What does electronic sick leave mean for an employer?

Sick leave is the basis for the appointment and payment of benefits for temporary disability or pregnancy and childbirth (Part 5 of Article 13 of the Federal Law of December 29, 2006 No. 255-FZ). A certificate of incapacity for work can be issued either on paper or electronically.

What should an employer do with electronic sick leave in 2021?

Employers using electronic sick leave do not need to ensure the safety of sick leave certificates. After all, all information from the moment the electronic certificate of incapacity is opened is stored in the Social Insurance Fund system, and the employer can request it repeatedly. And when the FSS conducts an inspection of the employer, there will be no need .

To start working with electronic sick leave, you need to enter into an agreement with the Social Insurance Fund. And only in this case, and also with the employee’s consent, can electronic sick leave be accepted (clause 2 of the Rules, approved by Decree of the Government of the Russian Federation of December 16, 2017 No. 1567).

New rules for issuing and processing sick leave in 2021

The Russian Ministry of Health published order No. 925n dated September 1, 2020 “On approval of the procedure for issuing and processing certificates of incapacity for work, including the procedure for generating certificates of incapacity for work in the form of an electronic document” (registered with the Ministry of Justice of Russia on September 14, 2020 No. 59812). The document came into force on December 14, 2020.

Officials have simplified the issuance of sick leave in the face of the threat of the spread of dangerous diseases, in particular the flu epidemic or COVID-19. They legalized the remote issuance of electronic certificates of temporary disability using telemedicine technologies. This means that the doctor and the patient will be able to chat via messenger or by phone or conduct a video conference to establish the diagnosis and disability of the patient. When applying remotely, it is allowed to issue even long-term maternity leave for pregnancy and childbirth.

Almost all doctors’ sick leave certificates were required to be filed as an electronic file. If necessary, they are allowed to be duplicated on paper. In the future, the Russian Ministry of Labor plans to completely abandon paper sick leave. But as an exception, they will be saved for:

- unemployed people who need to confirm a valid reason for their next failure to appear at the employment service at the appointed time;

- pregnant women who have lost the status of individual entrepreneur, lawyer or notary, as well as those dismissed due to the liquidation of the employing organization.

It has become possible to issue sick leave to parents of children attending kindergarten for the entire period of the declared quarantine, without the need for intermediate visits to the doctor. This opportunity is not provided for parents of schoolchildren.

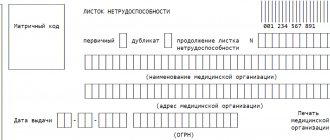

What does an electronic certificate of incapacity for work look like?

What does electronic sick leave look like in 2022? Where can I see the photo?

The form of electronic and paper certificates of incapacity for work is essentially the same . The form of the certificate of incapacity for work was approved by order of the Ministry of Health and Social Development dated April 26, 2011 No. 347n. And the procedure for generating electronic certificates of incapacity for work is by order of the Ministry of Health of Russia dated September 1, 2020 No. 925n. It’s just that the electronic sick leave is issued in the form of a file , and not on paper.

How a doctor fills out a certificate of temporary incapacity for work

The first section of the form is filled out by the attending physician or other responsible employee of the medical organization. We will indicate special points on how a medical worker fills out a sick leave form.

The first stage: the doctor makes a note about which document is being issued - the primary or duplicate. Let us remind you that if the doctor made a mistake and violated the procedure for filling out the sick leave, then instead of the form with the error, a new document should be issued, that is, a duplicate.

After this, the health worker enters the following information:

- Information about the initial certificate of incapacity for work if the LN is extended.

- Name of the medical institution (short if available), location address and OGRN.

- Date of issue of the document to the patient.

- FULL NAME. the patient and his date of birth. Middle name is indicated if available.

- The name of the organization in which the patient works (written in his words).

- Type of employment: at the main place of work or part-time.

- Special information about the disability case (if any).

- Information about the duration of the illness, full name. and the position of the doctor, his signature.

- The date from which the patient must begin performing his work duties.

A correctly executed sick leave certificate is certified by the seal of the medical institution and only then issued to the patient. The paper document is handed over to the employer through the employee. This is what a sick leave certificate looks like in 2022 with stamps, photo from the Internet:

When will electronic sick leave be issued in 2022, and when will paper leave be issued?

Sick leave in electronic form is issued at the request of the person. To do this, he writes consent to receive a certificate of incapacity for work electronically. There is no obligation - no .

The electronic sick leave is certified with an enhanced qualified electronic signature and placed in the FSS information system - the Unified Integrated Information System "Sotsstrakh". Paper equivalent - not issued .

