Budget classification code (BCC) 3-NDFL is a mandatory item when filing a declaration. When the codes in the document are written incorrectly, the funds will be sent to the wrong place, and a fine will be imposed on the company. Therefore, it is very important not only to carefully check the entered figures, but also to monitor changes in the laws on BCC before the onset of the next tax period, which happen quite often. In this article we will look at the budget classification code 3-NDFL

Why is budget classification needed?

Main purposes of budget classification:

- Assisting the government in planning and managing financial flows;

- Tracking revenues and expenses, ensuring visibility of data on sources of income;

- Ability to compare data from different budgets;

- Grouping of funds according to their intended use;

- Detection of inappropriate expenses;

- Easier control over the finances of the organization as a whole.

Budget classification code 3-NDFL: who needs to apply for 3-NDFL

Declaration 3-NDFL is submitted to the Federal Tax Service for the purpose of:

- familiarization with the income of individuals;

- personal income tax transfers to the budget;

- registration of tax deductions.

Let us remind you that 3-NDFL (and an application for a tax deduction, if necessary) is submitted to the Federal Tax Service no later than 30.04 of the year following the reporting year.

Submitting 3-NDFL upon receipt of funds:

- from sold property (tenure period - up to 3 years), real estate (tenure period - up to 5 years, if acquired no earlier than 2016) (in other cases, sales tax is not charged);

- from the main occupation of the individual entrepreneur;

- from notarial and advocacy activities (private practice);

- from the sale of a share in the authorized capital of a third-party company;

- from alienation of securities;

- from any types of winnings;

- from the introduction of intellectual works passed down by inheritance;

- from the acquired benefit when signing a gift agreement.

Submission of 3-NDFL by special categories of citizens:

- state employees whose positions or names were included in a special register by decree of the President of Russia;

- family members of government employees;

- employees of the Ministry of Internal Affairs.

Submitting 3-NDFL with an application for a tax deduction:

- from the acquisition of real estate (total value up to 2 million rubles);

- from payment for education;

- from purchasing medicines and paying for medical procedures;

- from donations;

- from contributions to the accumulated part of the pension.

How to apply for 3-NDFL

When filling out 3-NDFL for 2022, you need to keep in mind that it is drawn up according to the new form from the order of the Federal Tax Service of August 28, 2020 N ED-7-11 / [email protected] The declaration can be completed independently on paper.

The form can be downloaded here.

It is also possible to fill out the declaration online from the taxpayer’s personal account on the Federal Tax Service website. To do this, you first need to obtain a login and access password from the tax office upon presentation of your passport. When filling out in the LC, the declaration can be sent electronically, certified by the taxpayer’s electronic signature, which can be obtained there. You can attach supporting documents to the declaration (also in electronic form).

The declaration is submitted to the inspectorate at the place of registration of the taxpayer. 3-NDFL must be filled out according to the current recommendations of the Federal Tax Service of Russia. These recommendations are contained in the same document that approved the 3-NDFL declaration form.

We described in detail all the methods for submitting a report in the article “How to submit a 3-NDFL declaration.”

Find out how to fill out the 3-NDFL declaration to receive a property deduction for the costs of purchasing an apartment and for interest on a mortgage loan in ConsultantPlus. Study the material by getting trial access to the K+ system for free.

How to find out KBK tax

Option I: via online service. To facilitate filling out documents, the tax service has developed a specialized resource. It can be found by going to: service.nalog.ru Here you can not only find the necessary codes (IFTS, OKTMO, KBK), but also fill out tax receipts.

Without knowing the address of your Federal Tax Service, you can start entering the address, and the code will appear in the document on its own. Next, you determine what type of tax and payment you need; after entering this data, the KBK code will appear automatically.

Option II: through the tax website. Copy and enter in the browser into the search window: nalog.ru/rn01/taxation/kbk/fl/ndfl

The same page will open when you go to the “Personal Income Tax” section. Here you will find KBK codes and you can choose the one that interests you.

