Accounting and tax policies for 2022

Accounting policies are necessary to describe the methods used by the company to reflect property, income and expenses, as well as transactions in accounting and tax accounting and reporting.

The 2022 accounting policy can be formed as a single document with separate sections devoted to the nuances of accounting and tax accounting, or a separate policy can be created for each type of accounting.

The form of this document is not regulated by law, but it is necessary to provide for all the nuances of accounting. It is important to supplement the accounting policy with a working chart of accounts, forms of used primary documents and registers, document flow rules and other company decisions necessary for organizing accounting.

From 01/01/2022, FSB 27/2021 “Documents and document flow” will become mandatory. Let us remind you that the document flow schedule is a mandatory appendix to the accounting policy.

ConsultantPlus experts explained in detail how to organize document flow for accounting purposes under the new FAS 27/2021. Get trial demo access to the K+ system and upgrade to the Ready Solution for free.

Read more about the nuances of using the chart of accounts here .

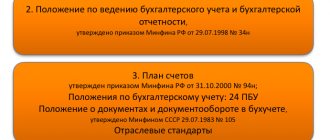

The basis for drawing up the accounting policy for 2022 is the rules enshrined in the accounting regulation 1/2008 “Accounting policy of organizations”, approved by Order of the Ministry of Finance dated October 6, 2008 No. 106n and introducing a number of assumptions and requirements (assumptions of consistency of application, property isolation, completeness requirements, timeliness, diligence).

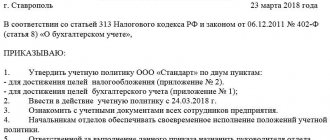

The accounting policy for 2022 is formed by the chief accountant (or other person entrusted with this) and approved by the head of the company. The date of approval of the accounting policy for 2022 is no later than December 31, 2021, since the accounting methods established by it are subject to application from January 1 of the year following the year of approval (clause 9 of PBU 1/2008).

Read about what is essential for the accounting policies drawn up by the simplified account here.

When is the accounting policy approved?

According to the general rules, each organization has 90 days or 3 months from the date of creation to develop and approve the MP. The day of creation is considered to be the registration of the organization in the Unified State Register of Legal Entities. This applies to newly created and reorganized companies.

For already existing organizations the procedure is different. The manager must issue an order to approve the new UE no later than the last day of the expiring year, since the accounting rules apply from the year following the approval. Therefore, it is not worthwhile to date the order on the UP for 2019 later than December 29, 2018.

In small companies, the UE may remain unchanged for years. It can be developed once and applied year after year, even until liquidation. There is no need to approve a new document annually. But changes and additions need to be made to the document.

How to draw up an accounting policy

There is no universal accounting policy suitable for all companies without exception. In order to correctly draw up this document, you will need to take into account not only all operations carried out by the company, but also those planned for the coming period, in order to cover the entire range of necessary methods for assessing and accounting for assets and liabilities. In addition, the 2022 accounting policy should provide for the timing and algorithm for conducting an inventory of property and liabilities, as well as describe the procedure for monitoring business operations.

The process of developing this document begins with an analysis of accounting methods permitted by law in order to rationally select the most suitable one for the company, taking into account the specifics of its work.

For example, the accounting policy of a construction company carrying out capital construction under long-term contracts must necessarily describe the procedure for recognizing revenue and expenses under these contracts in accordance with the requirements of PBU 2/2008 “Accounting for construction contracts” (approved by Order of the Ministry of Finance dated October 24, 2008 No. 116n) . But a trading company will not need this accounting policy when developing an accounting policy, because the specifics of its activities are different. At the same time, the latter will have to include other items in its accounting policy for 2022. For example, reflect the nuances of the formation of commercial expenses or the specifics of accounting for various discounts and surcharges on the price of goods. It is also necessary to display the procedure for accounting for fixed assets and lease obligations according to the new Federal Accounting Standards because:

- PBU 6/01 “Accounting for fixed assets” will no longer be in force, and accounting for fixed assets will be regulated by two new FAS 6/2020 “Fixed assets” and 26/2020 “Capital investments”. Read more about them here.

Find out what changes to make to the accounting policy in accordance with the new Federal Accounting Standards in ConsultantPlus. This material will help you navigate the innovations of FSBU 6/2020; this article will help you navigate FSBU 26/2020. Trial demo access to the system is provided free of charge.

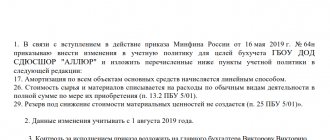

- Lease transactions must be accounted for in accordance with FAS 25/2018 “Lease Accounting”, approved by Order of the Ministry of Finance of Russia dated October 16, 2018 No. 208n.

ConsultantPlus experts explained in detail how an organization can switch to rental (leasing) accounting according to the new FSBU 25/2018. Get trial demo access to the K+ system and upgrade to the Ready Solution for free.

