Which companies are required to pay transport tax?

Tax legislation establishes that all legal entities that own vehicles are required to pay tax.

Termination of obligation is possible only if the vehicle is deregistered or destroyed. But both of these facts need to be documented , otherwise the Federal Tax Service will not take them into account.

That is, the fee will still have to be paid, even if the organization has not used the equipment for a long time, has leased it or contributed it to the authorized capital of another company.

But there is one exception - a company is exempt from paying transport tax if the equipment was sold due to enforcement proceedings.

The fee applies to most shipping, water and air vehicles. But some legal entities have the opportunity to save money. For example, the law exempts owners of offshore platforms, special equipment for agricultural activities, and fishing vessels from payment.

Preferential provisions for transport tax

Transport tax benefits are regulated by the legislation of the constituent entities of the Russian Federation. In Art. 361.1 of the Tax Code of the Russian Federation establishes only a general procedure for their application. For example, to use transport tax benefits, a company submits a special application to the tax office.

Important! To use the benefit, the company must submit an application. If this is not done, the benefit will not be provided even if it is mentioned in regional legislation.

This point does not apply to individuals and individual entrepreneurs - the benefit is provided by tax authorities independently based on the information they have. At the same time, entrepreneurs pay transport tax in the same way as citizens - based on a notification from the Federal Tax Service.

Based on clause 2 of Art. 358 of the Tax Code of the Russian Federation, in relation to some vehicles, no tax is paid at all - they are excluded from the object of taxation. In this case, there is no need to apply for the benefit, since the exemption is automatic.

For example, transport tax is not paid if the car is wanted. The fact of theft is confirmed by documents issued by the State Traffic Safety Inspectorate or on the basis of information received by tax authorities through interdepartmental information exchange.

In addition, some vehicles are not subject to tax because they are used in special areas of activity - agriculture, sea and river fishing, transport and cargo transportation by sea, river or air.

Instructions on how to calculate transport tax

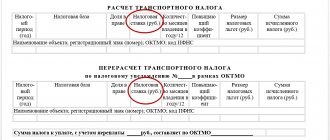

Transport tax is calculated using the formula:

TN = NB x NS , where:

- NB – tax base

- TS – tax rate current at the time of payment

The formula becomes more complicated if the company:

- makes advance payments

- wants to take advantage of tax benefits

- applies different coefficients

If all three conditions above are met, the calculation looks like this:

TN = NB x NS x Kv x Kp - NL - AP , where:

- Kv – vehicle ownership coefficient

- Кп – increasing coefficient

- AP – advance payments

- NL - benefits to which the payer is entitled

This is the complete formula, but it may vary depending on the situation.

Table of transport tax rates for Moscow

Transport tax rates are approved in Moscow by calculating them based on engine power , and the higher the power of the car, the greater the amount of tax the taxpayer must pay to the budget. Motor power is measured in horsepower.

For tax purposes, passenger vehicles are divided into 6 groups, each of which differs from the previous one with a larger engine power; trucks are divided into categories in the same way, only in their case only five groups are designated.

Main meanings of the formula

The main parameters for calculating tax are the tax base and tax rate . They are not excluded from the formula in any case. Other indicators complement it, if necessary in a specific situation.

The NB value can be found in the registration certificate or other documents for the vehicle. The base becomes engine power, gross tonnage or vehicle unit.

Please note that the engine power indicated in kW must be recalculated in horsepower: the number of kW must be multiplied by 1.35962 (this is a constant value). The resulting result must be rounded to 2 decimal places.

As for the tax rate, it is set by regional authorities and depends on:

- tax bases

- age of technology

- vehicle categories

- environmental class

If the LSG body has not determined the rates, companies have the right to use the basic indicators prescribed in Art. 361 Tax Code of the Russian Federation .

To find out the tax authorities in a specific region, you can use the Federal Tax Service help service:

- Specify region.

