Container accounting

Vasilyev Yu.A., General Director of CG "Ayudar", Ph.D. in Economics, author of the book "Annual Report 2004"

Containers are a rather specific type of inventory, when taking into account some of the subtleties of accounting and tax legislation cannot be ignored . Often an accountant has the following questions: how to correctly account for disposable and returnable packaging? How to reflect the costs of purchasing container materials in tax accounting? How to write off containers that have become unusable? Is it possible to deduct input VAT when purchasing containers? This will be discussed in this article.

Concept of container

Containers are a type of inventory intended for packaging, transportation and storage of products, goods and other material assets. The composition of the container also takes into account materials and parts intended specifically for the manufacture and repair of containers - container materials.

Accounting for packaging is carried out in accordance with the Guidelines for the accounting of inventories ** (hereinafter referred to as the Guidelines).

All types of containers and container materials according to clause 166 of the Guidelines are taken into account:

– on the subaccount “Containers and container materials” of the “Materials” account - by all organizations, except for organizations engaged in trading activities and public catering;

– on the subaccount “Containers under goods and empty” of the “Goods” account – by organizations engaged in trading activities and public catering.

Containers are accepted for accounting at actual cost; only in the case of a significant range of items and a high turnover rate is it allowed to be included in accounting prices. The resulting difference between the actual cost and accounting prices is written off from the accounting accounts (when purchasing containers) or cost accounts (when producing them independently) to financial results as operating expenses.

Containers used as inventory are accounted for depending on their service life on the fixed assets account or on the materials account (sub-account “Containers and container materials”).

Containers can be either disposable (paper, cardboard, polyethylene, etc.) or reusable (wooden, metal, plastic, glass, etc.).

Features of accounting for disposable containers

Disposable packaging is accounted for in accounting and tax accounting at cost excluding VAT. “Input” VAT is accepted for tax deduction in the general manner provided for in Art. 171 and 172 of the Tax Code of the Russian Federation, provided that products subject to VAT are packaged in such containers. The cost of disposable packaging is included in the price of the product and is not paid separately by the buyer. It refers to:

• to the debit of the “Main production” account (that is, included in the production cost of products), if packaging of products in containers is carried out in the production departments of the organization;

• to the debit of the “Sales Expenses” account, if the products are packaged after they are delivered to the finished goods warehouse.

In tax accounting, the cost of written-off packaging is included in material costs based on paragraphs. 2 p. 1 art. 254 of the Tax Code of the Russian Federation as expenses for the purchase of materials used for packaging and other preparation of manufactured and (or) sold goods (including pre-sale preparation). In this case, in accordance with paragraph 1 of Art. 318 of the Tax Code of the Russian Federation, we are dealing with indirect expenses, so they are fully taken into account in the current reporting (tax) period (clause 2 of Article 318 of the Tax Code of the Russian Federation).

However, packaging costs are not always indirect. In any case, this is what the local tax authorities think. Thus, if the packaging of manufactured products is included in the production cycle and is an integral part of it, then we will be talking about the costs of the taxpayer for the acquisition of raw materials and (or) materials used in the production of goods (when performing work, providing services) and (or) forming them basis or being a necessary component in the production of goods (performance of work, provision of services) (clause 1, clause 1, article 254 of the Tax Code of the Russian Federation), which, according to clause 1 of art. 318 of the Tax Code of the Russian Federation are direct expenses and, therefore, are subject to distribution to work in progress, part of unsold finished products and sold products. This point of view was expressed in letters from the Department of Tax Inspectorate for Moscow dated 03/04/03 No. 26-12/13048 and dated 09/15/03 No. 26-12/50798. It makes sense to agree with the tax authorities, especially since the benefit is obvious for the accountant - tax expenses will coincide with accounting expenses (as we noted above, packaging expenses carried out in the production departments of the organization form the production cost of products).

In trade organizations, packaging costs are always considered indirect. After all, direct expenses in trade are considered to be the cost of purchased goods sold in a given reporting (tax) period, and the amount of expenses for the delivery of purchased goods to the warehouse, if they are not included in the purchase price. All other expenses are recognized as indirect and reduce income from sales of the current month (Article 320 of the Tax Code of the Russian Federation).

Features of accounting for reusable containers

Such packaging, as a rule, is subject to mandatory return to the supplier, that is, it is returnable. If the terms of the contract require the receipt of a deposit for the packaging, then it is taken into account both from the supplier and from the buyer, according to the amount of the deposit (deposit prices).

The difference between the price of the collateral and the actual cost of the container is written off in the same way as when keeping records at accounting prices, that is, it is recognized as operating income (expense) and reflected in account 91 “Other income and expenses”.

Example 1.

The wholesale beer sales company Promek LLC purchased 1,000 units. plastic boxes at a price of RUB 82.60. for a total amount of 82,600 rubles, including VAT - 12,600 rubles. The boxes will be used many times (as containers for beer shipped to customers), so Promek LLC has set a deposit price for them of 90 rubles.

When purchasing boxes, the accountant of Promek LLC must make the following entries:

| Debit | Credit | Amount, rub. | |

| Containers were capitalized at deposit prices: (90 rubles x 1,000 pcs.) | 41-3 | 60 | 90 000 |

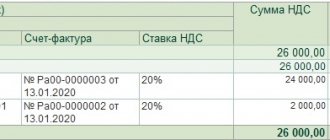

| VAT reflected on capitalized packaging | 19 | 60 | 12 600 |

| “Input” VAT is included in the cost of packaging <*> | 41-3 | 19 | 12 600 |

| STORNO for the amount of “input” VAT | 41-3 | 60 | (12 600) |

| The difference between the deposit price of the container and its actual cost (90,000 - 82,600) rubles is reflected. | 60 | 91-1 | 7 400 |

<*> Why packaging is accounted for together with VAT will be discussed below.

