Start of accounting. Who should do the accounting?

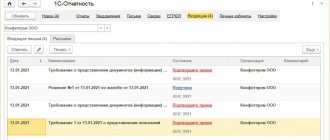

Keep records and submit all reports to the Federal Tax Service, Pension Fund of the Russian Federation, Social Insurance Fund and Rosstat through Kontur.Accounting.

Get free access for 14 days

The obligation to maintain accounting records is dictated by Federal Law No. 402-FZ “On Accounting”. It states that accounting must be maintained by all legal entities, commercial and non-profit organizations, and neither the form of ownership nor the taxation system removes this obligation.

There are concessions especially for small organizations. For example, Federal Law No. 209-FZ allows small businesses to keep accounting records in a simplified form.

Lack of accounting records or gross violations of accounting rules are punishable by fines. The only exception is individual entrepreneurs: they are not yet required to maintain accounting.

What documents regulate accounting in an organization?

As already mentioned, the main document regulating accounting nationwide is Federal Law No. 402-FZ “On Accounting”. Other basic documents are accounting regulations (APS), which describe how to conduct accounting in practice. Among the options offered in the PBU, you need to choose those that will be most beneficial for the business financially and will eliminate unnecessary questions from representatives of regulatory authorities and investors.

And, finally, another fundamental document - the chart of accounts for accounting the financial and economic activities of organizations, approved by Order of the Ministry of Finance dated October 31, 2000 No. 94n (the latest edition was approved by Order of the Ministry of Finance dated November 8, 2010 No. 142n). The organization's chart of accounts is drawn up and approved on the basis of this chart of accounts.

Accounting principles

Accounting principles are the basic rules of accounting. The principles are a general direction of movement and allow us to specify and clarify the accounting procedure in certain conditions, but are not specific practical examples of actions.

Thus, the following fundamental principles of accounting are distinguished:

- the principle of property separation (the assets and liabilities of an organization must be taken into account separately from the assets and liabilities of its owners and other organizations);

- the principle of going concern (the organization does not anticipate its liquidation or significant reduction in activities in the foreseeable future, therefore liquidation assessments are not applied);

- the principle of consistency in the application of accounting policies (the organization’s accounting policies are applied from year to year, there is no need to re-approve it annually, you can only make changes and additions if justified);

- the principle of temporary certainty of facts of economic activity.

Where to start accounting in an organization?

Keep records and submit all reports to the Federal Tax Service, Pension Fund of the Russian Federation, Social Insurance Fund and Rosstat through Kontur.Accounting. Get free access for 14 days

Accounting statements are submitted once a year, but accounting must be kept regularly and systematically, so that after the end of the reporting period you do not have to search for primary documents among counterparties and hastily post accounting entries to accounts. Moreover, accounting in an organization begins before the first transaction occurs. As soon as the title documents for the company are received, local regulations can be drawn up that regulate accounting in the organization.

First of all, the accountant must:

- Develop accounting policies

- Prepare forms of primary documents

- Approve the chart of accounts

What does the law say about organizing and maintaining accounting?

For those who need to study everything directly and thoroughly, below you can read an excerpt from the Federal Law “On Accounting” for the Organization of Accounting.

- Maintaining accounting records and storing accounting documents are organized by the head of the economic entity, except for cases where otherwise established by the budgetary legislation of the Russian Federation.

- If an individual entrepreneur or a person engaged in private practice maintains accounting records in accordance with this Federal Law, they themselves organize the maintenance of accounting records and storage of accounting documents, and also bear other responsibilities established by this Federal Law for the head of an economic entity.

- The head of an economic entity is obliged to entrust accounting to the chief accountant or other official of this entity or to enter into an agreement for the provision of accounting services, unless otherwise provided by this part.

The head of a credit institution is obliged to entrust accounting to the chief accountant.

