The average earnings calculator is a tool that calculates employee income indicators for sick leave, benefits and reporting.

For free calculations, use the materials and instructions from ConsultantPlus:

- Ready-made solution: how to calculate average earnings.

- Ready-made solution: how to calculate benefits.

- Expert consultation: how to calculate the average salary for the court.

- Average salary in Russia.

How does the average earnings calculator work?

Step 1. Select the date for which you want to make a calculation. The calculation of average monthly earnings in the online calculator is carried out by month, but there are formulas that allow you to calculate the amount in a few days.

Step 2. For each month, enter the data in the fields (if in the month the employee did not go to work on holidays and did not have non-working days, simply leave the fields blank).

Step 3. Fill in all 12 months with data and at the end click the “Calculate” button.

General provisions on average earnings

Key concepts about average daily earnings are enshrined in Government Decree No. 922 of December 24, 2007 (as amended on December 10, 2016). Payment based on average earnings is used when calculating all types of payments arising within the framework of labor relations. These include:

- payment for the period of the next labor leave;

- amounts for the period of additional, educational, vacations;

- salary for the period of business travel;

- vacation compensation upon dismissal;

- payment for periods of downtime due to the fault of the employer;

- other types of accruals calculated based on average earnings.

The calculation of average daily earnings within the framework of an employment relationship is calculated for the 12 calendar months preceding the month in which the incident occurred. For example, an employee goes on vacation in April 2022, therefore, the calculation should include the period from 04/01/2019 to 03/31/2020.

Periods covered:

- days of illness (injury, maternity leave, illness of children and relatives);

- vacation days (paid and unpaid);

- days of downtime, regardless of the reasons;

- days of care for a disabled child;

- days of stay on a business trip;

- other days during which the employee retains the average daily salary in full or in part -

are not taken into account. It is not always possible to calculate average earnings using an online calculator. Accountants mainly do this with the help of special formulas and recommendations.

How is the annual bonus calculated?

The annual bonus is also included in the calculation, but there are special conditions for its accounting:

- it must relate to the year preceding the year of the event with which the calculation of average earnings is associated, i.e. if vacation pay is calculated in 2022, then the annual bonus for 2019 is taken into account;

- taking it into account is not linked to the actual time of accrual of this bonus, i.e. if at the time of calculating vacation pay the annual bonus has not yet been accrued and therefore cannot be taken into account in income, then after accrual of this bonus the average earnings will have to be recalculated and additional vacation pay will be paid to the employee (letter Rostruda dated 05/03/2007 No. 1253-6-1).

The options for taking the annual bonus into account are as follows:

- it is accepted in full if:

- the entire calculation period has been worked out (letter of Rostrud dated February 13, 2007 No. 317-6-1), while the fact of accounting (non-accounting) of time worked does not play a role when calculating bonuses;

- the calculation period has not been fully worked out, but the period for calculating the bonus absolutely corresponds to the calculation period and the bonus was accrued taking into account the actual time worked;

- absolutely corresponds to the calculated one, but the bonus was awarded without taking into account the actual time worked;

- does not correspond to the calculated one (letter of the Ministry of Health and Social Development of the Russian Federation dated 03/05/2008 No. 535-17), while the fact of accounting (non-accounting) of time worked does not play a role when calculating the bonus.

K+ experts have prepared an example of taking into account the annual bonus when calculating vacation pay. Get free trial access to the system and proceed to recommendations.

We talk about calculating the annual bonus in more detail in the article “How to calculate and account for the annual bonus?” .

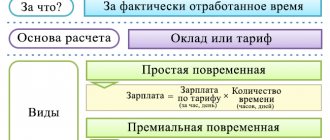

Calculation basis

Please note that not all types of accruals are taken into account when calculating the average. You cannot include social payments, all types of financial assistance, certain categories of compensation in favor of the employee (compensation for the cost of food, travel, rest, vouchers, travel to vacation spots, travel expenses, etc.).

In the base for calculating the average salary, include all types of accruals that are provided for by the regulations on remuneration in the organization. For example, include:

- official salary;

- incentive bonuses;

- bonuses;

- additional payments for overtime, night work;

- payments for combining positions;

- territorial and district allowances;

- other types of payments within the framework of remuneration for labor provided for by the current system of remuneration.

