Companies on OSNO use an invoice (SCF) for VAT accounting. The universal transfer document (UTD) is used much less frequently, despite its ability to replace several documents: SSF and primary accounting documentation. What prevents the universal use of UPD? Can both documents be used simultaneously and in what cases? When is it preferable to use an invoice? Let's figure it out.

In what order is the universal transfer document form ?

UPD and SSF

Invoice is an NU document. It confirms the release of goods to the buyer, the provision of services to him, the performance of work on operations subject to VAT, and is not used anywhere else. SChF details contain information:

- about the subject of the transaction;

- about his country of origin;

- about the amount;

- on the quantitative characteristics of a business transaction;

- about the tax rate;

- about excise tax;

- about the relevant group of goods;

- allowing taxpayers to be identified.

issues invoices and in what cases ?

The information contained in the SSF is used for VAT calculations and control of these transactions. When registering the release of goods, an accounting document is attached to the SChF: delivery note, delivery and acceptance certificate, etc.

The Universal Transfer Document (UDD) is a form created on the basis of the SSF. All information from the SSF is reflected in the UPD. For convenience, the “invoice area” is highlighted with a dark outline. In addition, the UPD contains information on the issue of goods and materials (act, bill of lading, partially - TTN, document on issue of materials f. M-11, etc.), i.e. information when the shipment was made, which official took responsibility for it and signed it, and on the basis of which agreement the shipment was made.

How to reflect UTD in the purchase book, sales book, invoice journal ?

UPD can be used both in BU and NU. The nature of use is marked with a number (1 or 2) - on the left side of the form, at the top:

- With status 1, the UPD acts as both an invoice and a document confirming the transfer.

- With status 2, the UPD is filled out only as a BU document.

It is obvious that SSF can be replaced by UPD with a simultaneous reduction in document flow. However, complete replacement in accounting practice does not occur. There are objective reasons for this.

How to issue a UPD instead of a certificate of completion of work

The process of drawing up this document may involve either using the recommended format or adding to the form certain lines necessary for carrying out certain transactions. In this case, it is not allowed to delete the mandatory column in Appendix 4 to the Letter . When entering information in the “Status” column, you should adhere to the following order:

- Code “1” needs to be specified only if the form will be used simultaneously as an invoice and act. This means that information will be required in both the invoice section and the additional primary section;

- Code “2” is used in the case of applying the universal protocol only as an act. In this case, it is allowed not to fill in the lines relating to VAT.

The main section of the UPD contains lines from the invoice. The format of such a form was approved by Resolution No. 1137 of December 26, 2011. A person acting as a taxpayer does not have the right to make any changes to this part of the document.

In the additional section, it is mandatory to indicate the details that are provided for by Federal Law No. 402 for primary registration. If necessary, it is possible to add additional lines to this section based on the specific features of the economic activities of a commercial structure.

UPD or SSF?

By letter No. ММВ-20-3/96 dated 10/21/13, the tax service recommends the use of UTD in accounting, and the use of invoices is enshrined in the Tax Code of the Russian Federation as mandatory. When choosing a document that records VAT amounts, taxpayers often refuse UTD for precisely this reason.

There are more compelling reasons indicating that it is not advisable to replace an invoice with an UTD:

- Restrictions on UPD format. According to the legislation, the UPD in paper form can be used comprehensively in accounting and accounting or only as an accounting document. It can only be used electronically as an invoice (according to Pr. No. ММВ-7-15/155 dated 03/24/16).

- Advance payments. Letter No. ММВ-20-3/96 records cases in which UPD is used (shipment of goods, transfer of property rights, provision of services). Advance payments are not mentioned in the list. Only an invoice is issued for the advance payment (Article 168-3 of the Tax Code of the Russian Federation).

- Adjustments. Changes in value, quantity of inventory items, and property rights lead to the need to use an adjustment invoice. In accounting, an act or a similar document is usually drawn up and signed, reflecting the difference between the original and changed indicators, the agreement of the parties to change the terms of shipment (the so-called credit note and similar ones). When using an adjustment UPD, all this information (VAT adjustments, adjustments for differences in indicators) will have to be reflected in one document. Considering that in practice, business situations have many nuances, this can cause difficulties and slow down the preparation of documents. It is much easier to draw up two different documents, make adjustments to them and register them.

