There is no statute of limitations for property deductions

In principle, there is no need to write further.

That's all. There is no statute of limitations - not ten years, not twenty. Have you owned an apartment since the distant 90s? You are welcome to the tax office with a deduction. No, you won’t get two million, since until 2003 the tax deduction was 600 thousand rubles, but this is also a wonderful gift from the state. And no one is interested in why you didn’t immediately receive the deduction - you didn’t know, or in the dashing 90s you had no time for personal income tax - the property deduction has no statute of limitations.

We remind you: you can submit documents to the Federal Tax Service at the end of the year for which you plan to receive a deduction. For example, a refund for 2022 is issued in 2022.

Example:

In 2004, you bought a house, and in 2022 you decided to get a tax deduction. It's possible, no problem. Fill out the 3-NDFL declaration and contact the tax office - you will get your money back.

Please note: for housing registered as property from 01/01/2003 to 01/01/2008, the maximum tax deduction is 1 million rubles.

Statute of limitations for tax deductions - how many years in advance can you get it?

Tax deductions are considered the main financial advantage when buying an apartment, paying for education, treatment, etc. In this case, the tax deduction has a certain statute of limitations.

The state, taking into account all expenses, helps the residents of its country by returning a partial amount of money. This is called a tax deduction.

Property deduction – what is it?

Property tax deduction is a government benefit that is provided to an individual when paying taxes after purchasing or selling property.

The relevant regulatory act for this phenomenon is the Tax Code - Article 220. This document provides comprehensive information regarding the procedure for application, the allotted statute of limitations and other nuances.

In practice, receiving a property deduction is precisely the return of income tax.

Tax deductions are given only for the last three years

Although the property deduction does not have a statute of limitations, there are restrictions on the return of personal income tax for previous years.

We read paragraph 7 of Art. 78 Tax Code of the Russian Federation:

“An application for a credit or refund of the amount of overpaid tax may be submitted within three years from the date of payment of the specified amount, unless otherwise provided by the legislation of the Russian Federation on taxes and fees.”

Example:

In 2009, you bought an apartment, but only found out about the tax deduction in 2022. You can return the tax for 2022, 2022 and 2016.

By the way, there are less than two weeks left for refunds for 2016! In 2020, the ultimate step back will be the return of personal income tax for 2017.

Various reasons for tax refund

Receiving a property return is not limited in time.

take advantage of the standard tax deduction .

Implementation is not possible unless the following steps are completed:

- the employer has not received an application with a request for provision and the corresponding package of documents confirming the right to receive it;

- the income received within 1 year exceeded the maximum amount - 350 thousand rubles. – in case of applying for a standard child tax deduction.

Every citizen has the right to a refund of overpaid tax, but only if the period does not exceed 3 years .

submit documents for a refund of social deductions within 3 years from the time the expenses occurred.

The value can partly be called fixed, since the costs of medical services, medications and expensive types of medical care are determined by law.

The deduction is based on expenses actually incurred , but cannot be greater than the total amount established for a particular financial year.

The statute of limitations for receiving a social deduction for treatment is 3 years . That is, income tax on the amount spent on medical care for yourself or your children in 2016 can be returned in 2017-2019.

The provision of social deductions, whether for treatment or training, is carried out annually.

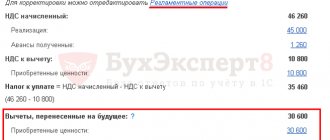

The limitation applies to the total amount of social deductions. Currently it is 120 thousand rubles.

A professional tax deduction is a procedure for reducing the taxable income received from any income-generating activity by the amount of expenses necessary to make a profit.

You can apply for such a privilege:

- entrepreneur;

- a citizen performing work or providing a service in accordance with the contract;

- author, inventor, designer, etc.

To receive a deduction, you must contact the tax office before April 30 and provide a completed declaration of income received during the past calendar year.

A citizen can apply for a professional deduction only if he acted in accordance with a contract or provided services.

An individual who has become the owner of royalties also has the right to a refund of previously paid tax. The reason for the reward may be a scientific discovery, a literary work, an object of art, an invention, etc.

How is a deduction for past periods provided?

It doesn’t matter what year the apartment was purchased - you can apply for a deduction for it at any time, but you need to take into account one important nuance: if the deduction is claimed for housing purchased in previous years, the rules and limits that were in force apply to it at the time of purchase.

Let us remind you that today the owner can claim a deduction in the amount of 2 million rubles for the costs of purchasing housing, returning 260 thousand rubles from it. Personal income tax (2 million x 13%), and for mortgage interest - a deduction in the amount of 3 million rubles, returning 390 thousand rubles. tax (3 million x 13%).