The head of an economic entity who, in accordance with this Federal Law, has the right to use simplified methods of accounting, including simplified accounting (financial) reporting, as well as the head of a medium-sized enterprise can take over the accounting. With the exception of the following economic entities:

1) organizations whose accounting (financial) statements are subject to mandatory audit in accordance with the legislation of the Russian Federation;

2) housing and housing-construction cooperatives;

3) credit consumer cooperatives (including agricultural credit consumer cooperatives);

4) microfinance organizations;

5) organization of the budgetary sphere;

6) political parties, their regional branches or other structural units;

7) bar associations;

law offices;

9) legal advice;

10) bar associations;

11) notary chambers;

12) non-profit organizations included in the register of non-profit organizations performing the functions of a foreign agent as provided for in paragraph 10 of Article 13.1 of the Federal Law of January 12, 1996 N 7-FZ “On Non-Profit Organizations”.

3.1. The procedure for transferring powers to maintain accounting records and present accounting (financial) statements by public sector organizations is established by the budget legislation of the Russian Federation.

- In open joint-stock companies (except for credit organizations), insurance organizations and non-state pension funds, joint-stock investment funds, management companies of mutual investment funds, in other economic entities whose securities are admitted to trading in organized trading (except for credit organizations), in organizations of the budgetary sector that prepare consolidated (consolidated) budget statements, consolidated statements of state (municipal) institutions, the chief accountant or other official responsible for accounting must meet the following requirements:

1) have a higher education;

2) have work experience related to accounting, preparation of accounting (financial) statements or auditing activities for at least three years out of the last five calendar years, and in the absence of higher education in the field of accounting and auditing - at least five years out of the last seven calendar years;

3) do not have an unexpunged or outstanding conviction for crimes in the economic sphere.

- Additional requirements for the chief accountant or other official responsible for accounting may be established by other federal laws.

- An individual with whom an economic entity enters into an agreement for the provision of accounting services must meet the requirements established by part 4 of this article (2 points above). A legal entity with which an economic entity enters into an agreement for the provision of accounting services must have at least one employee who meets the requirements established by part 4 of this article, with whom an employment contract has been concluded.

- The chief accountant of a credit organization and the chief accountant of a non-credit financial organization must meet the requirements established by the Central Bank of the Russian Federation.

- In the event of disagreements regarding accounting between the head of an economic entity and the chief accountant or other official entrusted with accounting, or the person with whom an agreement has been concluded for the provision of accounting services:

1) the data contained in the primary accounting document is accepted (not accepted) by the chief accountant or other official entrusted with accounting, or by the person with whom an agreement has been concluded for the provision of accounting services, for registration and accumulation in registers accounting by written order of the head of an economic entity, who is solely responsible for the information created as a result;

2) the accounting object is reflected (not reflected) by the chief accountant or other official entrusted with maintaining accounting records, or by a person with whom an agreement has been concluded for the provision of accounting services, in the accounting (financial) statements on the basis of a written order of the manager an economic entity that is solely responsible for the reliability of the presentation of the financial position of the economic entity as of the reporting date, the financial result of its activities and cash flows for the reporting period.

You can see the current changes if you find the “Federal Law of December 6, 2011 N 402-FZ” (as amended on July 26, 2019) “On Accounting” with current amendments.

How to write an organization's accounting policy?

An accounting policy is an internal document of a company that defines the principles and options for accounting. The accounting policy must be drawn up and approved within 90 days from the date of state registration of the legal entity.

In small companies where accounting is not rich in features, accounting policies are often adopted once for the entire life of the enterprise. However, if necessary, changes are made to the academic policy, for example: due to the emergence of a new area of activity of the organization or changes in legislation. There is no need to approve a new accounting policy for each year or issue orders for its renewal.

If an audit comes to you, be prepared to present your accounting policy: this will be the first thing they ask for. To ensure that inspectors do not have the opportunity to interpret the ambiguities of the law not in your favor, describe in your accounting policy the features of accounting in your business.

What to write in the accounting policy?

Keep records and submit all reports to the Federal Tax Service, Pension Fund of the Russian Federation, Social Insurance Fund and Rosstat through Kontur.Accounting. Get free access for 14 days

The accounting policy regulates the maintenance of both accounting and tax accounting, so it is convenient to divide it into two parts.

