How to organize accounting of the volume of work performed in food shops?

What forms of documents should I use?

How to build management accounting and cost control for remuneration of production personnel based on primary documents?

Accounting for wages begins in the shop with the preparation of primary documents to account for production, the volume of work performed by individual workers or a team.

The main tasks of accounting for production and wages of workers at food industry enterprises:

- complete timely documentary reflection and provision of reliable data in the primary and accounting records of operations related to the payment of personnel;

- control over the expenditure of funds on labor costs;

- correct calculation of taxes and fees related to wages;

- obtaining accurate data on the cost of finished products;

- monitoring the implementation of finished product production plans;

- monitoring the compliance of actual indicators with established time and production standards.

Tutorial 1C: Accounting 8

In the last lesson, we discussed such issues as the sale of inventory and services provided. Our course, dedicated to self-study of the 1C Accounting 8 program, is moving towards its conclusion.

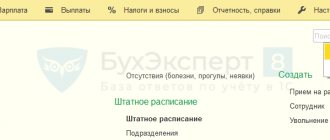

At this point we will consider the preparation of personnel documents and calculate wages. The 1C Accounting 8 program can perform simple payroll calculations for a company with up to 60 employees. Two modes for processing personnel documents are supported:

Simplified – without registration of personnel documents;

Complete - provides for filling out personnel documents related to the hiring, transfer and dismissal of personnel.

We will use full mode. We will hire people.

Let's look at the directory "Individuals", which contains information about individuals and their basic details. Let's look at the "Employees" directory. This directory already contains information about individuals who will receive wages in our company.

We will learn how to calculate sick leave, vacations, and deductions based on writs of execution.

At the end you will be asked to complete a practical task yourself.

Directories “Individuals” and “Employees”

Directory "Individuals".

The directory is intended to store information about all individuals.

In the directory, you can combine individuals into arbitrary groups or subgroups.

Each individual has the opportunity to indicate his personal data, such as:

- floor,

- Date of Birth,

- information about the identity document.

Directory "Employees".

Several employment contracts can be concluded with the same person, both simultaneously (i.e. a part-time job is registered, not only in different organizations, but also within the same one), or sequentially (a person quits the organization and after some time was rehired). At the same time, information about a person as an individual (about an “individual”, i.e. his personal data, such as full name, gender, age, etc.) does not depend on how many employment contracts and on what terms there are with him concluded. And information about a person as an employee (place, working conditions, salary, accrued and paid wages, etc.) will vary for the same person depending on the specific employment contract. In the 1C Accounting 8 program, employees are understood as individuals (people) with whom the organization can conclude one specific employment contract, in accordance with the Labor Code of the Russian Federation. If an organization concludes, for example, two employment contracts with the same person, then in the program this person should be represented by two employees. This will allow you to obtain information about a person as an employee under each such agreement separately (build reports on accruals in the context of such employees, etc.). The names (representation) of these employees in the program may differ, which is convenient for searching for them, selecting them, and obtaining information on them. In this case, the real last name, first name and patronymic of the person are stored separately and are the same for both such employees. Separately, in a special directory of individuals, all other personal information about a person, his personal data, is stored. This principle of storing information in the 1C Accounting 8 program (some of it is “tied” to the employee, and some to the individual) is associated not only with the fact that it is not necessary to re-enter the employee’s personal data when re-executing the employment contract, but if they change, make the same changes in several places (for different employees corresponding to this person). Another reason, for example, is that according to the Tax Code of the Russian Federation, personal income tax (NDFL) is calculated taking into account all the income of an individual from a tax agent (organization), and not separately under various employment contracts with this organization. Also, a “summary” for an individual is submitted to the authorities and reports on personal income tax. Similar provisions are contained in the law on insurance premiums. Thus, each person with whom the organization has an employment relationship is represented in the 1C Accounting 8 program separately as an individual and separately as an employee. In this case, one such individual may correspond to several employees if several employment contracts were concluded with him. It is unacceptable that in a situation where several employment contracts are concluded with one person by one organization, this person is represented in the program not only by several employees, but by several different individuals (the so-called “duplication of individuals”). Such duplication will lead to incorrect calculations of personal income tax, insurance premiums, and reporting for this organization. In this regard, in the program, data about a person as an employee and as an individual, on the one hand, is stored strictly separately, on the other hand, it is visually presented and can be edited both in the employee’s card and in the individual’s card. To prevent duplication of individuals, the program controls the entry of employees. If, when registering a new employee, it is discovered that there is already an individual in the program with the same or similar data, then it will report this. In addition to employment contracts, contracts for the performance of work, provision of services, author’s order contracts, i.e. can be concluded with a person. contracts of a civil nature (GPC) in accordance with the Civil Code of the Russian Federation. In the 1C Accounting 8 program, such agreements are also drawn up with an employee, while both an employment contract and one or more GPC agreements can be concluded with the same employee (in program terms). In other words, if a person has already been registered as an employee under an employment contract in the program, then there is no need to create a separate employee to register a GPC agreement.

