When transporting any product, a number of special documentation is required to turn the process into a legal action. Also, these papers will be mandatory when making the final payment between the customer and the logistics company, direct performers, in particular, drivers and forwarders. In this review we will explain what this documentation package is. How exactly is it used and what components does it consist of? So, what is a TTN in cargo transportation? This is a consignment note, that paper without which it is simply impossible to legally transport products on the territory of our country. Even if the shipper is not the importer, but the message occurs without crossing state borders.

Concept and application in accounting

This documentation contains basic information about the cargo. Weight parameters, dimensions, distance traveled. Provides information about the sender and the company, employees performing transportation. Accordingly, it is on the basis of paper that settlement takes place between the parties to the transaction. That is, this is a kind of confirmation of expenses that go into the accounting department as a separate line. And they help the tax service form a correct picture of production costs.

But at the same time, the TTN will not become the basis specifically for creating an accounting entry. This is a kind of evidence base, a way of confirmation. But this is not the basis for making an accounting entry in the financial statements.

The consignment note is a confirmation that the terms of the transaction have been fulfilled. This means that they are distributed on several sides. It is often customary to use 4 copies so that everyone has their own evidence base. The sender, the customer, persons authorized to accept the cargo and carry out posting, as well as the intermediary himself. That is, a private carrier or a logistics company.

It's hard not to understand the value of this documentation. In case of any deviation of the material component of the cargo from the order, a reconciliation is immediately carried out with the specification specification. Therefore, filling it out must always be correct, strictly according to the model, without liberties or amateur performances. Registration with deviations from existing norms and rules, with violations on forms - will automatically deprive the paper of legal force.

Accounting documents for the movement of goods

Despite the fact that the accounting system is many years old, there is still confusion about what accompanying documents should be issued when concluding a contract for the transportation of goods. Two forms are usually used:

- waybill

- and/or waybill.

It should be taken into account that since 2013, the consignment note is not a mandatory document for the transportation of goods. However, there are different positions on this matter, and regulatory authorities may request a consignment note to confirm transport costs.

Varieties

The question often arises whether the TTN is a primary accounting document. There is also confusion with related certificates. Some citizens mistakenly believe that these are all varieties of the same form. But no, there are fundamental differences to check. The invoice serves only for reporting purposes to the tax service. And specifically for VAT calculations. Whereas the documentation just confirms the fact of the enterprise’s expenses for the purchase of products. When it was accepted, after posting. But the hero of our review does not have such powers. It simply serves as proof that funds were spent on the delivery of these products. Not a purchase, not settlements with the shipper, but with the company that delivers. The difference is quite obvious.

Therefore, the accounting certificate does not become the main one for postings. But there are still varieties, and they are as follows:

- SP-31. It is used specifically for the supply of grain and cereal crops in any volume.

- SP-32. Transportation of animals. And not carcasses or meat, but exclusively living individuals that have value only in this form.

- SP-33. When working with dairy products of any type. From regular milk to curd products or cheeses.

- 1-T. But this type is used in all remaining cases. And, as one can easily assume, there are more than 90%. Accordingly, a universal form, which, most likely, will be used in the enterprise.

As we can see, although there are several different variations (we will indicate more later), in fact one option is used. Of course, if you are not a representative of an enterprise involved in the sale of grain, animals or dairy products. In all other cases, you will need 1-T. Now let's go through each point in detail.

International format (IFR)

The only option that is distributed only in triplicate. And also signed by the shipper and transporter. The fact is that this type is used when cargo crosses the border of a country. And delivery by car is also an important condition. Trucks or cars, it doesn't matter. But not sea, air or rail communications. Strictly motor transport. In addition, the country should, in principle, work in the IDA format. And the last condition is payment. Thus, humanitarian missions will have a completely different form of documentation. And they no longer apply here.

For grain crops

Actually, the waybill for the tax office is in the SP-31 form. It is used quite often, because grain is supplied not only in huge volumes. And also in local batches for retail sale at points of sale in small stores or retail outlets. Packaged cereals do not qualify here, but bulk grain does.

