When an employee quits or his employment contract is terminated, a calculation note is drawn up to calculate the payment necessary in this situation (salary or compensation for unspent vacation days, etc.).

There is a special uniform form T-61, which is used in this case. The specialists responsible for preparing this document are a personnel officer and an accountant. The HR employee enters general information about the employee, information about dismissal and the fact of termination of the contract (on the front side of the document). On the other side, the accountant calculates the amount of payment due to him.

You may find the form for a note-calculation on granting leave (Form T-60) useful.

Which form to use

The calculation note (form No. T-61) is a primary accounting document.

It was approved by Decree of the State Statistics Committee of the Russian Federation No. 1 of 01/05/2004 and is intended to calculate wages and other payments to an employee upon termination of an employment contract. An employer is not required to use Form T-61 when dismissing employees. It is advisory and convenient in that personnel and accounting programs already contain a unified T-61 form. But it is allowed to develop your own form of calculation note to take into account the characteristics of the organization. Use the T-61 as a base, it will simplify the task.

What is it for?

By receiving a payslip upon dismissal, an employee can find out all the components of his salary and the total amount that the employer will pay him upon payment on the last working day.

By detailing all accruals and deductions, the employee has the opportunity to determine whether there are any discrepancies in the payments indicated in the form with those that are due to him in accordance with the employment contract and the norms of the Labor Code of the Russian Federation.

A payslip allows you to make the relationship between employer and employee regarding remuneration as transparent as possible. If an employee identifies shortcomings in payments, he or she can recover the missing amount from the employer, and the employer, in the event of unlawful claims regarding accruals made, can prove that he is right by presenting a payslip.

Who fills out the calculation note

The calculation note is a two-sided register with an introductory part and a calculation table. The form is filled out by responsible personnel and accounting employees. The personnel officer indicates the proper information about the company and the dismissed employee on the front side, the accountant fills out the columns of the tabular part on the back side.

The calculation note is drawn up on the basis of the necessary documents (statements, payment and settlement documents, which reflect all accruals for the billing period).

Download the settlement note upon dismissal (form and sample T-61)

Calculation note upon dismissal (form T-61)

Calculation note upon dismissal (sample for filling out form T-61)

| ★ Collection and directory of all personnel documents (forms and documents in word format) > 1200 books purchased |

To organize personnel records in a company, beginner HR officers and accountants are perfectly suited to the author’s course by Olga Likina (accountant M.Video management) ⇓

| ★ Author's course “Automation of personnel records using 1C Enterprise 8” (more than 30 step-by-step video lessons for beginners with instructions) purchased > 2000 practical courses |

Download samples of the organization's personnel documents : Form T-1 and T-1a. Employment orderForm T-2. Employee personal card Form T-3. Staffing table of the organizationForm T-6 and T6a. Vacation orderForm T-7. We draw up a vacation scheduleForm T-8. Order of dismissalForm T-9 and T-9a. Business trip orderForm T-10. Travel certificateForm T-10a. Business trip assignmentForm T-13. Working time sheetForm T-49. Payroll Form T-51. Payroll for calculating and calculating wagesForm T-53. Payroll for salary paymentsForm T-53a. Payroll register Form T-54. Employee's personal account Form T-60. Note-calculation on granting leave

How to fill out a note-calculation

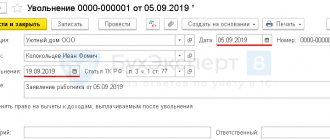

Let's look at step by step how to fill out a settlement note upon dismissal.

Step 1. Fill out the front side.

Here the personnel officer indicates:

- full or short name of the organization and its code in accordance with OKPO;

- details of the note itself - document number and date of completion;

- information about the employment contract with the dismissed employee - its number and date of conclusion.

Enter the employee's personnel details:

- last name, first name and patronymic;

- Personnel Number;

- department or structural unit.

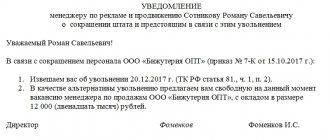

Please provide your resignation details below:

- basis in accordance with the Labor Code of the Russian Federation;

- order details;

- date of termination of the employment agreement.

All that remains is to enter the number of unused or advance vacation days.

After entering all the data, the responsible HR employee certifies the front side of the calculation note with a signature.

Step 2. Fill out the back side.

The reverse side consists of four tables in which the accountant calculates vacation pay and calculates compensation.

