Work book for individual entrepreneurs

Current legislation does not provide for an individual entrepreneur to be recorded in the work book for himself, since he is not an employee (Article 20 of the Labor Code of the Russian Federation). It is needed:

- to pay sick leave. Sick leave pay is calculated depending on the duration of activity. If the experience is 8 years or more, payment is made in the amount of 100% of the average daily earnings. From 5 to 8 years the payment is 80%. Less than 5 years - 60%. As for the individual entrepreneur, his length of service is counted if he made contributions to the Social Insurance Fund for himself;

- when registering pension accruals. The situation is the same as when paying for sick leave. The law allows the work time of an individual entrepreneur to be counted as output, but provided that he has made contributions to the Pension Fund for himself.

The individual entrepreneur will receive maternity benefits if he registers in advance with the Social Insurance Fund - at least one year before issuing a certificate of incapacity for work.

General procedure for filling out the TC

Technically, the answer to the question of how to make an entry in the work book about hiring an individual entrepreneur is exactly the same as in a large state corporation: in strict accordance with the new rules approved by Order of the Ministry of Labor of Russia dated May 19, 2021 No. 320n.

But if you go into details, nuances will emerge - it is important to correctly formulate what to write. Individual entrepreneurs do not have strict requirements for the internal structure, even for the fact of its existence. Sometimes an individual entrepreneur does not have a staffing table, and in this case he will write the name of the position without reference to the structural unit.

According to the law, an individual entrepreneur has the status of an employer. He will not be able to conclude an employment relationship with himself, since there is no other party (employee), and filling out a work book from an individual entrepreneur for himself does not make sense.

By hiring workers, an individual entrepreneur acquires not only rights (within the framework of the Labor Code of the Russian Federation), but also assumes certain obligations that extend far beyond the Labor Code and are limited by the Code of Administrative Offenses of the Russian Federation and the Criminal Code of the Russian Federation. To avoid mistakes and not become victims of fair justice, businessmen need to understand not only how to fill out an individual entrepreneur’s work book and why it is necessary to enter information into personnel records, but also which wording is correct or acceptable, and which should be avoided.

Requirements for filling in the case of hiring employees

How the work book of an individual entrepreneur is filled out when hiring other citizens is stated in the order of the Ministry of Labor No. 320n dated 05/19/2021, which is valid from 09/01/2021. Let's list the basic principles:

- the document does not use abbreviations;

- allowed to print using technology or stamps;

- all records are assigned a sequential number;

- if the TC runs out of pages, an insert is inserted and numbering continues;

- part-time workers do not have to enter information about activities other than their main location. This is done only if the employee himself requests it;

- notes on violations of internal regulations or disciplinary sanctions are not entered on the form.

ConsultantPlus experts examined the procedure for maintaining work records by an individual entrepreneur. Use these instructions for free.

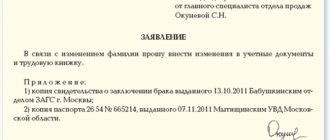

How to make changes to a work book

Naturally, no one is immune from mistakes, especially considering that the labor form is filled out manually.

If an error is detected when filling out a new book (from scratch), corrections are not allowed. The book is simply destroyed, and at the same time an act is drawn up stating that the document is destroyed.

But if an error is discovered during subsequent fillings, then the only way to correct it is to go to court. This is done so that a decision is made that the book belongs to this particular person. This is done when there are inaccuracies in the recording of the employee’s full name or other personal data. Based on this resolution, the following entry in the book is created.

How to make notes for an employee of an individual entrepreneur

According to the law, within 5 days after being hired, an individual entrepreneur is required to make a mark on the Labor Code form of a new employee (Article 66 of the Labor Code of the Russian Federation). If the employee has not worked anywhere before, the entrepreneur will issue an electronic work record book for the employee in 2022. The requirements for how to fill out an individual entrepreneur’s work book for an employee who already has a paper work record are determined by Order of the Ministry of Labor No. 320n dated May 19, 2021.

From 01/01/2021, for all new employees, when they are first hired, an electronic Labor Code is created, and a paper form is not issued. If a person already has it and has not switched to ETC, the entrepreneur-employer fills out the data according to the instructions.

The rules for filling out the Labor Code are the same for all employers:

- The full name of the individual entrepreneur is indicated on the job details page.

- The position of an employee is entered.

- The date of admission and details of the order on the basis of which the admission, transfer or dismissal was made are entered.

- An entry in the work book about dismissal at will or for another reason must contain a link to an article of the Labor Code of the Russian Federation.

