List of LLC expenses for OSNO

The list of income tax expenses under OSNO, which a limited liability company has the right to take into account when calculating the taxable base, is divided into 2 groups: related to production and sales, and non-sales.

Costs associated with production and sales are given in Art. 253 Tax Code of the Russian Federation . This list includes, in particular, the following types of costs:

- for the production, storage and delivery of products;

- for payment of wages and insurance premiums;

- for the operation and maintenance of fixed assets;

- for R&D;

- others directly related to production and sales.

The list of non-operating expenses that OSNO LLC takes into account when calculating the tax base is given in Art. 265 Tax Code of the Russian Federation . These include, for example:

- leasing payments;

- interest on obligations;

- costs of issuing own securities and servicing purchased ones;

- negative exchange rate differences;

- court fees;

- banking services.

What costs can be included in the costs of OSNO?

There are 3 main criteria that inspectors pay attention to ( clause 1 of Article 252 of the Tax Code of the Russian Federation ). Acceptable expenses must be:

- documented;

- economically justified;

- aimed at further profit generation.

Only if all three points are met, an OSNO LLC can take these expenses into account when calculating income tax. In this case, all expenses must be expressed in monetary form.

In addition to the general lists of expenses, the Tax Code of the Russian Federation has a separate list of expenses that can be taken into account to reduce the tax base only within established limits . Limitable expenses include:

| Types of costs | Limit | Normative act |

| Certain types of advertising costs | 1% of revenue for the year | pp. 28 clause 1 and clause 4 art. 264 Tax Code of the Russian Federation |

| Entertainment expenses | 4% of labor costs for the reporting period | pp. 22 clause 1 and clause 2 art. 264 Tax Code of the Russian Federation |

| Losses | Within the limits of natural loss | pp. 2 clause 7 art. 254 Tax Code of the Russian Federation |

| VHI, pension insurance | 12% of labor costs | clause 16, part 2, art. 255 Tax Code of the Russian Federation |

| Costs of organizing sanatorium-resort treatment | No more than 50 thousand rubles. for each employee for the tax period | clause 24.2 part 2 art. 255 Tax Code of the Russian Federation |

| Compensation for the use of personal transport | Depending on engine size | Decree of the Government of the Russian Federation dated 02/08/2002 No. 92 |

Limited costs

Save time and money

Accounting services at “My Business” from only 1,667 rubles per month

More details

Direct and indirect costs: the eternal problem of an accountant

Once again I read Yaroslavna’s latest lament on the forum: “How can I not show losses in my income tax return?” And involuntarily I came to the conclusion that the main principle of the Bolsheviks: first create difficulties for yourself, and then heroically overcome them, has not yet been forgotten by the Soviet Russian accountant and is successfully applied by him.

After all, even if not half, but a third of organizations receive losses for profit tax purposes due to the fact that indirect expenses are written off monthly, and sales of products (works, services) often do not occur every month, or even not every quarter.

Although for almost a decade and a half (since 2005), the list of direct expenses that are included in the cost of manufactured products (work performed, services provided) has been open, and the organization determines it independently (clause 1 of Article 318 of the Tax Code of the Russian Federation).

And other expenses that the organization itself has not recognized as direct will be considered indirect.

I suspect (although I could be wrong) that many colleagues are still captivated by the belief that the terms “direct and indirect costs” have the same interpretation, both in accounting registers and for profit tax purposes.

Let us recall that in accounting (Instructions for the use of the chart of accounts for accounting financial and economic activities of organizations, approved by Order of the Ministry of Finance of Russia dated October 31, 2000 No. 94), direct costs are understood as costs directly related to the production of products (performance of work, provision of services), and included in the cost of accounting units of manufactured products (work performed, services provided) on the basis of primary accounting documents.

Thus, direct expenses, in particular, are recognized as:

- wages of production personnel, included in the cost of a unit of production (work, services) on the basis of work orders, time sheets and other primary documents for labor accounting and payroll;

- materials included in the cost according to write-off acts;

- services (work) of co-executors (subcontractors), included in the cost price on the basis of acceptance certificates for the provision of services (results of work).