For transporting animals

Often the SP-32 format will be needed when collaborating with farmers as individual entrepreneurs. And now it's getting bigger. They are actively occupying the niche of large holding companies, and our country is moving into such a direction of agriculture following the example of the United States.

Therefore, checking the application of the format becomes quite frequent.

When sending dairy products

In this case, an important aspect is compliance with all standards and characteristics. If it is not particularly possible to judge the quality of grain, weight parameters and volume are sufficient. When working with milk, the fat content, acidity, and temperature parameters are taken into account (increasing the temperature to the maximum level is a violation of storage conditions, which means that the shelf life immediately drops to zero).

Therefore, the SP-33 form is considered one of the most complex.

Transportation of fruits, berries, vegetables

SP-34, waybill is a document that helps to send and receive goods from a farm. But already plant products. Mostly vegetables, of course. But also seasonal berries and even fruits. Moreover, many of the crops are brought to us from neighboring countries. This means that it is no longer this form that will be needed, but an international one. Which we reported at the beginning of our impromptu list.

Shipment of wool

Commodity TN in the form SP-35 is even more complex in detail than all those described above. Indeed, in this case, many parameters are used for calculation. And more specifically:

- Weight parameters by type net and gross.

- Methodology for identifying the final mass of objects.

- Quantitative factor kip.

- Product packaging method.

- The results of the tests performed before shipment in the laboratory.

Accordingly, paperwork increases significantly. But, in reality, the number of items to take into account is not the most important part. Not the factor that sets him apart. Much more important is the correct filling. After all, if there are obvious errors, the certificate will cease to have legal force. But it turns out that transportation occurs without it. And this is a violation of the current legislation of the Russian Federation. We will talk about the consequences of such an action further.

When is a waybill issued?

The consignment note is the primary document that is required when concluding an agreement for the carriage of goods by road (Parts 1, 2, Article 8 of the Federal Law of November 8, 2007 No. 259-FZ “Charter of Road Transport and Urban Ground Electric Transport”). The form of the consignment note for registration of transportation by road was approved by Government Decree No. 2200 dated December 21, 2020.

A waybill is issued when the goods are delivered to the buyer:

- shipping company;

- when the buyer picks up the goods from the seller’s warehouse. But only if he uses the services of a transport company. If pickup is carried out using the buyer’s own transport, an invoice is not needed. Transportation will be confirmed by the data on the waybill;

- the seller uses his own transport. But in this case, the delivery agreement must indicate the delivery condition, and its cost must be determined separately from the cost of the goods. If the cost of delivery of goods in the supply agreement is included in the cost of goods, then there is no need to issue a delivery note.

As a general rule, it is issued by the organization that orders the transportation - the shipper. But in the contract, the parties to the transportation may stipulate that the invoice must be issued by the carrier himself (Part 1, Article 8 of the Charter of Road Transport).

From January 1, 2022, the waybill can be issued both on paper and electronically.

In the bill of lading, the shipper and carrier agree on the terms of transportation. At the same time, the parties are not deprived of the right to include in it details that make it possible to reflect the specific circumstances of the execution of the contract of carriage. For example, the name of other persons who are related to the movement of cargo within the framework of a specific transportation contract - the client, the forwarder acting as a shipper, the person from whom the cargo is collected. Although this does not impose additional responsibilities on these parties (letter of the Federal Tax Service dated May 27, 2021 No. EA-4-26 / [email protected] ).

invites you to a free webinar on how primary management can save a company from claims: details here.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

What if the document is missing

Loss, incorrect registration, errors on the part of the shipper, planned scams, banal human irresponsibility. And the consequences will be unfavorable in any case.

This:

- Lack of records of costs associated with product delivery. As a result, unclosed holes appear in the accounting department, which will negatively affect the correct development of financial policy.

- Problems with tax authorities. After all, there will be no deductions for this expense item; the money, it turns out, simply disappeared from the balance sheet without explanation. This always raises reasonable questions.

- Imposition of penalties. Again, from the Federal Tax Service. The specific amount depends on the severity of the offense. And also on the number of unaccounted expenses.

Do not forget that in some cases the tax service has the right to directly demand confirmation of costs associated with transportation. Many people believe that the consignment note, consignment note, is the primary document. Actually no, but next to them it is also necessary for reporting.