Principles for creating employees in the program

When a new employee is added to the 1C Accounting 8 program, a corresponding individual is automatically created and “attached” to the employee. In this case, the person’s personal data can be entered into the employee’s card, and they will be saved in the directory of individuals. There is no need to separately open the directory of individuals and enter data into it. If you need to register another employment contract with this person, then it is convenient to create a new employee from the special “Work” section of the card of the corresponding individual. If, in order to register a new employment contract (for an individual already in the program), you enter a new employee directly into the employee directory, then when you enter a repeating last name, the program will inform you that a similar individual is already in the program and will offer to select him. When selected, this individual will be “linked” to the introduced employee. In this way, the program will avoid unwanted duplication of individuals. There is no way to explicitly indicate in an employee’s card that this employee corresponds to a specific, previously created individual, to “unlink” one individual and “link” another. Therefore, it is recommended to enter “repeated” employees from the card of the corresponding individual, and enter employees directly into the directory carefully, avoiding duplication of individuals. When registering an employment contract with a person for the first time, it is possible to first create a corresponding individual, and then create an employee from the card of this individual. This method should be used with caution as it may result in duplication of individuals. Creating an employee is not enough to register him in the 1C Accounting 8 program for hiring him under an employment contract. To complete the registration, you must enter the “Hiring” document, indicate in it this employee and the terms of his employment contract. The document can be entered directly from the employee’s card. To formalize the hiring of all employees when starting to operate the program, you can use the special document “Data for the start of operation.”

The list of employees by default does not show employees who are about. To display them in the list, you can set the corresponding flag.

HR documents

The “Hiring” document registers the hiring of employees, as well as the method and amount of remuneration.

The following details must be filled in:

- Organization. The organization for which the employee is hired. Selected from the “Organizations” directory. The details are displayed on the form if accounting settings for several organizations are enabled in the accounting settings.

- A comment. Any additional information to the document is indicated.

- Employees. This tabular part contains information about the places of work and working conditions of employees. Details of the tabular section: Employee - the employee being hired. Selected from the “Employees” directory.

- Period —reception date.

- Department - this field indicates the department to which the employee is being hired. Selected from the “Structural Units” directory.

- Position - this field indicates the position for which the employee is being hired. Selected from the “Positions” directory.

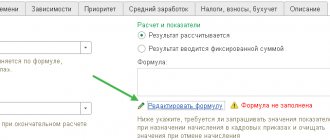

- Accruals. This tabular part contains information about methods of remuneration of employees. Details of the tabular part: Type of accrual - planned accrual of the employee. Selected from the directory “Types of charges“.

- Amount - the amount of planned accrual or deduction in the currency specified in the “Currency” attribute of the tabular section.

The “Personnel Transfer” document records the movements of employees, changes in payment methods and other working conditions.

The following details must be filled in the document:

- The organization where the transfer is taking place. Selected from the “Organizations” directory. The details are displayed on the form if accounting settings for several organizations are enabled in the accounting settings.

- Type of operation. Specifies the type of document operation. You are offered a choice from a list: move and change the payment method or change the payment method.

- A comment. Any additional information to the document is indicated.

- Employees. This tabular part contains information about new places of work and working conditions for employees. Details of the tabular section: Employee - the transferred employee. Selected from the “Employees” directory.

- Period —the date on which the changes take effect.

