Primary: NU

According to Article 265 of the Tax Code, expenses must be documented.

Documented expenses mean expenses supported by documents:

- issued in accordance with the legislation of the Russian Federation;

- executed in accordance with business customs applied in the foreign country in whose territory the relevant expenses were incurred;

- indirectly confirming the expenses incurred (including a customs declaration, business trip order, travel documents, report on work performed in accordance with the contract).

At the same time, in order to generate tax accounting data, it is necessary to have properly executed supporting documents confirming the expenses incurred.

According to Article 313 of the Tax Code, tax accounting is a system of summarizing information for determining the tax base for income tax based on data from primary documents , grouped in accordance with the procedure provided for by the Tax Code.

All innovations for 2019-2020 in the primary documentation will be discussed at a seminar in the capital on November 1.

You will learn how tax and law enforcement agencies work with the “primary” and what tax optimization techniques can lead to criminal liability.

The host of the event, Smirnova T.S., head of the department of documentary checks and audits of the Department of Economic Security and Anti-Corruption of the Ministry of Internal Affairs of the Russian Federation , which conducts joint tax audits of taxpayers of various forms of ownership, will share her practical experience with you.

Come!

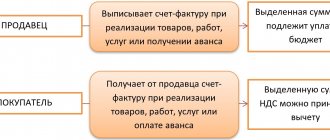

What is it, why is it needed and when is the document issued?

To receive the goods

TORG-12 is compiled by the organization that ships inventory items , therefore, at the time of acceptance of the products, the TN must be drawn up (read here about who signs the columns “accepted the cargo,” “received the cargo,” and others). The legislation provides for both paper and electronic formats of supporting documentation. The buyer has the right to refuse to accept goods and materials without documents for the delivery of cargo.

However, if upon receipt of the product the buyer discovers the product is of inadequate quality and wants to return it back to the seller, then the buyer must draw up a technical specification for the returned values.

Together with the invoice for the return of goods and materials, an act of discrepancy in the quantity and quality of goods is drawn up in the TORG-2 form. In addition, it is necessary to discuss the procedure for returning products with the supplier in advance and fix this point in the contract, otherwise the financially responsible person of the buyer does not have the right to return low-quality goods back at the time of acceptance.

There are no special rules for issuing TORG-12 for the return of material assets ; it is issued in the usual manner. The supplier and shipper here is the buyer who wants to return the defective product. The consignee and buyer are suppliers of low-quality products. In the “Grounds” column, you should indicate the details of the documents on the basis of which the goods are returned:

- invoices for which goods and materials were received;

- contracts for the supply of goods;

- TORG-2 act or defective statement, which records discrepancies in the quantity and quality of shipped products.

For implementation

The sale of goods, namely the transfer of goods and materials from one person to another on a reimbursable basis, must be documented with accompanying documents. Based on TORG-12, accounting records reflect the entries for the movement of inventory items from the warehouse and entries for settlements with customers.

All documentation for the sale of products is issued by the selling organization , indicating the buyer’s details in the document. As a rule, during sales, the party accepting the shipped products pays for it itself.

Therefore, when registering a technical document for sale, the columns “Consignee” and “Payer” are the same.

They indicate:

- name of company;

- its location;

- Bank details.

The “Base” field indicates the details of the supply agreement, order, specification or invoice for payment.

For shipment

In situations where the release of inventory items is carried out to one organization, and payment is received from another, the TN must indicate the details of the consignee and payer separately in the appropriate fields of the transfer document.

The payer will be the purchasing organization under the contract . The consignee may be a third party organization, a subsidiary, a branch or a representative office of the buyer. The delivery contract or an additional agreement to it must indicate where the cargo will be delivered and who the consignee is.

To supply

If the delivery of inventory items is carried out through a third-party organization, then the seller, in addition to the TORG-12 form, issues a bill of lading (TTN) according to the unified form No. 1-T.

This document is drawn up in triplicate (for the supplier, carrier and buyer) for each shipment of cargo transported by one vehicle, in contrast to the TN, which is drawn up for the entire shipment being shipped. 1-T does not replace TORG-12, but serves as a document accompanying the cargo.

The consignment note is issued in the usual manner, indicating the seller and buyer, all information about the cargo carrier is indicated in 1-T.

Read about the important rules for filling out TORG-12 with and without VAT in our material.