It turns out that, having capitalized the container at the deposit price, part of its value (the difference between the deposit price and its actual value) in accounting must be included in income (expenses) immediately, and the deposit value of the container must be written off as operating expenses when it is worn out (clause 190 Methodical instructions). In tax accounting, reusable packaging based on the actual costs of its acquisition should be reflected in non-operating expenses based on paragraphs. 12 clause 1 art. 265 Tax Code of the Russian Federation. Obviously, this should happen at the moment when it becomes unusable due to natural wear and tear. This fact must be documented by an act drawn up by the relevant commission and approved by the head of the organization or an authorized person (clause 171 of the Methodological Instructions). That is, in accounting and tax accounting, the cost of packaging is written off differently, which will lead to temporary differences. To prevent this from happening, deposit prices for reusable packaging should be set equal to its actual cost.

Accounting with the supplier

When shipping products (goods) in containers recorded at collateral prices, the cost of the container is reflected in the settlement documents (invoice, payment request, payment request-order, etc.) separately at collateral prices and is paid by the buyer in addition to the cost of the products packaged in it ( goods). The following entries must be made in the supplier's accounting:

Debit 76 Credit 10 subaccount “Containers and packaging materials”

or

Debit 76 Credit 41 subaccount “Containers under goods and empty.”

When returning containers, return entries must be made. The specified procedure for accounting for returnable packaging is due to the fact that the same physical object can be repeatedly transferred from supplier to buyer and back. Therefore, the use of sales accounts and settlements with buyers and customers would lead to an unreasonable overestimation of revenue volumes. The Ministry of Finance of the Russian Federation drew attention to this in a letter dated May 14, 2002 No. 16-00-14/177 “Accounting for returnable packaging.”

In accordance with paragraph 7 of Art. 154 of the Tax Code of the Russian Federation, when selling goods in reusable containers that have deposit prices, the deposit prices of this container are not included in the tax base if the specified container is subject to return. Thus, if deposit prices are set for reusable packaging, then its deposit value is not included in the VAT tax base for the sale of goods. Consequently, the packaging is paid to the supplier of goods excluding VAT.

According to Art. 171 of the Tax Code of the Russian Federation, the taxpayer has the right to reduce the total amount of VAT calculated on the basis of Art. 166 of the Tax Code of the Russian Federation, as established by Art. 171 of the Tax Code of the Russian Federation, tax deductions. Tax amounts presented to the taxpayer and paid by him when purchasing goods (work, services) used to carry out taxable transactions are subject to deductions. Since deposit prices for reusable packaging are not included in the VAT tax base, the tax paid to the supplier upon its acquisition is not deductible and is taken into account in the cost of the packaging on the basis of clause 2 of Art. 170 Tax Code of the Russian Federation.

Example 2.

The wholesaler (seller) and the Tatyana LLC store (buyer) entered into an agreement for the supply of beer in the amount of 1,000 bottles at the price

11.80 rub. per bottle, including VAT – 1.80 rubles. Thus, the cost of a batch of beer was 11,800 rubles, including VAT - 1,800 rubles. The actual cost of a batch of beer from the supplier is 8,000 rubles. When delivering beer, plastic boxes were used. Number of boxes – 50 pcs. The deposit price for one box is 90 rubles.

In November 2004, the buyer made an advance payment to the supplier against the upcoming delivery of goods. In the same month, Promek LLC shipped beer to Tatyana LLC, and the store transferred a deposit for the container in the amount of 4,500 rubles to the wholesale company.

The agreement stipulated that the boxes must be returned to the supplier before December 31, 2004.

The container was returned in August.

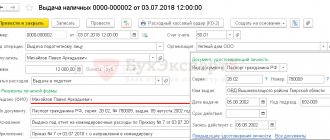

In supplier accounting, you need to make the following entries:

| Debit | Credit | Amount, rub. | |

| November 2004 | |||

| Received advance payment from buyer for goods | 51 | 62-2 | 11 800 |

| VAT accrued on the advance received for payment to the budget | 62-2 | 68 | 1 800 |

| Goods sold to buyer | 62-1 | 90-1 | 11 800 |

| Cost of goods sold written off | 90-2 | 41-1 | 8 000 |

| VAT accrued on goods sold | 90-3 | 68 | 1 800 |

| VAT on a previously received advance was restored | 68 | 62-2 | 1 800 |

| The advance received from the buyer is credited | 62-2 | 62-1 | 11 800 |

| Returnable packaging has been shipped to the buyer | 76 | 41-3 | 4 500 |

| Deposit received for containers | 51 | 62 | 4 500 |

| December 2004 | |||

| Returnable packaging received from buyer | 41-3 | 76 | 4 500 |

| The deposit amount for the packaging was returned to the buyer | 62 | 51 | 4 500 |

What to do if the buyer does not return the container to you? In this case, the amount of the deposit must be included in the financial results as operating income (clause 185 of the Methodological Instructions).

In case of failure to return the container within the established period, ownership of the container will pass to the buyer, and the supplier will have an operation to sell the goods (Article 39 of the Tax Code of the Russian Federation), which will lead to the emergence of an object of VAT taxation (clause 1, clause 1, Article 146 Tax Code of the Russian Federation). In such a situation, in our opinion, the taxpayer has the full right to offset the amounts of “input” VAT on sold packaging that were not previously accepted for deduction, because the packaging will be used in transactions subject to VAT.

Example 3.

We use the data from examples 1 and 2 with the only difference that the buyer - Tatyana LLC - did not return the boxes within the period specified in the contract.

The accountant of Promek LLC must make the following entries on December 31, 2004:

Returnable packaging: documents, accounting and taxes

As a rule, goods (products) are sold to customers in containers, often in reusable returnable containers owned by suppliers. However, a number of points related to its use require clarification. How to ensure the return of reusable packaging? How to avoid losses in case of non-return? How to keep track of returnable packaging from the buyer and how to organize accounting from the supplier? What tax features should be taken into account? Galina Viktorovna Starovoitova answered these and other questions during the online seminar “Returnable packaging: documentation, accounting and taxation.”

In practice, both containers and packaging are used for storing, moving and selling goods (products). What are they, what are their features and how does container differ from packaging?

Definitions of the terms “container” and “packaging” are contained in GOST 17527-2014 (ISO 21067:2007) “Packaging. Terms and definitions", approved. Resolution No. 34 dated 07/07/2015.

Packaging in this document refers to a product designed to house, protect, move, deliver, store, transport and display products (raw materials and finished products), used either by the manufacturer, user or consumer, or by the processor, assembler or other intermediary. Containers also include a packaging element designed to accommodate products <*>.