- Department - this field indicates the department to which the employee is moving. Selected from the “Divisions” directory.

- Position - this field indicates the position to which the employee is being moved. Selected from the “Positions” directory.

- Type of accrual - new planned employee accrual or bonus. Selected from the “Types of accruals and deductions” directory.

The “Dismissal” document is intended to register employee dismissals. The document terminates planned accruals for dismissed employees.

The following details must be filled in the document:

- The organization from which employees are leaving. Selected from the “Organizations” directory. The details are displayed on the form if accounting settings for several organizations are enabled in the accounting settings.

- A comment. Any additional information to the document is indicated.

- Employees. The tabular section indicates when and for what reason employees are dismissed. Details of the tabular section: Employee - dismissed employee. Selected from the “Employees” directory.

- Period - date of dismissal.

- Reason for dismissal - in this field, indicate in free form the reason for dismissal of the employee.

Hire an employee:

- Full name: Gusarov Dmitry Ivanovich Date of birth: 01/08/1975

- INN: 343504121109

- SNILS: 087-253-377 421

Hire an employee:

- Full name: Ivanov Ivan Ivanovich Date of birth: 02/02/1972

- INN: 770522222222

- SNILS: 087-008-223 33

Key aspects

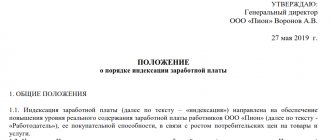

Salary is the employee’s remuneration, calculated based on the volume of work performed, qualifications, length of service and workload (Article 129 of the Labor Code of the Russian Federation).

The volume of payments is determined in accordance with the norms of current legislation, as well as taking into account the payment system established at the enterprise. Staff remuneration is a significant share of the costs of any economic entity. That is why it is so important to organize complete and reliable accounting of labor and wages at the enterprise. Systematic analysis of information will allow assessing cost effectiveness, as well as identifying reserves (financial and labor).

It should be borne in mind that wage costs directly affect the cost of production. Moreover, the cost calculation includes not only the earnings of workers in the main production, but also payments in favor of support staff.

An economic entity has the right to independently develop a payment system, taking into account the type of activity, specificity, complexity and harmfulness (danger) of production. At this stage, you should be guided by key principles:

- Legality. The conditions for calculating remuneration cannot violate the current requirements and norms of labor legislation.

- Justice. Payment must be equivalent to the work performed.

- Results-oriented. Provide a system of incentives and/or bonuses for employees for achieving specific results.

- Timeliness and frequency. Earnings must be paid systematically, without delay, in full.

It should also be noted that wages must be economically justified. Otherwise, there can be no question of the effectiveness of these costs.

Payroll

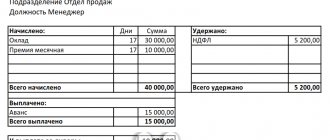

The document “Payroll” in the 1C Accounting 8 program is intended for calculating accrued and withheld amounts for all employees of an organization or employees of a certain department. The document is registered once a month.

On the “Accruals” tab, data can be filled in automatically by clicking the “Fill in accruals” button. On the “Deductions” tab, you can enter information about employee deductions.

When posting a document, entries are generated in the accounting accounts for payroll, personal income tax (NDFL), as well as accrued taxes (contributions) from the payroll. To enter a template for transactions that are used when calculating wages, the reference book “Methods of reflecting wages in accounting” is intended.

The calculation of personal income tax and taxes (contributions) from the payroll is carried out in the salary calculation document automatically based on the accrual data.

We will calculate salaries for the Administration division for January 2015.

How are wages calculated for time-based wages?

Time-based (time-based bonus) wages are most often found in the following 2 varieties:

- When the salary is calculated based on the employee’s monthly salary (supplemented in the prescribed manner with bonuses for labor results).

In this case, the following formula is used to calculate wages:

SALARY = (OP / RD) × OD,

Where:

SALARY - salary for the billing period;

OP - the employee’s official salary, supplemented by bonuses if any;

RD - the number of working days in the month that includes the billing period;

OD - days worked in the billing period.

