Why do you need to document downtime?

The essence of downtime is the forced suspension of activities by an employee or employees. This essence is the only characteristic of idle time that remains unchanged. All other parameters characterizing each specific situation of suspension of activity have options for selection and can occur in different combinations.

If you still have questions about employee downtime, you can find answers to them in ConsultantPlus.

Full and free access to the system for 2 days.

Not only the dates of occurrence and completion of the next downtime are different, but also:

- the reasons causing the suspension of work and, accordingly, the conditions determining the date of its end (Article 72.2, 414 of the Labor Code of the Russian Federation);

- persons guilty of downtime (Article 157 of the Labor Code of the Russian Federation);

- persons forced (regardless of whether they were at fault for the downtime) to suspend work;

- requirements for the presence of idle workers at work (Letter of the Ministry of Health and Social Development dated 02.02.2009 No. 22-2-2004);

- formulas used in calculating payment for time spent idle (Article 157 of the Labor Code of the Russian Federation);

- types of other work offered to an idle employee (Article 72.2 of the Labor Code of the Russian Federation).

The parameters related to a specific downtime will determine:

- does the employee need to go to work during it;

- whether he will receive wages or payments for downtime (provided that the employee is not guilty of it);

- calculation formula used when calculating payments for downtime;

- the final amount of payments during downtime.

To prevent these parameters from being ambiguous in their interpretation, they are documented. The document created in this case is called an order to introduce downtime. It is quite difficult to do without it (due to its importance), so it is mandatory.

Sample order for downtime

How is downtime paid?

It all depends on who is to blame:

- If the employer, at least 2/3 of the average salary is paid.

EXAMPLE from ConsultantPlus: An employee was idle for 4 working days - from 03/09/2021 to 03/12/2021. In the billing period from 03/01/2020 to 02/28/2021, he was on vacation from August 3 to 30. The employee worked the rest of the time and received a salary of 410,000 rubles. and vacation pay - 40,000 rubles.... Get trial demo access and find out how to correctly calculate the average earnings to pay for downtime due to the fault of the employer.

Find out how to calculate it from the article “How to calculate the average monthly salary (formula)?” .

- If neither party is at fault, at least 2/3 of the tariff rate or salary, calculated in proportion to the downtime.

An example of calculating downtime for reasons beyond the control of the parties:

The employee was idle for 10 working days. His salary is 40,000 rubles. Payment for downtime - RUB 13,333.34. (RUB 40,000 / 20 days x 2/3 x 10 days).

This is the minimum payment; the organization has the right to increase it.

- Downtime due to the employee's fault is not paid.

What documents are required to introduce downtime?

An order to impose downtime can be created either on the basis of other documents evidencing downtime, or without supporting documents.

A basis document will not be required if the initiative to introduce downtime comes from the employer (for example, in the case of a difficult economic situation for him) or is a consequence of reasons beyond the control of either the employee or the employer (for example, due to changes in legislation).

If downtime occurs directly at the workplace, then no matter what causes it, the employee is obliged to inform his immediate supervisor or other representative of the employer about this situation (Article 157 of the Labor Code of the Russian Federation).

Sample memo about downtime

Information to the immediate manager can be both oral and written (in this case, a written message about downtime due to a strike is required - Article 414 of the Labor Code of the Russian Federation). But the message is still conveyed to the final authority - the employer's management - (if not by the employee himself, then by his immediate supervisor) in writing. And it is this document that most often becomes the basis for issuing an order to introduce downtime.

In addition, the basis document may be an act drawn up by the commission.

Sample act of demurrage

Drawing up a downtime report is necessary if the employee fails to report a situation in which his work activity is suspended. If the employee is guilty of downtime, then an explanatory note will be required from him.

Sample explanatory note about downtime

When does Article 157 of the Labor Code apply?

Art. 72.2 of the Labor Code of the Russian Federation defines downtime as a temporary suspension of work for reasons of an economic, technological, technical or organizational nature. These reasons can be either external (for example, the supplier delayed delivery and the raw materials ran out) or internal (for example, equipment breakdown).

The culprits may be:

- worker;

- employer;

- reasons beyond the control of the employee and employer.

Both individual employees or departments, and the organization as a whole can be idle. But in any case, downtime must be paid for (we will discuss one exception to the rule below). This is where Article 157 of the Labor Code of the Russian Federation comes into play.

