Legal expenses in the form of state fees

The amount of state fees for each type of appeal is established by Ch. 25.3 Tax Code of the Russian Federation. State duty is a fee collected when filing a claim in court. The original payer is the plaintiff. The final payer of the amount is the losing party, who is awarded costs.

The fee amount is set depending on the characteristics: (click to expand)

- Type of claim – economic, non-property, administrative.

- Categories of appeal – statement of claim, appeal or cassation complaint.

- The level of the judicial body - arbitration, general jurisdiction, higher body.

The most common cases are those of a commercial nature. The amount of the fee depends on the value of the assessed claim. For applications from persons without specifying the price of the claim, a fixed fee is provided.

Payment is made before filing an application with the court using the details provided by the authority. If the amount increases during the meeting, an additional payment is made. The legislation establishes a list of persons exempt from payment or who have the opportunity to reduce the amount of payment. When filing a claim, persons belonging to the preferential category confirm their right with documents.

Determination of legal costs by the judicial authority

The list of costs arising during the trial is defined in Art. 106 Arbitration Procedure Code of the Russian Federation. The list is open and individual in each specific case. Costs arise when considering a claim and are necessary for a more accurate decision. Costs are considered expenses only if they are determined by a court decision. Costs include:

- Remunerations paid to attracted specialists - translators, consultants, legal specialists.

- Compensation for current expenses of specialists and witnesses - travel, daily allowance, rental housing and other types of expenses.

- Payment for the cost of conducting an examination or inspection of the territory.

- Reimbursement of costs associated with postal expenses for notifying persons.

Amounts qualified as costs must meet the criteria of reasonableness. Rewards and compensation to individuals are assigned by the court in agreement with specialists in accordance with the time spent or established minimum wage standards. Payment of remuneration and compensation to the involved persons is made from the court's deposit account, where funds are deposited upon request to invite a specialist. Amounts spent on the initiative of the judicial authority are paid from the budget.

Recognition of costs incurred is carried out by the court in each specific case. Costs cannot be allocated to the losing party without filing a claim. The need to cover expenses must be addressed to the court and a request must be included in the statement of claim or in the form of additional demands stated during the hearing. When covering expenses, several repayment options arise.

| Procedure | Compensation of expenses |

| The fee was paid by the plaintiff, the application was not submitted to the court | Refunds are made by the territorial office of the Federal Tax Service before the expiration of 3 years. |

| The fee has been paid, the claim has been satisfied pre-trial | In some cases, the amount of fees and costs is returned in a separate claim. |

| The claims were partially satisfied | The costs incurred by the plaintiff are partially compensated, in part of the recognition of the claim or at the discretion of the court |

| The defendant has no obligation to pay state duty | Only expenses are subject to compensation; the amount of state duty to the plaintiff is not covered. |

Expenses incurred by the plaintiff in the course of pre-trial consideration of claims are not covered. Expenses often include costs for the services of lawyers. The courts do not recognize such expenses and do not attribute them to the losing party.

In some cases, the losing party may be able to avoid paying the winning party's costs. In order for the court to make a decision, it is necessary to apply to the court to provide documentary evidence of the difficult financial situation, the unintentionality of the motives for causing the damage, and to pay off the claims during the proceedings or upon receipt of a deferment.

How to reflect in an organization's accounting the payment of a state fee when filing a claim in an arbitration court if the case is won and the amount of the state fee is fully reimbursed by the losing party?

The organization filed a claim with the arbitration court against its counterparty, the cost of the claim is 500,000 rubles. In the same month, the arbitration court issued a ruling to accept the statement of claim for proceedings. The state duty was paid in cashless form.

Payment to bailiffs for wiring

— the collected penalty and state duty were received; DEBIT 51 CREDIT 60 subaccount “Settlements for advances issued” - rub. - the part of the advance amount collected by the bailiffs has been received.* In the future, the accountant will make a similar entry as the bailiffs collect the remaining debt from the supplier. So, we’ve sorted out the income and income tax. And what about VAT? It is clear that this question does not arise in relation to the principal amount of the debt. After all, you have already accrued VAT on the previously taken into account revenue; the returned advance is not income at all.