As an example:

- Transportation for subsequent sale of alcohol-containing products. Here the extract will be strictly necessary so that the services can, in principle, check the legal basis of the turnover.

- When combining articles aimed at purchasing products and their delivery.

- At the request of the service, if there are still controversial issues and dark spots on the reporting. Just to clarify the situation.

Transport and consignment note

CTN (way bill of lading) is the primary accompanying document that must be issued if the shipper transfers the goods to the buyer by transportation by vehicle. TTN is needed not only in cases where a third party (motor transport organization) is present. A consignment note accompanying the cargo during its transportation must be drawn up if the shipper assumes the function of road transportation.

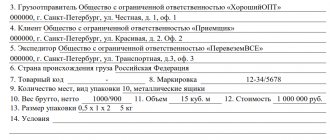

The document has a unified form approved by Decree of the State Statistics Committee of the Russian Federation dated November 28, 1997 No. 78 (Form No. 1-T). The document is drawn up in four copies. All copies of the invoice are handed over to the participants in the cargo transportation process:

- the seller needs the document to write off the cost of shipped goods (he keeps one copy for himself after issuing the invoice);

- The buyer, using the TTN, registers the received goods (the document is handed over to him by the driver of the car);

- For a motor transport company, the invoice serves as the basis for settlements with the customer for the transportation of goods;

- the fourth copy is also transferred to the carrier; it will be used as the basis for accounting for transport work and calculating wages to the driver of the vehicle.

Waybill (TN) - drawn up in accordance with the form approved. by Decree of the Government of Russia No. 272 of April 15, 2011. Issued in 3 original copies - for the sender, carrier and recipient of the products. Unlike the TTN, it does not contain a detailed product section, which describes the range of transported products.

If the transportation is accompanied by a waybill, then you do not need to fill out a TTN to confirm transportation costs. At the same time, it is not enough to fill out form No. 1-T instead of a technical document - the primary document confirming the transportation of goods is the consignment note.

Read also: TTN and TN - what is the difference

Functions

There are a number of them provided.

- Confirmation of the conclusion of the transaction. A kind of transfer and acceptance certificate, only not for material assets, but for the fact of provision of transportation services.

- A way to clarify settlement details with an agent.

- Accompanying document to confirm the legality of the act.

- Reporting. Accordingly, it is intended for the tax service.

- The ability to accurately check the quality of cargo transportation, the absence of thefts and losses, damage to material objects, deadlines and related factors.

TN

The waybill is a mandatory document according to the Post. Government No. 272 dated April 15, 2011. Typically, the TN is filled out by the sender of the cargo, unless another procedure is specified in the transportation contract. The document is drawn up for one batch or for several batches of goods and materials if they are transported by one truck.

Three original copies of the TN are filled out:

- to the sender;

- recipient;

- to the carrier.

The difference with the previous form, TTN, is the absence of a product section as such. This is reflected in the title of the document. The write-off and registration of transported goods and materials on the basis of technical specifications are not carried out.

You should keep in mind the Post. Government No. 1529 dated 12/12/17, according to which the legal emphasis of the rules for the transportation of goods by road has changed. Now the rules regulate the transportation of heavy (large) vehicles. Previously, the rules regulated the transportation, respectively, of heavy (oversized) cargo.

The changes also affected the technical document, as a document recording business transactions in this area:

- Section 13 is devoted to the route of transport, including those transporting hazardous goods and materials;

- Section 15 contains the amount of services of the ATP carrier, the amount of payment for the transportation of the relevant goods.

In Section 13, when transporting dangerous goods by car, the details of the transportation permit are also indicated.

Thus, the indicators of the two invoices are as close as possible in meaning and content.

Which document should be drawn up when transferring property: a transfer and acceptance certificate or an invoice in form N TORG-12 ?

TTN: what kind of document is this and why is it needed?