The first table includes the year of the billing period (column 1) and the calendar months of the reporting year preceding the date of dismissal (column 2). The lines corresponding to each month (column 3) reflect the total amounts of payments to the employee.

The second table of the calculation note reflects the total number of calendar days in the accounting year. Use a production calendar or calculate the number of days based on a conditional average. If the employee worked the entire month, then the number of calendar days will be 29.3.

If the month is not fully worked out, then the number of days is calculated as follows:

(29.3 / total number of days in the reporting month) × number of days actually worked according to the time sheet.

If an employee receives a salary for hours actually worked, then a special column in table No. 2 is filled in.

Now calculate your average daily earnings using the formula:

Average daily earnings = total amount of accruals for the billing period / total number of calendar days (hours).

Information about unused or advance-used vacation is entered into the last table of the calculation note, and then the amount of vacation pay to be paid or the amount of deductions that are made is calculated.

Step 3. Calculation of final payments in the note.

At the end, all calculated data is accumulated and the amount of compensation is calculated. The accountant must enter:

- wages for the reporting month;

- vacation pay (from the previous table);

- other charges;

- the total amount of accrued payments;

- estimated personal income tax on all charges;

- other types of deductions (if any);

- total for all types of deductions;

- debt of an organization to an employee or an employee to a company.

When all amounts are indicated, the final amount of payment to the employee upon dismissal is calculated. Then the same amount is written down in numbers and words. The accountant enters the details of the payroll, on the basis of which the employee received the appropriate funds. The accountant responsible for calculating compensation signs the table.

Fill out the calculation part of the T-61 form

The settlement part of the T-61 form is filled out in the accounting department. In this case, the rules for calculating compensation for unused (or used in advance) vacation are the same as for calculating regular vacation pay.

That is, for our example, the T-61 form will include the months from January to August and earnings for these months as the billing period.

IMPORTANT! When calculating compensation, not all payments made to the employee by the employer are taken into account. The full list of income taken into account in the calculation is given in clause 2 of the regulation “On the specifics of the procedure for calculating the average salary”, approved by Decree of the Government of the Russian Federation of December 24, 2007 No. 922. And those payments that do not need to be taken into account are contained in clause 5 of Resolution No. 922.

Based on the initial data entered into the T-61 form, the calculation is carried out:

- average daily earnings;

- the amount of compensation due for days of unused vacation or subject to deduction from payments to the employee;

- the total amount due to be paid to the employee, taking into account the salary accrued to him for the last month of work and the income tax withheld from the accruals made upon dismissal.

And here a note is made about the payment of this total amount with a decoding of its value and indication of the details of the expenditure document.

Read more about the nuances of calculating compensation in the article “Calculation of compensation for unused vacation according to the Labor Code of the Russian Federation.”

T-61 forms are available on our website.

A completed sample form can also be viewed and downloaded on our website.

Features of filling out a note-calculation

Here are the key rules, use them as a reminder:

- The front part of the form contains information about the employee, the grounds for hiring and termination of the employment contract. First, the HR department indicates the date of conclusion and number of the employment contract, full name. employee, his position, department. Then he puts the date of the dismissal order, its number, the basis for termination of the employment relationship, establishes the number of days of unused vacation for calculating compensation or, if the employee took vacation in advance, the amount of days used to make deductions. Signs the first page. Then the calculation note is transferred to the accounting department.

- The reverse side contains information for payment of vacation pay, information about wages and other payments for the period and the final amounts due to the employee. To do this, take a period of 12 months before the month of dismissal and all payments made to the employee during this time.

- After filling out all the columns, the accountant certifies the calculation note with a signature and passes it on for accrual of the amounts due.

- The calculator processes the information received and enters it into the appropriate columns of the form regarding charges and payments. Then it determines the amount of average daily earnings and the amount of compensation or the amount of the employee’s debt due for repayment. The calculation of compensation is determined by multiplying unused days by average daily earnings.

- In addition to compensation, wages are calculated for time worked. All accruals and deductions are reflected in the pay slip, which is issued to the employee, and payment documents for the payment of these amounts are transferred to the appropriate accounting specialist.

How long before dismissal should you write a note?

The legislation does not regulate the period of time during which a settlement note must be drawn up. The norms of the acts only establish the obligation to pay all money due upon dismissal to the employee either on the final day of work, or, if the salary is transferred to the card, then on the next day.

