Deadlines for submitting 6-NDFL

6-NDFL calculations are submitted by all tax agents at the end of each quarter. In 2022 the deadlines are:

- for 2022 - until March 01, 2022

- for the first quarter - until May 4, 2022 (April 30th is a day off)

- for the six months - until August 1, 2022 (July 30 and 31 are days off)

- nine months before October 31, 2022

- for 2022 - until March 1, 2022

If the deadline falls on a weekend or holiday , the calculation must be submitted no later than the next business day.

Tax agents submitting calculations in relation to 25 or more insured persons are required to submit it electronically using the TKS.

All others can choose the form (on paper or electronically) at their discretion.

Typically, the calculation is submitted by tax agents to “their” Federal Tax Service, that is, at the place of registration of the company or at the place of registration of the individual entrepreneur. But for certain cases, separate rules are established.

Separate units

A legal entity that has separate divisions submits a calculation at the place of registration of each of them . The form includes the income and personal income tax of employees of this division.

If two separate divisions are registered with the same Federal Tax Service, but they have different OKTMO codes (belong to different municipalities), then 6-NDFL is submitted separately for each of them. If the situation is the opposite, that is, two separate divisions with one OKTMO are registered with different Federal Tax Service Inspectors, then a legal entity can register with one of the inspectorates and report to it under 6-NDFL for both divisions.

It happens that an employee managed to work in different branches during one tax period. If they have different OKTMOs, then you will have to submit several forms.

On the title page of 6-NDFL, if there are divisions, you must indicate:

- TIN of the parent organization;

- Checkpoint of a separate unit;

- OKTMO of the municipality in whose territory the employees’ place of work is located (indicate it in the payment order).

Change of address

If during the tax period to another Federal Tax Service, then two forms 6-NDFL must be submitted to the new place of registration:

- the first - for the period of stay at the previous address, indicating the old OKTMO;

- the second - for the period of stay at the new address, indicating the new OKTMO.

The checkpoint in both forms indicates the one assigned to the new Federal Tax Service.

Nuances of reflecting information in line 100

Example 1

The company entered into a lease agreement for premises with an individual. The contract expires on September 30, 2019. A security alarm was installed with the consent of the landlord, the work was accepted according to the act - 04/10/2019. The company paid for the work on April 13, 2019. The lessor, under the terms of the contractual relationship, does not reimburse expenses.

Question

What date will be the day for the landlord to receive profit from the cost of inseparable improvements?

Answer

Profit in kind is considered received on the day of its transfer (Article 223, paragraph 1, subparagraph 2). In this case, inseparable improvements are accepted at the end of the lease agreement - 09/30/2019. This will include an act of handing over the premises to the landlord (03-04-05 – 79439).

The profit cannot be recognized as received, since the alarm system is in the possession of the tenant. When creating the calculation, put the date in line 100 – 30.09.

Personal income tax is withheld from the profits that individuals. the person will receive it after 09/30/2019. If there is no payment of income by the end of the year, then the fiscal authorities are notified by March 1, 2020 about the impossibility of withholding income tax.

How to fill out 6-NDFL

The calculation form was approved by order of the Federal Tax Service dated October 14, 2015 No. ММВ-7-11/ [email protected] On January 17, 2022, the Federal Tax Service by its order No. ММВ-7-11/ [email protected] made changes to it, which became effective on March 26, 2018 .

The form consists of a title page and two sections. The title states :

- tax agent name

- its basic details

- tax authority information

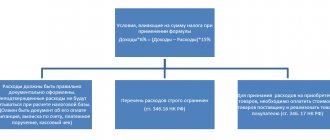

Sections 1 and 2 indicate information about all income of individuals from whom personal income tax is calculated. This includes not only employees, but also persons with whom civil contracts were concluded, if personal income tax is charged on payments thereunder. But income that is not taxed (for example, child benefits) is not reflected in the form.

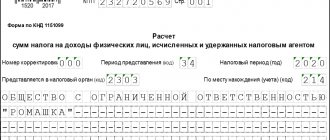

Title page

Filling out the 6-NDFL cover page usually does not raise any questions. how to fill out the TIN, KPP and OKTMO in the presence of separate divisions . Accordingly, in the absence of branches, their own codes are prescribed. The remaining fields are filled in like this:

- “Adjustment number” - upon initial submission, “000” is indicated, otherwise the serial number of the declaration is indicated - “001”, “002” and so on.

- “Submission period” is the code from Appendix No. 1 to Order No. ММВ-7-11/ [email protected] For a 9-month period it is “33”.

- "Taxable period" — 2022.

- "Tax authority code" consists of two values:

- the first two digits are the region code;

- the last two digits are the tax office number.

- The code “at the place of location (registration)” is taken from Appendix No. 2 to Order No. ММВ-7-11 / [email protected] Organizations registered at the place of registration and not among the largest taxpayers put “214”.

- The name of the tax agent in accordance with its constituent documents. The rules require the abbreviated name to be indicated, and if not, the full name. If the tax agent is an individual, then his full name is indicated without abbreviations in accordance with the passport.