In principle, the main purpose is to pay for transportation services. All related functions are in fact additional. And even tax officials have to present paper in rare moments. It is mandatory, it should exist in any case, but its only integral task is calculation. Availability check is a bill of lading, acts of capitalization; our accounting department contacts the Federal Tax Service using an invoice. All this is primary documentation, the accompanying documentation does not apply to it. But in view of this massive number of additional tasks, the value of the sheet increases and you definitely won’t be able to do without it. And then the legality of cargo transportation disappears; in principle, inspection or customs authorities are quite capable of turning the truck back to the sender.

When is the TTN checked by tax officials?

Why do tax authorities need a transport invoice? Federal Tax Service employees pay special attention to this document when checking the validity of VAT deductions. In some cases, the absence of a TTN may be grounds for refusal to receive them. That is why organizations try to issue a consignment note with or without reason.

In judicial practice, quite often there are disputes between taxpayers and the Federal Tax Service regarding the application of VAT deductions in the presence or absence of a tax identification form, as well as when it is filled out incorrectly. Some courts rule in favor of tax authorities, considering that the presence of an invoice is mandatory, while others allow taxpayers not to use this invoice in cases where they have other documents confirming the fact of purchase of goods and materials.

Who needs the document

There are four subjects who will definitely need their own copy.

- Shipper. At a minimum, prove that all terms of the deal have been met on his part. And there will be no complaints, even if something happens to the cargo along the way.

- Persons authorized to accept the product. For reporting, as well as capitalization.

- Customer. As already said, there are a lot of functions for it.

- Carrier. To receive the payment due. This is his estimate, where it is written in black and white that he coped with his task, and the work costs N amount.

And although all entities have different goals, they all need an identical form. After all, the purpose of the consignment note does not differ depending on which specific party it is intended for.

Who needs a consignment note and what are the consequences of not having one?

For so many years, taxpayers have been arguing with the tax authorities regarding the rights to deduct VAT and reduce the tax base for income tax, when the purchase of goods is registered with a TORG-12 consignment note, but the buyer does not have a 1-T consignment note.

If, among other things, the taxpayer sees in the request for documents a request to provide invoices, there is no need to be alarmed. We need to act. Namely, to raise the agreement with the supplier and check the correctness of filling out the invoice in the TORG-12 form, because these actions, ultimately, will not allow the tax authorities to charge additional VAT and income tax.

So, what is TTN?

A consignment note is a unified document. Its form was approved by Resolution of the State Statistics Committee of the Russian Federation dated November 28, 1997 No. 78 “On approval of unified forms of primary accounting documentation for recording the work of construction machinery and mechanisms, work in road transport.” It also describes the procedure for applying and filling out the consignment note.

The consignment note is a document of title for recording work in motor transport. The document consists of two sections: commodity and transport.

The goods section is necessary for the consignor and the consignee to write off inventory items from the warehouse of the first and post them to the warehouse of the second.

A waybill is issued when the delivery of the purchased goods to the buyer is carried out by the carrier company. First of all, the TTN is necessary to confirm the conclusion of a contract for the carriage of goods (clause 2 of Article 785 of the Civil Code of the Russian Federation, Article 8 of the Federal Law of November 8, 2007 No. 259-FZ “Charter of Automobile Transport and Urban Ground Electric Transport”).

For the seller, the invoice in form 1-T, in the commodity part, is the basis for writing off inventory, and for the buyer this same section is a source of information for recording inventory items.

The transport section of inventory materials is necessary for the carrier and the transport customer to carry out settlements. The carrier, based on the transport section, pays wages to the driver of the vehicle.

For the driver, the document is necessary for unhindered travel on roads, because the consignment note confirms the legality of transporting the cargo to the authorities exercising control on the roads.

Thus, the consignment note is a document that defines the relationship between shippers of motor transport customers and organizations that own motor vehicles that carried out the transportation of goods, and serves to record transport work and settlements between shippers or consignees with organizations that own motor vehicles for the services provided to them for the transportation of goods.

TORG-12 is sufficient for posting goods

The album of unified forms of primary accounting documentation for recording trade operations, approved by Resolution of the State Committee of the Russian Federation on Statistics dated December 25, 1998 No. 132, contains such a primary accounting document as a consignment note, which is used to register the sale (issue) of inventory items to a third party , drawn up in two copies. The first copy remains with the organization handing over the inventory items and is the basis for their write-off. The second copy is transferred to a third party and is the basis for the recording of these valuables.

