The Social Insurance Fund reimburses expenses to policyholders in regions where there is not yet a pilot project for the payment of benefits to individuals directly by the Social Insurance Fund. To receive compensation, business entities must prepare a package of documents. Many questions arise about what documents are needed to reimburse expenses to the Social Insurance Fund in 2020. The exact list of documents will depend on the type of payment, but in any case you need to prepare an application, a calculation certificate and an explanation of expenses. Employers who have spent more money on paying benefits to staff than insurance premiums have been charged will be able to receive compensation. If the contributions are sufficient, an offset is made against future payments.

Who has the right to claim compensation?

If the employer is an insurer and during the month paid temporary disability benefits and other social payments to employees, he has the right to request the return of sick leave from the Social Insurance Fund in 2022 or reduce the amount of the monthly contribution to VNiM by the amount of paid benefits from the funds of the fund (Part 2 of Article 4.6 255 - Federal Law of December 29, 2006, clause 2 of Article 431 of the Tax Code of the Russian Federation).

If the amount of the listed social benefits is greater than the insurance premiums calculated for the month, then the procedure for compensation for sick leave from the Social Insurance Fund in 2022 is as follows:

- Apply the excess balance toward the next month's payment.

- Write an application to the territorial department of the fund for monetary compensation of the difference.

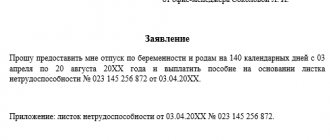

The application is sent according to the form from letter No. 02-09-11/04-03-27029 (approved by order No. 951n dated 12/04/2009). The following must be attached to the application:

- certificate-calculation;

- breakdown of expenses;

- supporting documents.

More information on how to fill out an application for a refund: “Instructions: fill out an application to the Social Insurance Fund for reimbursement of benefits.”

Pitfalls and bottlenecks

- The Social Insurance Fund makes payments to each employer (insurer) if a woman is employed in various organizations. She receives several sick leaves (read more about issuing sick leave for pregnancy and childbirth here). This document is the basis for one-time payments under the BiR (we talked in detail about how to go on maternity leave while working part-time, here, and from this article you will learn how to issue a certificate of incapacity for work).

Based on the information in clause 4.3 of the Procedure, the following conclusion is drawn: the benefit is paid both at the main place of work and at a part-time job. The bodies of the FSS of the Russian Federation, in Letter dated May 24, 2012 N 15-03-14/12-4664, decide the same. Testing of these provisions by judicial practice is not yet known.In case of part-time employment, one of three options for calculating benefits can be chosen:

- If a woman has been employed by several employers over the past 2 years, including at the time of the insured event (currently pregnancy and childbirth), then she has the right to count on withholding benefits from each of them.

If the insured person has less than 2 years of work experience with one employer, and was previously employed in other places (places), then he has the right to claim benefits from any employer at his discretion.

- If a woman has worked for the last two years with both her current and another employer, she has the right to receive benefits based on the average total earnings in two places, or from one of her choice.

- The Social Insurance Fund does not reimburse benefits to an employer who hires persons under a civil law contract (civil law), because the employer does not make insurance contributions to the territorial social insurance body.

- If a woman has become unemployed due to the bankruptcy and cessation of the company’s activities, then she may qualify for payment of benefits at her last place of work experience, based on information about the salary and other remunerations of the insured person provided by the territorial Pension Fund to the Social Insurance Fund.

- If a woman continues to perform her work duties after the date of maternity leave (on sick leave), then these days do not count towards the vacation and are not returned by the Social Insurance Fund to the employer (is it possible to work during sick leave under the BIR?). The fewer vacation days (140 days by law), the less the benefit. Working days are subtracted from these.

- A fiasco will await those who violate the Legislation of the Russian Federation for the sake of illegal enrichment. Based on past legal proceedings between the Social Insurance Fund and policyholders representing the insured persons, the following reasons for refusal to receive maternity benefits have been identified:

- The position held does not correspond to the employee’s qualifications.

- The salary is unreasonably high.

- The position for which she was employed arose almost simultaneously with the signing of the employment contract.

- Before maternity leave, the employee’s salary was sharply increased.

- Periods of incapacity for work by the employee are also included in the benefit bill.

- If the appointment to a position occurred several days or weeks before going on maternity leave on sick leave.

Quoted from Art. 13 Federal Law of December 29, 2006 N 255-FZ (as amended on March 7, 2018) “On compulsory social insurance in case of temporary disability and in connection with maternity.”

If the benefit was paid in a larger amount than was actually due, then the persons responsible for this situation compensate the insurer for the damage caused.

Debt is collected, as a rule, in court . (Article 15, 15.1 Federal Law of December 29, 2006 N 255-FZ (as amended on March 7, 2018) “On compulsory social insurance in case of temporary disability and in connection with maternity”).

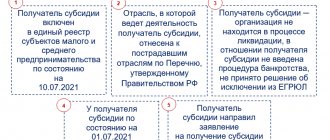

Features for pilot project participants

Participants in the pilot project submit documents for payment of social benefits directly to the Social Insurance Fund. Policyholders fill out the necessary documentation from Order No. 578 dated November 24, 2017 (Appendix No. 1 to the Order). The application and certificate of incapacity for work are transferred to the territorial department of the fund, and the territorial department makes all payments independently. As a result, compensation for sick leave for pregnancy and childbirth from the Social Insurance Fund is not required - the policyholder does not incur expenses for social benefits.