The deadline for its formation is the final working day of the resigning employee. If the employee terminates the contract on his own initiative, then according to the general rules he submits an application two weeks before this date.

Therefore, you can issue a dismissal order and draw up a settlement note from the moment you receive the dismissal application. However, you must also remember the employee’s right to withdraw the application before the end of the notice period. Therefore, the dismissal order and the note may have to be canceled.

You might be interested in:

Application for the standard child tax credit: when and how to write it in [year]

The personnel specialist must analyze the current situation and independently choose the period how many days before the termination of the employment relationship he should fill out a calculation note.

What to do if a document with calculations was not issued?

If upon dismissal an employee discovers that there is no payslip among the mandatory list of documents to be issued, the following procedure should be followed:

- Contact the company's accounting department to resolve the issue.

- If the accounting department refuses to receive the document, then the next step is to contact the labor inspectorate. Upon receipt of a complaint from a dismissed employee, inspectors will conduct an unscheduled inspection of the organization and, if a violation is confirmed, will hold the employer accountable in accordance with Art. 5.27 Code of Administrative Offenses of the Russian Federation.

- An employee can file a lawsuit against the employer. In the case of dismissal, a claim in court for violation of labor rights can be filed within a month from the date the employee receives a copy of the dismissal order or work record book (Article 392 of the Labor Code of the Russian Federation).

If the employee worked officially, then upon dismissal of his own free will or in another case, he needs to pick up a few more important certificates from the employer. In our articles you will find a detailed description of these documents, and also learn the rules for drawing up a letter of recommendation, a bypass sheet, what a copy of a work record book is and when it is needed.

Is it obligatory to issue it after the employee leaves?

Issuing a pay slip is not a right, but an obligation of the employer in accordance with Art. 136 Labor Code of the Russian Federation. Regardless of the type of organizational and legal form and form of ownership of the enterprise, management is obliged to provide staff with information about all payroll payments in writing.

For non-compliance with labor legislation, administrative liability is provided in accordance with Part 1 of Art. 5.27 Code of Administrative Offenses of the Russian Federation.

- Upon detection of violations, officials may receive a warning or a fine in the amount of 1,000 to 5,000 rubles.

- The fine for individual entrepreneurs (IP) is set at the same amount as for officials, and for organizations, violation of the law can result in a fine of 30,000 to 50,000 rubles.

In case of repeated violation, the fine increases (Part 2 of Article 5.27 of the Code of Administrative Offenses of the Russian Federation).

Violations of the norms of the Labor Code of the Russian Federation include cases when a pay slip is not issued to employees, as well as when it is issued late or contains incomplete information.

Filling rules

A unified form of the document is not established by law, therefore each employer can develop its own form of the form and establish the procedure for its issuance, taking into account the norms of the Labor Code of the Russian Federation. The issuance procedure is fixed in the local regulations of the organization, indicating the persons responsible for the issuance.

The legislation does not say in what form the document should be issued. This can be a standard A4 sheet or company letterhead. The sheet can be filled out either handwritten or printed. The pay slip must not contain typos or false information, otherwise the document will be declared invalid.

An accounting department employee is appointed responsible for the formation of the payslip, since he has access to information about payroll for each employee. Since the payslip is only an information document, it does not require the signature of the manager and the seal of the enterprise.

Upon dismissal, the pay slip must be issued to the employee on his last working day, when full payment is made and all documents are issued in accordance with the Labor Code of the Russian Federation.

You can hand over a payment document to an employee with or without a signature (what papers must the employee sign?). The first option is more reliable, since the employer can document the receipt by the employee of the sheet at any time. To implement it, choose one of the following methods:

- tear-off spine - upon receipt, the employee puts a personal signature on the tear-off part of the form, after which the spine remains with the employer;

- keeping a journal - upon receipt of a document, employees sign in the journal for issuing pay slips;

- an additional column in payment documents or a separate form where employees sign upon receipt of the document.

An employer may fulfill its obligation to inform staff, but not document this fact. This applies to the following cases:

- employees are informed about the issuance of pay slips, but they apply for the document themselves when necessary, for example, upon dismissal;

- information is provided by sending data by email;

- information is posted in the employee’s personal account on the corporate website (in case of dismissal, it may not be applied due to the employee’s access being blocked).

The sheet itself, with explanations of how accruals are calculated and how many deductions have been made, can be obtained in paper form from the accounting department of the enterprise, the cash desk, by e-mail or through a proxy (subject to the provision of a notarized power of attorney).