Pay taxes in a few clicks!

Pay taxes, fees and submit reports without leaving your home!

The service will remind you of all reports. Try for free

Employees are given bonuses as incentives for quality work and length of service. It can be paid annually, monthly or quarterly. The employer decides how often to stimulate employees. Taxes are collected on employee salaries, and many people wonder if bonuses are taxable.

A little theory: accounting concepts and types of bonuses

The bonus is an optional payment. This is a monetary reward for an employee for special merits. There are several types of incentives:

- by form of payment: in monetary terms or in the form of a gift (in kind);

- by frequency of payments: one-time or for a certain period;

- by purpose: production and non-production;

- according to the indicator: for the anniversary, for length of service.

According to Article 191 of the Labor Code of the Russian Federation, bonuses can be awarded for:

- high qualifications;

- high labor achievements;

- active in the development of the company.

Conditions for awarding bonuses

There are several official conditions for bonuses for employees:

- Federal Law No. 208. If one of the founders of the organization decides to award a bonus to employees, he makes this decision together with his colleagues.

- Article 129 of the Labor Code of the Russian Federation. The procedure for calculating monetary remuneration must be specified in the employment contract.

- Article 135 of the Labor Code of the Russian Federation. All issues of bonuses for employees must be agreed with the trade union, if there is one at the enterprise

Add bonuses for free and automatically calculate taxes through Kontur.AccountingTry for free

Taxation procedure for bonuses

Employers ask whether the bonus is subject to personal income tax. Their doubts are justified: firstly, such remuneration is always the employee’s income, and the income is taxed; secondly, the bonus is not remuneration.

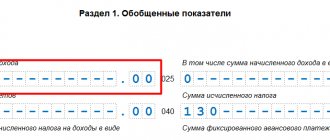

The answer to this question lies in the first point: the premium is income. According to Article 209 of the Tax Code of the Russian Federation, personal income tax and insurance payments are paid from it. The accrual of income tax on remuneration is standard - 13%.

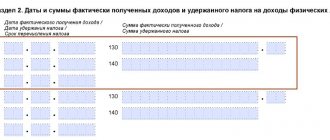

The tax on the premium is calculated on the day it is actually received. This date is determined differently depending on whether the bonus is for performance or for other reasons, such as the employee's 50th birthday:

- bonus for production results - the last day of the month in which it is accrued (except quarterly and annual);

- non-production bonus - the day the employee is paid.

Personal income tax is always withheld when paying remuneration to an employee. The tax must be transferred to the budget no later than the next day.

Taxes on stimulus payments

Let's consider the taxation of bonuses of the first group, recognized by the Tax Code of the Russian Federation as part of remuneration and recorded as such in the local documentation of the organization.

These funds reduce the employer's income tax base. The employer also has the right (not the obligation!) to apply regressive rates under the UST (Unified Social Tax) to these payments.

From the employee’s point of view, the bonus is income and therefore subject to mandatory personal income tax. There are several exceptions when payments to an employee will not be included in the personal income tax base:

- the employee received an international award;

- the award is for special achievements;

- the bonus was awarded to the employee by senior officials;

- the payment amount is less than RUB 4,000. per year (then it is regarded not as a bonus, but as a gift - Article 217 of the Tax Code of the Russian Federation).

In addition to personal income tax, profits, as part of income, are subject to mandatory contributions to the Pension Fund, Social Insurance Fund and Compulsory Medical Insurance Fund. Profits included in the exclusion group, that is, exempt from income tax, are not considered the basis for payment of insurance premiums.

NOTE! The execution of accounting documents is dated not on the day the bonuses are accrued according to the documents, but on the day when the funds are issued to the employee.

Why is it profitable to pay taxes on employee bonuses?