State duty is not taxed, this is obvious. Forfeits and penalties remain. You will not have to charge VAT on the amounts of penalties if you received them acting as a buyer or customer. Officials also agree with this (see, for example, letter of the Federal Tax Service of Russia dated August 9, 2011 No. AS-4-3/) According to a court decision, it is necessary to return part of the money paid for the work done to the legal successor of the bankrupt company.

What entries need to be made? In the situation under consideration, the organization will have to incur expenses that represent the repayment of debt in the form of overdue payment for work performed based on a court decision. According to clause 12 and clause 14.2 of PBU 10/99, compensation for losses caused by the organization is accepted for accounting in amounts awarded by the court or recognized by the organization. Therefore, the necessary entries in accounting must be reflected on the date the court decision entered into legal force: Debit 91, subaccount “Other expenses” Credit 76, subaccount “Settlements on claims” - an expense is recognized in the form of overdue payments. As the debt is repaid in the accounting you will need to make the following entry: Debit 76, subaccount “Calculations for claims” Credit 51 - the amount was transferred (partially) to pay off the debt.

How to correctly reflect in accounting the design work (rub.) and installation of a fire alarm (rub.) in the company’s office ✒ Design work Costs for the development of design documentation for construction…. Accounting for losses from car theft Is it possible to partially write off a loss from car theft and how to show all this in the declaration? Q….

What entries should be made to reflect accrued legal costs and the receipt of funds to the company’s current account from the bailiff service?

In accounting, the debt of citizens to reimburse legal expenses in accordance with a court decision is reflected by the entry: Debit 76 Credit 91-1.

Receive funds from citizens in pursuance of a court decision by posting: Debit 51 Credit 76. The rationale for this position is given below in the materials of the GlavAccountant System 1. Recommendation: How to reflect the state duty in accounting State duty for consideration of cases in court If the organization transferred the state duty for consideration of a case in court , include the amounts paid in other expenses () ().

When going to court, make the following entries: * Debit 91-2 Credit 68 subaccount “State duty” - the state duty has been charged for the consideration of the case in court. According to procedural law, if the plaintiff wins the case, the court will recover legal costs (including state fees) from the defendant in his favor* (, ).

The plaintiff organization reflects this transaction with the following entries: * Debit 76 Credit 91-1 - included in other income is reimbursement of legal costs (including

including state duties) by court decision; Debit 51 Credit 76 – reimbursement of legal costs (including state fees) according to a court decision was credited to the current account.

Sergey Razgulin, actual state adviser of the Russian Federation, 3rd class 2.

Recommendation: How to collect and reflect in accounting and taxation sanctions for violation of the contract imposed on the counterparty Accounting In accounting, the accrued penalty and interest for violation of the terms of the contract must be taken into account as part of other income (). Reflect the settlements on the claims made on account 76-2 “Settlements on claims” ():* Debit 76-2 Credit 91-1 – penalty accrued (interest for late fulfillment of a monetary obligation by the counterparty).

Acknowledgment by the debtor of a debt can be confirmed by any documents indicating that the debtor agrees to pay a penalty (interest on late payment), for example: ; , ;

Tax accounting

Accounting for legal expenses differs in a number of rules. All costs must be confirmed. These papers can be used as confirmation:

- Checks and receipts.

- Agreements for the provision of legal services.

- Travel tickets.

- Extracts from investigative bodies.

It is recommended that the costs of pre-trial settlement be specified in the agreement with the lawyer. Costs are calculated on the basis of documents attached to the case.

The costs will be classified as non-operating expenses. Expenses that can be included in this composition are stipulated by Article 106 of the Arbitration Procedure Code of the Russian Federation and Article 94 of the Code of Civil Procedure of the Russian Federation. However, the list considered is not exhaustive. Sometimes the court recognizes legal expenses that are not included in the list. For example, these may be the costs of copying documents, translating them, or notarizing them. Expenses are not recognized when their connection with the proceedings is not obvious.