Name of tax agent

The following line is filled in only by the legal successor of the reorganized company :

- in the field “Form of reorganization/liquidation” the code from Appendix No. 4 to Order No. MMV-7-11/ [email protected] ;

- in the next field you need to indicate the TIN and KKP that were assigned to the company before the reorganization.

Reorganization form

Note! Fields for assignees appeared on the form on March 26, 2022. This is due to the fact that from January 1, 2022, the 6-NDFL calculation must be submitted by the legal successor if the form was not submitted before the organization.

at the bottom of the title page :

- OKTMO code

- phone number

- number of calculation pages and supporting documents

- signatory code: 1 - if this is a tax agent or legal successor, 2 - if this is a representative

- Full name of the individual who signs the document

- date and signature

Details of the authorized person

If the form is signed by a representative, you must indicate the name and details of the document on the basis of which he acts. In addition, the full name of the representative or his name (if the representative is a legal entity) is indicated in this section.

Section 1

In this section, information is indicated on an accrual basis for the entire reporting period. Line by line filling is presented in the following table.

Table 1. Filling out the lines of section 1 of form 6-NDFL

| Line | What is indicated |

| 010 | Personal income tax rate |

| 020 | Total income of all persons since the beginning of the period (year) |

| 025 | Dividend income |

| 030 | Deductions for income from line 020 |

| 040 | Total calculated personal income tax |

| 045 | Personal income tax on dividends (included in line 040) |

| 050 | Amount of advance payment paid by a migrant with a patent |

| 060 | Number of persons for whom the form is submitted |

| 070 | The amount of personal income tax withheld for the entire period |

| 080 | The amount of tax that the agent was unable to withhold (for example, on income in kind). Personal income tax, which will be withheld in the next period, is not subject to reflection |

| 090 | The amount of personal income tax that was returned to the payer |

Attention! If income was taxed with personal income tax at different rates, you need to fill out several blocks of lines 010-050 and indicate information at one rate in each of them. In this case, in lines 060-090 the indicators are reflected in the total amount.

Section 2

Section 2 contains information only for the last 3 months of the reporting period. That is, in section 2 of form 6-NDFL for 2022, you need to indicate data for the fourth quarter.

The section contains several blocks of 5 fields that reflect the following information:

- on line 100 - date of receipt of income

- on line 110 - the date of personal income tax withholding from this income

- on line 120 - date of transfer of tax to the budget

- on line 130 - the amount of income received

- on line 140 - the amount of personal income tax withheld

The main difficulties when filling out section 2 are determined by the dates of receipt of income and transfer of personal income tax. They differ for different types of income. To avoid confusion, we recommend checking the following table.

The table does not contain a column with the date of tax withholding, since most often it coincides with the date of receipt of income . Exceptions to this rule are below the table.

Table 2. Determination of dates for 6-NDFL

| Income | date of receiving | Deadline for transferring personal income tax |

| Salary Prepaid expense* Bonus (as part of salary) | The last day of the month for which the salary or bonus for the month included in wages was calculated | No later than the day following the day of payment of the bonus or salary upon final payment |

| One-time bonus (annual, quarterly, in connection with any event) | Bonus payment day | |

| Vacation pay, sick pay | Pay day | No later than the last day of the month in which vacation pay or temporary disability benefits were paid |

| Payments upon dismissal (salary, compensation for unused vacation) | Last day of work | No later than the day following the day of payment |

| Dividends | Pay day | |

| For LLCs - no later than the day following the day of payment. For JSC - no later than one month from the earliest of the following dates:

| ||

| Help | Pay day | No later than the day following the day of payment |

| Gifts in kind | Day of payment (transfer) of the gift | No later than the day following the day the gift is issued |

*Explanation. Personal income tax is not deducted from the advance payment - it will be deducted from the salary for the second part of the month. However, it happens that the advance is paid on the last day of the month . In this case, it is recognized as wages for the month, and personal income tax is withheld as from wages.

The date of receipt of income and personal income tax withholding do not coincide in the following cases:

- When paying daily allowances in excess of established standards. The tax withholding day is considered to be the nearest day of payment of wages in the month in which the advance report is approved.

- When receiving material benefits - expensive gifts, other income. The tax withholding day is considered to be the nearest salary payment day.

When filling out lines 100-120, all incomes for which all 3 dates coincide respectively are summed up. That is, you can sum up your salary and monthly bonuses. But quarterly bonuses, vacation pay, sick leave will be shown separately. The form will contain the required number of blocks of lines 100-140.

Important! When filling out line 130, income is indicated in full. That is, there is no need to reduce it by the amount of personal income tax and deductions.

Filling out line 100 if earnings were paid both in cash and in kind

Management decided to pay wages for July on August 5, partly in cash from the expense account, and partly in products in the amount of 25% of earnings with the written consent of employees. This procedure does not contradict Article 131 of the Labor Code.

In this case, profit both in monetary terms and in kind is recognized as wages received on the last day of the month for which the accrual was made (Article 223, paragraph 2 of the Tax Code).

