The birth of a child is always a joyful and responsible event that requires certain efforts and expenses. One of the most important tasks is the assistance and support of young parents by the state. In the article we will talk about postings for maternity benefits in 2022 and give examples of calculations.

Types of benefits: (click to expand)

| Disposable | One-time |

| For pregnancy and childbirth | Child care up to 1.5 years old |

| When registering early | For a child of a conscripted soldier |

| Upon adoption | |

| Pregnant wife of a conscript | |

| Lump sum benefit at birth |

Amount of payments for children

In 2022, the size of the BiR one-time benefit in accordance with the law for women will be:

- 100% of the average salary of a working woman

- 100% of the amount of monetary allowance - for military personnel under contract

- In the minimum amount based on the minimum wage for everyone else, including the unemployed

For women giving birth who received high wages, for example a million a year, there is a limit on the payment of benefits, for example:

- RUR 266,191.8 - in general; RUB 368,865.78 – during multiple pregnancy; • 296,613.72 rub. - during complicated childbirth.

A sick leave certificate for pregnancy and childbirth is issued to a woman at 30 weeks.

For normal births, a certificate of incapacity for work is given for a period of 140 days, for complicated ones for 156 days, and if the pregnancy is multiple, then 194 days. The payment is calculated based on wages for the previous 2 years before the onset of maternity leave, for example, an employee left in 2022, which means For the calculation we take 2015 and 2016.

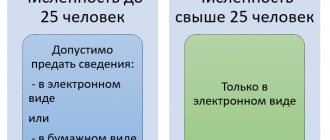

Formation of a register of information for the assignment and payment of benefits

When generating an electronic register of information in the program in accordance with Appendices No. 1, 2 to the order of the Federal Social Insurance Fund of the Russian Federation dated November 24, 2017 No. 579 from the workplace Benefits at the expense of the Social Insurance Fund or the section Reporting, certificates - Transfer of information about benefits to the Social Insurance Fund in the Register type field is indicated value of Disability Benefit (Fig. 2). Filling out the register is no different from filling out the register for temporary disability benefits.

Rice. 2

1C:ITS

For information on creating a register of information in 1C for the assignment and payment of benefits, see the section “Instructions for accounting in 1C programs.”

Postings for calculating a lump sum payment

The payment of all benefits is accounted for in account 70 - wages. The accountant will accrue benefits on the credit of account 70, and pay them on the debit. If wages are usually calculated from the organization’s sources, then benefits are paid from the Social Insurance Fund. All settlements with the Social Insurance Fund are carried out on account 69 “Settlements for social insurance”.

Thus, we will make the following entries:

- Debit account 69 – Credit account 70 - accrual of one-time benefit

Maternity payments are not subject to personal income tax. If the payment is from the cash register, then we will make the following entry:

- Debit account 70 – Credit account 50 “Cash”

If you transfer benefits to a bank card, we get:

- Debit account 70 – Credit account 51 “Current accounts”

Birth of a child - calculation of benefits

A mother or father can receive benefits for the birth of a child at their place of work. The amount of payment since the beginning of last year is 17,479.73 rubles. The amount of the benefit can be changed taking into account the regional coefficient. For example, the payment for the birth of a child in Krasnoyarsk is 20,975.68 rubles.

If the mother and father do not have a job, payments will be made by the social welfare services at the child’s place of residence.

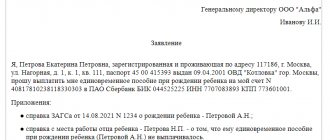

A parent can receive benefits by presenting the following documents to the employer or social security service:

- Completed application for payment of benefits for the birth of a child;

- Documents from the work of the second parent stating that he did not receive and was not assigned benefits;

- Certificate from the registry office about the birth of the baby.

Payment is made provided that six months have not passed since the birth of the child. The payment period is 10 days. Insurance premiums and personal income tax are not applied to such benefits. The benefit is issued using funds from the Social Insurance Fund.

We reflect the necessary information in 1C: accounting.

- We are looking for the “Salary Settings” subsection located in the “Salaries and Personnel” menu.

- Click on “Create” after clicking on the “Accruals” line. We indicate the type of payment - “Birth benefit”.

- We generate the “Payroll” document, enter information about the employee for whom the payment is intended.

- Select the type “Benefit for the birth of a child” by clicking on the “Fill in” line.

- Enter the payment amount in the window (if necessary, applying the regional coefficient to it)

- We look at the transactions generated according to the document using the Dt/Kt button.

In order for payment data to appear in the regulated reporting, we draw up the document “Contribution Accounting Operation”.

We are checking the reporting “Calculation of insurance premiums” for six months of 2022.