Limitations on Refunds

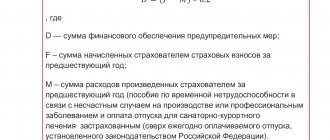

Compensation is limited to minimum and maximum values. The minimum and maximum are calculated for each individual employee for the two years preceding the insured event. The accountant determines the average earnings for these periods, taking into account the marginal base:

- for 2022 - 912,000 rubles;

- for 2022 - 865,000 rubles;

- for 2022 - 815,000 rubles.

The maximum payment in 2020 is paid within the range of 1,680,000 rubles (865,000 + 815,000). And for one day of illness they compensate no more than 2,301.37 rubles. (1,680,000 : 730 days).

The minimum amount is calculated similarly, for two years. But the value is determined by the minimum wage: Minimum wage x 24 months: 730 days. In 2022, the low for one day is 398.79. They will not pay less than this amount.

What employer expenses are reimbursed by the Social Insurance Fund?

In 2022, employers continue to pay, with subsequent reimbursement from the fund:

- Part of the disability benefit financed by interbudgetary transfers from the federal budget;

- Average earnings for four additional days off per month to care for disabled children;

- Funeral benefit (or reimbursement of the cost of funeral services provided according to a guaranteed list by a specialized service);

- Funds for preventive measures to reduce industrial injuries and occupational diseases of workers.

We will not touch on the last type of expense in this article - you can read about it in the article “How to reimburse expenses for injury prevention from the Social Insurance Fund.” Next, we will talk about the first three types of reimbursable expenses.

Work with electronic sick leave according to the new rules in Externa

What documents are needed

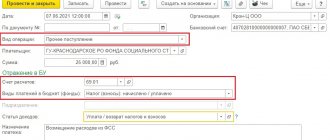

Order No. 951n specifies how to reimburse sick leave from the Social Insurance Fund in 2020:

- Determine the amount to be reimbursed and fill out the calculation forms.

- To write an application.

- Submit the package with documents for reimbursement to the fund.

The list of accompanying documentation is given in Order No. 951n and the methodological recommendations of the fund. We collected everything in one table:

| Benefit | Necessary documents to the Social Insurance Fund for reimbursement of sick leave in 2020 (and other insurance payments) |

| For temporary disability |

|

| For pregnancy and childbirth | And these are the documents for returning sick leave from the Social Insurance Fund in 2022 for pregnancy and childbirth:

|

| At the birth of a child |

|

| Child care up to 1.5 years old |

|

| For burial |

|

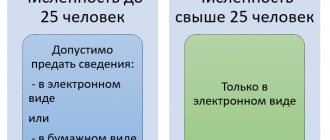

How to properly certify documents for reimbursement of expenses to the Social Insurance Fund in 2022

Social Insurance does not need to provide original documents confirming the legality of expenses. Certified copies are sufficient. But you need to be prepared for the fact that during the inspection, inspectors may demand to show them the originals of such documents. The originals will be checked against the copies and then returned.

Copies of documents to be submitted to the FSS are certified as follows:

- signature of the head of the organization;

- signature of the individual entrepreneur;

- seal of the organization (if there is one);

- the inscription “Copy is correct.”

It should be borne in mind that the Social Insurance Fund carefully controls the payment of benefits.

If the inspection inspectors have suspicions that the employing organization has created an artificial situation in order to obtain funds, Social Insurance will refuse to reimburse expenses. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Document verification deadlines

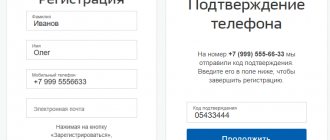

Instructions on how to return sick leave from the Social Insurance Fund in 2022:

- calculate funds for refund;

- fill out the application, certificate and transcript;

- submit papers to the fund;

- wait for the test results;

- receive funds.

The documentation is checked within 10 days (Part 3 of Article 4.6 255-FZ). If a specialist has questions about the calculations, he has the right to organize a desk audit (Part 4, Article 4.6 255-FZ). In this case, the money will come only after a positive control result and not earlier than in 2-3 months.

After how many days does the Social Insurance Fund pay for sick leave for an individual if the employer does not have enough funds?

Reimbursement for sick leave from the Social Insurance Fund is made directly to an individual in cases of liquidation of an enterprise, initiation of bankruptcy proceedings, lack of funds from the employer to pay for sick leave, or inability to find out where the organization is located. This is stated in paragraph 4 of Art. 13 of the law of December 29, 2006 No. 255-FZ. However, you must understand that for the first 3 days, social benefits for illness will not be paid, since this is the responsibility of the employer.

An individual must apply for compensation to the Social Insurance Fund branch at the address of the organization in which he worked. But the FSS, in letter dated 03/07/2012 No. 15-07-11/12-2451, reminds that the obligation to pay social benefits rests with the employer, and if he evades this obligation, the individual must contact the prosecutor’s office, the Labor Inspectorate or the court.

Note! In the regions where the pilot project is being carried out, employers only pay for the first 3 days of illness. Social Insurance pays benefits for the remaining days of sick leave directly to the employee within 10 days from the date of receipt of documents from the policyholder.