Personal income tax on profits received in kind, in this case, is withheld from the monetary part of the income, since payments are made on the same day.

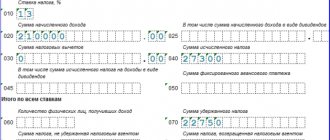

Filling example

Let's look at the procedure for filling out Form 6-NDFL for the year using the example of Romashka LLC. For the fourth quarter of 2022, the following information is available:

- number of employees - 6

- the total income of employees for the year amounted to 1,440,000 rubles (120,000 rubles per month)

- all employees are entitled to a standard deduction for a child in the amount of 1,400 rubles. The total amount of the deduction was: 1,400 x 6 x 12 = 100,800 rubles

- amount of calculated personal income tax on income: (1,440,000 rubles - 100,800) * 13% = 174,096 rubles (14,508 rubles per month)

- the amount of personal income tax withheld for the year was 8 = 159,588 rubles, since the tax on the December salary is subject to withholding in January

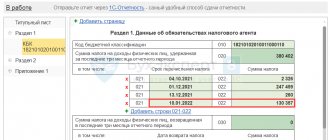

Section 1 is filled out like this:

Section 1

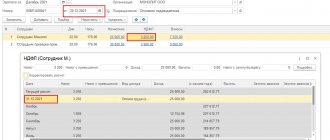

The following table lists the fourth quarter transactions that will be needed to be reported in Section 2.

Table 3. Operations of Romashka LLC in the fourth quarter of 2022 for payment of income and withholding personal income tax

| date | Operation and amount |

| 05.10 | Payment of salary for September |

| 08.10 | Personal income tax for September transferred |

| 30.10 | Salary accrued for October - 120,000 rubles, personal income tax calculated - 14,508 rubles |

| 05.11 | Salary paid for October |

| 06.11 | Personal income tax transferred for October |

| 30.11 | November salary accrued - 120,000 rubles, personal income tax calculated - 14,508 rubles |

| 05.12 | Salary paid for November |

| 06.12 | Personal income tax for November transferred |

| 31.12 | December salary accrued - 120,000 rubles, personal income tax calculated - 14,508 rubles |

Note! Wages for December, paid in January, will not appear in the calculation, since the deadline for paying personal income tax on it expires in another reporting period.

And here’s what Section 2 of the 6-NDFL calculation, completed using these data, will look like:

Section 2

Reflection of a long-term GPC agreement

Let's look at the situation using an example.

The company entered into an agreement with the individual. face of the GPC agreement. Validity period: 3 months. The acceptance certificate for completed work is signed on the last day of each month. Remuneration is paid on the 10th of the next month.

On May 31, the first act was signed; accordingly, the money was transferred on June 10. The next act was signed on June 30.

In calculations for the half-year, indicate in line 100 – 10.06. only profits paid for May. Personal income tax is withheld by the same number and transferred the next day.

Sanctions for violations

For violations of the deadline and form for filing 6-NDFL, tax and administrative liability is provided. All sanctions are collected in the following table.

Table 4. Possible sanctions for violating the procedure and deadline for filing 6-NDFL

| Violation | Sanction | Regulatory Standard |

| Form not submitted | 1 thousand rubles for each month (full and part-time) | clause 1.2 art. 126 Tax Code of the Russian Federation |

| The calculation was not received by the Federal Tax Service within 10 days after the deadline for submission | Blocking the current account | clause 3.2 art. 76 Tax Code of the Russian Federation |

| Error in calculation (if identified by the tax authority before the agent corrected it) | 500 rubles | Art. 126.1 Tax Code of the Russian Federation |

| Failure to comply with the form (submission on paper instead of sending via TKS) | 200 rubles | Art. 119.1 Tax Code of the Russian Federation |

| Submission deadline violation | 300-500 rubles per official | Part 1 Art. 15.6 Code of Administrative Offenses of the Russian Federation |

Company officials are held administratively liable . For example, a fine for late submission of 6-NDFL will be imposed on the chief accountant if his job description states that he is responsible for the timely submission of reports.

Adjustment

If an error is detected in the submitted form or when recalculating personal income tax for the previous year, an updated calculation . The Tax Code does not provide specific deadlines for this. But if you find a mistake yourself, correct it immediately and provide a “clarification”.

If you make a correction before the tax authorities find the mistake, you can avoid a fine of 500 rubles.

The features of the updated form 6-NDFL are as follows:

- the correction number is indicated - “001” for the first, “002” for the second, and so on

- in the fields in which inaccuracies and errors are found, you must indicate the correct data

- the remaining fields are filled in the same way as in the primary calculation

We will separately mention how to correct the form if you indicated an incorrect checkpoint code or OKTMO . In this case, you need to submit 2 calculations:

- In the first , you need to indicate the correct gearbox and OKTMO codes and enter the correction number “000”. All other data must be transferred from the previous form.

- In the second calculation, the adjustment number “001” is indicated, as well as the checkpoint and OKTMO, which were indicated in an erroneous form. All sections must contain zero data.