How is the average salary calculated? To do this, you need to divide the calculation base by the number of days in the calculation period. It is worth noting that, for example, for vacation pay the procedure is somewhat different from the generally established one.

General calculation formula:

If you need to calculate average earnings, an online calculator will help you do this easily.

Calculation of average salary upon promotion

The procedure for calculating average wages when increasing salaries provides for some features. If the increase occurred during the billing period or after its end, but earlier than the period when the employee was absent from work while maintaining average earnings, then some types of payments included in the average salary are indexed using increasing factors. The list of such payments is limited. Next, we will consider the procedure for applying the coefficients.

Payments subject to indexation:

- payment according to salary and tariff rates, remuneration in cash;

- fixed amounts applied to tariff rates, salaries and bonuses.

Payments that are not indexed:

- payments, the amount of which is tied to a certain range of values, set to tariff rates, salaries, and remunerations in cash;

- payments in absolute terms to tariff rates, salaries, remunerations in cash;

- non-monetary rewards.

Vacation: calculation features

When calculating vacation, the base and period are determined in a similar manner. The structure of payments included in the calculation is the same: we include remuneration for work provided for by the remuneration system, but exclude social payments and certain types of compensation. Average daily earnings when calculating compensation upon dismissal are calculated in the same way.

The time period for calculation is determined according to special rules. For each fully worked month falling within the billing period, we take into account the average number of days - 29.3. This is a similar average of days for calculating vacation pay ((365 days a year - 14 holidays) / 12 months).

If the month is not fully worked out, then use the formula:

Example.

In April, the employee was on a business trip from the 1st to the 10th. He worked the rest of the days completely. The base for calculating vacation is 1,000,000 rubles.

Let's do the calculation:

1. 29.3 / 30 days. in April × (30 days - 10 days business trip) = 19.5 days. for a month not fully worked.

2. Then the number of days for each month out of 12 calendar months are summed up.

3. 19.5 days. (for a month not fully worked) + 29.3 × 11 months. (for the rest of the time) = 341.8 days.

4. Average daily earnings - 1,000,000 / 341.8 = 2925.69 rubles.

To determine the amount of vacation pay, you must multiply the resulting average daily earnings by the number of vacation days, excluding holidays.

Please note how to calculate the average daily earnings upon dismissal to compensate for unused vacation. It is calculated in a similar manner.

What bonus rules are important for calculating holiday pay?

So, according to the rules stated above, the bonus should be taken into account when calculating vacation pay if it:

- taken into account in the wage system;

- named in the employer’s internal regulations reflecting the bonus procedure;

- accrued in the calculation period or must be taken into account (annual premium) in this period;

- cannot be regarded as a duplicate payment of the same frequency for a similar bonus indicator in the same period;

- recalculated in proportion to the share of time actually worked during the calculation period, if such recalculation is necessary in relation to it.

Of the duplicate payments, the current rules do not prevent the choice of the largest one. The rules for such a choice should be reflected in the internal regulations on bonuses.

The possibility of accepting bonuses in the calculation of average earnings in full or in part depends on three circumstances:

- whether the calculation period has been fully worked out;

- whether the entire period for calculating the premium is included in the calculation period;

- bonuses were calculated in proportion to the share of time worked or without taking this ratio into account.

Average earnings for a business trip

How to calculate the average monthly income for 12 months while on a business trip? First, determine the base for accrual and determine the billing period.

Include similar categories of payments in the database, but exclude material assistance, benefits, compensation for travel, accommodation, recreation, and food. Take into account the amounts that were accrued over the previous 12 months.

Include only the time actually worked in the pay period. Exclude days of illness, other business trips, vacations, downtime and other unworked time from the calculation.

Having determined these indicators, divide the base by the number of days worked. The resulting average daily earnings must be multiplied by the number of days spent on a business trip.

Please note that the duration of a business trip includes days spent on the road (to the place of business and back), days of downtime or delays. For weekends and holidays on which the employee did not work while on a business trip, average earnings are not accrued.