How to take into account legal costs in tax accounting for income tax ?

When expenses will definitely not be recognized

The conditions for recognition are specified in paragraph 1 of Article 252 of the Tax Code of the Russian Federation. In particular, these are:

- Validity.

- Availability of supporting documents.

How to reflect legal expenses in accounting ?

Expenses are not recognized in the following cases:

- No connection to legal proceedings. For example, a company entered into a subscription service agreement with a law firm. During the trial, the manager contacted lawyers about something unrelated to the case. Related expenses will not be recognized. In this case, they will be taken into account as part of expenses for legal services on the basis of paragraph 1 of Article 264 of the Tax Code of the Russian Federation.

- The representative did not take part in the proceedings. For example, the company paid for representation services, but the representative did not take part in any meeting.

- The firm is not a party to the proceedings. That is, the subject must be either a plaintiff, or a defendant, or a third party. If the firm is not a party, there will be no basis for recognizing legal costs.

- It is not the company that is involved, but its employee. If a company employee is held accountable, it will be his personal matter. That is, the company does not have to take into account associated costs.

Sometimes the company resorts to pre-trial settlement of the case. Related expenses for lawyers and consultants will also not be recognized. The corresponding decision was given by the Presidium of the Supreme Arbitration Court in Resolution No. 9131/08 of December 9, 2008.

Recognition of state duty

The fee must be included as an expense on the date the claim is filed. The latter is determined on the basis of the court's note on acceptance of the claim. Some do this on the payment due date, but this is not correct. The duty must be included in non-sales services on the basis of paragraph 1 of Article 265 of the Tax Code of the Russian Federation.

The fee may be returned by court decision. The amount received must be included in the structure of non-operating income on the basis of paragraph 3 of Article 250 of the Tax Code of the Russian Federation. Inclusion is made on the date the decision on the refund of the duty comes into force.

On what date should expenses be taken into account?

Legal costs are considered non-operating, and therefore they will be recognized on these dates on the basis of paragraph 7 of Article 272 of the Tax Code of the Russian Federation:

- Settlement date based on the terms of the agreement.

- The date of presentation to the payer of the papers on the basis of which calculations are made.

- The final date of reporting or tax time.

The company has the right to set its own dates for reflecting expenses on the basis of Letter of the Ministry of Finance No. 03-03-04/2/149 dated May 26, 2006. Typically, this is the date the service agreement is signed. For example, a company entered into an agreement with a lawyer. The date of signing the document will be the date of recognition.

Legal expenses reduce taxable income, regardless of whether they are recovered through the court. What does this mean? If the entity wins the case, the person found guilty must pay all of the winning party's legal costs. However, expense recognition is done regardless of wins or losses.

IMPORTANT! The costs of a third-party lawyer are also taken into account when the organization has a full-time lawyer on staff. However, if the work is carried out by a full-time lawyer, the costs are reflected in the structure of labor costs on the basis of Article 255 of the Tax Code of the Russian Federation. Expenses for your lawyer cannot be recovered from the losing participant in the case.

Documentary confirmation

The largest portion of expenses is legal fees. Related expenses can be verified. The following documents can be used as confirmation:

- Agreement with a specialist.

- Certificate of completed work.

- Payment papers.

The documents must indicate a list of services provided and their cost. It is necessary to record services in such a way that their connection with the proceedings can be traced. It is also recommended to prepare documents for confirmation:

- Power of attorney for a representative.

- Claim.

- Protocol of the proceedings.

- Judgment.

IMPORTANT! The enforcement fee is not taken into account when determining income tax.

