Conditions under which offset can be carried out

Offsetting allows you to pay for goods or services received in return.

In difficult market relations, many enterprises in the small sector of the economy experience certain problems with finances - they are often in short supply, they are invested in turnover, goods, etc., and yet it is necessary to pay off with partners. This is where mutual offset fits perfectly.

Key conditions for implementing this method of calculation:

- the presence of at least two contractual obligations in relations between companies . Moreover, according to one of them, each organization must be a creditor, according to the second, a debtor: in this way, mutual “overlapping” of debts occurs. In some cases, several enterprises participate in mutual settlements at once - the law fully allows this.

- the homogeneous nature of the obligations (for example, in the form of finances); in addition, it is necessary that certain deadlines be allocated for the offset to be completed or the possibility of demand be stipulated.

Organizations can use offset not for the entire amount of obligations, but partially, in other words, they can offset in the amount of the smallest debt. The rest can be paid in monetary terms.

Settlement act and agreement

We’ll look at how to include offsets in a contract in this paragraph. For the netting process to take effect, a statement from one side is sufficient. In this case, the document (a sample offset agreement is given above) may contain one single entry: “In accordance with the terms of this agreement, termination of obligations is allowed in accordance with Article 410 of the Civil Code of the Russian Federation by offsetting a homogeneous counterclaim.” In the future, when a necessary situation occurs, an act is drawn up. It must necessarily contain the following items: name, date and place of drawing up the document, the name of the organization that took care of the registration, measures in kind and monetary terms, links to source documents that gave rise to the obligation, information on it, the total amount offset, surname, name and patronymic of officials, namely the manager (director, general director) and chief accountant, as well as a seal. The act is drawn up in two copies, with copies of source documents attached.

Positive and negative aspects of offset

Offsetting has both its pros and cons. The advantage is that such an offset can be carried out without the participation of financial resources, but, for example, when using any goods or services, which, accordingly, leads to a reduction in costs and saving cash.

At the same time, this calculation method also has its own disadvantages , which, first of all, include the fact that for any business the most profitable and interesting thing is the receipt of financial resources.

Transactions of this kind, especially those carried out with some regularity, often attract the attention of tax authorities during their audits, which often entails the imposition of various types of fines on companies.

That is why it is better to resort to the practice of mutual settlements only in the most extreme cases, when other forms of settlement are impossible for some reason. And in the offset agreements, all the nuances of the transaction should be spelled out as carefully and in detail as possible.

Types of offsets and the procedure for their registration

Mutual offsets are divided into types according to the number of participants. Unilateral is carried out on the basis of an application or notification submitted by one party that the offset has been carried out and the mutual debt has been repaid.

Bilateral offset assumes that an organization has both accounts payable and receivable with one counterparty. It may be provided for by a contract or an additional written agreement (act). There may be three or more parties in a mutual settlement if they have a circular debt. We'll look at this in more detail later.

Meet the professional standard “Accountant”: complete training, confirm your professionalism and receive a diploma at Kontur.School

More details

Unilateral offset

Unilateral offset of claims is possible if the following conditions are met:

- counter demands (Article 410 of the Civil Code of the Russian Federation);

- the requirements are homogeneous;

- the deadline for fulfillment of obligations has arrived, is not specified or is determined by the place of demand (but there are exceptions in Article 410 of the Civil Code of the Russian Federation).

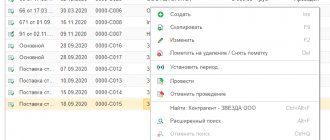

First of all, check whether the listed conditions are met and make sure that you have all the documents confirming the debt. Next, follow the algorithm:

Step 1: File a notice or statement of offset. There is no approved form, but you should include as much information as possible about the requirements for which you are offsetting.

Sample application for offset of counterclaims

Step 2. Send the statement of set-off to the other party by letter with return receipt requested. Send to the legal address indicated in the counterparty details. This will later help prove that you sent the notice properly.

Step 3. Obtain evidence of delivery of the statement of offset to the counterparty. If the application is not received, then the test is considered failed (clause 4 of the information letter of the Supreme Arbitration Court of the Russian Federation No. 65 dated December 29, 2001).

The counterparty did not receive the application letter by mail

A message is considered delivered in cases where it was received by the counterparty, but due to circumstances depending on this person, it was not delivered to him or the addressee did not familiarize himself with it (Article 165.1 of the Civil Code of the Russian Federation). If the post office sends you information about the impossibility of delivery due to the non-appearance of the counterparty, the court will be on your side, since you did everything to ensure that the counterparty received the letter.

Bilateral and trilateral offset

In order to carry out bilateral and trilateral offsets, it is not necessary to meet all the conditions for unilateral offsets. They are carried out by agreement between the parties, which can be recorded in a contract or formalized in a separate written agreement (act).

For three-way, four-way, etc. The offset has one more condition - the debt must be circular. This is clearly shown in the figure.

Tripartite circular debt that can be offset

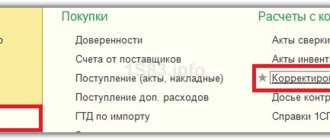

To set off, follow the algorithm:

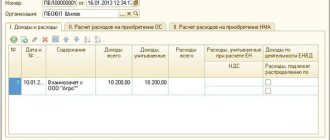

Step 1. Draw up a deed or agreement of offset. They can be drawn up in any form, but must comply with the requirements for primary accounting documents under the Law “On Accounting” No. 402-FZ. Please indicate in detail all the circumstances of the offset:

- what obligations are repaid;

- which ones arose;

- when they were due to be repaid;

- offset amount;

- separately allocate VAT to each counter-obligation.

If there is insufficient information, this may lead to disputes with the counterparty, tax authorities, and legal proceedings.