Thus, the concept of packaging is somewhat broader than the concept of containers. Packaging is a means or a whole set of means that protect goods (products) from any damage. In addition, packaging facilitates the process of transportation, storage and further sale of goods (products). Container is the main element of packaging , usually representing a container for goods (products) , without which they cannot be sold.

Background information In Art. 2 TR CU 005/2011 packaging also recognizes a product that is used for placement, protection, transportation, loading and unloading, delivery and storage of raw materials and finished products.

All packaging can be divided into immediate (primary) and external (secondary). Primary packaging is usually called packaging that has contact with goods (products) <*>. By secondary we mean a package containing one or more primary packages along with other protective materials <*>.

Thus, the TV can be sold to the buyer without using any packaging materials. But, given that it is made from fragile and expensive parts, for safety purposes it is placed in cardboard boxes, first wrapped in plastic wrap (film) and protected with foam plastic. All listed materials are packaging. But, for example, products such as milk (kefir, sour cream) are most often sold in plastic bottles or cardboard boxes (Tetra-Pak, Tetra-Brick, etc.). The mentioned dairy products cannot be sold without such containers, since they are placed in them. According to GOST 17527-2014 (ISO 21067:2007) “Packaging. Terms and definitions" such plastic bottles and cardboard bags are containers. Obviously, storing and moving bottles or bags separately is not very convenient. To facilitate this process, several bottles or cardboard bags are sealed in plastic wrap. This film is considered packaging.

For accounting purposes, the term “container” is used. Moreover, the definition of packaging does not limit its use solely for placing goods (products). Containers are viewed more broadly - as a type of inventory intended not only for packaging , but also for transportation and storage of goods (products). At the same time, depending on the turnover (service life), containers of single use (disposable containers) and multiple use (reusable containers) are distinguished <*>.

Disposable containers , as a rule, are intended for single (one-time) use and are not suitable for reuse. This includes most types of primary (direct) packaging, inseparable from the goods (products) packaged in it. Examples of such containers are cardboard bags, boxes, bottles, tubes, etc.

In general, reusable containers An example of such containers are wooden boxes (barrels, tubs, etc.); boxes made of corrugated and flat cardboard; metal and plastic barrels (boxes, cans), etc.

Despite the fact that the concept of “packaging” is broader than the concept of “container”, in practice they are mixed and often used as synonyms. And for accounting purposes, packaging means any product (type of stock) in which goods (products) are packaged. At the same time, in everyday life, disposable containers are more often called disposable packaging. And containers are called “multi-turn”.

Can disposable containers (packaging) be returnable?

The returnability or non-returnability of the container is determined by the terms of the supply agreement.

Thus, the buyer is obliged to return the reusable packaging to the supplier (seller) , unless, however, otherwise is provided by the supply agreement. Other containers and packaging are returned the supplier only in cases stipulated by the contract <*>.

Reference information Reusable packaging (container) is packaging (container) intended for repeated use <*>.

Thus, as a general rule, the buyer must return the reusable packaging to the supplier, regardless of whether such an obligation is specified in the contract or not <*>. The need to return disposable containers (packaging) arises when the corresponding condition is included in the supply contract.

For example, the product is supplied in cardboard boxes that are not intended for reuse, i.e. do not apply to reusable containers. At the same time, the supplier is interested in their return. In this case, the contract should indicate that cardboard boxes are returnable containers, are not transferred to the buyer's ownership and must be returned to the supplier.

The situation is different with regard to reusable packaging. If the contract specifies that the goods (products) are transferred in reusable containers, such containers are subject to return, even if the condition for return is not provided for in the contract. At the same time, the supplier may decide to transfer the reusable packaging into the ownership of the buyer. In this case, the contract must indicate that the reusable packaging cannot be returned to the supplier and is transferred to the ownership of the buyer.

Note: Due to the properties of the goods (products) packed in it, reusable containers are sometimes prohibited from being reused. For example, paper or wooden containers for pesticides (plant protection products), agrochemicals and mineral fertilizers must be burned <*>. We believe that the buyer may not return such containers.

Please note that when agreeing on the terms for the return of disposable containers (packaging) in the supply contract, it is advisable to also determine the procedure (how to determine it) and the period for its return.

In cases where disposable containers (packaging) must be returned under a supply agreement, its cost is not included in the cost of goods (products) shipped in it and is not paid by the buyer.

At the same time, it would be useful to agree on the cost of returnable packaging in the contract. As a rule, the actual cost of the container or its collateral value is indicated as such. The price agreed upon in this way serves as a guarantee of the return of the container and allows us to determine the amount of damage, including in the event of its non-return. In invoices for shipment of goods (products), the cost of returnable packaging, in this case, disposable returnable packaging, is indicated in a separate line.

Does the legislation of Belarus define a deadline for the return of specific types (types) of returnable returnable packaging, which should be established in the supply contract?

Currently, the deadlines (deadlines) for returning reusable returnable packaging are not established by law.

As a general rule, the buyer is obliged to return to the seller the returnable, returnable packaging in which the goods were received within the period specified by the contract or legislation <*>.

Thus, the parties to the supply agreement are recommended to independently agree on the period during which the buyer must return the reusable returnable packaging to the supplier.

When setting return periods in the contract, you can be guided by the USSR regulations, namely the Rules for the use, handling and return of reusable packaging materials (hereinafter referred to as the Rules for the return of containers) and the Rules for the circulation of returnable wooden and cardboard containers (hereinafter referred to as the Rules for the return of wooden (cardboard) containers), approved . Resolution of the USSR State Supply Committee dated January 21, 1991 N 1 <*>. According to the legal regulations, in general, the period for returning reusable returnable packaging is 30 calendar days from the date of its receipt <*>.

Note: The content of the above rules has largely lost relevance due to changes in both business conditions and socio-economic relations. However, some of their rules can still be applied today. For example, the return period can be calculated from the day of receipt of products and goods in reusable containers from the transport organization, acceptance at the sender's warehouse or at the recipient's warehouse. In some cases, when wholesale trade organizations supply from their warehouses and bases products and goods received by them in reusable packaging from manufacturers, the return period can be extended by 30 days <*>.

