The audit report on the accounting (financial) statements is an important element of information for users of the statements of any economic entity, since it increases the confidence of owners, counterparties, banks considering loan applications, and other entities that the statements are truthful and prepared in accordance with the rules accounting, there are no significant distortions associated with errors or dishonesty, or concealment of financial or non-financial information important to users.

Who is subject to mandatory audit?

Currently, organizations are legally defined whose annual financial statements are subject to mandatory audit (Table 1).

Table 1 — Subjects of mandatory audit

| Regulatory framework | Organizations whose accounting (financial) statements are subject to mandatory audit |

| Federal Law “On Auditing Activities”, Art. 5 (as amended on December 29, 2020 No. 476-FZ) | Organizations whose securities are admitted to organized trading |

| Organizations that are professional participants in the securities market, credit history bureaus | |

| Funds (except for state extra-budgetary, international), if the receipt of property, including cash, in the year preceding the reporting year exceeded 3 million rubles. | |

| Other organizations, except for state unitary enterprises, municipal unitary enterprises, agricultural cooperatives, their unions, consumer cooperatives, if income determined according to tax accounting rules in the year preceding the reporting year exceeded 800 million rubles. or the amount of balance sheet assets at the end of the year preceding the reporting year exceeded 400 million rubles. | |

| Federal Law “On Joint Stock Companies”, Art. 88 | Joint stock companies |

| Federal Law “On Banks and Banking Activities”, Art. 42 | Credit organizations |

| Federal Law “On the organization of insurance business in the Russian Federation”, Art. 29 | Insurance organizations |

| Federal Law “On Mutual Insurance”, art. 22 | Mutual insurance societies |

| Federal Law “On Organized Auctions”, Art. 5 | Trade organizing organizations |

| Federal Law “On Clearing, Clearing Activities and Central Counterparty”, Art. 5 | Clearing organizations |

| Federal Law “On Investment Funds”, Art. 50 | Joint-stock investment funds, mutual fund management companies |

| Federal Law “On Housing Savings Cooperatives”, Art. 54 | Housing savings cooperatives |

| Federal Law “On participation in shared construction of apartment buildings and other real estate and on amendments to certain legislative acts of the Russian Federation”, Art. 3 | Developers |

| Federal Law “On Credit Cooperation”, Art. 28, and | Credit consumer cooperatives |

| Federal Law “On Microfinance Activities and Microfinance Organizations”, Art. 15 | Microfinance companies |

| Federal Law “On Non-State Pension Funds”, Art. 22 | Non-state pension funds |

| Federal Law “On Political Parties”, Art. 35 | Political parties |

| Federal Law “On Consolidated Financial Statements”, Art. 5 | Organizations preparing and publishing consolidated financial statements |

The annual reporting of the Bank of Russia, state companies and state corporations, state and municipal unitary enterprises (in cases where the need for an audit is determined by the owner of a state unitary enterprise or municipal unitary enterprise), the Deposit Insurance Agency, the United Institute for Development in the Housing Sphere, the United All-Russian Association is also subject to mandatory independent audit. insurers, Professional associations of insurers, associations of insurance entities, the National Association of Self-Regulatory Organizations of Appraisers, the Association of Tour Operators in the Field of Outbound Tourism, non-profit organizations - foreign agents, organizers of gambling and lotteries, as well as some other socially significant organizations, a list of which can be found at website of the Ministry of Finance of the Russian Federation. For example, a list of cases of mandatory audit of organizations’ financial statements for 2022 is published here.

IMPORTANT! The number of mandatory audit subjects has decreased significantly since January 1, 2022, due to amendments to the Federal Law “On Auditing Activities”. In particular, small businesses with revenue from 400 to 800 million rubles were “excluded” from mandatory audit. and the amount of balance sheet assets from 60 to 400 million rubles, as well as funds whose annual receipts do not exceed 3 million rubles. However, if a contract for a mandatory audit of financial statements by such an organization was concluded and began to be carried out by auditors before these changes entered into force (i.e., until December 31, 2020 inclusive), the financial statements of the economic entity are subject to release (publication) along with the auditor’s report.

It should also be noted that, despite the fact that joint-stock companies as subjects of mandatory audit are not named in the new edition of Art. 5 of the Law on Auditing, the requirement to attract auditors to audit their annual accounting (financial) statements remains unchanged, since it is provided for in Art. 88 of the Law on Joint Stock Companies. Moreover, this rule applies to both public and non-public joint stock companies.

In recent years, when reviewing the materials of audit assignments by external auditors of audit quality, an amazing situation was observed: the shareholders (founders) approved one auditor in the prescribed manner, and the audit report issued by another auditor was posted on Fedresurs .

This, of course, suggests that the auditor chosen by the owners turned out to be “uncomfortable” and the manager had to find a more loyal inspector. Today, the first page of an organization’s balance sheet reflects information about a mandatory audit (whether the organization is subject to it or not) and the auditor with whom the contract is concluded. This is, firstly, a measure to prevent the replacement of the auditor, and secondly, it requires the audited entity to timely enter into an agreement for the provision of statutory audit services.

The procedure for submitting accounting reports to GIRBO

Submission of annual financial statements to the tax office is one of the organization’s responsibilities (clause 5.1 of Article 23 of the Tax Code).

In order to submit financial statements electronically, you will need:

- select an Electronic Document Management Operator and enter into an agreement with him;

- obtain a qualified electronic signature;

- purchase the necessary software;

- generate reports in approved formats and send them to the Federal Tax Service of Russia.