In terms of accounting, the accounting policy must contain:

- Working chart of accounts of the organization

- Form of explanations for the balance sheet and profit and loss statement

- Classification of the organization’s income and expenses into income and expenses from ordinary activities and other income and expenses (taking into account the specifics of the organization’s activities)

- Level of materiality of error for financial statements items

- The procedure for revaluing fixed assets or information that fixed assets are not revalued, methods for determining the useful life and calculating depreciation of fixed assets and intangible assets

- The procedure for assessing inventories (at the cost of each unit, at the average cost, or using the FIFO method - at the cost of the first acquisition of inventories)

- document flow schedule;

- inventory rules;

- Information about who will do the accounting: manager, accountant or accounting service.

In your accounting policy, write only about those accounting methods that you must approve yourself or choose from those proposed. There is no need to rewrite what is already mandatory for all enterprises. There is also no point in writing about those aspects of accounting that you will not apply. For example, if you don't have intangible assets and you don't plan to have them, you don't have to choose how to amortize them. If they suddenly appear, the accounting policy can always be supplemented.

The Kontur.Accounting web service makes it convenient to keep records, pay salaries, and submit reports.

Tax accounting rules must contain

- Tax accounting registers developed by the company in accordance with the requirements of the Tax Code

- The principle of distinguishing between direct and indirect expenses for the purpose of calculating income tax

- Method for estimating work in progress

- The procedure for assessing inventories during release into production and other disposals, during the sale of purchased goods (at the cost of a unit of inventory, at the average cost, at the cost of the first in time of acquisition - FIFO)

- The procedure for forming the cost of products and purchased goods for tax purposes

- The procedure for assigning the value of property to material expenses: one-time upon commissioning or (from 01/01/2015) over several reporting periods

- Methods for calculating depreciation of property (linear or non-linear)

- Rules for creating and using reserves

- Norms for recognizing standardized expenses as income tax expenses: entertainment expenses, expenses for voluntary medical insurance, etc.

Organizations working in the field of information technology indicate whether they classify computer equipment as depreciable property or consider the costs of its acquisition as material expenses.

The list of items is open; each organization compiles it independently, taking into account its specifics.

Primary documents and chart of accounts

Keep records and submit all reports to the Federal Tax Service, Pension Fund of the Russian Federation, Social Insurance Fund and Rosstat through Kontur.Accounting. Get free access for 14 days

Facts of economic life are reflected in accounting on the basis of primary accounting documents. Organizations can develop forms of some primary documents on their own. The main thing is to enter all the required details into the forms and approve them in the accounting policy.

However, if there are no non-standard operations in the economic life of the organization, it is better not to create individual forms of documents. In order not to complicate the document flow, it is better to use the forms recommended by the State Statistics Committee.

If necessary, the list of documents can be supplemented.

In addition to the forms of primary documents, the accounting policy requires approval of the organization's chart of accounts and accounting registers. From the chart of accounts approved by the Ministry of Finance, select those that you will use. And for a more accurate classification, you can enter subaccounts.

If the company is small and its economic life does not involve non-standard operations, the manager does not need to dive into all these subtleties. The online service Kontur.Accounting already has an accounting policy that is suitable for most companies, all that remains is to read it and print the order prepared in the service.

And then the actual accounting begins, but that’s another topic.

What must a primary accounting document contain?

Despite the fact that there is currently no single list of forms for primary documents, the legislator has established clear requirements for their content. After all, each such document must confirm the fact of an economic event that took place at the enterprise (clauses 1, 3, article 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ), and therefore reflect the main characteristics of such an event.

In paragraph 2 of Art. 9 of Law No. 402-FZ provides a list of details that any primary document must contain, regardless of which group (from the above) it belongs to. These details are:

- Name. Any document must contain a clear and correct name. A document without a name may be considered to have no legal force.

- The date on which the relevant document was executed by the company.

- Information about the compiler company (name, address of the company).

- Information directly about the business event that is documented by this document. In most cases, the content of a business transaction is clear from the title of the document, while the body of the document contains a detailed description of the event.

- Numerical and monetary characteristics, measures of the completed transaction (for example, how many units of manufactured products were sold to the buyer under a supply agreement and for what amount).

- Information about the person who compiled this primary document, as well as the signature of such person.

It is important for a specialist who is involved in drawing up a primary document to remember two main points. Firstly, such a document must be drawn up either immediately at the moment when the economic event took place, or immediately after the completion of such an event. Secondly, such a specialist must promptly submit the compiled primary document to the company’s accounting department so that its employees reflect the transaction in accounting.