Articles 255 and 272 of the Tax Code of the Russian Federation state that all monetary remuneration accrued to employees is included in labor costs. This reduces the amount of income tax (for organizations using the OSNO) or the single tax (for organizations using the simplified tax system “income minus expenses”). To avoid misunderstandings with the tax office, keep documents confirming your right to a tax reduction. Everything related to the premium and its inclusion in costs must be regulated by regulations.

The premium can be taken into account in expenses if the following conditions are met:

- In your employment contract or local regulations, specify the conditions for calculating remuneration. It is prohibited to deduct incentive amounts from income tax if this condition is not met (Article 270 of the Tax Code of the Russian Federation).

- The bonus is paid for length of service or for labor performance that can be confirmed by documents. For example, an employee of the sales department can be awarded a bonus based on a memo from the immediate supervisor with data on the implementation of the plan.

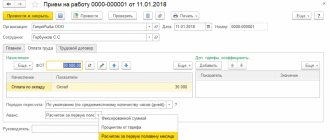

- The manager must issue an order to reward employees using Form T-11 for one employee, and Form T-11a for several.

Note! Only bonuses for production performance can be taken into account in tax expenses. Anniversary, holiday and other non-production bonuses cannot be taken into account. Also, bonuses paid from net income, special purpose funds or earmarked proceeds cannot be taken into account.

Taxes on bonuses not provided for by local acts of the organization

The second group of payments that can be accrued to employees includes one-time bonuses not provided for in the Regulations on bonuses or the collective agreement (employment contract). This is an essential condition that allows you to include bonuses in labor expenses and reduce the employer’s tax base. If it is not met, then the payment falls under a fundamentally different taxation system.

This type of bonuses is assigned on the basis of a management order (order), which in the usual manner must be familiarized with the signature of the employees named in it.

The accounting reflection of these payments will be different depending on the source of funds for their accrual:

- expenses for ordinary activities;

- other expenses.

What if we regulate these payments?

To reduce the tax base, entrepreneurs can take into account irregular payments in local acts. For example, in the documents you can indicate regular bonus payments to employees on March 8 or the New Year, upon reaching an anniversary date, etc. Such bonuses cannot be called production bonuses, but with a certain “favor” of the tax authorities, they can be justified as stimulating.

Even in such a situation, personal income tax and mandatory insurance contributions are charged on the amounts of these payments.

However, by law, one-time bonuses that are not assigned for labor performance cannot be included in profit expenses, so the risk of a legal dispute with tax authorities with an unknown outcome cannot be excluded.

ADVICE FOR EMPLOYERS. In order to avoid tax risk, the maximum number of payments to employees must be regulated as payment for labor, correctly substantiating this in the employment (collective) agreement and/or Regulations on bonuses. You can include in these documents the convenient wording “The employer reserves the right to reward the employee at its discretion.”

Insurance premiums from premium

According to Federal Law No. 212, payments to employees working on the basis of an employment contract are subject to insurance contributions. Deductions for insurance premiums from remuneration proceed in the same manner as with wages. Contributions must be paid to the Federal Tax Service, Social Insurance Fund and Compulsory Medical Insurance Fund.

Important! Insurance premiums are accrued in the same month in which the monetary reward was accrued. For example, an annual premium for 2022 accrued in January 2022 is included in the base for calculating contributions for January 2022.

According to the Ministry of Finance, bonuses for holidays, anniversaries and one-time payments are subject to contributions in the standard manner. However, companies that did not agree with this position and went to court were able to win against the tax office and defend their right not to charge contributions for such payments (Definitions of the Armed Forces of the Russian Federation dated December 27, 2017 N 310-KG17-19622, dated April 6, 2017 N 306 -KG17-2349, dated 10/13/2016 N 306-KG16-13002). It turns out that it is possible not to pay contributions on such premiums, but you should be prepared for the fact that the tax office will charge them additionally and the dispute will have to be resolved in court.

What needs to be done to minimize tax risks on premiums

So, let’s summarize regarding the taxation of bonus payments to employees.