Accounting court decision to collect the principal amount

The basis for transferring the amount to account is the order of the manager, or a certified statement by him of the person receiving the money on account. An order must be issued for each issue of an amount for reporting. It must include the full name of the employee, the amount issued for the report, the date of its return and the order number. If the amount is received by an employee upon application, then the manager will certainly put a note on paper about the amount, the period for which it is received, and put a date and signature. Typically, amounts of money are reported for the following types of expenses:

- business trips;

- household security;

- payment for fuel and lubricants.

The employee to whom the funds were issued for accounting is obliged to report for them to the accounting department of the enterprise. This must be done using an advance report, to which documents confirming expenses are attached.

Agreement with a lawyer

There are three types of agreement with a lawyer:

- 1. an agreement on the provision of paid services is concluded for the provision of legal advice or the preparation of legally significant documents;

- 2. an agency agreement is concluded for a lawyer to represent the interests of the company in court;

- 3. a mixed contract contains elements of both a contract for the provision of services for a fee and a contract of agency.

The agreement is drawn up in simple written form, then it must be registered in a lawyer’s office.

The contract states:

- information about counterparties;

- information about the lawyer’s membership in the bar association;

- subject of the contract;

- deadlines;

- the cost of a lawyer;

- procedure for covering lawyer's expenses;

- place of conclusion of the contract;

- date of conclusion of the contract and start date of the contract;

- liability of the parties for violation of obligations.

After execution of the contract, the parties draw up and sign the act. It is drawn up in free form, making sure to indicate the details of the parties.

The act of execution of the contract is attached to the contract with the lawyer. It is the primary document on the basis of which the costs of paying a lawyer are taken into account.

Postings according to the organization’s writ of execution

Content

Home » For a lawyer » Postings on writs of execution Return back to Writ of Execution To account for mandatory deductions on writs of execution to account 76, open the sub-account “Settlements on writs of execution”.

Penalties for delay are assessed on the date of recognition by the debtor or on the day the court decision enters into legal force ().

When deducting amounts under writs of execution from an employee’s salary, make an accounting entry: Debit 70 Credit 76 subaccount “Settlements under writs of execution” - deducted from the employee’s salary under writs of writ. When paying the withheld funds to the claimant from the cash register, make the following entry: Debit 76 subaccount “Settlements under writ of execution” Credit 50 – the amount withheld under the writ of execution was issued to the recipient.

When transferring the withheld funds to the claimant’s bank account, make an entry: Debit 76 subaccount “Settlements under writ of execution” Credit 51 – the amount withheld under the writ of execution is transferred to the recipient. Reflect the commission for the transfer with the following entries: Debit 76 subaccount “Settlements under the writ of execution” Credit 51 – the bank withheld a commission for the transfer of the amount withheld under the writ of execution.

The fee for a bank transfer or postage is paid by the debtor, that is, the employee (Part 3 of Article 98 of Law No. 229-FZ). Therefore, deduct the commission for a bank transfer from the employee’s salary: Debit 70 Credit 76 subaccount “Settlements under writs of execution” - the commission for a bank transfer of the amount under a writ of execution is repaid from the employee’s salary.

If the withheld amount is transferred by mail, make the following entries: Debit 71 Credit 50 - the amount of alimony has been issued for reporting, which must be sent by postal order, and money to pay the postage; Debit 76 subaccount “Settlements under writs of execution” Credit 71 – the amount withheld under the writ of execution was transferred by postal order, the postage was paid. Debit 70 Credit 76 subaccount “Settlements under writs of execution” - the postal fee for transferring the amount under the writ of execution is paid from the employee’s salary.

Write-off from the account by court decision

And therefore they are faced with malicious debtors among them.

When all attempts to resolve this situation have been exhausted, the company's management has no choice but to go to court to collect the debt.

Let's consider a situation where the court made a decision in favor of the creditor and, in addition to the debt, ordered the debtor to return legal costs and imposed a penalty.

Attention The Presidium of the Supreme Arbitration Court of the Russian Federation thinks the same way.

Therefore, if the amount is large, it is worth starting a dispute with the tax office.

If legal proceedings do not attract, then for peace of mind it is better to charge VAT.