Attention! Salaries must be paid at least twice a month (Article 136 of the Labor Code of the Russian Federation), therefore the billing period cannot exceed half a month (letter of the Ministry of Labor and Social Protection of Russia dated September 21, 2016 No. 14-1/B-911). In this case, salary accrual is displayed in the accounting registers on the last day of the month.

- When the salary is calculated based on the tariff rate per 1 hour or 1 day.

In this case, the following formulas are used to calculate wages:

- for hourly wages:

SALARY = NHT × PCH,

Where:

CHTS - hourly tariff rate under an employment contract,

OCH - the number of hours worked during the reporting period;

- for daily wages:

SALARY = DTS × OD,

where DTS is the daily tariff under the employment contract.

In both cases, the employee receives pay for weekends and holidays:

- when performing work on weekends and holidays - at a double tariff rate (Article 153 of the Labor Code of the Russian Federation);

- when resting on such days - in accordance with local regulations (Article 112 of the Labor Code of the Russian Federation).

In the scenario under consideration, salary calculation is carried out taking into account the fact that the employer is obliged to establish monthly standards (Articles 160, 162 of the Labor Code of the Russian Federation):

- by working hours;

- by production.

The basis for such standards may be, for example, standard indicators for the industry in which the employing company operates.

If the standards established by the employer are met, the employee in any case receives a salary no less than the minimum wage established in the constituent entity of the Russian Federation (Article 133 of the Labor Code of the Russian Federation).

Is it possible not to pay a salary to the director of a company? Find out the answer in ConsultantPlus by receiving free trial access to the system.

Now let’s talk about how wages are calculated under the piecework scheme.

Payment of wages

Payment of wages in the 1C Accounting 8 program in cash through the cash register is registered in the document “Statements to the cash desk” in the “Salaries and Personnel” section. You can generate a payroll in form T-53 by clicking the “Print” button.

To pay wages according to payroll T-53, it is necessary to enter an expense cash order based on the payroll with the type of operation “Payment of wages according to payrolls.”

To pay wages to each employee using separate cash expense orders, you must enter an expense cash order with the transaction type “Payment of wages to employee.” The document indicates the statement and the employee to whom the salary is paid. The payment amount is entered into the document automatically.

Wages not paid on time may be deposited. The document “Deposit of Organizations” is intended to register this fact. You can enter the document in the “Salaries and Personnel” - “Deposit” section.

The “Deposit” document can be generated on the basis of the “Statements for payment of wages through the cash register” documents. Data can be filled in automatically using the “Fill” button for the balances of unpaid wages.

When accounting for deposited wages, you should adhere to the following scheme:

- First, enter the document “Statement for payment of wages through the cash register.”

- Based on the saucer statement, the “Deposit” document. Only those employees who have not received wages should be included in the document.

- After this, based on the document “Statement for payment of wages through the cash register,” you can enter an expense cash order with the type of operation “Payment of deposited wages” or “Write-off from the current account.”

Amounts of overdue payments to depositors are written off using the document “Write-off of depositors as income of the organization.”

On January 31, 2015, generate a payroll statement for January 2015 for the “Administration” division. On the basis of the payroll, on January 31, 2015, issue the document “Issue of cash, expense cash order with the type of operation “Payment of wages according to statements.”

How to account for employee salaries

In an organization, wages are recorded in accounting records on account 70 of the chart of accounts (Order of the Ministry of Agriculture No. 654 of June 13, 2001). Analytical records are maintained for each employee. According to the Dt of account 70 “Settlements with personnel for remuneration”, the amounts transferred to employees for remuneration of labor activities, bonuses, benefits, pensions, accrued taxes, payments under executive documents and other deductions are indicated.

If the amount of monthly remuneration was accrued but not paid due to the employee’s failure to appear, then it is reflected according to Dt 70 Kt 76.

In a budgetary institution, the following items are used for payroll calculations:

- 211 - “Wages”;

- 212 - “Other payments”;

- 213 - “Accruals for wages”.

