general information

Our work records are kept like the apple of our eye in the personnel department of each organization in which we carry out labor activities. Look at your work book - you see how carefully the entries, various signatures and notes are made in it.

Many legislative acts require personnel personnel to carefully access In fact, this is a kind of face of the organization, which the resigned employee will take to show in a new place.

But sometimes the correctness and accuracy of maintaining and storing work books does not depend on personnel officers.

Various natural phenomena, old age and other factors are merciless to scraps of paper and sometimes, some labor ones that cannot even be restored are sent to the trash can.

Why this happens, and even if it happens, then in what order, we will look at in our material.

This information will be useful to personnel officers, employees, and employers.

Accounting for work records: practical recommendations

The procedure for storing and recording work books is prescribed in Government Decree No. 225 of April 16, 2003 “On work books” (hereinafter referred to as the Rules). It is worth noting that there are two types of accounting: accounting and personnel. In the first case, we are talking about reflecting the purchase of document forms and their write-off, which occurs in the event of the issuance of books to employees or their damage. It is this type of accounting that we will dwell on in more detail.

Let's sort out the bills

The sale of work books is not the main activity of the company. According to paragraph 46 of the Rules and paragraph 4 of the Procedure for providing employers with work book forms and an insert in it (approved by Order of the Ministry of Finance of December 22, 2003 No. 117n), employers “stock up” with them on a contractual basis for a fee. The supplier of such forms can be either the GOZNAK association itself or other distributors that meet the requirements established by the above association. In this regard, purchased forms should be accounted not on account 41 “Goods”, but on account 10 “Materials”, subaccount 6 “Other materials”. For the same reason, their issuance to employees is not accounted for using account 90 “Sales”, but is carried out as a sale through account 91 “Other income and expenses”.

Paragraph 42 of the Rules contains an indication that the forms of the work book and its insert must be stored in the organization as strictly accountable documents. Therefore, in addition to accounting for account 10 “Materials,” it is advisable to reflect the receipt and issuance of these forms on the off-balance sheet account 006 “Strict reporting forms” in a conditional valuation (usually 1 rub.).

For a fee or for free?

Clause 47 of the Rules stipulates that the employee must pay for the work book provided to him, and in an amount equal to the employer’s expenses for its acquisition. By the way, there is no need to use CCT in this case. This is explained by the fact that the organization, in fact, does not sell the form, but reimburses its own expenses. A similar statement is contained in the resolution of the Federal Antimonopoly Service of the North-Western District dated March 2, 2007 No. A56-44214/2006.

It should be borne in mind that if a company wants to engage in charity and donate a book, it will not be able to reduce the “profitable” base by the costs of its acquisition. Indeed, according to paragraph 16 of Article 270 of the Tax Code, expenses in the form of the value of property transferred free of charge are not taken into account for this purpose. It is also worth noting that when issuing a work book, the company is obliged to charge value added tax (clause 1 of Article 168 of the Tax Code). Otherwise, the auditors will refuse the deduction (Articles 171 and 172 of the Tax Code).

However, there are also situations in which the employer simply does not have the right to charge a fee for issuing forms, namely:

- in case of mass loss of work records by the employer as a result of emergency situations, such as: environmental and man-made disasters, natural disasters, riots and other emergency circumstances (clause 34 of the Rules);

- if the initial filling of the work book or the insert into it is incorrect (clause 48 of the Rules);

- if the form is damaged through no fault of the employee (clause 48 of the Rules).

Example

On August 1, 2007, LLC Privilege purchased 50 forms of work books from LLC GOZNAKsbyt at a price of 118 rubles. per piece (including VAT - 18 rubles). The conditional assessment is set at 1 rub. for the form. On August 6, 2007, Yu.V. was hired. Melnichenko, who had never worked anywhere before. The personnel worker ruined one form by filling out the work book incorrectly, and used up the second form. In accounting, transactions will be reflected as follows:

August 1, 2007:

Debit 10-6 Credit 60 - 5000 rub. (100 rubles × 50 pcs.) - 50 work book forms were received at a price of 100 rubles;

Debit 19 Credit 60 - 900 rub. (18 rubles × 50) - VAT presented by the seller is taken into account;

Debit 006 - 50 rub. (50 pcs. × 1 rub.) - 50 work book forms were capitalized;

Debit 60 Credit 51 - 5900 rub. — the received forms have been paid for;

Debit 68 Credit 19 - 900 rub. - submitted for VAT deduction.