Write-off by bailiffs of transactions from the current account

Contents of the article Unauthorized (without the client’s order) debiting funds from an organization’s account is permitted by a court decision, as well as in cases established by law or provided for by an agreement between the bank and the client (Art.

854 Civil Code of the Russian Federation). Direct debiting of funds from the debtor’s account by court decision is regulated by Art. 70 of the Federal Law of October 2, 2007 229-FZ “On Enforcement Proceedings” and Art.

27 of the Federal Law of December 2, 1990 No. 395-1 “On Banks and Banking Activities” and is carried out on the basis of a writ of execution or a bailiff’s order when presented to the bank. Along with the amount of the principal debt, the following can be written off from the organization’s current account:

- other expenses of the plaintiff in court.

- penalty;

- state duty;

Compensation for losses caused by the organization, as well as fines, penalties, penalties for violation of the terms of contracts are other expenses of the organization and are accepted for accounting in amounts awarded by the court or recognized by the organization (clause

11, clause 14.2 PBU 10/99). On the accounting accounts in accordance with the Instructions for using the chart of accounts (approved.

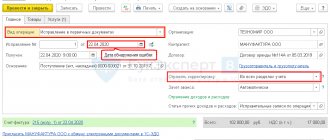

by order of the Ministry of Finance of the Russian Federation dated October 31, 2000 No. 94n), such expenses are reflected by an entry in the debit of account 91.2 “Other expenses” in correspondence with account 76.2 “Settlements on claims”. Direct debiting of funds by the bank is reflected in the credit of account 51 “Current accounts” in correspondence with account 76.2 “Settlements on claims”. For tax accounting purposes, the amount of fines, penalties and other sanctions for violation of contractual obligations recognized by the debtor or payable on the basis of a court decision, as well as the amount of compensation for damage, are recognized as non-operating expenses on the date of recognition by the debtor or the entry into force of the court decision (clause

13 paragraph 1 article 265, paragraphs. 8 clause 7 art.

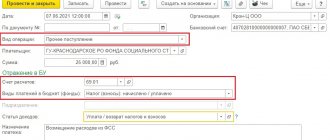

272 of the Tax Code of the Russian Federation). In the 1C: Accounting 8 program, the amounts of penalties and other legal costs presented to the organization are reflected in the “Operation” document. Direct debiting from a current account according to a writ of execution is documented in the document “Writing off from a current account.” in the program "1C: Accounting 8" (ed.

3.0)

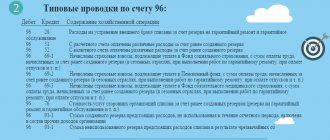

Accounting for payment of fines, penalties, penalties

The court may rule on the organization to pay fines, penalties, and penalties. These payments are classified as non-operating expenses. The amounts of penalties, fines, penalties recognized or awarded by the court, accrued for violation of the terms of business contracts, are reflected in the accounting records by the entry:

Debit 91-2 Credit 76-2

— penalties, fines, and penalties were accrued for violation of the terms of business contracts.

If the amount of the fine, penalty or penalty is quite significant, then the organization can create a reserve for contingent liabilities. In accounting, this operation will look like this:

Debit 91-2 Credit 96

— a reserve has been created for contingent liabilities: the buyer’s requirement to pay penalties for violating the delivery time of goods.

It should be noted that the creation of a financial reserve can be carried out in relation to disputes resolved both in court and out of court.

Example 3 In November 2003, the tax authorities conducted an on-site audit of the organization's activities. As a result, they decided to charge additional income tax in the amount of 100,000 rubles. According to the organization's experts, the amount of tax subject to additional assessment is only 50,000 rubles. At the end of the year, the management of the organization decided to create a reserve for a contingent liability in the amount of 50,000 rubles. As of December 31, 2003, the balance on account 99 (loan) was 150,000 rubles.

The issue of additional assessment of income tax was finally resolved on March 30, 2004. At the same time, the tax amount was 70,000 (20,000) rubles.