Example

Citizen Petrov learned that the property tax deduction has no statute of limitations only in 2022. He decided to file a deduction with the Federal Tax Service for two of his apartments purchased in different years. The first apartment was purchased in 2007 using his own funds, the second was purchased with a mortgage in 2014. What deductions will Petrov be able to receive in 2022:

- Until January 1, 2014, a different version of Art. 220 of the Tax Code of the Russian Federation, according to which it was possible to claim a property deduction only for one piece of real estate once in a lifetime. If the cost of housing was lower than the deduction limit, the unused balance was lost, i.e., it was impossible to “raise” the deduction to its maximum amount at the expense of other objects. In addition, the maximum deduction amount until 2008 was 1 million rubles. If Petrov, in 2022, claims a deduction for the first apartment, the ownership of which arose in 2007, he will be able to take advantage of a benefit in the amount of a maximum of 1 million rubles, accordingly, he will be able to return no more than 130 thousand rubles. tax (1 million x 13%). By using this deduction (even partially), Petrov will completely exhaust his right to a property deduction for expenses on the purchase of housing in the future and will no longer be able to apply the benefit to the second apartment.

- For property acquired in 2014 and later, different rules apply: the deduction can be applied until it is completely exhausted to any number of acquired real estate. The deduction limit for acquisition costs for an apartment purchased in 2014 is the same as now - 2 million rubles, but Petrov will be able to use it only if he does not claim a deduction for the first apartment. Petrov has the right to claim a deduction for mortgage interest paid to the bank when purchasing a second apartment in any case, since he does not apply this deduction to the first apartment.

Tax cannot be refunded for years preceding the year in which the right to deduction arose

According to the Tax Code of the Russian Federation (clause 6, clause 3, article 220), the right to a property deduction arises:

- when purchasing under a purchase and sale agreement - in the year of registration of ownership rights according to an extract from the Unified State Register of Real Estate (certificate of registration of ownership rights);

- when purchasing under an equity participation agreement - in the year of receipt of the Apartment Acceptance Certificate.

You can return the tax (receive a deduction) only for the calendar year in which the right to it arose and for subsequent years. It is not possible to refund taxes for years preceding the year in which the right to deduction arose.

Note: more detailed information about the moment when the right to deduction arises can be found in the article “When does the right to tax deduction arise when purchasing a home?”

Example: In 2022 Matantseva G.S. entered into a share participation agreement for the construction of an apartment. In 2022, the house was completed, and she received an Apartment Acceptance Certificate. This means that G.S. Matantseva has the right to deduction. arose in 2022. At the end of 2020 (in 2022), she can file for her 2022 tax refund.

If the deduction is not fully used (the tax paid is not enough to fully receive the deduction), then she will continue to receive it in subsequent years. Refund tax for earlier periods (for 2022, 2022, etc.) Matantseva G.S. can not.

Example: In 2022 Borisov A.A. I bought an apartment under a sales contract. The certificate of registration of ownership was received in the same year. This means that A.A. Borisov has the right to a property deduction. arose in 2022. Accordingly, now (in 2022) Borisov A.A. can submit documents to the tax authority for a tax refund for 2022 and 2020.

You can submit documents for 2022 only after its end. If the deduction is not fully used (the tax paid is not enough to fully receive the deduction), then he will continue to receive it in subsequent years.

Receive a deduction (return tax) for earlier periods, for example, for 2022 and 2022, Borisov A.A. cannot, since in these years the right to deduction has not yet arisen.

The only exception to this rule is when a retiree carries over a deduction. Pensioners have the right to transfer the deduction to three years preceding the year the right to it arose. This situation is discussed in detail in the article “Obtaining a deduction when purchasing an apartment by a pensioner.”

Statute of limitations for pensioners

Retired persons retain the right to apply for deductions when purchasing real estate, etc. But they do not pay personal income tax.

Accordingly, a situation may arise when there is simply nothing to return the tax from, because the amount has not been paid. Therefore, a different validity period for tax deductions is provided for pensioners. They can return income tax for the three years preceding the transaction, but only if they paid personal income tax during this period. For example, a pensioner purchased a plot of land in 2022. He is entitled to a deduction for the years 2016 – 2022 (inclusive). Those. They are allowed not only to shift the time frame, but also to increase the period for which the tax is refunded. If for all other taxpayers it is three years, for pensioners it is four years.

This rule applies to those pensioners who have actually stopped working and paying personal income tax. In all other cases, a property tax deduction can be issued at their discretion. If the income in the previous three years was higher than in subsequent years, which means higher income taxes, you can choose them. If it was lower, then you are allowed to choose the period after the transaction, but then not four, but three years in a row will be taken into account.

According to Russian law, receiving a tax deduction for an apartment does not have a statute of limitations. Each resident has the right to refund paid income tax at any time after it arises. You can only receive a deduction for the years following the transaction. This provision does not apply to non-working pensioners. They are entitled to receive a deduction for the three years preceding the transaction.