ConsultantPlus experts explained in detail how to register downtime due to the impossibility of temporarily transferring employees to remote work at the initiative of the employer in the situation of the spread of coronavirus (COVID-19). If you do not have access to the K+ system, get a trial demo access for free.

Downtime - employer actions

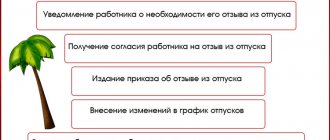

Actions taken when downtime is introduced are in the following sequence:

- Upon detection of downtime, a document is created that will become the basis for issuing an order to introduce downtime.

- A demurrage order is issued.

- Downtime spent without providing the employee with other work is recorded in the working time sheet with a special code, the choice of code of which depends on whose fault the downtime occurred (Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1);

- Payments for time spent in downtime are accrued to the dates of salary payment (Letter of the Ministry of Labor dated May 24, 2018 No. 14-1/OOG-4375).

The first point may drop out of this sequence if the initiator of the downtime is the employer.

Results

Employees who were unable to work due to the employer’s fault must receive compensation calculated according to the provisions of Art.

157 Labor Code of the Russian Federation. The basis for its payment is a local regulatory act - a separate order from management. This document reflects the circumstances of the downtime, and also establishes the procedure for the actions of responsible persons upon completion of the forced pause in the work of personnel. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Let's sum it up

- Each specific simple characterizes its own set of parameters related to it. Since these parameters are variable, their final set should be documented. The role of such a document is performed by an order to introduce downtime.

- An order to introduce downtime that occurs at the workplace must be preceded by information about it from the employee. It is transferred either to the immediate supervisor of this employee or to another representative of the employer. Downtime introduced at the initiative of the employer may not be accompanied by such a message.

- If the employee did not inform about the occurrence of downtime, such information is documented by the commission in the form of an act. This situation is often associated with the employee’s fault during downtime, and he is required to provide written explanations for his actions.

- Downtime spent without providing the employee with other work is reflected in the working time sheet. In this case, special codes are used that indicate the culprit of the downtime. Payment for downtime is calculated on the dates of payment of wages.

How to arrange a simple

Tatyana Gezha,

expert consultant at TLS-GROUP CJSC

Today there are often situations when, for one reason or another, organizations have to suspend their activities. What to do in this situation? What to do with employees? After all, it is impossible to send everyone on so-called “administrative” leave en masse. Transfer to part-time work (part-time work week) is possible only for reasons related to changes in organizational or technological working conditions. In this situation, in accordance with the law, it is only possible to introduce a downtime mode

Downtime is a temporary suspension of work for reasons of an economic, technological, technical or organizational nature (Part 2 of Article 72.2 of the Labor Code of the Russian Federation (hereinafter referred to as the Labor Code of the Russian Federation)).

Although the Labor Code of the Russian Federation does not explain what is the reason of an economic nature, it can be assumed that a decrease in production volumes, services provided, and the number of sales is such a reason.

Regardless of external or internal factors leading to downtime, Art. 157 of the Labor Code of the Russian Federation distinguishes three types of downtime:

- downtime due to the fault of the employer;

- downtime for reasons beyond the control of the employer and employee;

- downtime due to the fault of the employee.

How to arrange a period of downtime

Since there are no standardized forms for registering downtime, the organization must develop actions and document flow in this case itself. For example, the algorithm of actions in this case may be as follows.

1. First, you must record in writing the fact of the downtime that has occurred.

You can draw up a written act or report about the reason that led to the downtime (Appendix 1).

2. Based on the report or act, the head of the organization issues an order to introduce downtime (Appendix 2). The order must indicate the start and end date of the downtime (if the end date is known at the time the order is issued), whose fault it arose, which employees will be placed on downtime, the procedure for working during the downtime, and the procedure for paying for the downtime.

We notify the employment service

In accordance with paragraph 2 of Art. 25 of the Law of the Russian Federation of April 19, 1991 No. 1032-1 “On Employment of the Population in the Russian Federation” from January 1, 2009, when introducing part-time work or suspending production, employers are required to report this in writing to the employment service authorities within three working days after making decisions on carrying out appropriate activities.

There are no legally approved forms for this notification, so you can notify the employment service in any form (Appendix 3).