Payroll accounting itself is carried out on account 302.10, according to the budget accounting chart of accounts (instruction No. 157n). If the salary is paid at the expense of the budgetary activities of the institution, then the actions are reflected in the account. 1.302.10, for example, in a government institution. If within the framework of entrepreneurial and other income-generating activities, then to 2.302.10, for example, in BU or AU. If wages are calculated from subsidies for the fulfillment of a state task, then the reflection is made according to 4.302.10, according to targeted subsidies 5.302.10. To display mutual settlements for wages and allowances in a budgetary institution, Transaction Journal No. 6 is used.

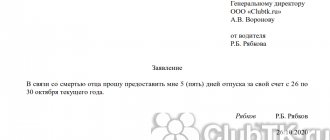

Accrual of sick leave and vacation pay

The document “Sick Leave” records the fact that an employee presented a certificate of incapacity for work, both for the purpose of assigning benefits and to reflect its absence in personnel records. When selecting an employee, average earnings are automatically calculated according to the information base based on information for the previous two calendar years. The document should be entered before the final payroll, because Personal income tax is calculated in the document “Payroll”.

The “Vacation” document records the fact that an employee has been granted annual leave. When selecting an employee, average earnings are automatically calculated according to the information base based on information for the previous 12 calendar months.

The document should be entered before the final calculation of wages, since the calculation of personal income tax and insurance contributions is carried out in the “Payroll” document.

For “Vacation” documents, a stamp of the order for granting leave in the T-6 form is provided.

Accrue sick leave to Ivan Ivanovich Ivanov for February 2015 (from 02/12/2015). Sick leave number 752455624. Cause of disability: (01, 02, 10, 11) Illness or injury (except for injuries at work). Release from work from 02/02/2015 to 02/08/2015 Payment percentage 60%.

Salary calculation. Principles and regulations.

There are many regulatory documents describing payroll calculations: this list is not limited. The calculation is regulated by the following main documents:

- Labor Code. It describes the basic principles of interaction between employer and employee, and also regulates some principles and restrictions when calculating wages. In addition, it describes in detail the standards of working time, the procedure for granting vacations, and maintaining average earnings in different cases.

- Ch. 23 parts 2 of the Tax Code of the Russian Federation - describes personal income tax.

- Federal Law of July 24, 2009 N 212-FZ - on insurance contributions to the Pension Fund, the Compulsory Medical Insurance Fund and the Social Insurance Fund.

- Federal Law of July 24, 1998 N 125-FZ - on insurance against industrial and professional accidents. diseases

- Federal Law No. 255-FZ of December 29, 2006 regulates the provision and calculation of benefits for temporary disability (sick leave) and in connection with maternity.

- Decree of the Government of the Russian Federation dated June 15, 2007 N 375 - describes the features of calculating average earnings for temporary disability benefits (sick leave), and

- Decree of the Government of the Russian Federation dated December 24, 2007 N 922 - describes the calculation of average earnings in other cases, for example, in the case of vacation or business trip.

- Other decrees and orders that regulate certain issues, approve certain forms and reports, or describe the calculation of wages for certain categories of employees. It is important for a payroll accountant to be aware of changes in those documents that relate specifically to his situation and employees.

Salary calculation in a couple of clicks

Salary and contributions are calculated automatically in Kontur.Accounting

Try it

The calculation of the main part of the salary is not described in detail by law, so the employer can move here with a fairly large degree of freedom. The Labor Code sets only limits: for example, the salary for a fully worked month should not be less than the minimum wage, work on a weekend or a non-working holiday is paid at least double the amount. But basically, the employer himself determines the remuneration system: what salary to pay his employees, what are its maximum limits, what does it depend on, how is it calculated, etc. All these points must be clearly described in the internal local regulations of the organization (regulations on wages, collective agreement, employment contract with the employee).

One of the basic principles that an employer should follow when paying wages is equality. Employees who have worked the same working hours under the same conditions and completed the same amount of work during this time, while possessing the same qualifications, must receive equal pay.

If the working conditions are different, this is regulated by allowances and additional payments. For example, if one of the employees works in Moscow and the other in Nizhnevartovsk, then the conditions of the second employee are worse than those of the first, and allowances for climatic conditions are applied.

Deductions based on writs of execution

The document “Writ of Execution” records the information necessary to automatically calculate the deduction from an employee’s salary. In particular, the recipient and the procedure for calculating the withholding (fixed amount, percentage or share) are indicated. Direct deduction is made when automatically filling out the “Payroll” document.

