Basic Concepts

Reserves are needed to ensure the reliability of asset valuations. Let's consider the criteria for creating a reserve for valuables:

- The value of valuables has actually decreased. This may be due to the obsolescence of the object, loss of consumer qualities, or a decrease in value by similar values on the market.

- Material assets do not belong to the consolidated accounting groups listed in paragraph 20 of the instructions of the Ministry of Finance. For example, they are not groups of basic or auxiliary materials, finished goods, or segment inventories.

- There are reasons to accurately determine the cost. For example, the cost can be determined on the basis of internal documentation, external information, and company accounting registers.

The procedure for creating a reserve is specified in clause PBU 5/01.

Question: How to reflect in accounting the creation of a reserve for depreciation of inventories due to the loss of materials of their original qualities, as well as their subsequent sale? Materials were purchased at a price of 300,000 rubles. (excluding VAT). At the end of the reporting year, a loss of their original qualities was revealed. Because of this, the materials cannot be used in production. They are supposed to be sold. Net sales value, defined as the price at which similar materials can be purchased, at the end of the reporting year amounted to 200,000 rubles. (excluding VAT). The following year, the materials were sold under a sales contract for RUB 240,000. (including VAT 40,000 rub.). Tax accounting uses the accrual method. View answer

Reservation for a decrease in the price of material assets and the procedure for its formation

The reserve involves the allocation of a certain amount to compensate for damage. Commercial organizations also create valuation reserves for future expenses. Provision for a decrease in value takes place at the end of the reporting year when the conditions for its formation are identified through the analysis of each individual item of inventory:

- MPZs have outlived their usefulness, are outdated - demand for them has decreased due to the emergence of new modern analogues;

- the reserves have completely or partially lost their original quality (determined on the basis of the assessment memos of the relevant specialists);

- There is a decrease in the market price of MPZ by the end of the period.

If there is a partial loss of quality, the reserves cannot be fully used for production or the needs of a commercial structure. However, a reserve for them is formed at a reduced cost, since they can be processed as raw materials or, for example, sold at a reduced price. The accounting must show the estimated selling price of such inventory.

Obviously, the formation of the reserve is due to the prevailing circumstances, which are provided for in clause 25 of the Accounting Regulations “ Accounting for Inventory and Inventory ” 5/01. Moreover, when they occur, the formation of a reserve is mandatory and should not be neglected. The only exceptions are those organizations that have the right to conduct accounting in simplified ways, including simplified accounting reporting. Then they may not apply this clause of the Regulations.

The reservation procedure is regulated by the Methodological Guidelines for Inventory Accounting (clause 20). You can create a reserve in two ways:

- individual (that is, for a single unit);

- group (by separate groups of homogeneous stocks: item number, batch of goods, etc.).

The selected reservation method is fixed in the accounting policy of the commercial structure. The reserve is formed based on the difference between the actual cost of inventories and their current market price. The reserve value is calculated for a single item or for groups of the same type of material assets using the formula: current market value * number of material assets.

Provision for impairment of value

Valuables whose price has decreased must be recorded in the balance sheet at the end of the year. Reflection is carried out at the current market value. In this case, the actual wear and tear of the valuables is taken into account. The basis of the provision must be consistent with the prudence principle. The essence of this principle is that recognition of expenses rather than income is paramount. Hidden reserves cannot be created. The procedure for creating a reserve for reducing the value of valuables:

- Valuable balances are tested for signs of depreciation. These signs can be internal and external. Local signs: unused valuables that have lost their consumer properties, the presence of damage on them. External signs: a decrease in market prices for similar values, technological progress that makes objects irrelevant. Testing is carried out as part of the inventory. It is carried out at the end of the reporting year. If the market value of the property is greater than the actual value, there is no need to create a reserve.

- It is required to establish the market value of the assets, on the basis of which signs of depreciation were detected. When determining the cost, you can use the prices indicated in official sources. It is also possible to use data obtained from independent specialists. For example, these could be experts. The validity of the calculation of market value must be confirmed by documents.