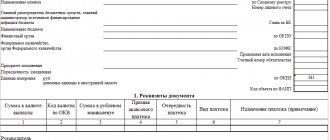

Primary: BU

In accordance with paragraphs 1 and 5 of Article 9 of the Federal Law of December 6, 2011; 402-FZ “On Accounting”, each fact of economic life is subject to registration as a primary accounting document.

The primary accounting document is drawn up on paper or in the form of an electronic document signed with an electronic signature.

The required details of the primary accounting document are:

- Title of the document;

- date of document preparation;

- name of company;

- content of the fact of economic life;

- the value of a natural or monetary indicator;

- position and signature of the person who completed the transaction, operation and is responsible for its execution.

Moreover, if the current legislation establishes mandatory forms of documents for registration of specific transactions, then the forms of documents established by the current legislation must be used.

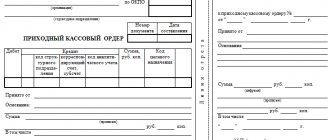

Why do you need an electronic cash receipt?

The need to issue an electronic check arises in accordance with paragraph 2 of Article 1.2 of Federal Law No. 54. When making payments at an online cash register, the client is required to issue a paper check to the client. If the client requests, the check is issued electronically. At the moment, chain stores that have their own smartphone applications are transferring customers to electronic receipts. It is enough to check the consent box and each time the cash register will issue an electronic receipt by e-mail instead of a paper one when purchasing. For online stores that accept payment directly through the website, an electronic receipt is the main one.

Based on paragraph 6 of Article 14.5 of the Code of Administrative Offenses of the Russian Federation, refusal to provide an electronic cash receipt is equivalent to an administrative offense and entails a fine in the amount of:

- for an employee - 2,000 ₽,

- for individual entrepreneurs - 2,000 ₽,

- for an organization - 10,000 ₽.

Cash register receipt as a document for expenses

The Ministry of Finance issued letter No. 03-01-15/63722 dated August 20, 2019, in which it explained what should be reflected in a cash receipt in order to accept it for expenses as a primary document.

According to Article 4.7 of Federal Law No. 54-FZ, a cash receipt must necessarily contain the following details:

- Title of the document;

- serial number for the shift;

- date, time and place (address) of settlement;

- name of the organization or full name of the individual entrepreneur;

- TIN;

- the taxation system used in the calculation;

- calculation sign;

- name of goods, works, services, their quantity, price per unit, cost taking into account discounts and markups, indicating the VAT rate;

- the calculation amount with a separate indication of the rates and VAT amounts at these rates;

- calculation form;

- position and surname of the person who made the settlement with the client and issued the cash receipt;

- CCP registration number;

- serial number of the fiscal drive model;

- fiscal sign of the document;

- Federal Tax Service website address;

- subscriber number or email address of the client in case of transfer of a cash receipt to him in electronic form;

- e-mail address of the sender of the cash receipt in case of transfer of the cash receipt to the client in electronic form;

- serial number of the fiscal document;

- shift number;

- fiscal sign of the message;

- QR code.

But that's not all the details. Clause 6.1 of the above-mentioned Article 54-FZ describes what additionally should be in the cash receipt when making payments between organizations and individual entrepreneurs :

- name of the buyer (name of organization, full name of individual entrepreneur);

- INN of the buyer (client);

- country of origin of the goods;

- excise tax amount (if applicable);

- registration number of the customs declaration - when making payments for the goods (if applicable).

Thus, when making these calculations, the cash receipt reflects information about both the seller and the buyer.

From all of the above, the Ministry of Finance concludes that expenses can be taken into account for the purpose of calculating income tax if the supporting documents are drawn up in accordance with the legislation of the Russian Federation and from these documents it is clearly and definitely clear what expenses were incurred.

At the seminar on primary documentation, you will receive a lot of information on this issue, thematic handouts, as well as answers to your questions on this topic.

Sign up! When registering through "Clerk" - discounts.

What is an electronic check

Electronic receipt - a cash receipt in electronic form, which is sent to the client as an SMS message or to an email address. A check in electronic form is equivalent to a paper version and can be used to process returns, submit documents for tax deductions, etc., i.e. is a complete document.

The sending of electronic cash receipts is carried out by the fiscal data operator (FDO).

What does an electronic cash receipt look like?

From a legal point of view, an electronic cash receipt is equivalent to a paper one. The contents of a paper check and its electronic copy are approximately the same, with a few exceptions.

An electronic check for the client has its undeniable advantages:

- The receipt is always at hand (you can view it from your smartphone),

- It will never be lost (the electronic document file is stored on the Tax Service server),

- You can maintain your own electronic accounting.