The information is reflected in the reports.

Still have questions? Order a free consultation with our specialists!

Did you like the article?

Want to receive articles like this every Thursday? Keep abreast of changes in legislation? Subscribe to our newsletter

Maintenance services up to one and a half years

The benefit until the child is one and a half years old is paid from the Social Insurance Fund. To do this, the accountant will make the following entries:

- Dt 69-1 Kt 70 accrual.

- Dt 70 Kt 50 payment.

Additional payment before actual earnings:

The employment contract may provide for additional payment up to actual earnings at the expense of the organization; this is not a benefit, so the employer will have to pay.

- Debit 20 (23, 25, 26, 44...) Credit 70 – an additional payment has been added to maternity benefits up to the actual average earnings;

- Debit 70 Credit 50 (51) – an additional payment was issued to maternity benefits up to the actual average earnings.

Example of calculating maternity benefits

- The employee went on maternity leave on July 3, 2022, the billing years will be 2015 and 2016, the vacation period is 140 days

- Woman's income in 2015 amounted to one hundred twenty thousand rubles in 2016. one hundred forty-four tons, total two hundred sixty-four tons../ 731, we get 361.15 rubles. average daily earnings.

- 361.15 *140=50561 rub. Total our allowance.

Accounting in 1C

Maternity benefit

When switching to direct benefit payments, make preliminary settings in the program.

When you receive a paper copy or electronic sick leave number from an employee, in 1C, fill out the Sick Leave document in the Salaries and Personnel - All Accruals section - Create button - Sick Leave (or from the Workplace Benefits at the expense of the Social Insurance Fund in the section Salaries and Personnel - Benefits at the expense of FSS - Create sick leave button).

For direct payments, the block FSS Pilot Project .

Step 1. Fill out the sick leave information as usual. Read more document Sick leave

Unlike the offset system, the BiR benefit is paid by the Social Insurance Fund, so there are no accrued amounts. Only average earnings are calculated for transfer to the Social Insurance Fund, which can be viewed via the Accrued and edited if necessary.

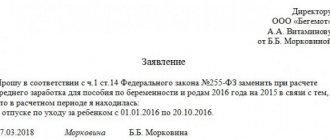

If there is an application to change years, then change the years; in the Earnings fields for the 2 previous years, the indicators will be recalculated.

At the request of the employee, replace the calendar year (years) of the billing period with the previous calendar year (years), if (part 1 of article 14 of Law N 255-FZ, clause 11 of the Regulations, approved by Decree of the Government of the Russian Federation of June 15, 2007 N 375):

- in any year(s) of the billing period, the employee spent the entire year(s) or part thereof on maternity leave or child care leave;

- replacement will result in an increase in benefit amount.

It is allowed to replace the year(s) of the billing period only with those immediately preceding the year in which he was on maternity leave or child care leave (FSS Letter dated November 30, 2015 N 02-09-11/15-23247).

Step 2. Using the link Fill in the data for the register of information transmitted to the Social Insurance Fund, fill out the form Certificate of incapacity for work ... on the Exemption from work with data from the sick leave.

If a certificate of registration is submitted along with the sick leave, then on the Special causes of disability indicate Yes , registered .

In this case, one Application for payment of benefits .

Step 3. Fill out an application for payment of benefits using the link Employee Application for Payment of Benefits :

- Type of benefit - Maternity benefit (filled in automatically).

Recipient tab is filled in automatically with data from the employee’s card.

On the Payment method , the Pay benefits switch is automatically set in accordance with the salary payment method specified in the employee’s card. If necessary, change the benefit transfer method.

From 01/01/2021, it is only possible to transfer benefits for the BiR (Resolution of the Government of the Russian Federation of 06/25/2020 N 920):

- to the MIR system card;

- to a bank account to which the card is not linked;

- by postal transfer.

The FSS recommends switching to non-cash forms of payment of state benefits and minimizing payments using postal transfers.

Read more Payment of benefits to MIR cards from October 1, 2020

On the Attached documents the following is automatically filled in:

- Certificate of incapacity for work No.... from - automatically.

Sick Leave document indicates that the employee was registered in the early stages of pregnancy, then the number and date of the corresponding certificate should also be indicated here.

Then the Type of benefit will be indicated Two benefits: For pregnancy and One-time benefit for those registered early .

Based on such an application, one register is created for both benefits with the type Maternity benefit .

Place of Work Information tab is filled in automatically with data from the organization’s card.

the Authorized representative field manually.

Benefit Calculation tab is filled in automatically with the data specified in the Sick Leave .

If the years of the billing period were replaced in the Sick Leave , the Employee replaced calendar years and earnings amounts taking into account the replacement checkbox will be automatically selected.