Liability for failure to provide notification is not specified in law. However, it can be assumed that the employer may be held administratively liable in accordance with Art. 19.7 of the Code of Administrative Offenses of the Russian Federation for failure to submit or untimely submission to a state body (official) of information (information), the submission of which is provided for by law and is necessary for this body (official) to carry out its legal activities in the form of a fine:

- for officials - from 300 to 500 rubles;

- for legal entities - from 3,000 to 5,000 rubles.

We prepare the time sheet

In accordance with the Resolution of the State Statistics Committee of the Russian Federation dated January 5, 2004 No. 1, downtime is noted in the working time sheet:

- through the fault of the employer - letter code “RP”, digital code “31”;

- for reasons beyond the control of the employer and employee - letter code “NP”, digital code “32”;

- through the fault of the employee - letter code “VP”, digital code “33”.

Payment for downtime

- Through the fault of the employer

In accordance with Art. 157 of the Labor Code of the Russian Federation, downtime due to the fault of the employer is paid in the amount of at least two-thirds of the employee’s average salary. A collective or employment agreement in an organization may provide for higher payment for downtime. At the same time, to calculate the average salary, all types of payments provided for by the remuneration system and applied by the relevant employer are taken into account, regardless of the sources of these payments (Article 139 of the Labor Code of the Russian Federation). The average salary is calculated in accordance with the Decree of the Government of the Russian Federation dated December 24, 2007 No. 922 “On the specifics of the procedure for calculating the average salary.” Payment for downtime caused by the employer will be calculated using the formula: (average daily earnings of the employee) x (2/3) x (number of working days during the downtime period). - Through the fault of the employee

Downtime due to the fault of the employee (absenteeism, intentional damage to production equipment, improper operation of equipment, theft of materials, etc.) is not paid (Part 3 of Article 157 of the Labor Code of the Russian Federation). - For reasons beyond the control of the employer and employee

In accordance with Part 2 of Art. 157 of the Labor Code of the Russian Federation, downtime for reasons beyond the control of the employer and employee is paid in the amount of at least two-thirds of the tariff rate, salary (official salary), calculated in proportion to the downtime. Calculation of payment for downtime for reasons beyond the control of the employer and employee will be made using the formula: (monthly tariff rate (salary))/(number of working days in the month of downtime) x (2/3) x (number of working days in the downtime period) . It is often difficult to understand whose fault the downtime occurred - the fault of the employer or for reasons beyond the control of the employer and employee. For example, it is a common position of the employer that downtime for economic reasons (financial crisis) is downtime for reasons beyond the control of the employer and employee. How to determine whose fault the downtime occurred? Let's say there is an equipment breakdown. If the employer did not periodically carry out scheduled technical inspections and did not control the proper condition of the equipment, this is downtime due to the fault of the employer. If there were any force majeure circumstances, this is downtime for reasons beyond the control of the employer and employee. If the equipment was used in violation of operating rules, this is downtime due to the fault of the employee. As for the difficult financial situation, the position of experts is ambiguous. Some are inclined to conclude that the employer, in accordance with Art. 22 of the Labor Code of the Russian Federation is obliged to provide work stipulated by the employment contract. And if the employer was unable to collect a sufficient number of orders and was unable to provide the employee with work, the downtime in this case was due to the fault of the employer. The opinion of other experts is that the employer is not to blame in this case, as well as in cases where the organization was let down by suppliers. In such cases, in our opinion, it is more expedient to either pay for this period as downtime for reasons beyond the control of the employer and employee, or to analyze each situation individually and in some cases pay for it as downtime due to the fault of the employer, and in others for reasons independent of the employer and employee. But be prepared for the fact that the employee may not agree with your decision and go to court. And the court will determine the presence or absence of the employer’s guilt in this case. During downtime, it is possible to transfer the employee to another job (Article 72.2 of the Labor Code of the Russian Federation).

Payment of sick leave

In accordance with clause 5, part 1, art. 9 of the Federal Law of December 29, 2006 No. 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity”, from January 1, 2011, temporary disability benefits are not assigned to the insured person for the period of downtime. Exception, in accordance with paragraph 7 of Art. 7 of this Law, there are situations where temporary disability occurred before the downtime period and continues during the downtime period. Temporary disability benefits for the period of inactivity are paid in the same amount as wages are maintained during this time, but not higher than the amount of temporary disability benefits that the insured person would receive according to the general rules.