If the terms for returning the packaging are not regulated in the contract, the buyer must return it within a reasonable time . And if not returned within a reasonable time - no later than seven days from the date of receipt of a written request from the seller (supplier) for return <*>. A reasonable period is understood as a period of time acceptable to both parties to the supply contract required for the return of the container by the buyer.

We believe that if the supply agreement does not contain conditions on the procedure and (or) timing for returning containers to the seller (supplier), then, to the extent that does not contradict current legislation, you can also be guided by the Rules for the return of containers and the Rules for the return of wooden (cardboard) containers.

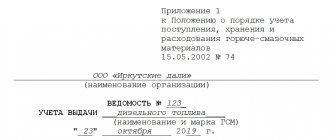

I would also like to note that if an organization uses various types of returnable (reusable returnable) containers (packaging), then it is advisable to approve the procedure for its use, handling and return. These could be rules, instructions, regulations. In such a document, in addition to resolving technical issues regarding the circulation of packaging, it is also advisable to determine what conditions on the types of returnable packaging should be contained in the supply contract, in what order and within what time frame this or that returnable packaging should be returned.

The organization sells goods in reusable returnable packaging, the actual cost of which is 100 rubles. (without VAT). The contract indicates the cost of the container is 110 rubles. (without VAT). What cost of returnable packaging should be reflected in the invoice (TTN, TN) for shipment of products to the buyer? Will it include VAT?

In column 4 “Price, rub. cop.” TTN and TN indicate the unit price of the goods shipped, established by the contract <*>.

In the buyer's accounting, packaging received from suppliers along with goods is reflected at the price stipulated in the contract <*>.

For a supplier of goods, the object of VAT taxation is returnable packaging that is shipped and not returned by the buyer within the period established by the contract (legislation) <*>.

Reference information For the purposes of calculating VAT, returnable packaging is recognized as packaging the cost of which is not included in the selling price of the goods shipped in it and which is subject to return to the seller of the goods under the conditions and within the time limits established by the contract or legislation <*>.

When goods are shipped in returnable containers, the container is not alienated to the buyer and ownership of it is not transferred to him. Therefore, at the time of shipment, VAT on returnable packaging is not calculated and is not presented <*>.

Thus, when shipping goods in returnable containers, the shipping invoice (TTN or TN) reflects the cost of returnable packaging agreed upon in the supply agreement. In our case - 110 rubles. At the time of shipment, VAT is not calculated on the cost of the container and is not presented to the buyer.

The seller ships the products to the Belarusian buyer on pallets. Previously, each unit of product is packaged in film and a certain number of units are placed in cardboard boxes. According to the supply agreement, pallets are reusable returnable packaging, film and cardboard boxes are non-returnable disposable packaging. How to fill out the tabular part of the product section of the TTN?

When filling out the consignment note, you must take into account the terms of the supply agreement and follow the general procedure for issuing invoices (consignment note and consignment note).

In the situation under consideration, the products are shipped on pallets, which, according to the supply agreement, are reusable returnable packaging and must be returned to the supplier. At the same time, the products were pre-packaged in film and cardboard boxes - disposable containers (packaging) that do not need to be returned <*>.

At the time of shipment of products in reusable containers, which are recognized as returnable in accordance with the supply agreement, the container is not alienated to the buyer and the ownership of it is not transferred to him. It turns out that within one shipment, products are transferred that are sold to the buyer, and returnable packaging, which is not sold to the buyer and must be returned.

In this case, the TTN reflects the cost of products and the cost of returnable returnable packaging, indicating their names, in separate lines <*>. Moreover, the cost of products includes VAT, the cost of returnable packaging does not include tax <*>.

The cost of disposable non-returnable containers (packaging), as a rule, is included in the cost of the sold products packaged in it and is not shown as a separate line on the shipping invoice.

Regarding filling out columns 9 and 10 in the goods section of the TTN, which respectively reflect the number of packages and the weight of the cargo, we note the following.

Instruction No. 58, which regulates the procedure for filling out the TTN and TN, does not directly establish how to fill out the named columns in the TTN in the situation under consideration. Organizations determine the appropriate procedure independently, taking into account the fact that, as a general rule, cargo for the purpose of filling out shipping invoices means both products and containers (packaging). Therefore, the TTN indicates the total weight of the cargo, which includes the weight of the product, as well as the weight of containers and packaging (returnable and non-returnable) <*>.

Based on the fact that when products are shipped in returnable containers in the TTN, the products and returnable containers are shown separately, column 10 “Cargo weight” of the product section, we believe, can be filled out in two ways <*>:

1) in the product lines, indicate the total weight of the cargo (gross weight), i.e. the mass of products together with disposable packaging (film and cardboard boxes) and returnable packaging (pallets), and put a dash in the line for returnable packaging;

2) in the lines for products, indicate the mass of the product together with disposable packaging (minus the weight of returnable packaging), and the weight of returnable packaging (if possible) is reflected in the line for returnable packaging.

With any of these methods, the total weight of the cargo (products together with containers (packaging)) in the invoice will be the same.

In our opinion, it is advisable to fill out Column 9 “Number of packages” of the product section of the TTN in any method in the following order: indicate the number of packages occupied by returnable containers (pallets) in the lines for products, and put a dash in the line for returnable containers.

It would not be superfluous to reflect in the TTN information about the return of pallets with reference to the corresponding clause of the supply agreement. This can be done in column 11 of line for returnable packaging.

The organization purchased containers from the manufacturer for packaging (packing) goods. It was delivered by a transport company. Can an organization attribute delivery costs to the increase in packaging costs?

Purchased containers (except for containers received with delivered products) are accepted for accounting at actual cost . The latter consists of all costs for the purchase and delivery of containers minus VAT <*>.

Organizations engaged in trade and trade-production activities, containers purchased for packaging goods (products) are accounted for in subaccount 41-3 “Containers under goods and empty” of account 41 “Goods”, all other organizations - in subaccount 10-4 “Containers and containers” materials" account 10 "Materials" <*>.

Thus, the costs of delivering containers are included in the increase in its cost and are reflected in subaccount 10-4 (41-3).