On the Registry Information :

- Date of submission of the package of documents the Sick Leave document is automatically entered if it coincides with the date the application was created.

Click the Print to print out the application and sign it with an employee. PDF

Step 4. Create a register for transfer to the Social Insurance Fund from the Workplace Benefits at the expense of the Social Insurance Fund in the section Salaries and Personnel - Benefits at the expense of the Social Insurance Fund - Create a Register button.

In the header of the document please indicate:

- Type of register - Disability benefits (we submit a separate register for each type of benefit).

By clicking the Fill on the Information required to assign benefits tab, all applications of this type that are not included in the register as of the current date, and information from these applications, are automatically filled in.

The saved register can be checked, downloaded or sent directly from the program to the Social Insurance Fund, and its status can also be changed.

When submitting in paper form, you do not need to create a register ; create a List of employee applications for payment of benefits in the Salaries and Personnel section - Transfer of information about benefits to the Social Insurance Fund - Create button.

Fill in button will fill in all statements not currently included in other inventories.

Specify manually:

- Number of pages - the number of pages of documents that are provided to the Social Insurance Fund;

- details of the Authorized Representative .

Click the Print to print the inventory and submit it to the Social Insurance Fund along with the original documents. PDF

One-time benefit for those registered in the early stages of pregnancy

Those registered with a medical organization in the early stages of pregnancy (up to 12 weeks) are entitled to a fixed amount of benefits (clause 19 of the Procedure, approved by Order of the Ministry of Health and Social Development of the Russian Federation of December 23, 2009 N 1012n, clause 10 of the Law of May 19, 1995 N 81-FZ) .

The size of the state benefit is indexed annually. In areas with a regional coefficient, the benefit increases by it (Article 5 of the Law of May 19, 1995 N 81-FZ).

To receive benefits, an employee brings to work:

- certificate of registration in the early stages of pregnancy;

- application for payment of benefits.

Step 1. Create an application for the payment of a one-time benefit from the workplace Benefits at the expense of the Social Insurance Fund in the section Salaries and Personnel - Benefits at the expense of the Social Insurance Fund - button Create Application.

Please indicate:

- Employee - a female employee receiving benefits;

- Type of benefit - One-time benefit for those registered in the early stages of pregnancy .

The data on the Recipient will be filled in automatically from the employee’s card.

On the Attached Documents , indicate:

- Certificate of employment... - date and number of the certificate provided by the employee.

Check the completion of the remaining tabs and, if necessary, correct them in the same way as in the application for payment of maternity benefits.

Step 2. Create a register for transfer to the Social Insurance Fund from the Workplace Benefits at the expense of the Social Insurance Fund in the section Salaries and Personnel - Benefits at the expense of the Social Insurance Fund - Create a Register button.

In the header of the document please indicate:

- Type of register - One-time benefits for those registered in the early stages of pregnancy (if you submit a separate register for each type of state benefit).

By clicking the Fill on the Information required to assign benefits tab, all applications of this type that are not included in the register as of the current date, and information from these applications, are automatically filled in.

The saved register can be checked, downloaded or sent directly from the program to the Social Insurance Fund, and its status can be changed in the same way as the register for the BiR benefit.

When submitting in paper form, you do not need to create a register ; create a List of employee applications for payment of benefits in the Salaries and Personnel section - Transfer of information about benefits to the Social Insurance Fund - Create button.

Clicking the Fill in inventory button will fill in all applications not currently included in other inventories, regardless of the type of state benefit (you can create one inventory for several benefits).

Specify the Authorized Representative and click the Print to print the inventory and submit it to the Social Insurance Fund along with the original documents. PDF

Category “Questions and Answers”

Question No. 1. I am an accountant at an enterprise, I am preparing maternity payments for an employee, what payments are due and how to make entries

First, you need to decide whether your region is participating in the Pilot Project; if so, then no wiring will be required, and if not, then:

- When a woman goes on maternity leave, you are provided with a sick leave certificate, on the basis of which you calculate a lump sum maternity benefit in accordance with her salary for the last two years

- then you need to apply for benefits if she is registered in the early stages of pregnancy

- when she gives birth, she provides the next sick leave for which you accrue benefits for child care up to one and a half years and a lump sum at birth

The postings will be similar for all operations,

- Dt 69 Kt 70

- KT 70 Dt 50(51)

If a woman in labor has a complicated birth, she is entitled to an additional payment to the one-time maternity benefit

Registration of maternity leave and calculation of average daily earnings

Registration of maternity leave and calculation of an employee’s average earnings for payment of benefits by the fund are carried out using the Sick Leave document (Salary - Sick Leave section - Create button or Salary - Sick Leave section).