- The current market value is compared with the cost of the assets. Cost refers to the data contained in accounting. If the cost exceeds the market value, a reserve is created for the difference.

- A reserve is being formed. It needs to be created for each value. The formation of reserves for enlarged groups is not allowed. For example, building materials cannot be taken as a unit. However, it is possible to combine units of value if they are homogeneous. For example, you can combine equipment with the same characteristics.

Each of the stages of cost reduction is mandatory.

Determining the current value of assets

Market value is determined based on the following factors:

- Statistical information published by Rosgosstat.

- Information published by the media.

- Methods of analytical calculations.

- Data provided by experts and appraisers.

IMPORTANT! The method for determining market value must be recorded in the accounting policy.

Determining the size of the reserve

The volume of the reserve is established for each item of value. The formula for calculations looks like this:

Book value – current market value * number of values

The current market value refers to the amount that can be obtained from the sale of valuables at the moment.

How to determine the cost of inventories on the market?

First of all, it should be noted that the creation of a reserve is carried out for each unit of the inventory range or, subject to the conditions of typicality and homogeneity of the inventory items in question, for a local group.

The current value of inventories on the market should be understood as the actual amount of money that an enterprise can earn for its inventories if it puts them up for sale at the time of valuation. In addition to the information given above as a basis for analysis regarding reservations for inventories, the following can be used:

- official statistical data (for example, published by Rosgosstat);

- data presented in specialized media (for example, stock market data);

- applicable methods of analytical calculations (for example, unsatisfactory results of the analysis of the turnover of the inventories under consideration);

- expert assessments (for example, a report from an independent appraiser).

The method(s) chosen by the enterprise for determining market value for the formation of reserves must be fixed in the accounting policy for accounting purposes.

For more information about including data in the accounting policy, read: “Drafting a statement on the accounting policy in the organization.”

IMPORTANT! Since the entire procedure for revising the cost of inventories is carried out primarily so that the user of the enterprise’s reporting receives correct information about the state of affairs, when choosing assessment methods, priority should be given to those that are most suitable for the principle of prudence. That is, based on the results of the assessment, the enterprise should be more ready to recognize expenses (form a reserve) than to recognize assets (not to reflect information about inventory write-downs in the report). Thus, assessment information obtained from independent parties is preferable to data from experts directly associated with the enterprise.

Adjustment of reserve for reduction in value

So, the reserve was founded. However, it can be changed if the following circumstances are present:

- Write-off of the reserve. Performed in the event that valuables are written off from the balance sheet due to their direction for production, sale, or transfer free of charge. Write-offs are made to other income.

- Creating an adjustment. Performed if the value of valuables has increased. The difference between actual and market value decreases. The reserve must be reduced.

If at the end of the reporting period the value of objects is reduced, but they are not written off, the reserve is allocated to the next period.

What to check in the annual balance sheet before submitting it to GIR BO: estimated reserves

When preparing annual reporting, a special role is played by the requirement of prudence - this is when in accounting we are ready to recognize expenses and debts rather than income and assets, while the creation of hidden reserves is not encouraged (clause 6 of PBU 1/2008). There should be no hidden reserves in accounting, but real reserves may well be accrued.

With the help of reserves, information about the elements of financial statements (assets, liabilities, capital, income, expenses) is presented objectively and reliably.

Valuation reserves include:

—

reserve for doubtful debts (account 63);

—

reserve for reduction in the value of inventories (account 14);

—

reserve for impairment of financial investments (account 59).

The creation of valuation reserves is regulated by PBU 21/2008 “Changes in estimated values” (Order of the Ministry of Finance of the Russian Federation dated October 6, 2008 No. 106n).

The amount of the reserve is a potential decrease in the value of assets (in relation to market value, in relation to the reality of circumstances (debt repayment, for example), etc.). The balance sheet shows the value of assets less reserves. Reserves are accrued from other expenses of the organization.