August 6, 2007:

Debit 91-2 Credit 10-6 - 200 rubles. — forms damaged by the HR employee and issued to the employee were written off;

Credit 006 - 2 rubles. — the forms damaged by the personnel officer and issued to the employee were written off;

Debit 73 Credit 91-1 - 118 rubles. — reimbursement of the cost of the work book form issued to the employee;

Debit 73 Credit 91-1 - 118 rubles. — compensation for the cost of the damaged form has been accrued;

Debit 91-2 Credit 68 - 36 rub. (200 rubles × 18%) - VAT is charged on the reimbursement;

Debit 70 Credit 73 - 118 rub. — the cost of the form is deducted from the new employee’s salary;

Debit 70 Credit 73 - 118 rub. — the cost of the damaged form was deducted from the personnel officer’s salary.

Blanks love counting

Another direct responsibility of the accountant related to work books is maintaining a receipt and expenditure book for accounting forms (clause 41 of the Rules), the form of which is given in Appendix 2 to the Resolution of the Ministry of Labor of October 10, 2003 No. 69 “On approval of the Instructions for filling out work books." This book should contain information about all transactions related to the receipt and use of work books and their inserts. In this case, it is necessary to indicate the series and number of each form. The pages of the receipt and expenditure book must be numbered and laced, after which the register is certified by the signature of the head of the company, sealed with a wax seal or sealed.

L. Tyurina , columnist for the Federal Financial Information Agency

In what cases can you write off?

The practice of maintaining labor books knows many cases in which labor was simply written off from the register .

Various natural phenomena can contribute.

Floods, earthquakes, fires...

All this does not have the best effect on paper, which means that documents damaged as a result of natural disasters may be written off.

But in addition to natural disasters, there are also man-made disasters. As a result of a collision with them, a person risks being left without any mention of where he worked. Man-made disasters include nuclear explosions and other emergencies.

Despite the fact that the modern work book received its usual form back in 2004, many still have old-style work books. For example, an employee with a work book from the late nineties probably cannot provide the document with the proper appearance. Over the years, the paper frays and becomes unusable, and such work books must also be written off.

In addition to old age, the basis for writing off is other damage to documents - dampness in the premises, careless handling - all this indicates that the fate of the work record book is decided - it can only be written off.

Careless filling out of the work book by an employee of the HR department is also grounds for write-off.

As you can see, many cases can affect the fate of your employment document.

Postings for writing off work books

The procedure performed must be reflected in the accounting records. For this purpose, entries are made for writing off work books. To record strict reporting forms, off-balance sheet account 006 is used. It displays various property that is temporarily located in the organization (for example, in storage or on lease). There is no double entry method on this account.

Let's look at the main entries for writing off work books:

- Dt 10 Kt 60 - the organization has capitalized the forms of purchased work books;

- Dt 19 Kt 60 – VAT reflected;

- Dt 68 Kt 19 – tax accepted for deduction;

- Dt 006 – work books are accepted for off-balance sheet accounting;

- Kt 006 – writing off documents from an off-balance sheet account after their destruction.

How to write off a damaged form?

How to write off a damaged work book? In order to do this in accordance with all the rules established in the legislation, namely in the government decree on the storage and maintenance of work books, it is necessary to perform a number of step-by-step actions.

All of them require the participation of several personnel department employees , as well as the employer himself.

Each action must be carried out at a precise time, following the stated plan, only then the accuracy of the work you carry out will be at the highest level.

In order to write off a damaged form, the organization must issue an appropriate order that would allow the creation of commissions and the write-off.

Only after this can you begin to act.

First of all, you need to re -register your work records . Inspect all documents you have in your possession. There is no need to touch copies that have a presentable appearance; put them aside.

But outdated work books, frayed, stained or crossed out inside, should be sent for inspection.

The head of the personnel department must create a specialized commission from his subordinates. The legislator dictates the following name for us - inventory commission . This commission reviews the copies left for write-off and once again approves them for write-off.

Now you need to draw up a corresponding write-off act . We will talk about how to correctly compose this document in the next paragraph.

Later, a completely different commission is formed. The legislator calls it liquidation .

This commission consists of the same members as the previous one, but the fact of its creation is formalized by a separate order.

The commission attaches to the drafted act all employment forms that were not used for any reason.

Next, the documents are destroyed. This must be done in such a way that not a single work book survives and someone does not have two documents on work.

Basic rules and responsibility for violating them

Entries in labor records are made in Russian - this is one of the basic rules. All employee records of the company are kept by the manager or responsible person. There is a certain administrative liability for failure to comply with or violation of any rules relating to labor:

- conducting,

- storage,

- accounting,

- issuance.

