In this article we will look at accounting for returnable production waste. Let's find out what is considered waste. Let's figure out how the types of waste differ. Let's talk about what documents are used to document waste in a warehouse.

Any company engaged in production inevitably generates waste of various types. Some of them are later put back into use, others are sold, and others are not to be used. In order to correctly process their capitalization, further use or sale, as well as not make mistakes in calculating taxes, an accountant needs to be armed with accurate knowledge. We will talk about what types of waste are, how they differ, what documents are processed and how they affect taxation.

What is waste?

Waste at a production enterprise can be things that have completely or partially lost their consumer properties.

These include:

- Residual raw materials;

- Own products;

- Semi-finished products;

- Materials;

- Inventory balances;

- Heat carriers.

They are divided into two groups:

- returnable waste;

- irrevocable.

Important! Returnable waste must be distinguished from all types of materials, distinguished from related products and other assets, since the correct calculation of cost, and, consequently, the tax base, depends on such differentiation.

How are the types of waste different?

The separation of irretrievable and returnable waste is carried out according to their characteristics:

| Returnable waste | Irrevocable waste |

| Similarities | |

| Availability of material embodiment* Are a product of manufacturing processes Changed/lost properties in full or part of them | |

| Difference | |

| Bring income For future use: – in all types of production processes with increasing costs - for a purpose that does not correspond to the original one | Does not provide economic benefit Not used in this production, but: – suitable for the manufacture of other types of goods and products – possible release as related (by-product) products |

There is a type of waste classified as irrevocable, which does not have a material form, for example, such as: evaporation, volatilization, attrition, drying of materials.

Main characteristics of irrecoverable waste

The production and marketing activities of an agricultural enterprise do not always go smoothly. Normally, part of the inventory loses weight and volume. Take transportation and storage, for example. Raw materials may deteriorate during transportation. The same goes for the storage process.

During the production of agricultural products, volume and weight losses are also possible. They qualify as technological losses and natural loss. In the first case, there was a physical impact on the raw materials and materials, in the second - not. In accounting, technological losses and attrition are reflected in different ways.

Irreversible waste has one thing in common: its properties change and differ from the properties of the original raw material. Also common is the impossibility of using economic benefits for healing purposes. This distinguishes non-returnable waste from returnable waste. That is, they are not allowed into production or processing.

What is important for an accountant to know about irrecoverable waste? They are not assessed and are not debited from the main production account.

Now we come to the accounting subtleties. Let's look at a few examples.

What documents are used to document waste in a warehouse?

Those wastes that are identified during the manufacture of products must be:

- counted and weighed;

- delivered to the warehouse.

Important! If it is not possible to count and weigh the resulting waste, a calculation method is used: the quantity of products is multiplied by the standard of expenditure approved by documents.

For delivery and registration of arrival at the warehouse and sale, the following documents are used:

| Form name | Document |

| MX-18 | Invoice for transfer of products to the warehouse |

| M-4 | Warehouse receipt order |

| M-11 | Requirement-invoice, which records the release upon re-entry into production |

| TORG-13 | Invoice for the transfer of goods, containers when moving within the company |

| TORG-17 | A journal that records the safety and movement of products within warehouses |

| M-8 | Limit-fence card for releasing when re-using in the manufacture of products |

| M-15 | Invoice for shipment to the third party when releasing to another organization |

| TORG-12 | Sales invoice |

Important! These documents are the basis on which costs and expenses are reduced in accounting and tax accounting, respectively. The storekeeper does not indicate the value of the capitalized assets; this is subsequently done by the accounting department by filling out the appropriate columns based on the calculation of the cost of expenses incurred.

All accounting documents must contain information about expenses.

Such data includes:

- Amount of waste;

- Units in which they are measured (pieces, kg, m, sq.m);

- Price.

Important! Since 2013, organizations can use documents developed by them independently, but subject to their mandatory approval by the manager and indication of the necessary details - those that comply with the requirements of accounting legislation.