Provision for doubtful debts

Debt is considered doubtful if it is not repaid within the prescribed period (for example, the period specified in the contract), is not secured by anything and is unlikely to be returned. In accounting, the category of doubtful includes not only the debt of buyers for goods and services sold, but also other types of debt - for example, for issued loans.

When calculating the reserve, consider several features:

—

if there are doubts about the repayment of the debt, a reserve must be accrued (unless your organization uses simplified accounting methods) (clause 70 of Regulation No. 34n);

—

calculate the reserve for each debt separately;

—

set the criteria for determining the amount of the reserve yourself in the accounting policy (you can apply similar tax rules);

—

there are no restrictions on the amount (except for the amount of debt);

—

reflected in account 63 “Provisions for doubtful debts”.

Deductions to the reserve are reflected as part of other expenses: Dt 91/2 “Other expenses” Kt 63. In the balance sheet, show the item “Accounts receivable” minus the balance on account 63. At the end of the year, be sure to check the reserve for validity - if the reserve remains unused, then its amount is restored and added to the financial results. But according to PBU 21/2008, this reserve can also be transferable if there is reason to expect the counterparty to repay the debt.

Example of accrual and use of reserves:

During the inventory of settlements, Gamma LLC revealed a doubtful debt in the amount of 100,000 rubles, the expected repayment amount is 50,000 rubles. The reserve includes the amount of 50,000 rubles. The debtor repaid 70,000 rubles. The accounting reflects:

Dt 91/2 Kt 63 - 50,000 rub. – a reserve for doubtful debts has been accrued;

Dt 51 Kt 62 - 70,000 rub. – part of the debt has been received;

Dt 63 Kt 62 - 30,000 rubles 0) - the uncollected part of the debt was written off from the reserve;

Dt 63 Kt 91/1 — 20,000 rub. (50,000 - 30,000) - unused reserve is included in other income.

Reserve for reduction in the cost of inventories

Since 2022, FSB 5/2019 has been applied (Order of the Ministry of Finance of Russia dated November 15, 2019 No. 180n). In accordance with FAS 5/2019, a decrease in the value of inventories is their depreciation, calculated as the difference between the actual cost of inventories and the net realizable value of inventories (net realizable value is the possible selling price minus selling expenses).

Inventories depreciate when they lose their usefulness, become obsolete, the market value of similar assets decreases, etc. The creation of a reserve is reflected in the amount of depreciation in account 14. Account 14 is now called “Reserves for impairment of material assets”; perhaps in the future the account will be renamed “Reserves for impairment of inventories”).

The reserve is included in other expenses: Dt 91/2 “Other expenses” Kt 14.

FAS 5/2019 changed the procedure for restoring the reserve for impairment of inventories: previously, the unused reserve was recognized as other income, now the amount of recovery must be attributed to the reduction in the amount of expenses recognized in the same period in connection with the sale of inventories.

Example:

As of the reporting date, the actual cost of inventories of Alpha LLC is 60,000 rubles, their net selling price is 40,000 rubles.

Alpha LLC creates a reserve for impairment of inventories:

Dt 91/2 Kt 14 - 20,000 rub. (60,000 - 40,000). In the balance sheet, inventories will be reflected in the amount of 40,000 rubles. (60,000 - 20,000).

In the next reporting period, these inventories have not yet been sold, and their net realizable value has decreased to RUB 30,000. The reserve for impairment of inventories needs to be increased by RUB 10,000. (40,000 - 30,000): Dt 91/2 Kt 14 - 10,000 rub. In the balance sheet, inventories will be reflected at a valuation of RUB 30,000. (60,000 - 20,000 - 10,000).

Provision for impairment of financial investments

The regulatory basis for calculating the reserve is paragraphs. 19, 21 PBU 19/02 “Accounting for financial investments” (Order of the Ministry of Finance of Russia dated December 10, 2002 No. 126n).

The reserve is created at the end of the year if a sustained significant decrease in the value of investments is identified, for which their current market value is not determined. The reserve is required (except for those who maintain simplified accounting) and is accounted for in account 59 “Reserves for depreciation of financial investments.” Contributions to the reserve - as part of other expenses: Dt 91/2 “Other expenses” Kt 63. If not used, the reserve is restored: Dt 63 Kt 91/1.

