Transport tax is paid by all legal entities with registered land, air or water transport. But not all types of transport are subject to taxation. All objects of taxation are specified in the Tax Code of the Russian Federation, and tax must be paid, otherwise there will be a fine and blocking of the company’s account. We will tell you how to correctly calculate and pay transport tax in this article.

Transport tax - what is it?

Transport tax is paid on almost any vehicle. In most cases, legal entities pay tax on cars

. However, there are also those companies in which planes, helicopters, sea or river transport are registered.

Evading the delivery of registration of vehicles with government agencies will not save you from paying taxes: after all, according to the law, an unregistered vehicle cannot perform its function (which is controlled more seriously for organizations). And, in addition, upon concluding a purchase and sale agreement, ownership passes to the buyer

. No one will want to pay tax on vehicles sold - so information about the sale will still end up with the Federal Tax Service or other responsible authorities.

You can stop paying transport tax only if the vehicle is deregistered or destroyed. Moreover, this can only be done upon application to the Federal Tax Service. In 2022, legal entities are required to report to the tax authorities themselves about the taxable vehicles they have.

Rates and payment terms differ in different regions where the transport was registered

. The only condition is that rates in the regions cannot exceed federal rates by more than 10 times.

The most important parameter when determining the tax is engine power

. The more powerful it is, the higher the tax. Rates are set in rubles per 1 horsepower of engine power. But for some type of transport, the tax amount may be determined by other parameters - for example, from the thrust of the jet engine and from the gross tonnage.

What is a penalty?

Let's consider part 1 of article 75 of the tax code:

1. Penalty is the amount of money established by this article that a taxpayer must pay in the event of payment of due amounts of taxes, including taxes paid in connection with the movement of goods across the customs border of the Customs Union, later than those established by the legislation on taxes and fees deadlines.

Thus, a penalty is a fine for late payment of tax .

Which movable vehicles are not subject to tax?

Not all vehicles registered to a company have to pay tax.

Transport tax is not calculated for the following categories of transport:

- transport for disabled people, if the organization has a disabled person, as well as cars with an engine power of up to 100 hp received through social security authorities. With.;

- agricultural machinery;

- passenger and cargo sea or river vessels and aircraft in the main activities of the organization: cargo or passenger transportation;

- rowing and/or motor boats with a power of no more than 5 horsepower.

- vehicles owned by the right of operational management to federal executive authorities, where military or equivalent service is legally provided for.

- airplanes and helicopters of air ambulance and medical services;

- ships registered in the Russian International Register of Ships;

- offshore fixed and floating platforms, offshore mobile drilling rigs and drilling ships.

In addition, the company does not have to pay transport tax if the car is wanted.

In this case, the main thing is to submit an officially certified document about the theft of the car to the tax authorities. And if the search was completed, but the vehicle was never found, then the tax authorities will also not be able to continue to charge transport tax (that is, the search stopped at the end of its period).

If the payment was not made on time

In this case, the Federal Tax Service charges penalties. They will also need to be paid using codes, but they will be slightly different. The BCC “Peny transport tax 2022 for individuals” differs from the main payment very slightly - the penultimate group of numbers (for the collection itself - 1000, for penalties - 2100). This is their main and only difference. BCC “Penalties on transport tax 2022 for individuals” are indicated in the second column of the table.

If an error is made in the payment document and it is identified in a short time, you can send a letter to the Federal Tax Service and ask to offset the payment using the correct details. Let us remind you that, as a last resort, you can appeal any decision of a government body in court. Often such legal disputes end in a positive decision for taxpayers; tax inspectors can also make mistakes.

Deadlines for payment of transport tax

Starting from 2022, tax payment deadlines have become the same throughout the Russian Federation - this is until March 1 of the year following the reporting year.

. That is, the payment deadline for 2022 should not be later than March 1, 2021, and for 2022 - no later than March 1, 2022. The tax must be paid at the place of registration of the vehicle.

Companies must pay advance payments if such an obligation is established in the region. Although most regions have introduced such an obligation for legal entities. In fact, in most regions of the Russian Federation, advance payments are established

.

You can download the regional document on transport tax using this link .

Starting from reporting periods in 2022, companies that must make advance payments must pay advance payments for transport tax within a uniform time frame - no later than the last day of the month following the expired quarter. That is, regional authorities no longer have the right to set their own payment deadlines.