Issuing the book itself to an employee working in the company at his request is prohibited. An exception is the situation when a specialist needs to present a work book to the pension insurance fund. The law stipulates that until the termination of the employment contract, the manager bears all responsibility for labor, which means in this case too.

In other cases, the employee needs to write an application for a copy of the document, for which the employer is given three days. Each completed page of the work report is copied and then approved with a seal and signature. Also on the last sheet it is recorded that the employee is still working in the organization.

An employer may not hand over the book upon dismissal only in two situations:

- the employee expresses reluctance to pick up his work document,

- the employee simply did not show up to collect the work document.

At his own discretion, the boss does not have any right to detain the employee’s work. If this happens, the owner must contact the appropriate labor protection authority or the court. It is worth noting that each case has its own statute of limitations, which a citizen must know when filing a claim.

The books of employees who were not received upon dismissal for certain reasons, including death, are kept in the organization. Upon request, they are given to relatives. But there are corresponding periods for storing labor if they were not in demand - fifty years.

The law also establishes criminal liability associated with work books. This includes cases where these documents were used to harm the owner or other citizens. Persons who enter illegal information, knowing about it in advance, are also subject to liability.

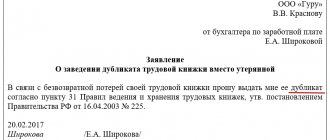

Write-off act

The act of writing off the work book is an extremely important document, although there is not a single mention in the legislation of what it should actually look like.

Everyone draws up this act by hand and arbitrarily .

We have derived only a number of rules that should be inherent in this document:

- it must contain the full name of the organization;

- the name of the act itself should be written in large letters in the center;

- We also do not forget to enter the very date when the act was written;

- the act should briefly outline the entire process regarding the write-off of labor;

- the number of written off documents is indicated, as well as the reasons for writing off each one;

- do not forget to list the composition of the inventory and liquidation commissions;

- The document must end with the seal and signatures of all participants in writing off the work books.

It is worth noting that this act is drawn up on A4 sheets, in duplicate . Written with a black or blue pen in the absence of a form.

Act on writing off work books.

How documents on professional activities are written off

A document on professional activity must be written off in the following cases.

If the sample document is already outdated

The last time the appearance of the work book changed was in 2004. This version of the document is still used today. But a situation may well arise when a person comes to find a job with an old version of a professional activity document. For example, if for some reason he had a huge break in his experience or worked all this time without proper registration. In such a situation, the citizen should be issued a new document with all the records from the old one transferred to it. The procedure is long, but still necessary.

If the document is damaged

The most common case of writing off a work book. Of course, all shortcomings and blots should be corrected, following certain rules.

- Firstly, you cannot correct mistakes made on the title page of the document. In this case, you will have to create a new document and destroy the old one.

- Secondly, a large number of corrections in the document itself or its inserts is also a good reason for writing it off.

- Thirdly, an emergency situation that has arisen in an organization can also lead to damage to work records. Of course, such important documents must be kept in a safe, but anything can happen. This is the worst option for the employer, because you will have to destroy and restore at your own expense not just one, but a large number of documents at once.

If the document is no longer in demand

The organization may retain the work book of a deceased employee if close relatives do not take it. There are cases when an employee dismissed on the basis of a certain article decides not to take away a document with a record discrediting him. Such work books are stored by law for 50 years in the company’s archives, and after this period they must also be destroyed.

How does destruction occur?

Today in large cities there are many services that are ready to help you get rid of documents for money.

This is not done for free, but quickly and efficiently.

If you have no desire to pay for work that you can easily do yourself, then go for it.

There are two ways to get rid of labor. Firstly, such documents can easily be torn into pieces and set on fire .

As a rule, a similar action is carried out on the territory of the enterprise so that everyone can make sure that the documents are destroyed.

The second method is shredding . A special machine shreds the paper to a state where it is simply impossible to read the contents in it.

Comments on the document “Sample. Act on writing off damaged work record forms"

Reply 0

| 5 Max | 10/18/2016 at 10:34:26 Quite a serious situation...the HR specialist will have a hard time if the book is damaged. |

Reply 0

| Daria | 10/19/2016 at 07:32:49 Oh, we actually had a lot of problems in the personnel department, all due to the incompetence of specialists. I understand those who use HR administration. |

What to do if an employee does not show up for work?

If an employee does not show up for a work book and there is a work document lying around in your archives, do not rush to get rid of it. The Labor Code suggests sending the work report by mail to the address indicated therein by registered mail. If such action is not possible, find a way to contact the owner of the work permit or his relatives.

