit in the form of dividends. Therefore, here you need to use account 58. The posting reflecting the debt of the enterprise for the contribution to the capital company has the form D58 K76.

The asset is transferred at its residual value. From the credit account 04, the residual value of intangible assets is written off to the debit account 76. The wiring looks like D76 K04.

Postings when entering intangible assets into the capital of another enterprise:

| Debit | Credit | Operation |

| 58 | 76 | Debt on contribution to the authorized capital of another organization is reflected |

| 05 | 04 | Accrued depreciation on intangible assets written off |

| 76 | 04 | Transfer of intangible assets at residual value |

V. Write-off of intangible assets

34. The cost of an intangible asset that is retired or is not capable of bringing economic benefits to the organization in the future is subject to write-off from accounting. The disposal of an intangible asset occurs in the event of:

- termination of the organization’s right to the result of intellectual activity or means of individualization;

- transfer under an agreement on the alienation of the exclusive right to the result of intellectual activity or to a means of individualization;

- transfer of the exclusive right to other persons without an agreement (including in the order of universal succession and when foreclosure on this intangible asset);

- termination of use due to obsolescence;

- transfers in the form of a contribution to the authorized (share) capital (fund) of another organization, mutual fund; transfers under an agreement of exchange, gift;

- making contributions under a joint venture agreement;

- identifying shortages of assets during their inventory;

- in other cases.

Simultaneously with the write-off of the value of intangible assets, the amount of accumulated depreciation charges on these intangible assets is subject to write-off.

35. Income and expenses from the write-off of intangible assets are reflected in accounting in the reporting period to which they relate. Income and expenses from the write-off of intangible assets are included in the financial results of the organization as other income and expenses, unless otherwise established by regulatory legal acts on accounting.

36. The date of writing off an intangible asset from accounting is determined based on the rules for recognizing income or expenses established by regulatory legal acts on accounting.

What refers to intangible assets

Intangible assets represent a special category of non-current assets of an organization, which, in the absence of a tangible form, are capable of bringing the organization quite material income.

Intangible assets, in particular, include:

- exclusive right to an invention, industrial design, utility model, computer program and database, trademark, selection achievement, topology of an integrated circuit, production secret (know-how), audiovisual works;

- business reputation of the organization.

In order to classify an object as an intangible asset, the following conditions must simultaneously be met:

- the object must be intended for use in production or for the management needs of the company;

- the company does not intend to sell the property before 12 months and it will be used beyond this period;

- the object has documents that confirm the company’s rights to it;

- the object does not have a tangible form and its actual value can be reliably determined.

The following table will help you understand what intangible assets are and what documents confirm their existence:

| Type of intangible asset (IMA) | A document confirming the existence of intangible assets and your organization’s right to it |

| Exclusive right to an invention, industrial design, utility model | Patent issued by Rospatent (if the NMA was created in your organization). Agreement and exclusive license (if your organization has acquired exclusive rights to this intangible asset) |

| Exclusive right to a computer program, database | An act certifying the readiness of the intangible asset for use, or a certificate of registration of the right to this intangible asset, obtained voluntarily (if the intangible asset was created in your organization). Agreement and primary documents confirming the transfer of intangible assets (if your organization has acquired exclusive rights to this intangible asset) |

| Exclusive right to the topology of an integrated circuit | Certificate of registration of rights issued by Rospatent (if the NMA was created in your organization). Agreement and primary documents confirming the transfer of intangible assets (if your organization has acquired the property right to this intangible asset) |

| Exclusive right to a trademark, service mark, appellation of origin of goods | Certificate issued by Rospatent (if the NMA was created in your organization). Agreement and primary documents confirming the transfer of intangible assets (if your company has acquired the exclusive right to this intangible asset) |

| Exclusive right to selection achievements | A patent issued by the Ministry of Agriculture of the Russian Federation (if the intangible asset was created in your organization). Agreement on the alienation of a patent (if your organization has acquired exclusive rights to this intangible material) |

| Business reputation of the organization | Agreement for the purchase and sale of an enterprise as a property complex registered in Rosreestr, and the transfer deed |

| Production secret (know-how) | Agreement on alienation of exclusive rights (if your company has acquired know-how) |

VII. Disclosure of information in financial statements

40. At a minimum, the following information is subject to disclosure as part of information about the organization’s accounting policies:

- methods for valuing intangible assets not acquired for cash;

- the useful life of intangible assets adopted by the organization;

- methods for determining depreciation of intangible assets, as well as the established coefficient for calculating depreciation using the reducing balance method;

- changes in the useful lives of intangible assets;

- changes in the methods of determining the amortization of intangible assets.

41. In the financial statements of an organization, at least the following information on certain types of intangible assets is subject to disclosure:

- actual (initial) cost or current market value, taking into account the amounts of accrued depreciation and impairment losses at the beginning and end of the reporting year;

- the cost of write-off and receipt of intangible assets, other cases of movement of intangible assets;

- the amount of accrued depreciation on intangible assets with a certain useful life;

- the actual (initial) cost or current market value of intangible assets with an indefinite useful life, as well as factors indicating the impossibility of reliably determining the useful life of such intangible assets, highlighting the significant factors;

- the cost of revalued intangible assets, as well as the actual (initial) cost, amounts of revaluation and depreciation of such intangible assets;

- the remaining useful life of intangible assets in activities aimed at achieving the goals of creating non-profit organizations;

- the value of intangible assets subject to impairment in the reporting year, as well as the recognized impairment loss;

- the name of intangible assets with a fully repaid value, but not written off from accounting and used to obtain economic benefits;

- name, actual (initial) cost or current market value, useful life and other information regarding the intangible asset, without knowledge of which it is impossible for interested users to assess the financial position of the organization or the financial results of its activities.

When disclosing information on intangible assets in the financial statements, information on intangible assets created by the organization itself is disclosed separately.

VIII. Business reputation

42. For accounting purposes, the value of acquired business reputation is determined by calculation as the difference between the purchase price paid to the seller when acquiring an enterprise as a property complex (in whole or part thereof), and the sum of all assets and liabilities on the balance sheet on the date of its purchase (acquisition ).

43. Goodwill should be treated as a premium to the price paid by the buyer in anticipation of future economic benefits associated with the unidentifiable assets acquired and treated as a separate inventory item. Negative business reputation should be considered as a discount on the price provided to the buyer due to the lack of factors of the presence of stable buyers, reputation for quality, marketing and sales skills, business connections, management experience, level of personnel qualifications, etc.

44. Acquired business reputation is amortized over twenty years (but not more than the life of the organization). Depreciation charges for positive business reputation are determined using the straight-line method in accordance with paragraph 29 of these Regulations.

45. Negative business reputation in full is included in the financial results of the organization as other income.