The accountant’s task when reflecting direct expenses is to receive such a primary document and include the cost of resources indicated in it in the cost of a unit of production (work, services).

If this primary document contains only natural indicators (pieces, kilograms, meters, etc.), the accountant additionally needs to evaluate the indicators given to him in monetary terms - put the pieces in rubles.

Indirect costs (expenses) that an organization incurs in connection with the simultaneous production of several types of products (works, services) are included in the cost of each of them by some calculation method, according to the economically feasible methods chosen by the organization.

This point of view is supported, in particular, by the Modern Economic Dictionary (Raizberg B.A., Lozovsky L.Sh., Starodubtseva E.B.M. INFRA-M., 2011), according to which indirect costs are costs associated with production several types of products, included in their cost not directly, but indirectly, using special calculations, in accordance with economically sound coefficients.

The Methodological Recommendations for the application of the Chart of Accounts for accounting financial and economic activities of enterprises and organizations of the agro-industrial complex, approved by Order of the Ministry of Agriculture of Russia dated June 13, 2001 No. 654, also states that indirect production costs are a set of costs associated with production that cannot (or economically inexpedient) taken into account and directly attributed to specific types of products. Therefore, they are accounted for in separate accounts and distributed by type of product by calculation.

Thus, it is quite difficult to give an unambiguous definition of direct and indirect costs (expenses) for all organizations, regardless of the type of their activities. Some costs for one organization can be considered direct, while for another they should be considered clearly indirect.

With regard to the costs of maintaining management personnel, as well as costs associated with sales (commercial expenses), the organization has the right to choose (clause 9 of the Accounting Regulations “Costs of the Organization” PBU 10/99, approved by order of the Ministry of Finance of Russia dated 05/06/99 No. 33n).

They can be included in the cost of each type of product (work, service), distributed according to a selected economically justified indicator, for example, the amount of direct costs incurred. The organization also has the right on a monthly basis, regardless of the fact of sales of products (works, services), to write off all administrative and commercial expenses as a reduction in the financial result, without distributing them to the cost price. The option chosen by the organization to write off administrative and commercial expenses must be enshrined in its accounting policies.

And once again I would like to draw your attention to the fact that an organization can write off monthly not all indirect expenses, but only administrative and commercial ones.

For profit tax purposes (clause 1 of Article 318 of the Tax Code of the Russian Federation), production costs for the sale of goods (products, works, services) are also divided into direct and indirect.

But the same terms have a completely different meaning.

Direct expenses (clause 2 of Article 318 of the Tax Code of the Russian Federation) are included in the cost of goods (products, works, services) and reduce taxable profit as they are sold.

Indirect - monthly, regardless of the fact of sale, they are written off to reduce taxable profit (the same clause 2 of Article 318 of the Tax Code of the Russian Federation).

The organization makes the distribution of expenses for direct and indirect ones independently, enshrining it in the accounting policy (clause 1 of Article 318 of the Tax Code of the Russian Federation).

Thus, for profit tax purposes, the terms direct and indirect expenses mean the moment at which they are attributed to the reduction of profit - upon sale (direct) or monthly (indirect). Whereas in accounting registers - the method of inclusion in the cost price , directly or indirectly (calculated).

When drawing up accounting policies for accounting purposes, the division of expenses into direct and indirect does not make any sense.

This does not depend on the will of the leadership. In addition, as mentioned above, during the year some types of costs may be recognized first as direct and then indirect, or vice versa. But when choosing a method for writing off part of indirect expenses, that is, administrative and commercial, you need to approach it with great care.

At first glance, the monthly write-off of management expenses to reduce the financial result is more convenient and profitable for the organization.

- Firstly, the work of calculating the cost of products (works, services) is simplified. There is no need to distribute the costs of maintaining management personnel between types of products (works, services).