For example, the cost of purchased packaging is 960 rubles. (including VAT - 160 rubles). Delivery costs are 240 rubles. (including VAT - 40 rubles). The debit of subaccount 10-4 (41-3) in correspondence with the credit of account 60 “Settlements with suppliers and contractors” reflects the cost of packaging purchased externally, 800 rubles. (960 – 160) and the cost of its delivery is 200 rubles. (240 – 40). The actual cost of the container is 1000 rubles. (800 + 200) <*>.

The VAT amounts presented by the container manufacturer (160 rubles) and the transport company (40 rubles) are shown in the debit of account 18 “Value added tax on purchased goods, works, services” and the credit of account 60 <*>

What is container

Containers are the main element of the packaging complex for goods, designed to preserve commercial quality during movement, storage and sale of products.

REFERENCE! The Italian word "tara" comes from the Arabic "tarha", which means "something thrown away."

The terms “container” and “packaging” do not duplicate each other, despite the fact that the Guidelines for accounting of inventories, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n, call containers “outer packaging.” GOST 17527-2003 “Packaging: terms and definitions” directly calls not to consider them synonymous.

According to legislative clarifications, containers differ from packaging in that without containers, products in principle cannot be sold, while packaging only facilitates this process and makes it more convenient.

FOR EXAMPLE. The washing machine can theoretically be delivered to the store and to the consumer without any additional work with it. However, since it is expensive, and the appearance of the product may be damaged during transportation, the body and its elements are protected with a cardboard box, foam pads, and plastic film. All this is packaging.

Lemonade cannot be sold without some kind of container in which it is placed when bottling. A plastic or glass bottle will be a container, and a film in which 6 bottles or a box are packed at once will be a package.

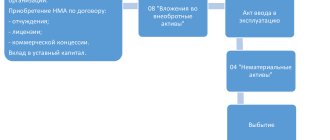

Purchase of containers for a fee

If the organization purchased containers for a fee (under sales, delivery, exchange agreements), take into account its receipt at the actual cost.

Reflect the receipt of containers at actual cost using the following entries:

Debit 10-4 Credit 60 (76, 75-1…)

– containers are capitalized at actual cost;

Debit 19 Credit 60 (76)

– VAT on purchased packaging is taken into account.

Determine the actual cost of the purchased packaging based on the data from the primary documents.

Such rules are established in the Instructions for the chart of accounts, paragraphs 5 and 6 of PBU 5/01, paragraph 62 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n.

Situation: does the supplier need to include input VAT in the actual cost of packaging purchased for packaging its own products?

Yes, it is necessary if the organization plans to use the container as returnable.

In accounting, the actual cost of packaging received under paid contracts is recognized as the cost of its acquisition (clause 63 of the Methodological Instructions, approved by Order of the Ministry of Finance of Russia dated December 28, 2001 No. 119n, clause 6 of PBU 5/01). The actual cost is also formed by input VAT, the cost of which is not reimbursed from the budget.

When selling products in returnable containers, VAT is not charged on the cost of such containers, since in this case there is no sale (Article 146 of the Tax Code of the Russian Federation). This means that input VAT paid to the container supplier cannot be deducted (clause 2 of Article 170 of the Tax Code of the Russian Federation).

Thus, if the organization plans to use the purchased packaging as returnable, include input VAT in the actual cost of such packaging. In other cases, do not take into account input VAT when determining the actual cost of received packaging.

In accounting, record the receipt of packaging that the organization plans to use as returnable by posting:

Debit 10-4 Credit 60 (76, 75-1…)

– containers are capitalized at actual cost (including input VAT).

Such rules are established in the Instructions for the chart of accounts.

Container classification

Containers are divided into types for several reasons:

- Application in the production process:

- containers that are used in the technological process itself;

- containers for warehouse storage;

- container for placing goods sold in it.

- According to the material of manufacture:

- metal;

- cardboard;

- glass;

- polyethylene;

- plastic;

- ceramic;

- fabric, etc.

- By form:

- bottles;

- boxes;

- barrels;

- boxes;

- banks;

- packages;

- canisters;

- flasks;

- tubes;

- bags, etc.

- By purpose:

- consumer – the one in which the product reaches the final buyer (can be individual or group);

- production - containers used for storing raw materials and product elements, as well as for moving them within production;

- transport – to facilitate transportation and storage (can be small or large);

- special (preservative) - to ensure the safety of products.

- By frequency of use:

- one-time;

- multi-turn (return);

- special - is part of the product itself, equipment for it.

IMPORTANT! When they talk about the type of container, they most often mean its shape, and when they talk about the type of container, then the material.

Nuances of accounting for returnable packaging

Possible accounting difficulties are caused by the special status of returnable packaging: despite the fact that it is delivered to the buyer along with the goods, the ownership of it remains with the seller. An important point that determines accounting is the classification of reusable containers into different types of assets:

- material and production inventories;

- fixed assets.

Accounting for returnable packaging as stock

It is possible to register returnable containers as inventories in accounting if their useful life does not exceed 1 year or one operating cycle (if it exceeds 12 months).

To reflect transactions with such containers, the following are used:

- account 22 “Low value and wearable items”;

- subaccount 10.4 “Containers and packaging materials” - for warehouse and in-production storage and movement;

- subaccount 284 “Containers for goods” - mainly used by trading enterprises.

Accounting for returnable packaging as a main means of production

If the period of use of the container is greater than 12 months, and the cost is included in the limit established for the fixed assets, it falls under the definition of a fixed asset and should be recorded in the corresponding account 115 “Non-current assets”. Like all fixed assets, it is subject to depreciation and subsequent write-off.

Accounting for containers at the supplier

The supplier gives the container along with the goods, retaining ownership of it. In the receipt documents, a separate line is allocated to account for the cost of purchasing such containers; it is not added to the cost of other inventories, but is calculated at net realizable value. When it arrives with the goods, it will have a separate line on the delivery note or invoice.

Stock containers are recorded on account 41 “Containers under goods and empty,” and special containers are recorded on account 01 as fixed assets.

Accounting for containers from the buyer

The safety of returnable packaging and its return can be guaranteed by the text of the contract; in this case, no deposit is required, but sanctions for damage or loss of packaging are stipulated. This procedure will have to be taken into account in off-balance sheet account 002 “Inventory and materials accepted for safekeeping.”