We have reviewed the main points of payroll calculation in the 1C Accounting 8 program. You can proceed to completing an independent task.

Individual record of work performed

It is used to account for production and payroll separately for each worker. Issued for any convenient (accepted by the company) period.

An individual statement allows you to take into account the volume of work performed by type of product.

In turn, each product has its own recipe, technological process, and piece rates. The statement indicates the amount of work performed (columns 4–11) by dates (column 2).

Thus, on May 2, 2017, the workshop produced “Okhotnichye” meat cutlets, “Slavyanskie” meat cutlets and minced zrazy with mushrooms. The volume of minced meat prepared is indicated in columns 4, 5, 10. The volume of work for each day is summarized in the “Total” column. In total, as of 05/02/2017, the volume of work was 300 kg.

The amount of wages (line “Amount, rub.”) is obtained by multiplying the data in the “Total” column by the data in the “Rate” column.

For example, on 05/05/2017, worker A.P. Vetrova prepared 140 kg of minced meat according to the “Rural” meat-containing cabbage rolls recipe. The price for this work is 2.4 rubles. Then the piecework wage is 336 rubles.

For your information

Since business is now focused on the needs of customers, products are launched into production in limited quantities.

The size of the batch of products to be released, in terms of product names, and the quantity of each type, is often kept according to work orders (or simply orders).

An order is a grouped order from several wholesale buyers, retail outlets, collected by sales department managers or sales representatives of the company.

For management accounting purposes, to calculate the actual cost of each order, the cost code (order) is indicated in the individual statement of work performed. So, for order 120/25-04, the economist will assign a direct salary in the amount of 319 rubles. for preparing minced meat in the amount of 110 kg of minced meat for sausages for the “Shashlychny” grill, as well as 299 rubles. for preparing 130 kg of minced meat for Khabarovsk meatballs.

For your information

In this example, work is performed at piece rates. The same form of individual statement can be used to record work on a time-based wage system. To do this, indicate “time-based” in the “Type of payment” column; the “Rate” and “Amount” columns are not filled in. Shop staff are paid based on time sheets.

Practical task

Hire an employee:

- Full name: Semenov Semen Semenovich Date of birth: 03/03/1973

- INN: 770303030303

- SNILS: 087-256-325 41

Hire an employee:

- Full name: Vasiliy Vasilyevich Date of birth: 04/04/1974

- INN: 771425632541

- SNILS: 087-254-155 88

Hire an employee:

- Full name: Nikolaev Nikolay Nikolaevich Date of birth: 05/05/1985

- INN: 770125412893

- SNILS: 087-258-965 47

Install for Semenov S.S. from 01/01/2015, the method of reflecting wages is: “General production expenses”.

Set for Vasilyev V.V., Nikolaev N.N. from 01/01/2015, the method of reflecting wages is: “Main production”.

Calculate wages for the “Production Shop” for January 2015.

Register the writ of execution dated 02/25/2015. Withhold from V.V. Vasiliev in favor of Vasilisa Vasilievna Vasilieva from 02/01/2015 to 04/23/2025 1/3 of the salary.

Register the writ of execution dated 03/01/2015. Withhold from Semyon Semenovich Semenov in favor of the shopping center KOMUS LLC from 03/01/2015 to 03/31/2015 46,000.00 rubles.

Calculate wages for February 2015.

Accrue Nikolay Nikolaevich Nikolaev vacation pay for March 2015. Vacation period from 03/30/2015 to 04/05/2015 for work from 01/15/2015 to 03/31/2015.

Calculate wages for March 2015.

Next Previous

These features are available to both users of local versions and cloud solutions, for example 1C:Fresh, 1C:Ready Workplace (WWW) . To purchase boxed versions or rent the 1C:Accounting 8 program in the cloud, please call +7(499)390-31-58, or e-mail: [email protected]

We recommend that you read the sections

How to enter information about organizations in the 1C: Accounting 8 program

| Closing a period in 1C Accounting |

| How to create a user with “Administrator” rights in 1C Accounting 8.3 |

| Purchase of goods and materials and settlements with suppliers |

| Accounting for production and production costs |