For example, the advance payment for the second quarter of 2022 must be paid no later than July 31, 2022

. And if the payment deadline falls on a non-working day, you can pay on the working day following the payment deadline.

Find and check

The BCC of transport tax in 2022 for individuals is determined by law. But these data are constantly changing by the legislator. Information about both the meaning of the budget classification code and the amount of the mandatory fee can be found on the official website of the Federal Tax Service (you need to select your region).

You can also find other details there, because they are different for each region, only the KBK “Transport tax for individuals” 2020 is the same for the entire country.

You can also find the following details on the IFTS website:

- full name of the recipient (the receipt first indicates the Treasury, and then the short name of the Federal Tax Service in brackets);

- TIN and KPP, OKTMO;

- bank and current account;

- name and address of the Federal Tax Service.

In addition, on the website you can generate a payment document and save it. At the same time, when generating a payment order and indicating the KBK “Transport Tax 2022 for individuals”, the Moscow region will show the same codes as any other region, since the codes are the same for the entire country.

Citizens can find the KBK “Transport tax for individuals 2020” in the taxpayer’s personal account, along with other important data. The codes can be found in reference books or from the Federal Tax Service specialists.

How to calculate the amount of transport tax

To calculate the tax amount you need to know:

- tax base for the vehicle;

- tax rate;

- vehicle ownership time.

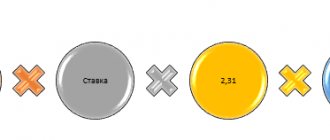

Formula for calculation

transport tax looks like this:

The tax base in 2022 is determined differently for each type of transport:

- vehicles with an engine - engine power in horsepower;

- aircraft with a jet engine - nameplate thrust;

- non-self-propelled water vessels - gross tonnage;

- other transport – a vehicle unit.

If the car is expensive, then the resulting value must be multiplied by a special increasing factor:

- 1.1 – a car worth from 3 million to 5 million rubles and manufactured in 2022 and later;

- 2 – cars worth from 5 million to 10 million rubles and manufactured in 2022 and later;

- 3 – the cost of the car is from 10 million to 15 million rubles and the year of manufacture is 2012 and later;

- 3 – a car worth more than 15 million rubles and manufactured in 2002 or later.

Taxpayers

Owners of vehicles are the payers of this fiscal payment.

Moreover, the fact of operation does not matter. The tax burden will have to be assessed and paid to the budget both from a working vehicle and from vehicles that have not been officially deregistered. Some economic entities were excluded from the category of taxpayers under the Tax Code. For example, confederations, national football companies and associations, FIFA, FIFA subsidiaries and other organizations.

ConsultantPlus experts have figured out how to avoid paying transport tax. Use these instructions for free.

to read.

In addition, officials determined that for vehicles transferred for temporary use under a power of attorney executed before the entry into force of Chapter 28 of the Tax Code of the Russian Federation, the persons indicated in such powers of attorney are recognized as taxpayers. But when transferring vehicles on a trust basis, after entry, only the fact of state registration of the taxable object is important.

To transfer transport tax, all taxpayers must indicate the budget classification code in the payment order. But to pay the toll, a code is not required: drivers pay it for driving on toll roads.

How to stop paying transport tax

In order for a company to stop paying transport tax, a legal entity must submit an application to the Federal Tax Service

, which indicates the reason for canceling the accrual of the vehicle.

A document confirming the loss or sale of the vehicle is attached to the application. Since there are not many reasons for stopping payment, it could be:

- contract of sale;

- a document confirming the search or termination of the search for the vehicle (if it was never found);

- disposal act if the owner decided to destroy the vehicle at his own request.

Transport tax ceases to be calculated on the first day of the month following the month

destruction, sale or theft of vehicles.

For what period is the penalty accrued?

Part 3 of Article 75 of the Tax Code:

3. A fine is accrued for each calendar day of delay in fulfilling the obligation to pay tax, starting from the day following the tax payment established by the legislation on taxes and fees, unless otherwise provided by this article and Chapters 25 and 261 of this Code.

A penalty is charged for each day of delay.

For example, if the transport tax for 2016 was paid on December 5, 2017, then the penalty will be charged within 4 days, because payment deadline is December 1.