In accounting, the transactions performed are reflected as follows.

31th of December:

Debit 99 Credit 96

— 50,000 rub. – a reserve has been created for the probable amount of additional payment of income tax;

Debit 99 Credit 84

— 100,000 rub. (150,000 – 50,000) – net profit from the organization’s economic activities in 2003 was written off.

As of March 30:

option 1 – tax amount is 70,000 rubles:

Debit 96 Credit 68

— 50,000 rub. – the reserve created for additional payment of income tax was used;

Debit 99 Credit 68

— 20,000 rub. – the difference between the estimated and actual amount of additional payment for income tax has been accrued;

Debit 68 Credit 51

— 70,000 rub. – additional payment of income tax is transferred to the budget.

— option 2 – tax amount is 20,000 rubles:

Debit 96 Credit 68

— 20,000 rub. – a partially created reserve for a contingent liability was used;

Debit 68 Credit 51

— 20,000 rub. – additional payment of income tax is transferred to the budget;

Debit 96 Credit 91-1

— 30,000 rub. – the unused part of the reserve for a contingent liability is written off.

End of example 3

In tax accounting, when calculating income tax, legal expenses, if the cases under consideration are related to the production activities of the organization, are included in expenses that reduce the income received: state duty expenses are classified as other expenses (subclause 1, paragraph 1, article 264 of the Tax Code), other legal expenses, as well as arbitration fees, are included in non-operating expenses (subclause 10, clause 1, article 265 of the Tax Code of the Russian Federation). Moreover, they are taken into account regardless of the status of the party in the case (plaintiff or defendant) and regardless of the outcome of the case.

The organization can classify expenses for legal services, including a lawyer, and notary services (in the amount of the established tariffs) as other expenses (subclauses 14 and 16 of clause 1 of Article 264 of the Tax Code of the Russian Federation).

Income in the form of fines, penalties and (or) other sanctions for violation of contractual obligations recognized by the debtor or payable by the debtor on the basis of a court decision that has entered into legal force, as well as amounts of compensation for losses or damages are recognized as non-operating (clause 3 of Article 250 Tax Code of the Russian Federation).

In tax accounting, in the list of possible reserves created, there is no reserve for a contingent liability. Therefore, the amount of this reserve taken into account in accounting will cause the formation of a deductible temporary difference. And this, in turn, will lead to the obligation to accrue a deferred tax asset (clauses 11 and 14 of PBU 18/02 “Accounting for income tax calculations”; approved by order of the Ministry of Finance of Russia dated November 19, 2002 No. 114n).

Example 4 Let's slightly change the condition of example 3. In November 2003, a claim is received from a buyer of products in the amount of 100,000 rubles. The organization’s experts estimated that the buyer would have to transfer 50,000 rubles. A reserve for a contingent liability is created at the end of the year for this amount. In March, the court ordered the organization to transfer 70,000 rubles to the buyer.

In accounting, the transactions performed are reflected as follows.

As of December 31st:

Debit 91-2 Credit 96

— 50,000 rub. – a reserve has been created for the probable amount of the claim;

Debit 09 Credit 68

— 12,000 rub. (RUB 50,000 x 24%) – deferred tax asset accrued.

As of March 31:

Debit 96 Credit 76-2

— 50,000 rub. – the reserve created for the contingent liability was used;

Debit 91-2 Credit 76-2

— 20,000 rub. – the difference between the estimated and actual amount of the claim established by the court is additionally accrued;

Debit 68 Credit 09

— 12,000 rub. – the amount of the deferred tax asset is written off;

Debit 76-2 Credit 51

— 70,000 rub. – the amount of the buyer’s claim, established by the court, is listed.

End of example 4

Tax audits are becoming tougher. Learn to protect yourself in the Clerk's online course - Tax Audits. Defense tactics."

Watch the story about the course from its author Ivan Kuznetsov, a tax expert who previously worked in the Department of Economic Crimes.