Taxes during downtime

Payment for forced downtime is considered employee income subject to personal income tax (Clause 1, Article 210 of the Tax Code of the Russian Federation). In accordance with Art. 210 of the Tax Code of the Russian Federation, when determining the tax base for personal income tax, all income of the taxpayer received by him, both in cash and in kind, or the right to dispose of which he has acquired, is taken into account.

In accordance with Art. 7 of the Federal Law of July 24, 2009 No. 212-FZ “On insurance contributions to the Pension Fund of the Russian Federation, the Social Insurance Fund of the Russian Federation, the Federal Compulsory Medical Insurance Fund and the territorial compulsory medical insurance funds”, the objects of taxation of insurance premiums for payers of insurance contributions are payments and other remunerations accrued by payers of insurance premiums in favor of individuals within the framework of labor relations. Consequently, payment for forced downtime is subject to insurance premiums.

In accordance with clause 3 of the Decree of the Government of the Russian Federation dated March 2, 2000 No. 184 “On approval of the Rules for the accrual, accounting and expenditure of funds for the implementation of compulsory social insurance against industrial accidents and occupational diseases,” payment for downtime is subject to insurance premiums against industrial accidents and occupational diseases.

Why is it needed?

If a decision is made to temporarily suspend the activities of an individual employee, a division or an entire company, the employer must:

- inform the team or individuals about the situation;

- approve changes to the work schedule;

- determine the payment procedure for such a period.

All these points need to be documented, so an order for forced downtime is drawn up.

IMPORTANT!

In connection with the situation with COVID-19 and the publication of Presidential Decree No. 206 of March 25, 2020 “On declaring non-working days in the Russian Federation,” the employer is obliged to provide employees with paid days off. If it is possible to switch to remote work and the employee does not mind, then an agreement must be concluded. If there is no opportunity to work remotely, and the employer forces you to write an application for leave at his own expense or for a part-time transfer, he is breaking the law, the employee has the right to complain to the State Labor Inspectorate.

How to draw up an order to end downtime

There is no approved recommended form of termination order, therefore the employer has the right to proceed from the forms of internal documents adopted by him.

The document should indicate:

- details of the document that declared the suspension;

- the reasons for the introduction and an indication that production activities are being resumed;

- return to work date;

- list of employees returning to work.

All employees called to work are notified and introduced to the document for signature.

Employer Responsibilities

The employer has the following responsibilities during the downtime period:

- Drawing up an order in accordance with the Labor Code.

- Taking all possible measures to resume work processes.

- Calculation of compensation in the established amount.

An employer does not have the right to send employees on unpaid leave.

Transferring an employee to another location during downtime

The manager has the right to transfer an employee to another department or to another position. This is the most optimal solution for both the employer and the employee. However, such a decision is rarely made, since its implementation requires free space in the enterprise.

IMPORTANT! Transfer of a person without his consent is possible only if the downtime lasts no more than a month, and the employee is offered a position equal to his qualifications. Also, in the new place, the employee must receive a salary the same as his previous salary. If one of these conditions is not met, the employee's consent is required for the transfer.

The maximum duration of the transfer is 12 months. After the end of the year, the manager must either return the employee to his previous position, or officially register him in a new one.

Downtime due to unfavorable epidemiological situation

If, under the current circumstances, an enterprise (for example, when a non-food store, restaurant, bar, or leisure center is closed for quarantine) is unable to provide employees with work, the manager declares idle time. Moreover, this can be total (for all employees) or selective downtime (when, for example, employees who support the life support of the enterprise continue to work, while the rest have suspended work). Downtime due to an unfavorable epidemiological situation is paid in the amount of 2/3 of the tariff rate or salary (Part 2 of Article 157 of the Labor Code of the Russian Federation).

The fact of suspension of work must be documented: an order for downtime is the basis for payment to employees of monetary compensation established by Art. 157 Labor Code of the Russian Federation. The article determines the obligation of the employer guilty of downtime to pay compensation to employees in the amount of 2/3 of the average salary for the period of temporary suspension of activities. The accounting department of the enterprise will be able to fulfill the requirement of labor legislation if an order is issued.

There is no obligation to formulate this administrative act in the Labor Code of the Russian Federation, but it is needed to protect the employer from possible dissatisfaction on the part of employees. The presence of paper is checked by the labor inspectorate.