At the same time, both a construction company and a trading company may have the same approaches, for example, to methods for calculating depreciation of fixed assets and intangible assets or rules for writing off inventories.

We talked about how to draw up a tax accounting policy for a construction customer here.

See the list of all current PBUs here .

The scope of accounting policies depends on many circumstances: types of assets and liabilities, variety of taxes paid and other nuances. For example, if a company does not have its own property on its balance sheet, its accounting policy will not contain a description of methods for calculating depreciation and a section devoted to calculating property taxes.

Inventory accounting: FSBU 5/2019

FSBU 5/2019 must be applied from 2022 instead of PBU 5/01. The new standard regulates the procedure for accounting for inventories of a company.

MPZ include:

- materials, raw materials;

- goods for resale;

- finished products.

Accounting for incoming assets is carried out at their cost, which includes the cost of receipt agreed upon by the buyer and supplier, and all overhead costs associated with the acquisition of these assets. In this case, micro-enterprises can take into account related costs as part of current expenses. Other companies that maintain simplified accounting can include such expenses as current expenses, provided that there are no significant material and production balances.

For information about who is allowed to conduct simplified accounting, read the article “Features of accounting in small enterprises.”

IMPORTANT! Companies that have the right to use a simplified version of accounting may provide in their policies a simple method of accounting, without using double entry (clause 6.1, section 2 of PBU 1/2008).

Disposal of inventories can be carried out:

- at average cost;

- at the cost of each unit;

- FIFO method (the asset that was first registered is written off first).

ConsultantPlus experts explained how to apply FAS 5/2020 in practice and what nuances to take into account when making changes to the accounting policies for 2022. Get free demo access to K+ and go to the Ready Solution to find out all the details of this procedure.

Accounting policy for tax accounting purposes: nuances

The accounting policy for tax accounting differs significantly from the accounting policy, since it is based on other regulatory documents (the main one is the Tax Code of the Russian Federation). In addition, there are more frequent changes in tax legislation that require a timely response to them, including adjustments to accounting policies.

IMPORTANT! For the absence of an accounting policy or its provisions requiring independent choice or establishment, controllers are punished as a gross violation of accounting rules. In accordance with Art. 120 of the Tax Code of the Russian Federation, the fine will be 10,000 rubles. (30,000 rubles - if the violation extends to several tax periods). A fine will also be imposed on the official - under Art. 15.11 Code of Administrative Offenses in the amount of 5,000 to 10,000 rubles. (and in case of repeated violation from 10,000 to 20,000 rubles or will lead to disqualification).

For information on what constitutes the basis of accounting policies under IFRS, read the material “Accounting policies in IFRS format - basic provisions” .

Accounting policy of an organization (LLC): example-2022

The accounting policy of an organization (LLC) - an example from 2022 can be found on numerous websites on the Internet. We also have samples: for VAT, for the simplified tax system, etc. However, it is useless to look for the ideal one. All the subtleties of accounting are provided depending on the specifics of the activity, and each company has its own. You can use special design services offered on the Internet. But they can only be used as a basis, subject to further refinement and adjustment.

accounting policies for 2022 can be found on our website by clicking on the picture below:

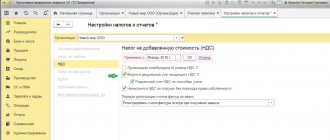

Accounting policies can also be created in 1C: Accounting. Find out how to do this correctly from a typical situation from ConsultantPlus. There you will also find examples of accounting policies for each tax system. And if you don’t have access to K+, sign up for a temporary demo access. It's free.

Accounting policy in 2022

When drawing up an accounting policy for the next year, the company must take into account the following points:

- in connection with the abolition of UTII, it is necessary to decide which taxation system will be used for accounting; if the choice falls on the simplified tax system, then before the end of 2022 you must notify the tax office of your decision (see in more detail Which regime to switch to after UTII?)

- from next year, more companies will be able to apply for the use of the simplified tax system due to an increase in the maximum values of mandatory limits

- for SMEs in 2022, reduced rates of insurance premiums will be applied for wages above the minimum wage, which also affect the size of the reserve for vacation pay

- from next year it is allowed to adhere to the requirements of the Federal Standard “Fixed Assets” instead of PBU6/01

- IT companies can apply a reduced rate on insurance premiums and income tax (see more details Income Tax. Changes for 2022)

- The form of the waybill has changed, the accounting policy must reflect the method of registration: paper or electronic

Results

Drawing up a competent accounting policy means reducing the risk of accounting errors, avoiding incorrect reflection of assets and liabilities or distortion of the tax base when calculating taxes.

The development of this policy is carried out taking into account the assumptions and requirements established by law and depending on the specifics of the company’s activities. The developed accounting policy must be relevant at the time of approval, and also be promptly supplemented and changed in cases provided for by law. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.