Title page

Consists of basic information about the employee:

- FULL NAME. employee. Entered in accordance with the passport data;

- Date of Birth. Only Arabic numerals are entered;

- level of education (secondary, secondary specialized, higher) and specialization. Information is entered as indicated in the diploma;

- date of completion, signature and seal of the employer, signature of the employee.

Recruitment

When registering a new employee, it is necessary to fill out an individual entrepreneur’s work book indicating the information:

- full name of the company. Below in parentheses is an abbreviation;

- serial number of the record;

- employment date;

- information about place and position;

- number and date of the employment order.

This is what an employment record looks like for an individual entrepreneur employee:

Dismissal for various reasons

To make the correct mark, you need to take into account the rules of how an individual entrepreneur records the dismissal of an employee for various reasons in the work book, and what information is indicated:

- serial number;

- date of dismissal;

- information about the article of the Labor Code of the Russian Federation on the basis of which the contract was terminated;

- details of the dismissal document (number and date);

- signature of the person responsible for maintaining the forms, seal of the organization.

Please note that the entry in the work book about the termination of an individual entrepreneur is made as a dismissal, and not as a liquidation of the organization, according to clause 1 of part 1 of Article 81 of the Labor Code of the Russian Federation, but the decision to terminate the activity is indicated as the reason.

This is what the entry looks like in case of transfer or dismissal of an employee by an individual entrepreneur:

Awards

Information about awards is recorded on specially designated pages of the work book. Information about the award that the employee has received is entered there. This is a certificate, diploma, gratitude and other type of award. Entries have their own serial numbering.

This is how the individual entrepreneur records information in the event of awarding an employee:

Features of filling out a work book in different situations

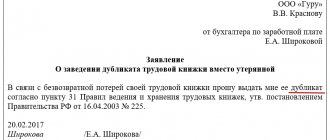

When a duplicate is filled

A duplicate copy of the book is filled out when the document is either lost or has become unusable. Another option is when one of the records is considered invalid. This may be data on enrollment, dismissal, reinstatement, etc.

If you are preparing a duplicate work book, you need to make a note about this on the title page. It is placed in the upper right corner.

If the primary document is nevertheless found, an entry is also made in it. It will read: “A duplicate has been issued in return.” The series with the number of the second book is also recorded.

Also included in the duplicate book is the employee’s continuous length of service to a specific organization in the overall calculation - meaning the total number of years, months and days. But again, documents are required. However, there is no requirement to identify firms or periods of employment in their positions.

The next step in this chapter is to record information about the incentives that were displayed in the first book for past employment.

After all this, a gradation of the total length of service is made for specific periods with the names of the companies in whose positions the employee was listed.

Copy of work book

As a standard, they photocopy those pages of the work book where the information is located. The quality of the copies taken must be acceptable - do not change the scale and it is better not to print the scan.

Certification of copies remains with personnel officers.

In addition to the above, on the copy itself you need to put the serial number of the page, the inscription “currently working”, the date of certification and the name of the employee who carried out the certification.

At the bottom of the page of the copy there is a signature “the copy is correct” and the name of the certifier with a personal signature. Similar notes should be on each copied page.

As for the “employees”, their status as an employer obliges them to issue a stamp for themselves. And as we know, printing for individual entrepreneurs is mandatory only in some cases. Filling out a work book is just one of these.

What do drivers need to provide in order to obtain a work book?

- Passport

- SNILS

- Past work history.

- Military.

- Driver's license.

- Documents confirming education.

In addition to the above documents, you will need to have a medical examination certificate in hand. It is required so that medical contraindications to work can be identified. But such records are not made in labor records. Everything about the filling processes is done the same way.

Can individual entrepreneurs fill out a work report for themselves?

Although the law establishes the obligation of an individual entrepreneur to maintain the work records of his employees, the entrepreneur himself should not make an entry in his work record that he is working in his enterprise.

The employment relationship between the employee and the employer begins after the conclusion of the employment contract, but in this case, both parties to the contract would be one person, which cannot be. An entry into the employment record must be confirmed by an employment contract and a corresponding order, and since no contract has been concluded, an entry cannot be made.

An individual entrepreneur is registered to conduct business, and not for the purpose of carrying out labor activities, therefore the owner of the individual entrepreneur does not have to keep a work book. At the same time, the entrepreneur’s work experience will not be taken into account, but it is important for assigning a pension. But there is no need to be upset about this, since the law regulates this issue.

If a person works for himself, then when calculating his pension, not his work experience, but his entrepreneurial experience will be taken into account. Entrepreneurial activity is confirmed by documents confirming the registration of an individual entrepreneur with the tax authority.

True, the old-age labor pension is assigned only to insured persons working for themselves. So, after registering an individual entrepreneur, you need to report this to the Pension Fund and subsequently pay insurance premiums.