Read also:

- What to check in the annual balance sheet before submitting it to GIR BO: estimated liabilities

- What to check in the annual balance sheet before submitting it to the GIR BO: events after the reporting date

reporting submission of reports

Send

Stammer

Tweet

Share

Share

Accounting

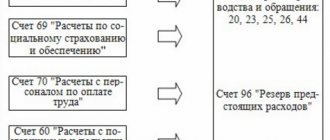

To record information about reserves for depreciation in value, account 14 “Reserve for depreciation of value on assets” is used. The formation of the reserve is recorded in accounting as follows:

- DT91 KT14. A reserve has been created.

- DT14 KT91. Restoring the reserve amount in the process of writing off valuables.

DT14 KT91 – a record that is relevant when the market value increases. It is used at the end of the reporting period if the reserve has not been used.

Examples of accounting entries

When working with reserves to reduce the value of valuables, these following accounting entries are used:

- DT 91 (subaccount “Other expenses”) KT14. A reserve has been formed to reduce the cost.

- DT99 (sub-account “Permanent tax obligations”) KT68. Fixation of tax obligations.

As the products are used, the reserve is restored:

- DT62 KT90. Recognition of revenue from sales of products.

- DT90 (sub-account “VAT”) KT 68 (sub-account “VAT”). VAT on proceeds from the sale of products.

- DT90 KT41. Write-off of the cost of valuables.

- DT14 CT 91 (subaccount “Other income”). Write-off of a previously formed reserve to reduce the value of valuables.

- DT68 KT99 (sub-account “Tax obligations”).

The main account for a decrease in value is active-passive account 14. The formation of a reserve is recorded by credit, and the restoration or increase in value is recorded by debit.

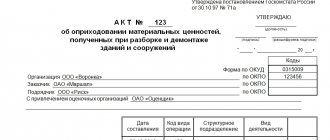

Primary documents

Each accounting entry is based on primary documentation. The supporting documents confirm the indicated amounts and transactions. Let's look at an approximate list of primary items:

- Leader's order.

- Certificate from the accounting department.

- Various payment documents.

If information from primary documents contradicts accounting data, regulatory authorities will have questions.

Examples of transactions and postings on account 14

Example 1. Markdown of goods

Let’s say Prim LLC purchased a group of goods worth 23,000 rubles. At the end of the 3rd quarter of 2016, they were marked down due to loss of presentation to 18,000 rubles. In March 2022, 8 units were sold. for 14,400 rub.

Table of entries for account 14 when marking down goods at Prim LLC:

| Dt | CT | Transaction amount, rub. | Wiring Description | A document base |

| 60 | 41.01 | 23 000 | Goods accepted for accounting | Packing list |

| 91.02 | 14.01 | 5 000 | A reserve for depreciation has been created | Manager's order, Accounting certificate |

| 99 | 68.04.2 | 1 000 | Permanent tax liability | Accounting information |

| 62.01 | 90.01.1 | 14 400 | Revenue from sales of goods is reflected | Packing list |

| 90.03 | 68 VAT | 2 197 | VAT accrual on sales | Invoice |

| 90.02.1 | 41.01 | 18 400 | Write-off of cost reflected | Packing list |

| 14 | 91.02 | 4 000 | Write-off of the reserve amount | Accounting information |

| 68.04.2 | 99 | 800 | Permanent tax asset | Accounting information |

Tax accounting

Chapter 25 of the Tax Code of the Russian Federation does not imply a reduction in taxable profit. That is, a reserve that reduces accounting profit but is not taken into account when creating taxable profit is considered a permanent difference. In the period in which the permanent difference was formed, a tax liability arises. This is a tax that provokes an increase in tax payments. Let's look at transactions related to taxation:

- DT99 (sub-account “Tax obligations”) KT68.

- DT68 KT99 (required to create a subaccount). The posting is used when restoring the reserve.

Both tax and accounting must comply with regulations.