On the Main tab, in the Reason for incapacity field, indicate (05) Maternity leave (Fig. 1). In the Exemption from work from... to... fields, the period of exemption from work is indicated in accordance with the certificate of incapacity for work (the entire period, even if there are several entries in the section “Exemption from work” of the certificate of incapacity for work). If during the employee’s maternity leave you plan to hire (or transfer) another employee to his rate, then set the Free rate for the period of absence flag.

Rice. 1

This flag appears in the document if the ability to maintain a staffing table is enabled in the personnel accounting settings (section Settings - Personnel Accounting). When the flag is set, the staffing rate will be temporarily released. Filling out other fields of the document is carried out similarly in the example of accruing sick leave at the main place of work (main case).

1C:ITS

For the accrual of sick leave at the main place of work (main case) in the 1C: Salaries and Personnel Management 8 program (rev. 3), see the section “Instructions for accounting in 1C programs.”

After entering the necessary data in the Average earnings field, the amount of the employee’s average daily earnings is automatically calculated according to the information base. Since the maternity benefit is paid entirely from the funds of the Social Insurance Fund of the Russian Federation, the benefit is not calculated in the document, lines with a zero calculation result are formed (see Fig. 1).

To analyze the calculation of average daily earnings, you can generate a printed form Calculation of average earnings or Calculation of benefits by clicking the Print button.

The maternity benefit is calculated based on the average earnings of the insured person, calculated for the two calendar years preceding the year of maternity leave. Average earnings, on the basis of which the benefit is calculated, are taken into account for each calendar year in an amount not exceeding the maximum base for calculating insurance contributions for compulsory social insurance in case of temporary disability and in connection with maternity for the corresponding calendar year, for 2022 - 865,000 rub. and for 2022 - 912,000 rubles.

The average salary of an employee was: 830,000 rubles. (earnings for 2022) + 940,000 rub. (earnings for 2022) = 1,770,000 rubles.

In our Example, the employee’s earnings for 2022 are 830,000 rubles, which does not exceed the maximum base value for 2022 (865,000 rubles).

Earnings for 2022 amounted to 940,000 rubles, which exceeds the limit for 2022 (912,000 rubles).

Therefore, to calculate maternity benefits, earnings for 2020 will be limited to a maximum value.

1. Average earnings taking into account the maximum values:

830,000 rub. (employee’s earnings) + 912,000 rub. (maximum value of the base for 2022) = 1,742,000 rubles.

The number of calendar days in the billing period was 714, of which:

- in 2022 - 355 calendar days (365 days - 10 days);

- in 2022 - 359 calendar days (366 days - 7 days).

2. Average daily earnings:

RUB 1,742,000 / 714 days = 2,439.78 rubles.

This is more than the maximum average daily earnings for maternity benefits in 2022 - (865,000 rubles + 912,000 rubles) / 730 = 2,434.25 rubles, but not less than the minimum average daily earnings calculated from the minimum wage - 420 .56 rub. (RUB 12,792 x 24) / 730 days). On the day of the insured event, the minimum wage is 12,792 rubles. (Federal Law No. 473-FZ dated December 29, 2020).

The employee’s actual average daily earnings are greater than the maximum average daily earnings for maternity benefits, therefore, to calculate the benefit, the maximum amount in 2022 will be taken into account, i.e. RUB 2,434.25. (Part 3.3 of Article 14 of Law No. 255-FZ).

Further calculation and payment of benefits will be made by the FSS of the Russian Federation after sending it the necessary documents.

But we will calculate the amount of the benefit to understand how much the employee will receive from the fund.

In accordance with Article 11 of Law No. 255-FZ, maternity benefits are paid to the insured woman in the amount of 100% of average earnings. However, the length of her experience does not matter.

In our Example, the duration of the employee’s insurance period is 5 years 9 months. Despite this, the benefit is paid in full.

3. Amount of daily allowance:

RUB 2,434.25 (average daily earnings) x 100% (percentage of payment from earnings) = 2,434.25 rubles.

4. Amount of maternity benefit:

RUB 2,434.25 x 140 days = RUB 340,795

Exception to the general rule

An exception to the general rules for paying a lump sum benefit at the birth of a child are insurance companies registered in the constituent entities of the Russian Federation taking part in activities within the framework of the pilot project (Resolution of the Government of the Russian Federation dated April 21, 2011 No. 294). Currently, 33 constituent entities of Russia are participating in it, in which employees receive payments by contacting the Social Insurance Fund directly.

In addition, an exception is made for employees of organizations in the Far North and similar areas: the size of the one-time benefit is adjusted by the regional coefficient.