The list of EDF Operators can be found on the website of the Federal Tax Service in the section “Taxation in the Russian Federation” – “Presentation of tax and accounting reporting” – “Organizations - operators of Electronic Document Flow”.

From January 1, 2022, the obligation to use the services of an EDF Operator when submitting financial statements in the form of an electronic document will be eliminated. The Federal Tax Service recalled this in a letter dated 04.08.2021 No. KV-2-24/ [email protected] This is due to the changes made by the article of the Federal Law of 02.07.2021 No. 352-FZ to paragraph 5 of Article 18 of the Federal Law of 06.12.2011 No. 402 - Federal Law “On Accounting”.

That is, from January 1, 2022, an organization will be able to submit electronic reporting not only through the EDI operator, but also through the Federal Tax Service website. To this end, the department is preparing updates to its order dated November 13, 2022 No. ММВ-7-1/ [email protected]

Previously on the topic:

From January 1, 2022, accounting reports can be submitted through the website of the Federal Tax Service of Russia

Posting information about mandatory audit on Fedresurs

Information on the results of a mandatory audit must be posted on the Federal Resources Agency (in the Unified Federal Register of Information on the Facts of the Activities of Legal Entities).

In contrast to the information in the GIR BO, the audit report on Fedresurs is not published in full, but only in part of the most important information for users (who conducted the audit, in relation to which statements and for what period, what opinion the auditor expressed and what were the grounds for this opinion , as well as other information provided for in paragraph 6 of article 5 of the law on auditing).

To post information, the head of the audited entity must obtain an electronic signature from one of the certification centers from the list on the Fedresurs website. Special software can be used on this site for free. But posting information is paid. If the manager does not have an electronic signature to post information about the audit report or other information, you can contact a notary, who will sign the message with his digital signature and post it on the Federal Resource.

At the time of writing, for posting one message on Fedresurs, a fee of 860.35 rubles is charged, including 20% VAT. Qualified digital signature certificates for the Fedresurs website (as well as other business purposes, for example: submitting accounting and tax reporting, registering online cash registers, receiving financial services, etc.) are issued by authorized certification centers; the cost of issuing an digital signature ranges from 2,800 to 3,000 rubles.

Failure to comply with the requirement to post information is an administrative offense (clause 6-8 of Article 14.25 of the Code of Administrative Offenses of the Russian Federation):

- violation of the established deadlines for posting information on the Federal resource will entail a warning or a fine of 5,000 rubles for the official;

- failure to provide information or posting false information - the fine increases and can range from 5,000 to 10,000 rubles;

- repeated violation may result in a fine for the manager from 10,000 to 50,000 rubles. or even to his disqualification for up to three years.

Thus, the costs of posting mandatory information on the Fedresurs (in this case, about the results of a mandatory audit) cannot be compared with the possible financial consequences of failure to comply with this requirement.

Features of information disclosure by joint stock companies

The annual accounting (financial) statements of a joint stock company, both public and non-public, are disclosed by publishing its text on the Internet page (usually on the company’s official website) no later than three days from the date of drawing up the auditor’s report, but no later than three days from the date of expiration of the deadline established by the legislation of the Russian Federation for submitting a legal copy of the compiled annual accounting (financial) statements.

In 2022, this date falls on April 5: since the deadline for posting reports along with the audit report falls on a weekend (Saturday 04/03/2021), the end date of this period is considered the nearest working day. These requirements are set out in the Regulation of the Bank of Russia dated December 30, 2014 No. 454-P “On the disclosure of information by issuers of equity securities” and are controlled by the Central Bank of the Russian Federation.

IMPORTANT! For joint stock companies whose securities are admitted to organized trading, interim (quarterly) financial statements are also subject to publication on the website. However, it must be published together with the auditor's report, provided that an audit of these statements was carried out.

Very significant sanctions for violating the procedure and deadlines for disclosing information by joint stock companies are established in clause 2 of Art. 15.19 of the Code of Administrative Offenses of the Russian Federation: a fine in the amount of 30,000 to 50,000 rubles may be imposed on officials. or a decision may be made to disqualify the manager for a period of 1 to 2 years. The fine for organizing in this case is from 700,000 to 1,000,000 rubles.

How to send reports prepared directly in the program?

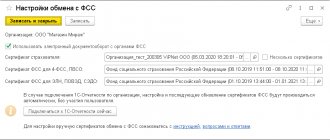

Before sending reports, you must remember to add the necessary data in the FTS and Pension Fund menu item. There you will need to enter some details that will “connect” the program with the delivery directions.

What to do next?

Select the direction of delivery (we show the example of the Federal Tax Service) and click “Fill in the system”:

In the list that opens, you need to find the desired report form, select it - an editing window will open. The report itself is filled out in this window. What is useful is that there are two links to the “material parts” - regulatory documents and instructions for filling out:

At the end of the process of working with the report, you need to click “Save and Close”, then “Submit”. The report will be automatically checked for technical errors and compliance with the format. If errors are found, a warning will appear. Then you will need to edit the report.

Automatic testing is an excellent feature of Extern, which does not prompt the user to choose whether to check or not check the report, but does it immediately and forcefully. Thus, even the most hasty clients will be protected from errors.

If there are no errors, a window will appear:

Click “Proceed to sending”:

Click “Sign and Send” and the report is sent.