Read more about this on the official website of the FSS here.

To receive a sick leave certificate in electronic form, the medical organization and the employer must be participants in the Sotsstrakh information interaction system.

The employee can find out whether the employer is connected to this system from the accounting or human resources department.

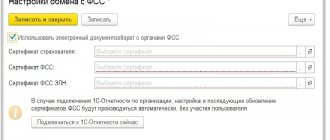

To connect to the Social Insurance system, employers can use their own modified software, as well as the policyholder’s personal account.

Electronic sick leave certificates in 2022 - how it works

This system functions if the parties - the medical institution and the employer - both participate in information cooperation and exchange information to generate an electronic sick leave.

| Advice To participate in such interaction, the employer can use its own adapted software or log into the policyholder’s Personal Account located at https://esia.gosuslugi.ru. |

You will need the employee's personal identification number and SNILS number. Login to the FSS personal account for filling out electronic sick leave is carried out through the Unified Identification and Autonomous Information System.

What is electronic SNILS and why is it needed? This is what our material is about.

| Advice To view their electronic sick leave, the employee needs to go to the page https://lk.fss.ru. To log into your FSS personal account, enter the data used for the State Services website. |

Step-by-step preparation of an electronic sick leave certificate

From the employee's side:

- gives consent to the medical organization to issue an electronic sick leave in writing;

- the clinic/hospital receives an electronic slip number in the Social Insurance system;

- the doctor issues a sick leave certificate electronically and informs the employee of its number;

- after the end of the period of incapacity, the employee informs the manager or human resources department of the document number.

There is no difficulty in how to obtain an electronic sick leave certificate for an employer in 2022; for this you need:

- in the Social Insurance system, enter the employee’s electronic book number and SNILS, a field will open for entering data about the policyholder and calculating the payment;

- Sign the completed document with an electronic signature and save;

- the data is automatically transferred to the FSS.

| Important! To work with the electronic sick leave certificate, you do not need to specifically learn how to print an electronic sick leave certificate - all work is done in the system, the document is stored in the Social Insurance Unified Information System and has the same legal force as a traditional paper one. |

In order for an employer to correctly interact with the Social Insurance Fund system and medical organizations, it is necessary to correctly configure the technical capabilities:

- obtain a qualified electronic signature;

- conclude an agreement with the territorial office of the Insurance Fund on information interaction;

- select and install software for working with electronic sick leave certificates in your personal account or from special programs;

- notify employees about the possibility of providing electronic sick leave.

How to fill out an electronic sick leave certificate for an employer:

- enter information about the organization (name, registration number in the Social Insurance Fund);

- enter the TIN, SNILS, date of employment, length of insurance, period of illness of the employee;

- calculate the amount of benefit;

- certify with an electronic signature;

- save.

The entered data is stored in the Social Insurance Fund system. Employers gain access to electronic sick leave through certain software. This may be the policyholder’s personal account on the FSS website.

| , "Compass-SPb", "Tensor" (SBIS), "SKB "Kontur", "PARUS" ensures communication of all actors in the formation of electronic sick leave directly from software products. |

Since 2022, the FSS project “Direct Payments” has been extended to all regions of Russia (No. 401-FZ dated November 30, 2016). Now employers must pay only the first 3 days of sick leave, the rest is paid by the Social Insurance Fund directly to the employee.

What does an electronic sick leave sheet look like?

In terms of the number of fields to fill out, the electronic book is no different from a paper one. This is what the field for the employer to fill out looks like.

1.

2.

The medical institution issues the employee an electronic sick leave number printed on the coupon. The employee reports this number to the accounting department or human resources.

The employee reported that he has an electronic sick leave: what should the employer do?

If the sick leave is generated electronically, the employer will receive from his employee only the number of the electronic certificate of incapacity for work. information from the Social Insurance system about the issued certificate of incapacity for work.

The employer cannot find out the specific diagnosis from the certificate of incapacity for work. The sheet contains only the code. It will also not be possible to view sick leave certificates that the employee received while working for other employers.

Since 2022, the FSS pilot project “Direct Payments” has been extended to all regions of Russia (Federal Law No. 401-FZ dated November 30, 2016). This means that employers must continue to pay only :

- the first 3 days of sick leave;

- additional days off to care for a disabled child;

- funeral benefit.

The FSS pays the rest of the benefits itself .

In 2022, an electronic sick leave benefit must be assigned for temporary disability and maternity leave within 10 calendar days from the date the employee applies with an electronic sick leave number. And the payment of benefits must be made on the day closest to the date established for the payment of wages .