If the connection is lost, do not rush to part with the document. According to the provisions of labor regulations, the book must remain at the enterprise until either the former employee himself or one of his relatives or representatives comes to collect it.

The occurrence of emergency situations in the organization and actions with work books

If there is a massive loss of documents on the professional activities of employees during a fire, flood or other emergency situations, the head of the organization must record the scale of this disaster.

To do this, you need to obtain certificates from the Ministry of Emergency Situations or from the utility service confirming the fact of the emergency. It is necessary to independently film the consequences of the incident at the enterprise on a photo or video camera. This data will help you communicate with regulatory authorities if they have questions regarding the loss of work books and other documents.

A special commission is created to restore documents on the professional activities of employees of the affected company. It includes members of trade unions, representatives of employers and other labor organizations. The commission is collecting documents and drawing up an act according to which the manager will be able to issue the employee a duplicate document on professional activities.

The process of writing off issued work books is quite complicated. Therefore, you need to be more serious about filling out such important documents so that errors and corrections do not occur.

How to draw up an act correctly

The document does not have a unified form. Its form is arbitrary, but there is a standard structure for acts:

- Name of the company or enterprise where work records need to be destroyed.

- Document's name.

- The number assigned to this document.

- City or other locality, date of signing the act.

- Listing of positions, names and members of the commission.

- The time interval during which damaged work books accumulated, or the date when they were damaged, if this happened on a certain day.

- The reasons why the books were damaged.

- The number of forms and inserts for them, their numbers.

- The method by which work records were destroyed.

- Signatures of the commission members.

For some organizations, it is more convenient to draw up a list of damaged work books in the form of a table, where the document numbers and reasons for their damage are entered.

Important! You can write the act by hand, but for greater readability it is recommended to use a typewritten version. For companies where workers are often written off and destroyed, it is more convenient to use a form.

Reasons for write-off

Work books, as strictly accountable documents, are kept by the employer for the entire period of the employee’s employment. The employer is obliged to take care of their safety, their correct maintenance and timely completion. The procedure for working with employees' working documents is described in the rules approved by Government Decree No. 225 of April 16, 2003.

IMPORTANT!

Not only the papers of current employees are subject to accounting, but also blank forms and inserts for them that are available in the company.

Employees' work documents and unused forms are destroyed by the employer in the following cases:

- work book forms damaged when filling out must be disposed of in accordance with clause 42 of the rules;

- papers heavily damaged by natural disasters and emergencies are disposed of;

- Unclaimed documents of former employees are disposed of after their storage period expires. In accordance with paragraph 449 of Rosarkhiv Order No. 236 dated December 20, 2019, such documents are stored for 50 years if they were completed in office work after January 1, 2003, and 75 years if before this date.

Who draws up the write-off act

A specially created commission draws up and signs the paper. It consists of at least three people from among the organization's employees, as a rule, these are personnel and accounting employees. The responsibilities of the commission include:

- identify papers to be destroyed;

- make sure that they need to be disposed of, including: check the shelf life if unclaimed paper is destroyed, make sure there are errors, since further filling out the work book if the form is damaged is not allowed, or that the document is unsuitable for further use;

- draw up a deed and sign it;

- carry out independently or personally supervise the process of physical destruction.

For what reasons can work books be written off?

Everything related to maintaining a work record book is described in the following legislative documents:

- Rules for maintaining work books approved by the Post. Government of the Russian Federation dated April 16, 2003 No. 225;

- Instructions for filling out work books contained in Post. Ministry of Labor of the Russian Federation dated 10-10-2003 No. 69.

An employee, when joining an organization, is obliged to submit a work report to his employer. When a person is employed for the first time, such a document is created by the employer himself.

The personnel officer is forced to write off the work book in the following cases:

- Damage to the form due to the fault of the personnel officer. For example, when filling out an employee made a mistake and immediately discovered it. Then he must destroy the damaged form, drawing up a corresponding act.

- Damage as a result of accidents and natural disasters, such as flood, fire, sewer pipe break, building collapse, etc.

Such situations arise infrequently, but nevertheless it is necessary to know what to do in such cases, how to correctly write off a work book and draw up an act.

How to correct an error in a document

If a mistake was made and noticed when writing the act, then it needs to be corrected as follows:

- carefully cross out the error;

- write the correct option at the top;

- put o next to it;

- commission members sign.

If a large number of inaccuracies and errors are made, a new document is generated and the old one is destroyed.