Decoding the code

Since the administrator of these payments is the Federal Tax Service, the codes always begin with the numbers 182. Further they contain the following information:

- 1 - tax nature of budget income;

- 06 - object of taxation (property);

- 04011 — appointment (for transport);

- 02 — budget level (subject of the Russian Federation);

- the next four digits are the subtype of income (tax, penalties, fine or interest);

- 110 - tax income in accordance with the Tax Code of the Russian Federation.

In this case, you should not confuse the administrator and the recipient who appears in the payment document. We are talking about the Federal Treasury Department. The Federal Tax Service is given in parentheses, for example: “UFK for the city of St. Petersburg (INFS of Russia for the city of St. Petersburg).

Transport tax fell into unclear payments: what to do

Various errors may be made in the payment order: in the BCC, tax period, payer status and other numerous details. If the error did not creep into the name of the recipient's bank, other errors cannot lead to non-payment of tax (see, for example, letter of the Ministry of Finance of Russia dated January 19, 2017 No. 02-02-07/1/2145).

Re-transfer of tax is not required here, but the payment must be clarified. The procedure for this procedure is described in paragraph 7 of Art. 45 of the Tax Code of the Russian Federation. The taxpayer is required to submit an application to the tax authorities with a request to clarify the erroneous details. The controllers are required to inform the taxpayer of their decision on this application within 5 days from the date of its acceptance. At the same time, they have the right to request a paper copy of the payment order from the bank. Bankers have 5 days to submit a payment document upon request of the inspectorate.

How to write an application for clarification, how to send it to the Federal Tax Service, as well as other nuances of clarifying a tax payment, are described in this article.

From January 1, 2019, tax officials can also clarify errors in the Federal Treasury account without repeated payments and refunds (Law No. 232-FZ dated July 29, 2018), if the following conditions are met:

- no more than 3 years have passed since the date of tax transfer;

- the money ended up in the budget, despite an error in the payment order (this can be found out by checking with the tax authorities);

- clarification of payment will not lead to arrears.

If the taxpayer himself discovers an error in the treasury account, he needs to write an application to clarify the payment. If the tax authorities discover this error, they will clarify the payment themselves and without an application.

Answers to common questions

Question No. 1: The owner of the vehicle died, the car was registered in his name, to whom does the obligation to pay transport tax pass?

Answer: The taxpayer's tax obligations cease from the date of death of the owner of the vehicle. Debts can be transferred to the regional budget by the heir who has entered into the rights of inheritance of the vehicle, and then the amount of tax is paid by him from the day when he registers the vehicle in his name.

Question No. 2: How to pay tax on a car deregistered in Krasnoyarsk on November 21 and registered in Moscow on November 30?

Answer: If the car does not change owner, but is re-registered in another subject of the Russian Federation, the tax for the month in which it was re-registered is transferred to the budget of the region where it was registered as of the 1st day, in your case this Krasnoyarsk, and from the new month you must pay the tax to the budget of Moscow.

When is transport tax paid?

The legislation provides for the conditions under which the obligation to pay transport payments and advances ceases:

- Termination of property rights;

- Liquidation of a company (death of an individual);

- Vehicle theft (the case will require documentary evidence);

- Application of existing benefits (or introduction of new preferences).

In all cases that are not listed in this list, payment is made:

- Until December 1 by individuals;

- Until February 1 of the year following the previous reporting period.

Advance payments are subject to payment within the time limits provided for by regional legislation. For organizations, the reporting deadline is also limited to February 1. For other individuals, reporting is not required.

How to indicate BCC?

Budget classification codes may change over time. So it is advisable to periodically check their approved values. More specifically, KBK is a code of 20 characters. It must be written in line 104 of the payment order. There are prescribed rules for writing codes.

The first digits of the code have the value 182. This indicates that the leading administrator of budget revenues is the tax authorities.

To make the payment correctly, pay attention to digits 14-17 KBK in the payment slip. This will enable the current system to understand the payment correctly. Considering information about these combinations. This way you can check all payments made and the accuracy of their calculations.

Do not ignore advice from tax authorities. Tax authorities will help you enter the code values correctly. This will allow you to avoid fines and penalties for late taxes.

Use the calculator to calculate your tax correctly. This way you will not have problems with mandatory payments. Make sure that the BCC is indicated correctly. Otherwise, the paid amount may be lost. Try to make payments in advance. If you make a mistake, you will have time to correct it. Mistakes are not so scary. If the declared amount still falls into the budget, the organization will not bear any responsibility for the error.