- Payments of a production nature are justified by local acts of the enterprise.

- One-time bonuses may or may not be provided for in regulatory documentation.

- Both production and one-time payments are subject to personal income tax and insurance premiums (except for cases recognized by law as exceptions).

- Production bonuses reduce the employer's income tax base, but one-time bonuses do not.

- To protect yourself from tax risks, an employer should:

- carefully develop the Regulations on bonuses or prescribe the mechanism for calculating bonuses in the collective agreement (employment contracts);

- try to justify the maximum number of additional payments to employees as bonuses for work;

- take care of proper documentation of bonuses (compliance with the designated bonus criteria, their transparency and unambiguous interpretation, execution of a one-time incentive by order, financial justification, correct accounting entries, etc.).

What happens if you don’t pay taxes on your premium?

In accordance with the Criminal and Tax Codes, penalties and fines are provided for tax evasion, penalties are possible from responsible persons (accountant, director of the organization) and blocking of the company's current account. According to paragraph 3 of Art. 110 of the Tax Code of the Russian Federation, in case of accidental violation of tax legislation, a fine of 20% of the missing amount is provided. And for intentional violation of the law - 40% of the missing amount.

So, all employee bonuses, regardless of whether they are paid permanently or one-time, are subject to income tax and insurance payments. Exceptions may include rewards for special achievements in science, as well as incentives, the amount of which per year does not exceed 4,000 rubles.

Pay taxes on premiums automatically in the cloud service Kontur.Accounting. The service will help you correctly reflect the premium and pay taxes on it. Use the support of our experts and use the service for free for the first 14 days.

Try for free

When insurance premiums for incentive payments are not paid

Although employers have the right to make holiday incentives only at the expense of profits and they are not directly related to the performance of the labor function, the Ministry of Finance believes that they are subject to deductions for compulsory medical insurance, compulsory medical insurance and VNIM in the usual manner (letters of the Ministry of Finance dated 02/15/2021 No. 03-15-06/ 10032, dated December 14, 2020 No. 03-15-06/109203, dated October 25, 2018 No. 03-15-06/76608).

IMPORTANT!

Officials explain whether a premium is subject to insurance contributions or not if it is a one-time payment, paid out of profit and not related to labor functions, based on the list of non-taxable payments from Article 422 of the Tax Code of the Russian Federation. Bonuses for holidays and anniversaries are not included.

The Supreme Court of the Russian Federation previously expressed a different point of view. Based on the results of an analysis of the now abolished Federal Law No. 212-FZ of July 24, 2009, judges indicated that only payments directly related to the performance of a labor function are subject to taxation. This position on whether a holiday premium is subject to insurance premiums (not unless related to work) is set out in:

- determination of the Armed Forces of the Russian Federation dated December 27, 2017 No. 310-KG17-19622;

- determination of the Armed Forces of the Russian Federation dated April 6, 2017 No. 306-KG17-2349;

- determination of the Armed Forces of the Russian Federation dated October 13, 2016 No. 306-KG16-13002.

The employer has the right to take into account the position of the RF Armed Forces and not charge insurance contributions for compulsory health insurance, compulsory medical insurance and VNIM if he complies with the conditions specified by the judges:

- bonuses not only to current employees, but also to those who have retired and family members;

- an indication in the collective agreement of the specifics of bonuses for holidays with the reference that the payment is not of an incentive nature for work;

- The amount of the incentive does not depend on the position, qualifications and length of service (the best option is one amount for everyone).

In addition, there is a legal way to avoid paying taxes on bonuses to employees in 2022 for the New Year or anniversary - register it as a gift to the employee. The non-taxable personal income tax of a gift is 4,000 rubles. Sometimes a one-time bonus is issued as financial assistance, but when checking, Federal Tax Service specialists will still try to find signs of remuneration in such transfers in favor of employees and add additional payments to compulsory health insurance, compulsory medical insurance and VniM if an error is made in the registration.