What to write in the labor report if an employee is transferred

As the main personnel document regulating the relationship between employer and employees states, in cases where an employee is transferred from one place of work to another, the basis for the transfer plays an important role. A transferred person can be:

- of one's own free will;

- by order of management, but only with consent.

The specialist at the former place of work must indicate one of these two points, while the personnel officer from the new job no longer needs to write about the reasons for the transfer. It is enough to confine yourself to a brief note that the employee was hired for such and such a position as a transfer.

Important! When making any records of dismissal in work books, you must strictly follow the letter of the law and avoid mistakes. Quite often, HR department specialists, when recording information about dismissal, refer to Article 80 of the Russian Labor Code. But you need to remember that this article does not serve as a basis for dismissal. It only regulates the termination of a previously concluded employment contract between the organization and the employee. If a personnel specialist from a new job discovers this error in an employee’s work record, he will ask the person who made it to correct it. Thus, a small mistake can lead to unnecessary troubles and worries.

How to save an employee’s work record?

Storage of the work book

The work book must be kept by the employer during the entire employment of the employee. After dismissal, she is given into his arms. As practice shows, former employees are not always able or willing to take back the document. For example, if the settlement is not paid, then you are simply too lazy to go get the book. Or the employee died and there is no one to do it.

You should never rush to throw away documents, because they are extremely important. According to the law, books must be stored for at least 2 years, and then they are transferred to the archive and stored there for 50 years.

How to apply for a work permit for an employee if this is his first work experience?

So, imagine that you hired an employee to help you. But, as we know, and in accordance with the legislation of our country, he cannot work for you unofficially. That is why the fact of the existence of an employment relationship between you must be documented.

But what to do if an employee decides to get an official job for the first time . In this case, you need to correctly draw up the employee’s first employment document. Where to start if you yourself are a young individual entrepreneur who has never encountered anything like this?

First, you need to worry about purchasing a work book. You can purchase it at any print store. But here the entrepreneur is faced with the question of who exactly should be involved in purchasing the document. Since Article 16 of the Labor Code states that it is the employer who hires the employee and is the drawer of his labor document.

This means that it is the employer who purchases the work book for his employee . Also, the employer cannot shift this responsibility to a subordinate. The only thing an individual entrepreneur can do is, with the employee’s consent, to withhold half of the labor cost from the employee’s salary.

If the work report is created for the first time, then it is the employer who is responsible for filling out the work report. Therefore, an entrepreneur needs to take this process very seriously. For more information about registration when applying for a job, see the article at the link.

Filling out a work book by an individual entrepreneur - sample:

Calculation of sick leave and other benefits

To calculate benefits for illness, pregnancy and childbirth, the total length of service of an individual entrepreneur does not necessarily need to be confirmed by an entry in the employment record. In accordance with the requirements set out in the Order of the Ministry of Labor and Social Protection of the Russian Federation dated 09.09.2020 No. 585n “On approval of the rules for calculating and confirming insurance experience to determine the amount of benefits for temporary disability, pregnancy and childbirth,” periods of individual work activity are confirmed either certificates from financial authorities or archival institutions about the payment of social insurance payments (if we are talking about the period before 01/01/1991), or a document from the territorial body of the Social Insurance Fund of the Russian Federation about the payment of social insurance payments (for the period from 01/01/1991 to 12/31/2000, and for the period after 01/01/2003). Confirmed length of service is entered into the employee’s personal card (form T-2).

IMPORTANT!

From 09/01/2021, with the introduction of new rules for maintaining work books, filling out a personal card has become optional for both individual entrepreneurs and legal entities.

Filling procedure

Personnel workers are often interested in how an individual entrepreneur can make entries in a work book. Information in the books of employees with whom the individual entrepreneur has entered into contracts is entered according to general rules.

The name of the employer is written in full, for example: “Individual entrepreneur Ivanov Viktor Vasilyevich.”

Here is a sample entry in the employment record for employment with an individual entrepreneur as an example:

A sample record when dismissing an employee looks like this:

Or like this:

As you can see, the wording is different, but they both comply with the current legislation.

IMPORTANT!

The new rules have officially allowed the use of imprints for entries in the Labor Code, so we recommend making your work easier and ordering a template for filling out an individual entrepreneur’s work book in the form of a stamp.

An employee has the right to refuse to maintain a paper TC at all and choose to provide data electronically. In this case, there is no need to fill out a work book for him; the information is generated on the basis of SZV-TD reports.

IMPORTANT!

It is necessary to report on all personnel activities to the employer (including individual entrepreneurs) using the SZV-TD form, regardless of the form of labor management chosen by the employees.