If an employee brings an electronic sick leave certificate, and the employer has not switched to electronic interaction with the Social Insurance Fund, the employee will be asked to replace the electronic certificate of incapacity for work with a paper one.

Previously, a register of information was transferred to the FSS for calculating benefits by offset. It also indicated in what form the sick leave certificate was received from the employee - paper or electronic.

KEEP IN MIND

In 2022, FSS employees called organizations and demanded that they switch to electronic sick leave as soon as possible. However, the employer has the right to refuse to use electronic sick leave. This rule applies to all companies.

If the employer does not want to deal with electronic sick leave, you do not have to connect to the Unified Integrated Information System of the Social Insurance Fund “Sotsstrakh”. Then employees will continue to be issued sick leave on paper. And even if the medical institution issues an electronic form to the employee, he will have to return for a paper form. This does not threaten the employer in any way (FSS letter dated 08/11/2017 No. 02-09-11/22-05-13462).

What information must be filled out by the employer on the sick leave certificate?

The sick leave certificate is filled out by the employer taking into account the rules provided for in paragraphs 73 and 74 of Order of the Ministry of Health of Russia dated September 1, 2020 No. 925n.

The employer section should contain the following information:

- The employee’s place of employment and his status.

- Registration number and subordination code.

- INN and SNILS of the employee.

- Special marks.

- Information about the act in case of injury.

- Start date of work, insurance period and non-insurance periods.

- The period for calculating temporary disability benefits and the amount of average earnings.

- The amount of temporary disability benefits.

- Signatures and seal from the employer.

Let's take a closer look at how each block is filled out.

Block 1 – Place of employment of the employee and his status

In the first block, fill in the name of the organization or full name of the individual entrepreneur.

Since the number of cells is limited, it is necessary to indicate the abbreviated name without quotes. For example, instead of “limited liability company. One letter is written in each cell; one cell is skipped between words.

Next, you must indicate the status of the employee depending on whether the place of work is the main one, or whether the citizen is registered as a part-time employee. In the first case, a tick is placed in the “Primary” field, in the second - “Part-time”.

Block 2 – Registration number and subordination code

The second block contains the registration number and subordination code.

The registration number is the number indicated in the notice (notification) of the policyholder. It is assigned when an employer registers with the Social Insurance Fund to pay insurance premiums.

The subordination code is a number indicating the territorial body of the Social Insurance Fund in which the employer is registered at the time of filling out the certificate of incapacity for work.

Block 3 – TIN and SNILS of the employee

The third block indicates the employee’s INN and SNILS.

The information is taken from a copy of the TIN certificate and a copy of SNILS, provided by the citizen when applying for a job.

To fill out maternity benefits, the TIN may not be filled out.

Unit 4 – Special Marks

In cases provided for by law, special o.s. are placed in the fourth block.

You will need to select one of the following codes:

- 43 – for citizens exposed to radiation;

- 44 – for workers living in the Far North;

- 45 – for disabled people;

- 46 – for employees with whom an employment contract has been concluded for a period of less than six months;

- 47 – for citizens who become ill or injured within 30 days from the date of dismissal;

- 48 – for citizens who violated the treatment regimen for a valid reason;

- 49 – for disabled workers who have been ill for more than 4 months in a row;

- 50 – for disabled workers who have been ill for more than 5 months in a row;

- 51 – for part-time employees.

If the grounds listed above are absent, special marks are not placed.

Block 5 – Information about the act in case of injury

The fifth block is filled in when an employee has an accident at work or becomes ill with an occupational disease.

While a citizen is on sick leave, the employer conducts a special investigation to determine the causes of the injury or illness. If it is confirmed that they arose in connection with the performance of official duties, the citizen has the right to additional payments.

Block 6 – Start date of work, insurance period and non-insurance periods

In the sixth block, the start date of work, insurance experience and non-insurance periods are filled in.

The start date of work is written in the event of cancellation of the employment contract if the illness or injury occurred between the date of its conclusion and the day of cancellation. The employer must indicate the date, month and year from which the citizen was supposed to start working. In all other cases, this field remains blank.

In the “Insurance Experience” field, you must indicate the number of years and months of the employee’s activity that are taken into account in the insurance experience. That is, this is the period of time during which contributions to the Social Insurance Fund were paid for the employee by all employers with whom he was employed.

In the “non-insurance periods” field, the full number of years and months during which the employee performed military service, worked in the police department, fire service, drug control, and the Federal Penitentiary Service is written.