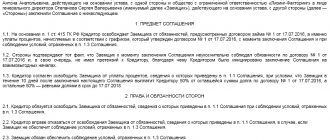

Sample settlement agreement between two parties

Step 2. Write down the procedure for the counterparties after the offset and indicate on what date the agreement comes into force.

Sample of the final part of the agreement

Step 3. Draw up one copy of the agreement for each party and indicate that they all have the same legal force. Enter the details of the parties and make sure that the agreement is signed by all parties.

and receive a response within 24 hours

How to compose a paper

The netting agreement does not have a unified form, so representatives of enterprises and organizations can write it in any form or according to a model developed and approved within the company. The main thing is that the structure of this document complies with certain standards of office work; in addition, in terms of content, it must include some mandatory information. These include:

- the name of the organizations between which the agreement is being formed, their details;

- place and date of drawing up the form.

In the main part of the document it is necessary to record:

- the fact of an agreement reached;

- reference to the agreements under which it is carried out.

If there are any additional conditions or documents that are attached to this agreement, they must be noted as a separate paragraph.

Contract form

At the discretion of the parties, the form of the contract may be arbitrary depending on the requirements presented by the counterparties. The only limitations are the rules of office work. As a rule, the following circumstances and conditions are notified in the text of the contract:

- Time and place of execution of the transaction.

- Full names of organizations (enterprises) entering into the agreement.

- Passport details of authorized persons representing the interests of their organizations.

- List of debts indicating specific amounts. The register should contain references to defining the roles of counterparties as creditors or debtors. Documentary argumentation (with references to the numbers and dates of the relevant contracts) for the occurrence of debts is also necessary.

- The procedure for calculating debts. The amount to be indicated in the contract after settlements is as follows: the entire amount accepted as offset if the debts of both parties are identical; the difference in case of discrepancy between the amounts of debts to be paid to the creditor.

The final part of the agreement indicates the date of its entry into force, postal addresses and bank details of the parties to the transaction. This is followed by the signatures of authorized representatives of the parties and the seals of the organizations.

Offsetting between enterprises is quite often used in business practice, but their repeated use leads to increased attention from government control authorities.

Nuances of drawing up an agreement between organizations

The execution of the agreement, as well as its content, is completely left to the employees of the companies. It can be written on an ordinary sheet of paper of any convenient format or on the letterhead of any organization, by hand or in printed form. Next, the document is signed by the directors or their representatives on both sides. Signatures must be “natural”.

If organizations use seals and stamps in their activities, then the agreement form should be endorsed.

The agreement is made in two identical and equivalent copies - one for each of the interested parties. After the document is completed and endorsed, it must be registered in the document register of each company. In the future, the document serves as the basis for carrying out relevant accounting operations.

The agreement should be stored together with the contract in a separate folder for the period established by the legislation of the Russian Federation or internal regulations of companies (but not less than three years).

Example of an agreement to set off mutual claims

Agreement on Set-off of Mutual Claims

Arkhangelsk September 15, 2022

We, the undersigned,

Korotkova Anna Sergeevna, born 05/11/1982, passport of a citizen of the Russian Federation series 63 22 number 127487, issued 03/04/2007 TOM of the Central District of Astrakhan, registered at the address: Russia, Astrakhan region, Astrakhan, st. Raduzhnaya, 11, apt. 56, hereinafter referred to as "Side 1", on one side, and

Nikitin Pavel Konstantinovich, born 02/06/1979, passport of a citizen of the Russian Federation series 01 23 number 4987563, issued by the Federal Migration Service of Russia for the Novgorod region in the Sovetsky district of Nizhny Novgorod on 02/11/2012, registered at the address: Russia, Astrakhan region, Astrakhan , st. Dubrovskogo, 105, apt. 9, hereinafter referred to as "Side 2", on the other hand,

and together referred to as the “Parties”, guided by Art. 410 of the Civil Code of the Russian Federation, have entered into this agreement as follows:

- 1. In order to partially terminate mutual obligations, the Parties offset similar counterclaims specified in clause 3 of this Agreement.

- The amount of offset of counterclaims of the same type under this Agreement is 47,000 (seventeen thousand) rubles.

- Information on mutual claims and debts of the Parties as of the date of signing of this Agreement:

- under the residential lease agreement dated 05/02/2017 (apartment No. 9, located at the address: Russia, Astrakhan region, Astrakhan, Dubrovsky St., building 105, cadastral number 49:65:569856:458) amount of debt of Party 1 for payment of rental payments to Party 2 is seventeen thousand rubles. The deadline for submitting a claim was September 2, 2018.

— the cost of inseparable improvements to the leased property under the residential lease agreement dated 05/02/2018, made by Party 1 with the consent of Party 2, is 30,000 (thirty thousand) rubles. The deadline for submitting the claim has not arrived.

— under the loan agreement dated July 4, 2018, the amount of debt of Party 2 to return to Party 1 the amount of principal and interest for the use of funds is 50,000 (fifty thousand) rubles.

- After the offset, the balance of Party 2’s debt to Party 1 as of September 15, 2018 is 3,000 (three thousand) rubles. By an additional agreement dated September 15, 2018 to the loan agreement dated July 4, 2018, the deadline for repayment of the balance of funds was extended until October 3, 2018.

- From the moment of signing this agreement, the Parties consider themselves free from the obligations provided for in clause 3 of this Agreement, in the amount established by clause 2 of this Agreement.

- This Agreement is drawn up and signed in two authentic copies - one for each Party.

- This Agreement comes into force from the moment it is signed by the Parties.

- Details and signatures:

Korotkova Anna Sergeevna Nikitin Pavel Konstantinovich