It is the bill of lading that, in the case of delivery of products by suppliers, is sufficient evidence of the receipt of goods; registration of invoices is not necessary.

There have been many disputes between taxpayers and tax authorities regarding the application of VAT deductions and accounting for the cost of inventory items in expenses, whether or not the buyer has invoices. Some courts decide in favor of the mandatory presence of an invoice, others allow not to use this invoice if the company has other documents confirming the acquisition of goods and materials.

We hope that the Presidium of the Supreme Arbitration Court, in Resolution No. 8835/10 of December 9, 2010, has resolved the conflict between taxpayers and tax authorities once and for all. After all, the formal quibbles of the tax authorities regarding the lack of a copy of the TTN from the buyer have recently been one of the most common reasons for not accepting incurred expenses when calculating income tax and denying the taxpayer the right to deduct input VAT. Now we can certainly say that if a buying company purchases goods and does not act as a customer under a transportation contract, such a company has the right to take into account the costs of purchasing inventory and materials in expenses and to deduct input VAT on such goods, even if the buyer does not have goods - waybill.

The main thing is to have supporting documents confirming the transaction and confidence that the information contained in these documents is complete, reliable and (or) consistent.

Do you want to avoid disputes with tax authorities and your counterparty? Indicate in the supply agreement that the goods are posted on the basis of the TORG-12 consignment note.

TORG-12 by proxy

Despite the simplicity of the question of whether the buyer’s stamp is needed on the consignment note in the TORG-12 form, if the goods are received by the buyer’s representative by proxy, the question remains open. There are two diametrically opposed points of view when answering this question. One of them is based on the norms of clause 2.1.2 of the Methodological Recommendations for accounting and registration of operations for the receipt, storage and release of goods in trade organizations (approved by letter of Roskomtorg dated July 10, 1996 No. 1-794/32-5). In particular, the recommendations indicate that the invoice is signed by the financially responsible persons who delivered and accepted the goods, and is certified by the round seals of the supplier and recipient organizations. The form of the consignment note TORG-12, among other details, contains the attribute “MP”.

Does this mean that a stamp on TORG-12 is needed even if the person who signed the invoice and accepted the goods on behalf of the buyer has a power of attorney?

We believe that a stamp on TORG-12 is not necessary if the authority of the buyer’s representative is confirmed by a power of attorney.

The power of attorney already bears the seal of the organization, because this is provided for in clause 5 of Art. 185 of the Civil Code of the Russian Federation. The power of attorney contains the details of the invoice, according to which the buyer’s representative receives the goods. Therefore, a stamped power of attorney can be attached to the issued invoice. There are no tax penalties for the absence of a stamp on the invoice.

To indicate the details of the power of attorney, the corresponding lines are provided in TORG-12. The authorized person signs in the line “Accepted the cargo”. If the goods are accepted by the head of the enterprise, then he signs in two lines of the document: in the line “The cargo was accepted”, and in the line “The cargo was received by the consignee”. Since the head of the organization, as the sole executive body, can accept goods without a power of attorney, dashes are placed in the lines indicating the details of the power of attorney.

By the way, sellers of goods need to take into account that if the buyer of the goods is an individual, then form No. TORG-12 is not filled out. Indeed, according to Goskomstat Resolution No. 132, this form of invoice is used to formalize the sale (release) of inventory items to a third-party organization.

TTN - a document for the posting of valuables

Your out-of-town supplier sent you a consignment of goods, attaching only an invoice in Form 1-T as a shipping document. At the same time, the TTN is supplemented with the column “VAT amount” and some other details. Can you accept goods under such an invoice for accounting and easily claim input VAT deduction?

We believe that the fact of purchasing goods and recognizing expenses for their acquisition for the purposes of calculating income tax, as well as deducting amounts of input VAT in the presence of only a tax identification number, is possible. And that's why. For expenses to be legal, they must be aimed at generating income, economically justified and documented (Article 252 of the Tax Code of the Russian Federation). To accept input VAT on acquired assets for deduction, it is enough to accept inventory items for accounting, have an invoice and confirm the fact that these inventory items are used in taxable transactions (Clause 1, Article 172 of the Tax Code of the Russian Federation, Article 171 of the Tax Code of the Russian Federation).