Returnable production waste: postings

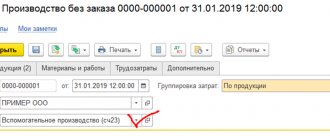

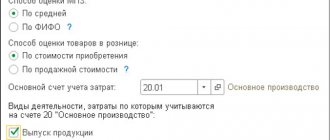

Since in accounting VOs are materials, their accounting in accordance with the Chart of Accounts is carried out in a specially opened subaccount to account 10 “Materials” - 10/12 “Other materials”.

To control the safety of VO, the company organizes analytical accounting by types and places of occurrence, arriving by posting D/t 10/12 K/t 20, 23, 29, thus reducing the cost of goods and materials transferred to production.

The algorithm for collecting and transferring VO to the warehouse is fixed by the company’s internal local regulations. In accordance with the specifics of production, the amount of generated waste is calculated in the most appropriate way - by weighing, recalculation or, if it is impossible to directly determine their quantity, by applying the established standard to the volume of finished products produced for a specific period.

The receipt of returnable waste from production to the warehouse is formalized with a delivery note, a receipt order (Form M-4), a demand invoice (Form M-11) or an invoice for internal movement (TORG-13). The transfer of VO from the warehouse for subsequent processing is accompanied by the preparation of a new demand-invoice, and for sale - one of the forms M-15 or TORG-12. An enterprise has the right to operate with other primary accounting documents approved for use in accounting policies.

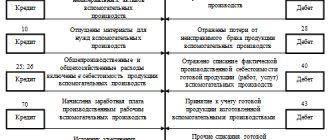

Accounting entries for accounting for returnable waste in production will be as follows:

| Operation | D/t | K/t |

| Raw materials for production were transferred from the warehouse | 20,23,29 | 10/1 |

| Returnable waste from the main production has been capitalized | 10/12 | 20,23,29 |

| VO transfer: | ||

| - for further use in production | 20 | 10/12 |

| - for implementation | 91/2 | 10/12 |

| Proceeds from the sale of VO | 62 | 91/1 |

| VAT is charged on the cost of VO | 91/2 | 68 |

Reflection in tax accounting

When recording the movement of returnable waste in tax accounting, you must be guided by the following instructions of the Tax Code of the Russian Federation:

- When using the accrual method, the cost of waste, defined as returnable, reduces the organization’s costs in the tax period corresponding to the tax period of their secondary receipt into production.;

- It should be taken into account that the day on which they were actually used (re-entered into production or on sale) is not taken into account;

- It is also necessary to remember that when calculating income tax, when total expenses are reduced by returnable waste, it is necessary to document them accordingly using the above registers.

Important! Returnable waste in both types of accounting has the same reflection: their receipt is recorded on the day they appeared, and the decrease in the cost of products occurs in the same tax period.

How waste is valued in accounting

Important! Accounting legislation gives the company the right to use any of the methods by which waste is assessed, regardless of its future purpose (sale or release into production). In this case, it is necessary to prescribe the methodology by which the price is determined in the accounting policy.

Inventory accounting, as defined by the guidelines for inventories, is carried out according to:

- The price at which they can be used;

- Selling price.

Important! If accounting uses the price of waste that corresponds to the possible or estimated selling price, then a situation may arise when the price changes upon sale. In this case, no adjustment is made for the resulting difference. In this case, the company either has other income or a loss.

How to reflect the sale of returnable waste?

The organization sells returnable waste, in particular, waste paper generated during the production process. How to reflect this operation in accounting and tax accounting?

Accounting

In accordance with paragraph 111 of the Guidelines for accounting of inventories, approved. by order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n:

- waste generated in the organization's divisions is collected in the prescribed manner and delivered to warehouses using delivery notes indicating their name and quantity.

- the cost of recorded waste is included in the reduction in the cost of materials released into production (i.e., a posting is actually generated - Debit 10 Credit 20), that is, waste is recorded on account 10.

When selling waste generated in the divisions of the organization, the proceeds from their sale are reflected as part of other income, while the cost of waste is taken into account as part of other expenses (clause 7 of PBU 9/99 “Organizational Income”, approved by order of the Ministry of Finance of Russia dated 05/06/1999 No. 32n, clause 11 PBU 10/99 “Expenses of the organization”, approved by order of the Ministry of Finance of Russia dated 05/06/1999 No. 33n).