- Secondly, the monthly write-off of these expenses allows you to optimize financial flows when calculating income taxes.

However, such a point of view has the right to exist in the case when the organization has a stable market for its products (works, services).

In this case, with regular revenue, monthly write-off of management expenses (without including them in the cost price) will give almost the same result as the opposite option, that is, including management costs in the cost price. However, for the majority, in the current very difficult economic situation, a stable sales market is a dream that does not always come true.

Manufactured products, especially if their production period is not two or three days, but more, it is still unknown when they will be sold, but all management costs are written off monthly. Losses that are likely to arise in this case may lead, in particular, to a decrease in net assets. This can be avoided by choosing an option in which management costs are included in the cost of production. And in this case, the amount of losses will be less.

The same applies to both the performance of work and the provision of services.

For profit tax purposes, the organization determines the list of direct expenses independently. It should be noted that some of the expenses that may be recognized as indirect in the accounting registers (deductions to extra-budgetary funds for the salaries of key production personnel, in particular) must be recognized as direct for profit tax purposes (clause 1 of Article 318 Tax Code of the Russian Federation).

The list of direct costs, as well as indirect ones, is open. At the same time, some organizations strive to “push” maximum costs into indirect expenses in order to save on paying income tax.

Both the Ministry of Finance of Russia and tax authorities constantly indicate (letters of the Ministry of Finance of Russia dated December 6, 2018 No. 03-03-06/1/88527, dated August 29, 2019 No. 03-03-06/1/66440, letters of the Federal Tax Service of Russia dated February 24, 2011 No. KE-4-3/ [email protected] , dated July 12, 2019 No. KCH-4-7/13613), which, indeed, the organization determines the list of direct and indirect costs independently. However, the list of indirect costs must be justified. This justification should lie in the fact that costs that are associated with the production of products (performance of work, provision of services) cannot be indirect. That is, the algorithm for distributing costs into direct and indirect costs must contain economically sound indicators determined by the technological process. It is possible to recognize costs associated with the production of products (works, services) as indirect costs only if there is no real possibility of classifying them as direct costs using economically sound indicators.

Officials protest against recognizing maximum costs as indirect costs. The opposite situation, in which costs are recognized as direct expenses, does not cause such a protest from them.

This is the first thing.

Secondly , in order not to create even greater differences between accounting and tax accounting (there are already more than enough of them), it is optimal, in our opinion, to recognize as direct expenses for profit tax purposes those costs that are included in the cost in the accounting registers products (goods, works, services) . And although they will be indirect in the accounting registers (distributed according to some calculations), for profit tax purposes they should be recognized as direct, and included in the cost price using exactly the same algorithm.

Thirdly , in modern unstable economic conditions, it is optimal, in the author’s opinion, to reduce the list of indirect expenses for profit tax purposes to a minimum . After all, as mentioned above, most companies do not have firm confidence in the regular receipt of income (sales). And with “inflated” indirect costs, most often the organization will incur losses that could have been avoided by recognizing the maximum of them (or even all) as direct. And so it turns out that the organization is initially concerned with proving to the tax authorities that the maximum costs cannot be attributed to direct expenses using economically sound indicators. Then the accounting department and management begin to rack their brains about how and where to hide the losses, since the inspectorate (albeit unofficially) refuses to accept such a declaration.

These problems can be avoided quite easily by recognizing most (and even all) management expenses in tax accounting as direct.

And then Yaroslavna’s cry: “Where to hide the costs of maintaining the organization’s apparatus in the absence of sales?” They will sound much less often.

Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 15.

Sign up

What costs cannot be taken into account?

The Ministry of Finance of the Russian Federation regularly provides explanations on how to take into account certain types of costs. In particular, LLCs on OSNO cannot take into account the following for calculating income tax:

- The cost of an unfinished construction project in the event of its liquidation. These expenses cannot be taken into account, since such an object is not depreciable property ( letter dated November 23, 2011 No. 03-03-06/1/772 ). However, some organizations think differently, and there are court decisions in favor of the taxpayer ( AS NWO of the Russian Federation dated January 22, 2019 No. F07-16106/2018 ).