- Enter “About transport tax” into the search. The system will automatically display the law that is in force in the desired subject of the Russian Federation.

- Click "More details".

- Go to the “Bets” tab.

- Check the box next to “Legal Entity”.

- Click the “Show” button.

The service will display rates for TN in the selected region.

Calculation example

The calculation, made with only the basic values, is very simple. For example, during 2022, the company owned a passenger car with a power of 145 hp, which is the tax base. The tax rate in the region is 35 rubles.

We multiply the two indicators and get the amount of transport tax:

145*35 = 5 075 rubles

This is how much the organization needs to pay without taking into account advance payments, benefits and coefficients.

Transport tax changes in 2022

In 2022, changes to the transport tax affected a number of serious issues.

Application for benefits

Taxpayers must now notify the tax office of the tax benefits they have. For such notification, the form regulated by the Order of the Federal Tax Service dated July 25, 2019 No. ММВ-7-21/ [email protected]

Before 2022, such notice did not need to be filed because information about the benefits was contained in the tax return. Tax officials explained that this document should be submitted only for tax periods starting from 2022. For past years, the notification is not submitted, and it does not need to be submitted during 2022 (if the legal entity is reorganized or liquidated). The Federal Tax Service noted this point in Letter dated September 12, 2019 No. BS-4-21/ [email protected]

Important! The deadline for filing a notice of benefits is not established by law. The company can transfer it to the Federal Tax Service both before the date of payment of the tax (the first advance payment) and after the tax authorities transmit a message about the amount of the calculated transport tax. The Federal Tax Service explained this situation in Letter dated December 3, 2019 No. BS-4-21/ [email protected]

Transport tax declaration

Changes in 2022 regarding the transport tax also affected the declaration form for it. Its new form is regulated by Order of the Federal Tax Service dated November 26, 2018 No. ММВ-7-21/ [email protected] It was used to submit the declaration for 2022, as well as to transmit corrective information.

As for the declaration for 2022, it is no longer necessary to submit it, since such an obligation has been canceled on the basis of Federal Law No. 63-FZ dated April 15, 2019. It is precisely because the transport declaration has been cancelled, companies need to submit an application for benefits to the Federal Tax Service.

Important! There was no requirement for individual entrepreneurs to submit a transport tax return.

New list of expensive cars

When calculating the tax, it is now necessary to take into account the updated list of vehicles classified as expensive. Increased odds are applied to them. This list included both premium cars and popular brands - Honda Pilot, Mazda CX-9 and Subaru Outback.

Advance payments and final technical specification

The frequency of advance payments depends on whether the regional authorities have established reporting periods or not. If yes, then you need to pay quarterly, if not, then at the end of the year.

Advance payments are made in equal installments. The formula used to calculate them is as follows:

AP = ¼ x TN

At the end of the year, TN is calculated minus advance payments:

TN = NB x NS – AP

Calculation example

Throughout 2022, the company owned a passenger car with an engine power of 150 hp, which is considered the tax base. The regional rate is 10 rubles.

First, the tax amount is calculated:

150*10=1500 rubles

Then the advance payment is determined from it:

¼*1500=375 rubles

The final transport tax, taking into account advances made every quarter (that is, 3 times), is calculated as follows:

1500- (375*3)=375 rubles

Accounting for vehicle ownership coefficient

An organization applies a ownership coefficient (Q) when equipment is not registered for it for the entire reporting year or quarter. If the vehicle is owned for a full year, then the coefficient is 1 and does not affect the final amount of the TN. Therefore it is not taken into account.

The coefficient is calculated using a separate formula:

Kv = number of full months of vehicle ownership/number of months in the reporting period

How is an incomplete month of vehicle ownership taken into account?

As mentioned above, if a legal entity owns a vehicle for an incomplete period, it is necessary to apply the ownership coefficient. Let's look at how all this is taken into account using an example.

