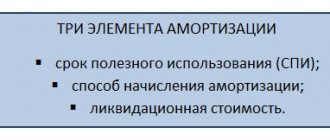

What are depreciation elements? According to FAS 6/2020, 3 elements are involved in the depreciation calculation process:

The role of the document The waybill must be drawn up by individual entrepreneurs and legal entities. The document decides immediately

Why is the balance sheet reformed? The financial result of the work of each organization during the reporting year

Accident insurance premium rates in 2021 Insurance premium rates are determined by class

The volume of work in a certain position does not always require the involvement of a full-time employee. Exit

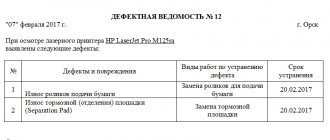

Why and when is an inspection needed? In any organization it is carried out at least once a year.

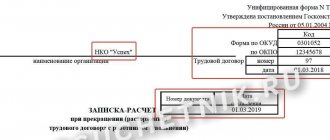

When an employee resigns or his employment contract is terminated, to calculate the amount necessary for this

Your company has already entered into a leasing agreement and you have questions about how to reflect the leasing

In "1C: Accounting 8" starting from version 3.0.65 you can reflect the gratuitous transfer of goods - gifts,

FREE CONSULTATION WITH A LAWYER Tel. +7 (800) 302-65-54 Free in Russia In case of detection