- Costs paid for another organization ( letter dated 02/08/2019 No. 03-03-07/7618 ).

- Value added tax, which is assessed upon the gratuitous transfer of services or goods. When calculating the tax base, such property, as well as all costs incurred in this regard, are not taken into account ( letter dated November 12, 2018 No. 03-07-11/81021 );

- The organization's loss from debt forgiveness. The Ministry of Finance equates such losses to property transferred free of charge and applies the same approach to them ( letter dated May 22, 2018 No. 03-03-06/1/34203 ).

- Costs for product samples ( letter dated February 22, 2018 No. 03-03-06/1/11485 ).

- Gifts to the company's clients ( letter dated September 18, 2017 No. 03-03-06/1/59819 ).

It will not be possible to take into account in calculating the tax base under OSNO the expenses that are listed in Article 270 of the Tax Code of the Russian Federation . It contains an extensive list, which includes, for example, dividends, advances and deposits, various excess payments to employees, etc.

Tax authorities will interpret the recognition of such expenses as a deliberate understatement of the taxable base.

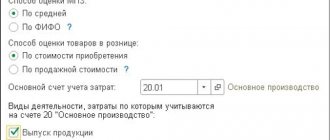

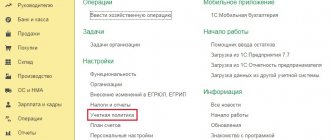

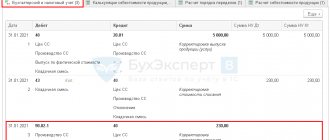

Setting up expense items in 1C:ERP

To reflect the company's expenses, a single mechanism of expense items is used. The composition and parameters of expense items are specified in the list Financial results and controlling - See also - Expense items .

Figure 1 - Access to the functionality of expense items

To highlight a separate cost element, you must use your own expense item, which will be indicated when reflecting the corresponding business transactions. Therefore, when compiling a list of expense items, you need to take into account the requirements of all types of accounting planned for maintenance within the framework of one information base.

For each expense item in the list Financial result and controlling - See also - Expense items on the Main following are indicated:

- group of articles – determines the location of the article in the hierarchical structure of the list, used for ease of searching and using the article;

- type of expenses - determines the target targeting of expenses (for the purchase of goods, warehousing and processing, sale of goods, etc.);

The following values are used as target addressing of expenses (types of expenses):

- expenses for purchasing goods;

- warehousing and handling costs;

- expenses for selling goods;

- production costs;

- formation of the value of non-current assets.

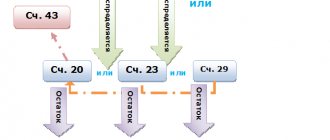

The choice of a specific type of expense determines in the future the available types of expense analytics and options for allocating expenses for the purposes of management and regulatory accounting.

- expenses by activity - determines the attribution of expenses to the main or other activities of the organization;

- distribution option B reg. accounting – sets the settings for reflection in regulated accounting;

- distribution option In ex. accounting – sets the settings for reflection in management accounting;

- expense analytics type – indicates the object (reason) of expenses, used as an independent analytical aspect of expense accounting;

- Checkbox Control filling of analytics - ensures completeness of the source data.

Figure 2 - Creating an expense item

On the Regulated accounting :

- Separate accounting of VAT for expenses allows you to select a method for distributing VAT by type of taxation:

- option refers to the type of taxation of the purchase document , suggesting that the VAT accounting procedure is determined by the type of VAT activity directly in the document. This option is not available for expense items in which the distribution option B reg. accounting is defined as Reflect on production costs ;

- The option Determined by the accounting policy of the organization is available for expense items in which the distribution option B reg. accounting is defined as Reflect on production costs . With this VAT accounting option, if the option Separate accounting of itemized production costs for VAT taxation , then the final type of VAT activity is determined at the time of sale of the products for the production of which the costs were incurred. If this option is disabled, then the VAT accounting procedure is determined by the type of VAT activity directly in the document;

- VAT option , which means that regardless of what type of VAT activity is indicated in the document, VAT will be distributed to different types of activities in proportion to revenue as part of the Month Closing procedure.