The buyer who has paid a deposit for returnable packaging undertakes to return it to the seller in undamaged condition, after which he will receive the deposit amount back. This procedure is subject to accounting on balance sheet accounts 10 “Container” (if the goods arrived for your own use) and 41 “Container under the goods” (if resale is planned).

Example of posting dynamics of returnable packaging

Uchkuduk LLC entered into 2 agreements:

- Agreement for the supply of lemonade for its subsequent resale to the consumer. Lemonade in glass bottles is in plastic boxes of 6 pieces. The boxes are multi-return containers, for non-return of which there is a fine of 5,000 rubles. – reimbursement of the cost of boxes.

- Agreement for the supply of drinking water for employees of Uchkuduk LLC. Water cans are provided by the supplier on a returnable basis with a deposit of RUB 2,000.

Postings regarding containers under Contract 1, made by Uchkuduk LLC (buyer):

- debit 002 “Inventory and materials accepted for safekeeping” – 5,000 rubles. – plastic boxes in which lemonade is supplied are accepted;

- credit 002 – 5,000 rub. – plastic boxes are returned to the supplier.

Postings regarding containers under Contract 1, made by Zhazhda LLC (seller):

- debit 62 “Settlements with buyers and customers”, credit 41 “Container” - 5,000 rubles. – plastic boxes containing bottles of lemonade were handed over;

- debit 41 “Containers”, credit 62 “Settlements with buyers and customers” – 5,000 rubles. – plastic boxes were returned by the buyer.

Postings regarding containers under Contract 2, made by Uchkuduk LLC (buyer):

- debit 76 “Settlements with various debtors and creditors”, credit 51 “Settlement accounts” - 2,000 rubles. – a deposit has been paid for drinking water cans;

- debit 10 “Container”, credit 76 “Settlements with various debtors and creditors” - 2,000 rubles. – received canisters of drinking water;

- debit 76 “Settlements with various debtors and creditors”, credit 10 “Container” - 2,000 rubles - drinking water cans were returned to the supplier;

- debit 51 “Current accounts”, credit 76 “Settlements with various debtors and creditors” - 2,000 rubles. – deposit amount received for water canisters.

Postings regarding containers under Contract 2, made by Zhazhda LLC (seller):

- debit 51 “Current accounts”, credit 62 “Settlements with buyers and customers” – 2,000 rubles. – a deposit was accepted for drinking water cans;

- debit 62 “Settlements with buyers and customers”, credit 41 “Container” - 2,000 rubles. – canisters of drinking water were handed over to the buyer;

- debit 41 “Container”, credit 62 “Settlements with buyers and customers” – 2,000 rubles – drinking water cans were returned;

- debit 62 “Settlements with buyers and customers”, credit 51 “Settlement accounts” - 2,000 rubles. – the deposit amount for water canisters has been returned.

Features of accounting for collateral containers

For some types of reusable packaging, according to the contract, the supplier may charge the buyer a deposit (instead of the cost of the container). Collection of a deposit for packaging is carried out in cases provided for in contracts and is a means of ensuring the buyer’s obligation to return the packaging.

The terms of the agreement may also provide for additional sanctions for failure to fulfill obligations to return the deposit container.

If the reusable packaging is returned to the supplier within the period stipulated by the contract, its deposit value is returned to the buyer or is counted, by agreement of the parties, to pay off the buyer's debt for goods already supplied or as an advance for future deliveries of goods.

If the container is not returned to the supplier within the terms stipulated by the contract, ownership of it passes to the buyer and the deposit value of the container is not returned to him.

In this case, the supplier must reflect the deposit value of the container as proceeds from its sale and charge VAT.

The amounts of the received (paid) collateral are reflected in account 76 “Settlements with various debtors and creditors” in correspondence with the cash accounts (both for the supplier and the buyer).

Accounting for collateral containers from the seller

The owner of returnable containers shipped to the buyer is the supplier. This container is not sold to the buyer, but is transferred to him for temporary possession and use.

After shipping the container to the buyer, the supplier does not write it off from his balance sheet, but must record the fact of this shipment, i.e. credit account 41.3. The question arises: which account should be debited? Some authors suggest using account 45 “Goods shipped” for this purpose. However, the instructions for using the chart of accounts indicate that account 45 “is intended to summarize information on the availability and movement of shipped products (goods), the proceeds from the sale of which cannot be recognized in accounting for a certain time...”. It follows that there will eventually come a time when this revenue will be recognized. One of the conditions for recognizing revenue in accordance with clause 12 of PBU 9/99 “Income of the organization” is the transfer of ownership from the seller to the buyer. However, this transition usually does not occur and, therefore, it is unlawful to use the score 45 in this case. In our opinion, the movement of returnable packaging (shipment to the buyer, return by the buyer) should be reflected within the account in which the deposited packaging is accounted for (for example, in separate sub-accounts: “Containers shipped to customers” and “Containers in warehouse”).

Clause 182 of the guidelines for accounting for inventories states that reusable packaging, for which deposit amounts are established in accordance with the terms of contracts, is accounted for at these amounts (hereinafter referred to as deposit prices). The difference between the actual cost of the container and its deposit price is taken into account by the supplier in the financial performance accounts as operating income and (or) expenses.

Main accounts:

Debit 41 subaccount 3 “Containers shipped to customers” Credit 41 subaccount 9 “Containers in warehouse” - shipment of containers to the buyer;

At the same time, in order to receive on account 62 “Settlements with buyers and customers” the total amount of the buyer’s debt (for shipped goods and the deposit for the packaging) for the collateral value of the packaging, the following entry should be made:

Debit 62 “Settlements with buyers and customers” Credit 76 “Settlements with various debtors and creditors” Debit 51 “Settlement accounts” Credit 62 “Settlements with buyers and customers” - receiving money from buyers for goods and the collateral value of containers; Debit 41 subaccount 9 “Containers in warehouse” Credit 41 subaccount 3 “Containers shipped to customers” - receipt of returnable packaging from the buyer; Debit 76 “Settlements with various debtors and creditors” Credit 51 “Settlement accounts” - return to the buyer of the deposit for packaging; Debit 76 “Settlements with various debtors and creditors” Credit 62 “Settlements with buyers and customers” - offset of the deposit for packaging to pay off the buyer’s debt for goods already delivered or as an advance for future deliveries; Debit 76 “Settlements with various debtors and creditors” Credit 91 subaccount 1 “Other income” - for the cost of collateral containers not returned by the buyer;

At the same time, a record is made:

Debit 91 subaccount 2 “Other expenses” Credit 41 subaccount 3 “Containers shipped to customers” Debit 91 subaccount 2 “Other expenses” Credit 68 “Calculations with the budget” - VAT is charged on the packaging sold.