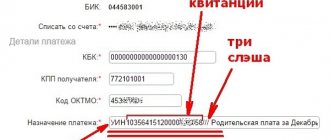

Where to indicate KBK

Let's take a closer look at where the BCC indication is necessary.

| Money orders | Tax returns |

| There should be only one code indicated. For cases when you need to make a payment using more than one code, two or more payment documents are filled out. You can transfer funds to pay: – tax, – collection, - fine, – fine. In the approved payment order form, field 104 is allocated for BCC. | Declarations: – profit tax; – VAT; – transport tax; - fear. deductions. The KBK here is intended to help the tax authorities see the debts for payment of the above fees and pay them off immediately after the money arrives in the budget. |

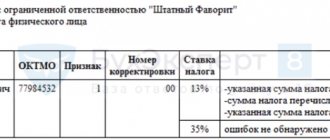

KBK in 3-NDFL for individuals

Let's take a closer look at the BCC in 3-NDFL.

| Russian citizens | foreign citizens who have issued a patent (advance payments) | |

| Personal income tax, recalculations, arrears, debts, canceled payments | 18210102030011000110 | 18210102040011000110 |

| penalties for personal income tax debts | 18210102030012100110 | 18210102040012100110 |

| % of personal income tax payment | 18210102030012200110 | 18210102040012200110 |

| personal income tax fines | 18210102030013000110 | 18210102040013000110 |

KBK in 3-NDFL for legal entities

Let's take a closer look at the BCC in 3-NDFL for legal entities.

| Income tax | Paying tax | Penalties and % | Fines |

| in fed. budget | 18210101011011000110 | 18210101011012000110 | 18210101011013000110 |

| to the subject's budget | 182101010121000110 | 18210101012022000110 | 18210101012023000110 |

| within the framework of production sharing agreements (without determining special tax rates), signed before the adoption of the Federal Law on such agreements | 18210101020011000110 | 18210101020012000110 | 18210101020013000110 |

| from enterprises that have income from foreign companies (there is no representative office in the Russian Federation). Except for: dividends, % on shares. | 18210101030011000110 | 18210101030012000110 | 18210101030013000110 |

| for Russia companies with dividends from domestic enterprises | 1821010104001100110 | 18210101040012000110 | 18210101040013000110 |

| for foreign companies from dividends of domestic enterprises | 18210101050011000110 | 18210101050012000110 | 18210101050013000110 |

| for Russia companies from dividends of foreign enterprises | 18210101060011000110 | 18210101060012000110 | 18210101060013000110 |

| % on shares | 18210101070011000110 | 18210101070012000110 | 18210101070013000110 |

When to pay personal income tax in 2022: deadlines

Salary

As a general rule, personal income tax must be paid in 2022 no later than the day following the day the employee (individual) was paid income (clause 6 of Article 226 of the Tax Code of the Russian Federation).

EXAMPLE

The employer paid the salary for January 2022 on February 7, 2020. This means that the date of receipt of income is January 31, 2022, and the tax withholding date is February 7, 2022. The date no later than which you need to pay personal income tax to the budget is February 10, 2022 (since 02/08 and 02/09/2020 are Saturday and Sunday).

Sometimes an employer has to pay income (salaries) to persons who do not have the status of a tax resident of the Russian Federation. Which BCC to indicate in the payment order for the payment of personal income tax in this case, read in ConsultantPlus:

In the payment order for the payment of personal income tax from the salaries of non-residents, from dividends paid to non-residents, the organization should indicate the KBK - ... (see full answer).

Benefits and vacation pay

Personal income tax withheld from temporary disability benefits, benefits for caring for a sick child, as well as from vacation pay, must be transferred no later than the last day of the month in which the income was paid (paragraph 2, paragraph 6, article 226 of the Tax Code of the Russian Federation).

EXAMPLE

The employee goes on vacation from August 7 to August 24, 2022. His vacation pay was paid on August 3. In this case, the date of receipt of income and the date of withholding personal income tax is August 3, and the last date when personal income tax must be transferred to the budget is August 31, 2022.

Withheld personal income tax in 2022 is generally paid according to the details of the Federal Tax Service with which the organization is registered (paragraph 1, clause 7, article 226 of the Tax Code of the Russian Federation).

Individual entrepreneurs, in turn, pay personal income tax to the inspectorate at their place of residence . However, individual entrepreneurs conducting business on UTII or the patent taxation system transfer tax to the inspectorate at the place of registration in connection with the conduct of such activities.

After the personal income tax transferred by tax agents enters the budget, these funds are distributed between the budget of the constituent entity of the Russian Federation and the budgets of municipalities (settlements, municipal districts, urban districts) - according to the standards established by budget legislation.