- Classification of expenses for tax accounting and accounting purposes. reporting:

- The Accepted for tax accounting for income tax check box determines whether expenses for this item are recognized when calculating income tax;

- for expenses accepted for tax accounting for income tax, depending on their belonging to the main or other activities of the enterprise, it is required to indicate the Type of expenses for the main activity or the Type of expenses for other activities , respectively. The selected value affects the filling of tax accounting registers, income tax returns and financial statements of the organization. In addition, the indication of certain types of expenses determines the classification of expenses as standardized.

- Recognize expenses checkbox determines whether expenses for this item are recognized as expenses when using the simplified taxation system with the taxation object Income minus expenses .

If the organization applying the main taxation system is a payer of the single tax on imputed income (hereinafter referred to as UTII), then it is necessary to indicate the activity under which taxation system the expenses relate.

For expense items with the distribution option Write off to financial result , if expenses cannot be unambiguously attributed to activities with a certain taxation system, the value of OSNO and UTII . Such expenses will be distributed according to the base defined in the accounting policies of the organization.

- Accounting account —specify the default accounting account.

- The hyperlink Set up accounting accounts by organizations and divisions provides a transition for more detailed setting of accounts.

Figure 3 - Creating an expense item. Accounting setup

On the Restriction of use the Restrict use in business transactions checkbox selected , you can specify a list of types of business transactions (according to documents) in which the use of this item is allowed. Using a restriction allows you to reduce the number of user errors when reflecting business transactions and reduces the time for selecting an expense item when filling out.

Figure 4 - Creating an expense item. Setting restrictions

If you need 1C:ERP advisory support, you can contact us in any convenient way. We are also ready to provide 1C:ERP configuration in the cloud.

Recognition of expenses for basic assets

LLC expenses can be taken into account under the general taxation system in two ways.

The first of these is the accrual method, which in practice is often called “shipment-based” accounting. ( Article 272 of the Tax Code of the Russian Federation ). This is the most common accounting option as it can be used by all organizations without restrictions.

With the accrual method, costs are taken into account in the period in which they are incurred, regardless of the transfer of money.

The second method is the cash method, or “on payment” accounting. On the contrary, it depends on the movement of money , because Expenses are recognized in the period in which actual payment is made.

However, the cash method is not available to all LLCs. According to paragraph 1 of Art. 273 of the Tax Code of the Russian Federation, only those companies that:

- over the past 4 quarters, they received revenue of no more than 1 million rubles. in each;

- do not belong to credit institutions;

- do not engage in hydrocarbon production;

- are not controlling persons of foreign companies.

The difference between the two cost recognition methods is easy to understand using the example of payroll accounting.

Example

The employee's salary accrued for October amounted to 50 thousand rubles. At the same time, an advance payment in the amount of 20 thousand rubles. paid in October, and the final payment (30 thousand rubles) - in November. When using the accrual method, all 50 thousand rubles. will be included in the company's expenses for October. And with the cash method in October, only 20 thousand rubles will be written off as expenses, and the remaining 30 thousand rubles. will be included in November costs.

Conclusion

Expenses taken into account when calculating the income tax base on the general taxation system must be confirmed, economically justified and aimed at generating income.

Most LLCs must use the accrual method of accounting for expenses, but some microbusinesses have the right to use the cash method.

To correctly calculate the tax base of an LLC on OSNO, you should carefully study the provisions of the Tax Code of the Russian Federation and the clarifications of the Ministry of Finance to determine whether certain costs can be taken into account. Otherwise, the tax base will be underestimated, which will entail unnecessary attention from the tax inspectorate.

To correctly calculate taxes, fill out reports, and receive expert advice, register in the “My Business” service.