The company on March 10 , 2022. (this is NB). The tax rate in the region is 10 rubles. How, in this case, to calculate the advance for the first quarter and the transport tax at the end of the year?

Please note that there is a "15th" rule :

- the car was registered in the period from the 1st to the 15th of the month (inclusive)

- the car was deregistered from the 16th to the 30th (31st) day of the month (for February from the 16th to the 28th/29th)

In this case, this rule works exactly. The car was registered on March 15, which means that this month is taken into account in full for calculating tax.

First we calculate the ownership coefficients:

- first quarter – 0.3333 (1 month of ownership/3 months of the reporting period)

- at the end of the year – 0.8333 (10 months/12 months)

Then we move on to advance payments:

- first quarter – ¼*150*10*0.3333=125 rubles

- second – ¼*150*10=375 rubles

- third – ¼*150*10=375 rubles

Finally, we calculate the total amount of transport tax:

150*10*0,8333 — (125+375+375)=375 rubles

We must not forget that the TN amount is rounded to the nearest ruble if it comes out to more than 50 kopecks.

Deadlines for payment of transport tax by legal entities in 2022

The payment deadline for transport tax is the same for everyone; it no longer depends on the region.

Organizations are required to pay transport tax for the past year no later than March 1 of the following year. Thus, companies pay tax for 2021 until 03/01/2022.

Regions still have the right to establish their own procedure for transferring taxes and oblige organizations to make advance payments. At the same time, regions no longer set deadlines for paying advances; they are also the same for the entire Russian Federation - the last day of the month following the reporting quarter. Taking into account weekends and holidays in 2022, the dates are as follows:

- 05/04/2022 — advance payment for the 1st quarter;

- 08/01/2022 — advance payment for the 2nd quarter;

- 10/31/2022 — advance payment for the 3rd quarter.

In order for the payment to reach the recipient, it is important to indicate in the payment order the current BCC for payment of transport tax. If you use Extern, you will be able to automatically fill out payment orders for declarations and requirements of the Federal Tax Service.

What is a multiplying factor?

Tax legislation requires the use of an increasing coefficient (Kp) if the company owns a high-value passenger car. This value depends on the average price and age of the car.

The list of cars for which the KP must be applied when calculating tax is published on the official website of the Ministry of Industry and Trade. This list is updated every year. The new version can be viewed no later than March 1 .

Calculation of TN taking into account KP is carried out according to the following formula:

TN=NB*NS*Kp – AP

Advance is calculated as follows:

AP = ¼*NB*NS*Kp

Calculation example

Throughout 2022, the company owned a BMW 340i xDrive Gran Turismo passenger car with a power of 326 hp (HP), costing 3,200,000 rubles. The tax rate in the region is 150 rubles. In accordance with the list of the Ministry of Industry and Trade, the increasing coefficient for such a machine is 1.1.

Prepaid expense:

¼*326*150*1,1=13 448 rubles

Final transport tax:

(326*150*1,1) – (3*13 448)=13 446 rubles

Who is eligible for tax breaks?

Article 358 of the Tax Code of the Russian Federation contains a list of vehicles for which legal entities are not required to pay tax. But regional authorities have the right to establish additional benefits.

For example, in the capital, companies that transport passengers on public transport do not pay the fee. In St. Petersburg, companies that own floating docks pay 50% less tax.

You can find out if there are benefits in your region by contacting the tax office.

When calculating, the amount of the benefit is deducted from the amount of the transport tax. The resulting amount must be paid to the Federal Tax Service.

When is an increasing and when a decreasing coefficient applied?

In order for legal entities or individuals to be able to use the CV coefficient that increases the value in the calculation part of the tax return, the following condition must be met - the cars available must correspond to the description given in the second paragraph of Article 362 of the Tax Code.

If the above condition is not met, then the use of a multiplying factor when filing a declaration is prohibited.