Both goods and waybills are the primary documents for recording the movement of goods. The forms of invoices TORG-12 and 1-T are contained in the albums of unified forms of primary accounting documentation (Resolutions of the State Statistics Committee of Russia dated December 25, 1998 No. 132, dated November 28, 1997 No. 78). In accordance with the Procedure for using unified forms of primary accounting documentation, if necessary, both invoices can be supplemented with the necessary details.

Accordingly, if the purchasing organization does not pay for the transportation of goods, then an issued consignment note (Form No. 1-T) or a consignment note (Form No. TORG-12) can be used to capitalize and reflect the cost of purchased goods and materials in accounting. Similar conclusions are contained in letters of the Ministry of Finance of the Russian Federation dated January 31, 2011 No. 03-03-06/1/42, dated June 15, 2010 No. 03-03-06/1/413.

Conclusions:

Are you a buyer and pick up goods from the supplier's warehouse by self-pickup using your own transport? There is no agreement with the carrier, and there is no need to fill out a TTN.

Are you a supplier and independently deliver goods from your warehouse to the buyer’s warehouse using your own transport? All you need to do is arrange the shipment of goods with the TORG-12 consignment note; you do not need to draw up a consignment note.

You are the buyer and, under the terms of the contract, are obligated to pay the supplier the cost of delivery. What document can be used to confirm the delivery costs incurred? There is no unified document form for reflecting delivery services. Therefore, an act on the provision of delivery services is drawn up for the amount of services for the delivery of goods from the supplier to the buyer.

Are you a carrier - the owner of a vehicle? Are you a consignor or a consignee - a participant in the relationship with an organization - the owner of a vehicle transporting goods? For you, the consignment note is mandatory, since the use of Form 1-T is mandatory for all legal entities operating vehicles and being senders and recipients of goods (clause 2 of Resolution No. 78).

Do you want to win a tax dispute? When filling out primary documents, follow the rules provided for by Federal Law No. 129-FZ “On Accounting” and methodological recommendations for filling out certain unified document forms. The courts note that until the tax authority has proven that the information contained in the taxpayer’s primary documents is incomplete, unreliable and (or) contradictory, the taxpayer has the right to be considered in good faith.

Hello Guest! Offer from "Clerk"

Online professional retraining “Chief accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 1.

Sign up

Features of filling out form 1-T

We have already clarified that this format is the most popular. And it is used in the vast majority of cases. The nuances are that the form is divided into two parts. The first is commodity. It is filled out by the seller, because it is he who must provide a certain quantity of the product under the order, supply or purchase agreement. But the second part, the transport part, is already compiled by both the shipper and the carrier. The first one issues an order for logistics activities, the second one carries them out, and, if necessary, makes adjustments.

Product section

It is based on the quantity, volume, quality of goods and materials. This is kind of the central part of the deal. And after listing all the characteristics, a mandatory aspect is the stamp or seal of the company. You will also need the signature of the responsible person, otherwise the certificate will be invalid.

Do not forget that it is through this section that capitalization occurs. Any violations will be identified at this point.

Transport section

We already understand how the TTN works and what kind of document it is. And since he is solely responsible for transportation, this section becomes dominant for his purpose. After all, payment of delivery costs depends not on the quantity and quality of the cargo, but on the performance of transportation functions. Also, the clauses must indicate who will pay the company and in what share. This is usually the buyer's responsibility, but there are exceptions. Also, the driver and the forwarder, in principle, can be part of the company receiving the cargo; accordingly, the section will not become a payment grant, but proof of performance of official duties. And the forwarder already signs here.

TTN

Consignment note, according to Post. Goskomstat No. 78 dated 11/28/97, should be used to account for the work of vehicles and special vehicles in the construction industry. Information No. PZ-10/2012 The Ministry of Finance has actually abolished this form as mandatory since 2013, but many organizations continue to use it in accounting. In addition, according to current legislation, in some cases the use of Form 1-T is still mandatory. This will be discussed later.