Postings are generated in accounting: Debit 10 Credit 20

– the amount of production expenses is reduced by the cost of waste,

Debit 62.01 Credit 91.01

– waste is transferred to the buyer,

Debit 91.02 Credit 68.02

– VAT is charged on sales,

Debit 91.02 Credit 10

– the cost of waste sold is written off.

Tax accounting

For profit tax purposes, the remains of raw materials (materials), semi-finished products, coolants and other types of material resources formed during the production of goods (performance of work, provision of services), which have partially lost the consumer qualities of the original resources (chemical or physical properties) and are therefore used with increased costs (reduced product yield) or not used for its intended purpose, are returnable waste (clause 6 of Article 254 of the Tax Code of the Russian Federation. In tax accounting, as in accounting, returnable waste is valued at the price of possible sale. For profit tax purposes, revenue from the sale of all returnable waste you specified (excluding VAT) is taken into account as part of the income from sales (clause 1 of Article 249, clause 1 of Article 248 of the Tax Code of the Russian Federation). At the same time, the amount of material expenses of your organization is reduced by the cost of returnable waste (clause 6 Article 254 of the Tax Code of the Russian Federation. In other words, in the case of the sale of returnable waste to third parties, the proceeds from the sale of such waste are reduced by their cost taken into account in tax accounting (letter of the Ministry of Finance of Russia dated April 26, 2010 No. 03-03-06/4/49 ). Please note that non-operating income from the sale of these values (in addition to income from sales) is not generated. According to subparagraph 1 of paragraph 1 of Article 146 of the Tax Code of the Russian Federation, the sale of these material assets on the territory of the Russian Federation is subject to VAT. The tax base for VAT is determined based on the sales price without including VAT (clause 1 of Article 154 of the Tax Code of the Russian Federation). Taxation is carried out at a tax rate of 18% (clause 3 of Article 164 of the Tax Code of the Russian Federation).

The 1C:ITS information system is updated every day and contains ready-made advice on accounting, tax and personnel records.

It is quite possible that the answers to the specific practical questions that you are currently looking for are already in the “Auditor Answers” section of the 1C:ITS Information System. And in order not to miss the latest expert consultations and other useful information, you can subscribe to the free newsletter: https://its.1c.ru/news/subscription.php

You can enter into an information technology support agreement with a recommended partner

More about 1C:ITS

Valuation in tax accounting

The Tax Office points out that there are two ways to assess waste:

- At the possible price of use in production, which is lower than that of the source material;

- At the market price when the waste is intended for sale.

Important! Tax accounting differs from accounting in that the former depends on the valuation of waste on how it will be used in the future. As in accounting, in tax accounting, if the actual sale price is not identical to the capitalization price, it is not revalued.

Valuation of returnable waste for tax accounting

Since waste is classified as materials, it is received during generation, subsequent receipt at the warehouse and at the time of issue. At the same time, the cost of the raw materials from which they are composed is reduced, since they are subsequently reused.

The option for assessing residues depends on how they are reused:

- When reused in the production process at your own enterprise, the cost of raw materials is equal to the cost of use

- When resale of raw materials, the purchase price is indicated in the report

Tax accounting data often differs from accounting estimates. The reason for this phenomenon is different calculation methods. To adjust the indicators, additional postings are applied.

Accounting for a single tax on imputed income

Unlike accounting for returnable waste under the main taxation system, an organization that pays a single tax on imputed income, according to the Tax Code of the Russian Federation, cannot sell goods that it itself produces. Returnable waste also falls under this rule. Such an enterprise can sell only purchased goods at retail using the UTII system. If an enterprise produces products on UTII, then in this case it needs to organize separate accounting:

- When combining “imputation” and the main system - separate accounting for UTII, profit and VAT;

- When combining “imputed” and “simplified” - accounting for UTII and tax according to the simplified tax system.