Basic calculation rules

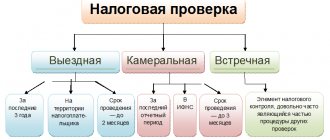

Average earnings from September 25, 2021 are calculated by the employment service authorities on the basis of information on payments and other remunerations at the last place of work (service), for which insurance contributions for compulsory pension insurance were accrued, in the following order:

- it is taken for the 3 months preceding the calendar quarter before the month of filing an application for the provision of a public service to assist citizens in finding a suitable job (exception - the average earnings of a person dismissed during the 12 months preceding the month of filing the application from military conscription service due to its expiration term; it is calculated for 3 months preceding the calendar quarter before the month of conscription for military service);

- average earnings are obtained by dividing the amount of a person’s income for which insurance premiums for compulsory health insurance were calculated for the billing period by the number of months in this period.

| SITUATION | SOLUTION |

| In any of the months the citizen had no income for which contributions to compulsory pension insurance were calculated | When calculating average earnings, this month (months) is excluded from the calculation period |

| During the entire period falling within the 3-month period preceding the calendar quarter before the month of filing the application, the citizen had no income for which contributions to compulsory pension insurance were calculated | Average earnings are determined for the previous period, equal to the estimated |

If the employee did not have an actual accrued salary or days worked during the billing period and before it, the average earnings are determined by the actually accrued salary for the days actually worked by him in the month of dismissal .

Sickness benefits

To calculate benefits for illness or work injury, you must act in accordance with the provisions of Federal Law No. 255-FZ of December 29, 2006. This standard differs significantly from the rules established by Resolution No. 922. Let's look at the differences.

What is included in calculating the average salary for benefits? To calculate the benefit, you will need to determine all the same calculation indicators: the calculation base and the calculation period. These indicators are calculated in a special way.

The calculation base includes all types of remuneration for labor from which insurance premiums for temporary disability and maternity (VNiM) were calculated and paid. This includes official salary, bonuses, territorial additional payments, compensation bonuses and other types of payments assigned as part of the labor relationship with the employee. The calculator for calculating average earnings for unemployment benefits works similarly.

The base is strictly limited; it must not exceed the established limit on VNiM insurance premiums for the corresponding calendar years. Current limits:

- 2016 - 718,000 rubles;

- 2017 - 755,000 rubles;

- 2018 - 815,000 rubles;

- 2020 — 865,000 rub.

The calculation period for benefits is equal to two calendar years preceding the year in which the insured event occurred (illness, maternity leave, injury). For example, if a certificate of incapacity for work was issued in 2020, then the years 2022 and 2022 will be included in the calculation.

From the calculation period, exclude all days for which the employee was not accrued remuneration for work. For example, unpaid leave, maternity or child care leave, duration of illness, injury or caring for a sick relative.

For fully worked two years, the billing period will be 730 days. If it is a leap year, the period increases to 731 days.

An example of how to calculate the average daily earnings for sick leave.

Morkovkin issued a sick leave certificate from February 11 to February 20, 2020. For previous years his salary was:

- in 2022 - 595,500 rubles, which does not exceed 755,000 rubles. — the maximum base for contributions to VNiM in 2022;

- in 2022 - 850,000 rubles, which exceeds 815,000 rubles. — the maximum base for contributions to VNiM in 2022, therefore, the calculation includes an amount equal to the established limit for VNiM SV.

The base for calculating sick leave is RUB 1,410,500. (RUB 595,500 + RUB 815,000).

Morkovkin’s average daily earnings to pay for sick leave benefits are 1,932.19 rubles. (RUB 1,410,500 / 730 days).

Situations when there was no salary in the billing period

If the employee’s salary was not accrued during the billing period, the calculation of average earnings is based on the salary accrued for the previous 12 months. In the case where the employee does not have a salary (time worked) before the start of the billing period, but has one in the month of calculation, the average earnings are determined by the amounts accrued for this month. If there is no salary in the month of calculation, the average salary is calculated based on the assigned tariff rate or salary.

Find out more about unpaid leave in the material “How to take unpaid leave.”