Among other things, the electronic form of a check saves paper resources.

You can check whether the check is real or not on the OFD or Federal Tax Service website. The buyer will always be able to find an electronic receipt. To do this, you need to install the application “Checking a cash receipt in the Federal Tax Service of Russia” for the App Store and “Checking a cash receipt” in Google Play. The application allows you to scan the QUAR code on a paper receipt or search by entering the necessary data.

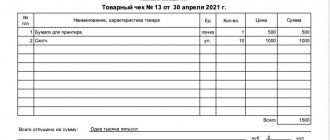

Sales receipt format

It is not fixed, so each business has some freedom in terms of design. You can choose from those offered in the public domain or develop your own. To do this, you can contact any printing house or order a project from in-house specialists. Many printing houses offer ready-made samples to choose from, and if they have their own designer, they can develop an individual sample for you.

The document does not apply to strict reporting forms, but it should not be neglected. Modern cash register systems usually print the full range of purchased goods on a cash register receipt, but in older models it is impossible to implement this function, so you cannot do without receipts. For entrepreneurs working under UTII or PSN, a check is the main document issued to the buyer.

Sales receipt: purpose and characteristics

A sales receipt is an official document confirming the provision of services or provision of goods by the seller and the fact of payment by the buyer.

It can be used as:

- primary document;

- attachment to the cash receipt;

- an alternative for him.

This document is not unified, however, the design and information contained in it must comply with the requirements of Art. 9 of Law No. 402-FZ on primary accounting documents. Indeed, it can be used not only as confirmation of the transaction and given to the buyer, but also used for accounting as evidence of a fact in the economic life of the enterprise.

One of the mandatory items presented when filling out this type of receipt is a detailed description of the contents of the sale: the name and quantity of goods.

Modern accounting programs allow you to enter this data directly into a cash receipt, however, earlier versions may not have this ability, so in this case the sales receipt is used as an attachment to the cash register, revealing the details of the purchase.

This application is optional and can be issued to the buyer upon his request. However, there are exceptions. Thus, according to the Decree of the Government of Russia dated January 19, 1998 No. 55 “On approval of the Rules for the sale of certain types of goods,” the seller is obliged to issue the buyer a sales receipt disclosing the details of the purchase in the case of sales of the following types of goods:

- motor vehicles;

- weapon;

- pieces of furniture;

- items of clothing and footwear;

- gems;

- animals;

- Construction Materials.

In all other cases, drawing up such a check as an attachment to a cash receipt is not necessary.

The condition under which a sales receipt must be issued is that it is an alternative to a cash receipt.

How and when is it issued?

Taking into account the above provisions of the law and clarifications of regulators, the following main scenarios for the use of sales receipts can be identified:

- When is a sales receipt required?:

- by virtue of a direct order by law;

- due to the presence in the law of norms that indirectly prescribe the issuance of a sales receipt.

On the first basis, a sales receipt is issued in accordance with Resolution No. 55, which we mentioned above:

- as an independent document (issued regardless of the fact of issuance or non-issuance of a cash receipt);

- as a document supplementing a cash receipt - if it does not contain the required information, which is provided for by the resolution.

In accordance with paragraph 20 of the Rules for the sale of individual goods, which are approved by Resolution No. 55, a sales receipt must be issued if retail trade is carried out (with the exception of trade in food products, which are listed in paragraph 2 of paragraph 4 of the Rules). The same paragraph provides information that must be reflected on the check:

- Name of product;

- seller information;

- quantity and cost of goods.

The check must also be signed by the seller.

In accordance with paragraph 60 of the Rules, a sales receipt must be issued when selling cars. The receipt must indicate, in particular, the make of the car and its engine number.

Other “mandatory” scenarios for issuing a sales receipt are sales transactions:

- weapons (clause 101 of the Rules);

- furniture (item 117).

Paragraph 46 of the Rules states that if a cash receipt for a product represented by one or another type of textile product or knitwear does not include the name of the product, article or grade (if provided), then along with the product the buyer is given a sales receipt with the data information (and other details of the sales receipt, which we mentioned above). If jewelry is sold, and the cash receipt for its sale does not contain information about the name of the product, sample, type, characteristics of the stone and article number, then a sales receipt is also attached to the fiscal document, which contains this information - as follows from paragraph 69 of the Rules.

Essentially similar requirements - for issuing a sales receipt in addition to a cash receipt, where there is “insufficient information” - are established in relation to retail sales transactions:

- plants and animals (clause 80 of the Rules);

- building materials (clause 111).