- Corrections. If it is necessary to correct the invoice data, a new copy is issued (Rules for filling out the SChF, clause 7, Permanent Law No. 1137), while the number and date of the document cannot be changed. It is easier to make corrections in accounting documents; for example, digital information is simply crossed out, the date of correction is marked, and the responsible person signs next to the entry. As in the previous case, it is easier to use the financial statements and primary accounting documents for the transaction separately.

In addition, the structure of the accounting service at some enterprises (agricultural, manufacturing) involves the use of several copies of primary accounting documents, for example, in warehouse accounting and summary reports of responsible persons of departments, the same invoice is used. The use of UPD in this case does not make sense.

Question: Is it possible to issue a correction invoice when returning a product if a UCD was issued when it was sold, and vice versa - to issue a UCD instead of an invoice and invoice? View answer

From this point of view, the universal transfer document is recommended for use in small and medium-sized businesses, with a limited number of business transactions and a small staff of accounting employees.

Important! The use of UPD, as well as the use of invoices, must be reflected in the accounting policies of the organization. It is advisable to approve the used form of UPD (adjustment UPD) by local regulations. When switching to UPD in the middle of the year, additions to the accounting policies should be introduced before the start of the tax period.

Type of universal document

IMPORTANT!

The UPD form was proposed in the letter of the Federal Tax Service of Russia dated October 21, 2013 No. ММВ-20-3/96.

The invoice form was taken as the basis for the universal transfer document. In 2022, some changes were made to it, and in 2022 the following UPD form is relevant:

Why did we indicate that the form was proposed the Federal Tax Service? The fact is that since 2013, the unconditional use of unified forms of documents has been abolished . They began to use forms that were relatively free-form. But in any case, when drawing up such documents, only the following conditions must be observed:

- the document contains mandatory details (their list is approved by law);

- the form of the document is approved and fixed in the accounting policy of the enterprise;

- The agreement with the counterparty stipulates the use of this form of document closing the transaction.

A UPD is issued instead of a certificate of work performed (certificate of services rendered or bill of lading) and an invoice. Therefore, the mandatory details of the UPD are a compilation of the mandatory details of the primary document and invoice .

What the primary accounting document should contain (certificate of work performed/services rendered/invoice) is established by Federal Law No. 402-FZ dated December 6, 2011 on accounting. And the type of invoice is specified in Art. 169 of the Tax Code of the Russian Federation. From July 1, 2022, changes were made to the invoice form, so similar adjustments should be in the UPD.

A sample UTD with all the necessary details and data can be viewed in our article “Universal transfer document (UDD) from July 1, 2022: completed sample.”

Can I use two documents at the same time?

Situations may arise in which the question of simultaneous use of UTD and SSF arises. For example, one counterparty requires that the transaction be formalized with an invoice and a waybill, while the other agrees to exchange the UTD. From a legal point of view, both options are completely legitimate and can be used in the same organization.

The use of one of the design options is possible within the framework of one contract, i.e. all shipments under one contract can, for example, be formalized with a package of documents “SChF + invoice”, and under another contract – with a UPD filled out in accordance with status “1”. Different parties within the framework of one contract can be issued both with a package of documents “SChF + primary document BU” and UPD with status “1” (according to the text of letter No. GD-4-3/8963 of the Federal Tax Service dated 05/27/15).

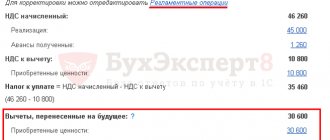

In NU, these amounts are also recognized for the purpose of calculating income tax, simultaneously with VAT accounting.

The use of UPD does not impose restrictions on the use of other accounting forms in document flow. Theoretically, there is no legal prohibition on the use of UTD with status “2” while simultaneously issuing an invoice.

Main

- UPD is advisable to use when document flow and volumes of business transactions are limited.

- SSF can be used in a package with supporting accounting documents almost everywhere.

- In some cases, it is impossible to replace the UTD invoice.