In this case, the supplier must issue an invoice to the buyer for the amount of VAT.

Accounting for non-returnable packaging

Accounting. If the cost of disposable packaging is already taken into account in the purchase price of the property received in it, then it is not reflected separately in accounting. 162 Guidelines, approved. By Order of the Ministry of Finance dated December 28, 2001 No. 119n (hereinafter referred to as the Directives).

But if you purchase such containers separately from the property (in the supplier’s invoice its cost is highlighted as a separate line), then the following entries are made.

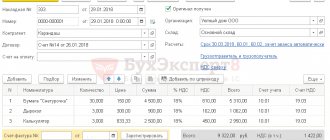

| Dt | CT | |

| The cost of packaging increases the actual cost of the goods received in it. | 08 “Investments in non-current assets”, 10 “Materials”, 41 “Goods” | 60 “Settlements with suppliers and contractors” |

| VAT is reflected on purchased packaging | 19 “VAT on purchased assets” | 60 “Settlements with suppliers and contractors” |

| Accepted for VAT deduction | 68 “Calculations with the budget”, sub-account “VAT” | 19 “VAT on purchased assets” |

However, reusable packaging can also be non-returnable. Accounting for such packaging (if its cost is highlighted in the documents) will depend on how you intend to use it in the future.

| Situation | Dt | CT |

| If the container is sold together with the goods received in it, then by its cost you increase the cost of the goods received at the warehouse. 5, 6 PBU 5/01 | 41 “Goods”, subaccount “Goods in warehouses” | 60 “Settlements with suppliers and contractors” |

| If the container is sold separately from the goods received in it, sub. “a” clause 178 of the Instructions, then you accept it for accounting as an independent product at the prices indicated in the delivery note | 41, subaccount “Containers under goods and empty” | 60 “Settlements with suppliers and contractors” |

| The container will be used for your own needs | 10 “Materials”, subaccount “Containers and packaging materials” | 60 “Settlements with suppliers and contractors” |

VAT. Input VAT on packaging purchased separately from property is deductible subject to the following conditions of Articles 171, 172 of the Tax Code of the Russian Federation:

- the container has been accepted for accounting;

- the container will be used in transactions subject to VAT;

- The supplier has issued an invoice.

Income tax. Tax accounting also depends on how you intend to use the container in the future.

| Situation | Tax accounting | |

| The container (both highlighted and not highlighted in the invoice as a separate line) will be sold along with the property received in it | The cost of packaging is taken into account in the purchase price of the property received by NAP. 1 tbsp. 268 Tax Code of the Russian Federation | |

| Container paid in excess of the cost of the property packed in it and highlighted in the invoice as a separate line |

| Expenses for the purchase of containers are recognized at the time of sale of containers. 1 clause 1 art. 254, para. 1, 2 tbsp. 318 Tax Code of the Russian Federation |

| Expenses on packaging are recognized when the container is transferred into operation (for example, when the container is transferred from a warehouse to production) p. 1 tbsp. 254, para. 1, 2 tbsp. 318 Tax Code of the Russian Federation | |

What refers to containers in accounting?

Container is a packaging element intended for placing products (clause 3.2.24 of GOST 17527-2014, introduced by order of Rosstandart of the Russian Federation dated September 5, 2014 No. 1004-st).

According to Art. 481 of the Civil Code of the Russian Federation, the supplier must transfer the goods to the buyer in containers or packaging (unless otherwise provided by the contract). An exception is made for goods that do not require packaging. The previously valid GOST 17527-2003 specified the following types and types of containers:

- open;

- closed;

- standard;

- individual;

- returnable;

- multi-turn, etc.

In the current GOST 17527-2014, the main term used is “packaging”. The types of containers that were in the previous GOST 17527-2003 now refer to packaging. In business, both terms are used.

Types of containers are not mutually exclusive: for example, containers can be reusable, but non-returnable. The type and type of packaging, the procedure for its inclusion in the price and calculations for packaging are prescribed in the terms of the contract.

There is another definition of container - a type of goods intended for packaging, transportation and storage of finished products, goods and other material assets.

In accounting, containers are reflected in subaccounts in accordance with the type of material from which they are made: wood, cardboard or paper, glass, woven, metal, plastic.

The packaging includes parts used for its manufacture and repair: rivets and iron hoops for barrels, bottle caps, etc.

Single-use packaging is included in the cost of production and is not paid separately (clause “d” clause 3, clauses 9, 10, clause “a” clause 11, clause “a” clause 12 FSBU 5/2019) . The buyer either returns multiple containers to the supplier or keeps them. To guarantee the return of reusable packaging, the supplier may take a deposit from the buyer for it. Such containers are called collateral, and the amount of the collateral itself, the procedure for its payment and subsequent return are stipulated in the contract.

ConsultantPlus experts explained how to formulate wording in a supply agreement regarding the deposit price of returnable packaging. To do everything right, get a trial demo access to the K+ system and go to the Trade Guide for free.

The supplier takes into account the containers that he will use for packaging goods and materials at the actual cost. In rare cases (huge product range and a large number of operations with containers), containers can be accounted for at accounting prices.

The purchased containers and packaging materials for packaging goods and materials are taken into account:

- companies from the trade and catering sector - on subaccount 3 of account 41 “Containers under goods and empty”;

- manufacturing companies using containers for packaging their own finished products - on subaccount 4 of account 10 “Containers and packaging materials” of the Chart of Accounts (approved by order of the Ministry of Finance of the Russian Federation dated October 31, 2001 No. 94n).