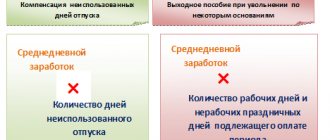

The reducing coefficient value can be applied in the following situations:

- The owner of the car disposes of it for less than one year, provided that this particular time falls under the concept of “reporting period”.

- The object of transport tax became the subject of illegal acts, in other words, it was stolen.

However, it should be remembered that in order to use the second circumstance as a reason for indicating a reduction factor in the declaration, it is necessary to submit an application to law enforcement agencies. In addition, a criminal case must be initiated regarding the theft.

Next, you need to obtain the relevant certificates and submit them to your tax service unit, where you will also have to write an application in your own hand with a request to use a reduction factor to calculate the declaration. Remember that the tax office can only accept documents from the owner of the vehicle. There is another option in which you can use a reducing value of the Kv coefficient.

In this case, we are talking about the category of people who are entitled to various types of benefits. By the way, the types of benefits, as well as the categories of persons entitled to them, vary depending on the region of the country. For example, pensioners living in the Moscow region have the right to pay half of the accrued transport tax, and residents of the Chechen Republic who own vehicles with a power unit capacity of up to 150 horsepower are completely exempt from the tax burden.

In addition, benefits apply to such categories of citizens as large families, disabled people, combatants and many others. For the convenience of users, you can find out complete information about persons who are granted preferential rights to pay transport tax on the websites of regional tax departments, or by personally contacting the nearest tax office.

You can receive benefits, and with them the right to use a reduced transport tax rate, by personally contacting the tax service. You must have with you an application of the appropriate form, as well as a package of documents confirming your relationship to a particular category of beneficiaries.

Now it has become clear for which cars increasing coefficients are established for calculating transport tax, and for which cars standard coefficients should be used.

Is a tax declaration required?

A transport tax return is no longer required . Federal Tax Service employees independently request information from the State Traffic Safety Inspectorate and Rostechnadzor about which equipment is registered to a legal entity. As a reminder, the inspectorate sends the payer a notice of the tax amount.

If a citizen has calculated the fee himself, and his result differs from the Federal Tax Service, he can defend his position if it is correct. You will need to justify the correctness of your independent calculations with documentation. The tax service allows 10 days from the date of receipt of notification of the amount of transport tax.

Transport tax benefits in Moscow

Before considering the list of citizens and organizations entitled to partial or complete exemption from the transfer of transport tax amounts, let’s figure out which transport is not subject to this tax in any case:

- ships entered in the Russian International Register of Ships;

- transport involved in freight and passenger transportation (across the river or sea, as well as by air);

- offshore drilling vessels, platforms (floating and stationary);

- airplanes/helicopters operated by medical or sanitary services;

- machines used in agriculture for raising livestock or growing crops;

- rowing boats;

- bicycles, scooters, scooters, etc.

| Legal entities entitled to transport tax benefits | A comment |

| Companies engaged in passenger transportation by public urban transport | Taxi services are not included in this list |

| Legal entities that are residents of the Zelenograd SEZ are exempt from tax on vehicles registered in this zone | The benefit is valid for 5 years, starting from the month of vehicle registration |

| Categories of individuals exempt from transport tax | A comment |

| Heroes of the USSR, Russian Federation | one vehicle, except water, air transport, snowmobiles and motor sleighs |

| Awarded the Order of Glory | |

| Veterans and disabled people of the Second World War and military operations | |

| Former juvenile prisoners of the Nazis during the Second World War | |

| Citizens with disabilities of 1st and 2nd groups | |

| Parent (guardian, trustee) of a disabled minor | |

| Parent (adoptive parent) in a family with 3 or more children | |

| Guardian of a disabled child | |

| Participants in tests of (thermo)nuclear weapons, accident liquidators, testers of nuclear installations, survivors of radiation sickness | |

| Owners of passenger cars up to 70 hp. | |

| Victims of radiation |