KEEP IN MIND

Federal Law No. 172-FZ of June 8, 2020 exempted from paying personal income tax for the 2nd quarter of 2022 individual entrepreneurs, notaries, lawyers, and other private practice specialists affected by the coronavirus. This is an advance payment for the first half of 2022 minus the advance for 1 quarter. 2022. For more information, see “To whom and what taxes will be written off for the 2nd quarter of 2022: list.”

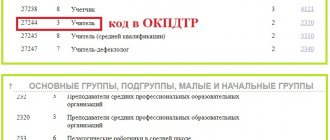

KBK in 3-NDFL for individual entrepreneurs

Entrepreneurs who transfer personal income tax for themselves (not to be confused with personal income tax withheld from employees’ salaries) use the KBK:

18210102022011000110

BCC for entrepreneurs, depending on the chosen taxation system:

| simplified tax system | UTII | Unified agricultural tax | Minimum tax | ||

| “Income” | “Income minus expenses” | ||||

| Paying tax | 18210501011011000110 | 18210501021011000110 | 18210502010021000110 | 18210503010011000110 | 18210501050011000110 |

| Penalties and % | 18210501011012000110 | 18210501021012000110 | 18210502010022000110 | 18210503010012000110 | 18210501050012000110 |

| Fines | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 | 182 1 0500 110 |

| Payment of tax for reporting periods up to January 1, 2011. | 18210501012011000110 | 18210501022011000110 | 18210502022021000110 | 18210503020011000110 | 18210501030011000110 |

| Penalties and interest for reporting periods up to January 1, 2011. | 18210501012012000110 | 18210501022012000110 | 18210502022022000110 | 18210503020012000110 | 18210501030012000110 |

| Fines for reporting periods up to January 1, 2011. | 18210501012013000110 | 18210501022013000110 | 18210502022023000110 | 18210503020013000110 | 18210501030013000110 |

Let's take a closer look at PSN:

| PSN | ||

| To budget | To the budget of the municipal district | |

| Paying tax | 18210504010021000110 | 18210504020021000110 |

| Penalties and % | 18210504010022000110 | 18210504020022000110 |

| Fines | 18210504010023000110 | 18210504020023000110 |

Application forms for a refund of 13% personal income tax and tax overpayments

In the KBK for personal income tax, code 182 1 0100 110:

- 3 numbers at the beginning (182) reflect the fact of payment of funds to the account of the tax structure;

- Next, let's look at the signs:

“1” Indicates that it belongs to tax payments “01” Indicates a subgroup of payments - taxes on profits “02”, “030” Item and sub-item of profit “01” The transfer is made to the federal level budget

- “1000” (program code) – funds are used to pay taxes, and not to pay off penalties or fines;

- “110” - classification of income of an economic nature - tax income.

KBK is selected from the directory depending on the purpose for which the declaration is filled out: Operation KBK Budget classification code 3-NDFL for returns from the budget for education, treatment, purchase of housing, etc.

Common mistakes

Error : The payment order contains an incorrect KBK.

Comment : To help the Federal Tax Service quickly determine where the error occurred, you need to send an application asking to clarify the payment, attaching a payment slip with a bank mark. Having examined the document, inspectors will take into account the incorrectly transferred money when repaying the shortfall.

Error : The document contains an outdated BCC.

Comment : Changes to the KBK system are constantly being made in order to optimize transactions carried out between the tax office and citizens of the Russian Federation. The Tax Office recommends checking before the start of each tax period to see if there have been any changes. This will help avoid errors with outdated codes.

Error : The individual entrepreneur indicates the BCC related to the taxation of the enterprise employee.

Comment : There is a separate code for personal income tax transferred from the income of individual entrepreneurs. For taxation of employees, the BCC for personal income tax on employee salaries is used. Even if they work for an entrepreneur, this does not matter here.

Results

The budget classification code is one of the details indicated in the 3-NDFL declaration. When paying tax in accordance with the declaration, the same BCC is indicated. The KBK error in the declaration is corrected by submitting a clarification, and the KBK error in the payment order is corrected by submitting an application for clarification of the payment.

Sources:

- Tax Code of the Russian Federation

- Order of the Federal Tax Service dated October 15, 2021 No. ED-7-11/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.