Any business entity - individual entrepreneur and LLC - selling goods named in the relevant regulations is required to follow the requirements listed above.

In some cases, the issuance of a sales receipt is assumed indirectly, but also on the basis of legal provisions. We are talking about rather rare schemes of legal relations in the retail sector - but, nevertheless, the presence of rules requiring their participants to use cash receipts should be taken into account.

In accordance with paragraph 17 of Article 7 of Law No. 290 of the Federal Law, individual entrepreneurs in special modes - the simplified tax system, PSN, UTII and Unified Agricultural Tax, if there is an obligation to use online cash registers, have the right not to include information on the number of goods, works or services in the cash register receipt until February 2022. In this sense, a cash receipt may be even less informative in comparison with a sales receipt, where the quantity of goods is a mandatory detail.

In turn, for the buyer of goods from such individual entrepreneurs, confirmation of the purchase of a certain number of goods can be very important. As an option, if the buyer took the money accountable. In this case, an individual entrepreneur who issues an “insufficiently informative” cash receipt at an online checkout can, at the buyer’s request, supplement it with a document certifying the list of purchased goods. Such a document could be just a sales receipt.

- When a sales receipt replaces a cash receipt, which is formally needed and used in the general case - but cannot be issued.

Most often - when the cash register is broken. At the same time, the sales receipt plays the role of a document, which, first of all, is issued to the buyer in order to ensure his protection as a consumer. That is, in which case the sales receipt will be used by the buyer to exercise those rights that are enshrined in the Law on the Protection of Consumer Rights and, accordingly, fall under the responsibility of Rospotrebnadzor. But if a sales receipt is not issued, the fact of concluding a retail transaction can be confirmed by testimony.

Thus, a check that replaces a cash register in case of a broken cash register has practically no fiscal function: at least the Federal Tax Service, when publishing its letters regarding failures in the operation of online cash registers, does not directly refer to the desirability of confirming cash flows using sales receipts. The main thing from a fiscalization point of view is to generate correction checks on a corrected cash register in a timely manner. But, obviously, the presence of copies of sales receipts in the accounting department is a strong argument in possible disputes with tax authorities regarding revenue unaccounted for at the checkout. Therefore, de facto, a sales receipt can also act as an alternative fiscalization tool.

- When a sales receipt is used “by itself” by law instead of a cash register - in cases where a business entity takes the opportunity not to install cash registers, and at the same time is obliged to issue customers alternative documents to confirm the purchase instead of cash register receipts.

These are the cases provided for in paragraphs 2.1 and 3 of Article 2 of Law No. 54-FZ (LINK) in the current edition. The actual sales receipt must contain the details according to paragraphs 4-12 of Article 4.7 of Law No. 54-FZ (LINK). In accordance with paragraph 2.1 of Article 2 of the law, individual entrepreneurs on the PSN - those carrying out types of activities not related to those named in the specified paragraph - are exempt from the mandatory use of cash registers. And according to point 3 - individual entrepreneurs and legal entities carrying out sales in hard-to-reach areas.

Please note that for business entities using sales receipts based on the provisions of Article 3 of the law, there are separate instructions for issuing such documents - approved by Decree of the Government of Russia dated March 15, 2017 No. 296 - LINK.

- When a sales receipt is used “by itself” at the will of the seller (since no document, including a cash receipt, is officially needed).

In general, the considered option for using a check is observed in legal relations in which, in accordance with paragraph 2 of Article 2 of Law No. 54-FZ (or for other legal reasons), the seller has the right not to issue cash receipts - but to maintain trust on the part of the buyer, issues sales receipts.

This area of legal relations can also be informal: the buyer can, on his own initiative, ask for a sales receipt, and the seller, who generally does not issue any documents, makes an exception and issues a check. For example, in order to confirm travel expenses: an employee who has arrived in another city is sometimes forced to “collect” cash or sales receipts from all stores in order to then take them to the accounting department.

- When a sales receipt is used simultaneously with a cash receipt - generated at the online checkout.

Almost the only reason for this is the need to confirm those very travel expenses. This is essentially a legally useless scenario—since the cash receipt alone is sufficient to substantiate the employee's expenses as a customer. But sometimes accountants, out of old habit, also ask for sales receipts from posted workers. And sellers, who are, in principle, accustomed to issuing such checks in such situations, meet buyers halfway - issuing both types of checks.

A separate question: what form of sales receipt, in the absence of an officially established one, should be used? Let's look at the options further.