Block 7 – Period for calculating temporary disability benefits and the amount of average earnings

In the seventh block, you must indicate the period for which the benefit is paid, the average earnings on the basis of which the benefits are calculated, and the average daily earnings.

The period for calculating benefits coincides with the days of illness and must fit within the maximum possible number of days that are payable. Information about the period is taken from the first part of the sick leave, which is filled out by the medical organization.

In the “average earnings” field, write the amount of the average salary for the two years of work preceding the day the insured event occurred. For example, if an employee becomes ill in 2022, the wages for 2022 and 2022 are added together to make the calculation.

In the “average daily earnings” field, write the amount obtained by dividing the average earnings by 730 days.

Block 8 – Amount of temporary disability benefit

The eighth block is filled out based on information about the average daily earnings and the period for calculating benefits.

The payment amount is determined by multiplying the average daily earnings by the number of sick days to be paid.

If the first three days must be paid by the employer, and the remaining days from the Social Insurance Fund, then each part of the payment is calculated and the final value is determined. The results of the calculation are entered into the certificate of incapacity for work.

Technical features of working with electronic sick leave in 2022

The introduction of ENL allows you to immediately correctly create a register in accordance with the requirements of the Social Insurance Fund. In your personal account, you can immediately draw up an application for payment to the employee and give it to him for signature. Also, the program will automatically update the details of the clinic and the bank, so errors for the benefit recipient are excluded .

Also, in your personal account, you can send several e-numbers and registers at once (relevant for large companies with a large staff) . The register and electronic login can also be sent by a company serving your business or a remote accountant.

The digital signature certificate automatically checked for authenticity, and the registry is checked for errors. If you made mistakes, you can see them in the protocol and correct them immediately .

If you have already sent the register to the Social Insurance Fund via electronic tax record and noticed an error (for example, in determining the length of service), this can be easily corrected: you need to create a new register with updated data and send it again in your personal account to the Fund.

Benefits for employers from 2021

Working with sick leave on the principle of direct payments allows the employer not to have a reserve of funds to pay benefits. This improves the financial stability of policyholders.

When electronically processing sick leave certificates, it takes significantly less time to fill them out. Also, when filling out it is almost impossible to make mistakes (except for the calculation part).

When preparing reports to the Social Insurance Fund, you do not need to calculate the amounts that should have been offset against the amount of insurance premiums and benefits paid. This greatly simplifies the work of an accountant.

What does a sick leave certificate look like?

Since two thousand and eleven, at the federal level, a unified form of disability form has been adopted, valid in each region of the Russian Federation.

New sick leave certificates contain several degrees of protection, allowing you to clearly distinguish between an original and a fake or photocopy.

The main protective elements are:

- Mesh background;

- Availability of watermarks;

- Binary code;

- A unique twelve-digit barcode.

The state form of the form is blue and is designed to be read by a special device. Each of the fields to be filled out is designed in the form of cells allocated for each letter or number in order to avoid counterfeiting.

The reverse side of the document contains basic tips on how to fill out the sheet and codes related to each degree of disability.

A blank template to fill out is shown in the picture below.

you can here

The completed sick leave certificate should look like the picture below.

Benefits for employees from 2021

As for employees, from 2022, the widespread use of electronic tax nomenclature excludes violations in the assignment of benefits. The employee is no longer dependent on the employer in this regard.

Payments have become more transparent , which has increased the social security of all residents of the Russian Federation.

An employee can easily check information about the timing and amount of the upcoming sick leave payment in his FSS personal account by gaining access through the State Services website. If there is no Internet, this can always be done directly through FSS employees.

The introduction of electronic sick leave allows you to receive benefits in several ways:

- postal transfer;

- to a bank account;

- to a payment card.

That is, this part is not tied to the salary project.

If the employee only knows the card number, the benefit can be received by indicating only this detail in the application (ideally, the bank’s BIC or correspondent account).

conclusions

So, the following points will help you understand the issue of payment for electronic sick leave in 2022:

- Electronic sick leave completely replaces paper ones. An employee can be prescribed it only if both the employer and the medical institution are connected to the Social Insurance Unified Information System;

- In the UIIS, an electronic sick leave appears after it is discharged by a medical institution. There the employer fills out his part of the document. to print and store electronic sick leave ;

- to work with the Unified Personal Information System, an organization needs a personal account on the State Services website;

- You can work with the UIIS through the policyholder’s personal account on the FSS website or the FSS software, or through an accounting program that allows this.