Come in, register and learn. Training is completely remote, we issue a certificate.

Postings of the plaintiff and defendant using the example of payment of state duty

During the trial, M.’s organization filed a claim against the actions of IP K. of a non-property nature, the assessment of which cannot be made. The amount of state duty was 6,000 rubles. The amount of expenses reimbursed by the losing party is recognized as part of other income.

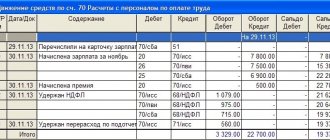

| Operation name | Correspondence from the plaintiff | Correspondence from the defendant | Amount (in rubles) |

| Payment of state duty | Dt 68 Kt 51 (50) | Not produced | 6 000 |

| Reflection of state duty as part of expenses | Dt 91/2 Kt 68 | Not produced | 6 000 |

| Recognition by the court of expenses for payment of state duty | Dt 76/2 Kt 91/1 | Dt 91/2 Kt 76/2 | 6 000 |

| Reimbursement of expenses has been made | Dt 51 Kt 76/2 | Dt 76/2 Kt 51 | 6 000 |

An example of reflecting expenses in the plaintiff’s accounting records

The Contractor enterprise did not receive payment for labor after completing work under a construction contract. The contractual terms set the terms of payments for the construction of the facility. Negotiations on payment for labor did not bring a positive result, which necessitated the need to resolve the issue in court.

When going to court, the company paid: a state fee in the amount of 2,300 rubles, the services of a lawyer in the amount of 5,000 rubles and an expert to confirm the compliance of the object with the terms of the contract in the amount of 7,000 rubles. According to the court's decision, the defendant must pay the plaintiff the cost of the contract and compensate legal expenses.

The following entries are made in the company's accounting: (click to expand)

| Operation | Debit entry | Credit of record | Amount (in rubles) |

| Payment of state duty to the budget has been made | 68 | 51 | 2 300 |

| The state fee for filing an application with the court is included in the costs | 91/2 | 68 | 2 300 |

| Reflected legal costs when making a court decision | 91/2 | 60 | 12 000 |

| The court recognized the costs incurred when considering the issue in court | 76/2 | 91/1 | 12 000 |

| The court recognized the costs of paying the state duty | 76/2 | 91/1 | 2 300 |

| A sum has been received to compensate for expenses | 51 | 76/2 | 14 300 |

The court makes a decision on compensation for expenses based on documents confirming the expenses.

How to correctly reflect in accounting the money that the company has seized from contractors

- You are using an outdated browser version!

- Enter the site

- Legal costs and legal income

- Topic: Reflection of income by court decision

- How to correctly reflect in accounting the money that the company has seized from contractors

- Write-off of accounts receivable and tax accounting

- Debt collection through court - postings

- Collections by court order posting

- Repayment of the counterparty's debt by court order

- Receipt of funds from bailiffs

Debt collection through court posting

The seller issued an invoice, which Brando LLC paid. However, the goods were never shipped.

The company filed a claim in the arbitration court.

— the portion of the advance amount collected by the bailiffs has been received.

In the future, the accountant will make a similar entry as the bailiffs collect the remaining debt from the supplier. Charge VAT on the amount of the penalty only if you have collected the debt from the buyer. So, we have sorted out the income and income tax.

What about VAT? It is clear that this question does not arise in relation to the principal amount of the debt.

Composition of expenses in bankruptcy

https://www.youtube.com/watch?v=ytcreators

The insolvency procedure is carried out under the supervision of the Arbitration Court. The body determines the stage of the procedure and the manager conducting financial control of the operations. Covering expenses is carried out at the expense of the debtor and is not compensated by third parties. Expenses subject to judicial approval include:

- Manager's remuneration.

- Payment for current activities in the form of postal, office, and transportation expenses.

- Amounts required for publication of notifications about the start of the procedure in the Bulletin.

- Funds spent on holding public auctions of the debtor's property.

- Payments for the services of appraisers, auditors, experts and others.