- The use of two types of documents within different parties under an agreement or within different agreements is not prohibited by law.

- The legislation also does not prohibit the simultaneous use of UPD and any other documents.

UPD functions

In modern accounting, UPD is widely used. This abbreviation stands for – universal transfer document. However, it was introduced into circulation not so long ago - only in 2013.

The main goal of UPD is to reduce the number of documents drawn up for one transaction. This document is most relevant for companies that carry out work and, for this purpose, simultaneously sell their goods or products to the client. Let's look further at why this happens.

How does UPD reduce the number of documents? The bottom line is that its main function is to combine a primary document and an invoice. The UPD replaces the certificate of completion of work/certificate of services rendered or a delivery note issued under a transaction in combination with an invoice.

What form should I use to fill out the UPD?

The UPD form was proposed in the letter of the Federal Tax Service of Russia dated October 21, 2013 No. ММВ-20-3/96 and was created on the basis of the invoice form.

The UPD form is used both to confirm the provision of services and to confirm the shipment of goods. Moreover, one UPD can reflect both the shipment of goods and the provision of services.

Unified forms of documents have been cancelled, so it is not necessary to strictly adhere to the given form. You can make your own adjustments, but maintaining those details that are considered mandatory.

Mandatory details include the “Status” attribute.

Let us note the features of filling out some UPD columns for services:

- code of goods/works/services in the UPD (column B) is optional detail. Also here the article is for goods, and the type of activity code is for works/services;

- code of the type of product (column 1a) - for exporters to the EAEU countries (not filled in for services);

- unit of measurement (columns 2, 2a) – do not fill in for services;

- country of origin of goods (columns 10, 10a) – do not fill in for services.

Features of using UPD

When drawing up the UPD, you should remember the following features of the use of this document:

- It is unacceptable to replace an advance invoice with a universal transfer document, since when issuing an advance invoice there are no grounds for drawing up a primary document;

IMPORTANT!

An invoice can only be a primary document and cannot be only an invoice. Here we will clarify that you can issue an invoice and UPD at the same time , where the UPD will have the status “2” and act only as a primary document.

- the use of UPD is not necessary . An organization can use UPD or a package consisting of a primary document + invoice. Moreover, you can use different sets of documents with different counterparties;

- The UPD can simultaneously include not only data about the product, but also about the work performed or services provided .

And here we come to the answer to the question asked at the beginning of the article: why is UPD so beneficial to those who perform the work.

UPD (universal transfer document)

For quite some time now, the tax authorities have been considering the issue of simplifying the company’s primary documentation, since many documents can duplicate each other, either partially or completely. Therefore, it was decided to use such a universal document as the UPD.

The very name of this document indicates that this document is used to achieve external rather than internal goals. Externally, this document resembles an invoice, since it was based on the invoice that it was developed. But in addition to the invoice details, the document may also contain details of the delivery note (

What is good about UPD for those doing the work?

For example, an organization installs equipment for a customer. In this case, she must draw up as closing documents:

- delivery note for equipment + invoice;

- act of completion of work + invoice.

If the organization is on a simplified taxation system, the number of documents is less:

- Packing list.

- Certificate of completion.

What package of documents should I give to the customer? Invoices, acts, invoices or UPD? In our opinion, the answer is obvious: one UPD instead of four (or two) documents.

Here are examples of filling out the UTD for those using the basic taxation system (OSN) and for simplifiers.

EXAMPLE

Let Principle LLC install the equipment on the customer’s vehicles.

This is what the UPD of Principle LLC looks like if the company is on OSNO:

SAMPLE UTD FOR GENERAL MODE

Let's consider the UPD of Principle LLC, if it applies the simplified tax system:

SAMPLE UPD FOR USN

Application of UPD in a simplified manner

Since we are talking about using UPD instead of an invoice, a logical question arises: can a simplifier use UPD instead of a certificate of completion of work?

Yes maybe . Despite the fact that the simplifier does not issue invoices.

When applying the UPD for completed work, the simplifier must carefully consider filling out this document, namely, the “Status” field (those using the simplified tax system should use only status “2”).

Find out about indicating statuses in the UPD from our article “What does status mean in the UPD.”