However, in some situations, containers should be taken into account in the balance.

No price? Come at market price

If the cost of reusable non-returnable packaging is included in the cost of the property received in it and is not indicated in the receipt documents, and you intend to use this container in the future (for example, to sell separately from the received goods), then the cost of the container must be separated from the cost of the acquired property. 3 tbsp. 254 Tax Code of the Russian Federation. In this case, the container is accounted for at market value, and the acquired property is taken into account at its cost reduced by the cost of the container.

You determine the market value of the container yourself on the date it was accepted for accounting. A guideline can be suppliers' prices for a similar type of container (you can get information on prices from the Internet) para. 2 clause 9 PBU 5/01. You record the market value in a report drawn up by the inventory commission and attach supporting documents to it. Here is an example of filling out such an act.

| LLC "Era", Moscow, st. Svobody, 13 organization, address | |

| warehouse structural unit | |

| Provider | LLC "DonPoddon", Moscow, |

| st. Leskova, 26, tel. 206-76-76 name, address, telephone number | |

I APPROVED

| CEO position | |

| (signature) | S.Yu. Lykov (signature transcript) |

"28" April 2014

Act on the receipt of packaging No. 18 dated April 28, 2014.

This act was drawn up by the commission in connection with the posting of packaging received on the supplier’s account without a price: delivery note No. 10/171 dated 04/25/2014, invoice 1136 dated 04/21/2014.

| Name of container | Unit | Quantity | price, rub. | Amount, rub. | Note |

| 1 | 2 | 3 | 4 | 5 | 6 |

| Metal container, used, GOST 14861-86 | PC. | 10 | 3000,00 | 30 000,00 | The price is determined as the average market value. Price lists are attached |

| Metal box, used, GOST 554454-25 | PC. | 5 | 2500,00 | 12 500,00 |

| Chairman of the Commission | CEO | S.Yu. Lykov | |

| job title | signature | full name | |

| Members of the commission: | Chief Accountant | N.I. Kulakova | |

| job title | signature | full name | |

| head of administration office position | signature | S.G. Konaikin decryption of signature | |

| Tara accepted | storekeeper position | signature | E.I. Makarov signature decoding |

Returnable packaging

Contractual issues

The contract must provide for the following points regarding returnable packaging.

Return period for containers. If the contract for returnable packaging specifies the return period, then there is no problem. But the lack of such information may lead to disputes with the supplier in the future.

Deposit value of containers. You pay it upon receipt of the goods. The supplier will return the deposit price to you after you return the container to him. If the container is not returned, the deposit value will remain with the supplier. If the contract did not establish a security deposit for the packaging, you will compensate the supplier for the cost of the unreturned packaging at market prices. 15 Civil Code of the Russian Federation.

Other ways to ensure the return of packaging. The agreement may also establish penalties (forfeits, fines, penalties), for example, for returning containers later than the deadline established by the agreement, etc. 1 tbsp. 330 Civil Code of the Russian Federation

Who bears the additional costs of returnable packaging? These may include the costs of delivering the containers back to the supplier. 517 of the Civil Code of the Russian Federation, for its cleaning and repair. The contract must indicate who will bear these costs - the supplier or the buyer.

Accounting for returnable packaging

Since returnable packaging is in your temporary use, it can be accounted for in off-balance sheet account 002 “Inventory assets accepted for safekeeping.”

If for some reason you do not return the deposit container to the supplier, then the deposit value will remain with him, and the container will remain with you. 185 Instructions:

- <or> upon expiration of the return period established in the contract for the supply of property;

- <or>on the date established by written agreement (additional agreement concluded, by correspondence).

Let's look at the procedure for accounting for collateral containers using an example.

Example. Accounting for collateral containers from the buyer

/ condition / The supplier handed over 40 boxes of goods to the buyer at a deposit price of 500 rubles for the boxes. a piece. The buyer returned only 30 boxes to the supplier, by agreement of the parties he kept 5 boxes for use for his own needs, and another 5 were broken due to the fault of the employee.

/ decision / The buyer makes such entries in accounting.

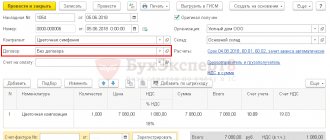

| Dt | CT | Amount, rub. | |

| Deposit containers have been accepted for accounting (at the deposit price) (40 pcs x 500 rubles) | 002 “Inventory and materials accepted for safekeeping” | 20 000 | |

| The collateral value was transferred to the supplier | 76 “Settlements with various debtors and creditors”, subaccount “Pledge” | 51 “Current account” | 20 000 |

| The container was returned to the supplier (at the deposit value) (30 pcs. x 500 rub.) | 002 “Inventory and materials accepted for safekeeping” | 15 000 | |

| Received money for returned containers | 51 “Current account” | 76, subaccount “Deposit” | 15 000 |

| Containers written off balance that were not returned to the supplier (10 pcs. x 500 rub.) | 002 “Inventory and materials accepted for safekeeping” | 5 000 | |

| Containers intended for further use have been accepted for balance (5 pcs. x 500 rub.) | 10 “Materials”, subaccount “Containers and packaging materials” | 76, subaccount “Deposit” | 2 500 |

| The amount of loss from damage to containers is included in settlements with the employee (5 pieces x 500 rubles) | 73 “Settlements with personnel for other operations”, subaccount “Settlements for compensation of material damage” | 76, subaccount “Deposit” | 2 500 |

The supplier must reimburse you for additional expenses that you incur in connection with the use of returnable packaging, unless otherwise provided by the contract. This is reflected in accounting as follows.

| Dt | CT | ||

| Costs associated with delivery (repair, cleaning) of containers are reflected |

| 60 “Settlements with suppliers and contractors” | 10 “Materials”, subaccount “Containers and packaging materials”, 69 “Calculations for social insurance”, 70 “Settlements with personnel for wages” |

| 76 “Settlements with various debtors and creditors” | ||

| Received money from the supplier for delivery (repair, cleaning) of containers | 51 “Current account” | 60 “Settlements with suppliers and contractors” | |

If the container breaks down due to your fault, and the supplier repaired it, you will compensate him for the expenses incurred.