The document has two sections, reflected in the name: commodity and transport. The first indicates the data necessary for the sender and the recipient of the transported goods and materials: one for deregistration, the other for registration. The second records the information necessary for the carrier and the customer of the service (sender): physical indicators, loading and unloading activities and their duration, data for calculating for the service, including the driver’s salary.

In general, TTN is an optional form; therefore, its use is subject to reflection in the company’s accounting policies.

The consignment note is issued by the sender of the goods in 4 original copies:

- to the shipper's accounting service as a document for writing off inventory items;

- to the consignee's accounting service for capitalization of inventory items;

- to the ATP accounting service - 2 copies (one is then transferred to the customer of the service as the basis for payment, and the other remains with the carrier as the basis for paying the driver).

The sender signs three copies and gives them to the driver (forwarder), who passes them on to other contractors.

Question: On the deduction of VAT presented upon the purchase of goods (work, services) and the preparation of invoices and delivery notes N TORG-12. View answer

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

When is a waybill needed?

Dear users!

Due to the fact that the consultation line often receives questions about in what cases when transporting goods a consignment note is not needed, we decided to prepare a reminder for you.

So, in what cases is TTN not needed?

- if the employee picks up the goods in his own car;

- if the employee personally receives the goods and orders a taxi for its delivery;

- if an employee brings goods from a neighboring premises where the seller is located;

- if the buyer delivers the goods to the buyer’s warehouse using his own or rented transport.

In the cases listed above, an invoice or any other document that confirms ownership of the cargo is sufficient. Let's explain why. According to the List of documents required for the transportation of cargo by car during domestic traffic, the TTN is mandatory for drivers of legal entities and individual entrepreneurs who carry out transportation under the terms of a contract. In other words, they provide these services to others.

Delivery by mail or courier is a popular practice these days, especially when it comes to small items. But this method is not considered to be transporting goods by road. Accordingly, it provides for the preparation of other documents, but not the TTN.

Relations between the post office and users of these services are regulated by the Rules for the Provision of Postal Services No. 270. A settlement document drawn up in accordance with legal requirements is accepted to confirm payment for postal services for forwarding. To receive the goods by mail, it will also be necessary to provide documents confirming the identity of the recipient.

When delivering goods by courier

An agreement for courier delivery services is drawn up in accordance with the relevant legal requirements. Here, too, a TTN is not required, but when drawing up an agreement, the subject must be clearly stated: the provision of courier services under code DK 016-2010 - 53.20.1 “Mail and courier, others”, under code DK 021-2015 - “Courier services”).

It’s hard not to get confused in the documentation when running a retail business. Here we need an automation system that will allow us to regulate all processes and fully automate the trading activities of both individual retail outlets and large retail chains. Supports connection of retail and cash register equipment: cash registers, scanners, label printers.

To automate a large trading business, the solution “1C: Trading Enterprise Management for Ukraine” is suitable.

Can't find a solution for trading automation on your own? Contact our specialists!

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter

“First BIT” Chelyabinsk invites you to Vladimir Yakuba’s training “Live time management 2.0. Managing yourself and your team” Question and answer: should a private entrepreneur keep personnel records if he hires employees?

No time to read? We'll send it to you by email!

Order help from a 1C specialist

Log in to leave a comment

Use your social media account to leave a comment or review!

Registration in EGAIS

This is the only case when a document becomes reportable at all stages. It is entered into the system at the time of sending. According to the law, all participants in the process must be in the database. Therefore, at each point of cargo transfer, as well as during capitalization, it is necessary to check the Unified State Automated Information System. Conduct a complete product check.

In principle, to post goods with automatic accounting of the invoice, it is better to use a single operating system. Suitable software can be found in Cleverence. We offer:

- Solutions for any type of business.

- Manage all operations from a single device.

- Fast pace of execution of work processes.

We looked at how to work with a consignment note, what it is in accounting, what types and functions this document has, and found out that the invoice becomes vital in many cases.

Especially with increased interest from the Federal Tax Service. Number of impressions: 11420