How long do you need to work to get 100% sick leave (legal norms)

The main conditions for payment of documents indicating the illness of employees are contained in a special regulatory legal act of the Russian Federation - the law “On compulsory social insurance...” dated December 29, 2006 No. 255-FZ.

In ch. 2 of this law reflects information about in what cases an employee has the right to receive sick leave, from what point sick leave payment is 100 percent and what length of service and documents are necessary to determine it, as well as about the main circumstances of sick leave payment, the amount of benefits and basis to reduce its size. Note that the insurance period is the entire work activity of a citizen during which insurance premiums for compulsory insurance were paid.

In Art. Chapter 7 2 of this legal act talks about the amount of sickness benefits, which depends on how much insurance coverage the employee has on the date of receipt of sick leave from a medical institution. Let's look at how length of service affects the amount of benefits.

Sick leave from a private owner

What if a person basically undergoes treatment only in private clinics? How should he deal with such a situation?

In fact, there is nothing complicated here either. The question of whether weekend days are included in sick leave that was issued in a private clinic can only be answered in the affirmative. The fact is that the current legislation, again, does not regulate which organizations have the right to issue sick leave. And if the institution has a license, then the employer cannot refuse to accept sick leave.

However, lawyers strongly recommend making sure in advance that a particular private clinic has the right to issue such documents. The fact is that management does not have the right to refuse to take sick leave, but they may well demand a copy of the institution’s license.

It is worth noting that a private clinic also has the right to issue sick leave on days off. At the same time, there are fewer problems with this than when contacting a government agency, since most private organizations operate as usual on Saturday and Sunday.

How many years after employment is sick leave paid at 100%

If the employee’s work experience is less than six months, then the monthly benefit cannot be higher than the minimum wage, taking into account the coefficients.

For an algorithm for calculating benefits for less than 6 months of service, see the article “The amount of the minimum wage for calculating sick leave .

If the length of service is more than 6 months, but less than 5 years, then the benefit is paid in the amount of 60% of average earnings.

With 5 to 8 years of experience, the benefit increases to 80% of the average daily earnings.

If the employee’s length of service has crossed the 8-year mark, then the benefit is paid at 100%.

When can weekends and holidays fall into the non-payment period?

At the same time, the issue of paying sick leave on weekends and holidays may be related to periods for which sick leave is not payable in principle (Article 9 of Law No. 255-FZ). These are periods when the employee:

- released from work without pay or with preservation (full or partial) of average earnings, but not due to going on another vacation;

- suspended from work without accrual of wages for this period;

- taken into custody or subjected to administrative arrest;

- undergoes a forensic medical examination;

- is in downtime, but not for a situation where the sick leave was issued before the start of the downtime period that arose through the fault of the employer.

You don’t have to worry about paying sick leave on holidays and weekends that fall within such periods: it will not be paid, since the entire period is unpaid.

But payment for sick leave on holidays and weekends will be made on a general basis if the period of incapacity for work:

- coincided with the next vacation (in addition, this will lead to a shift in the end of the vacation or the transfer of its unused part);

- began before the period of downtime caused by the employer;

- fell on 30 calendar days following the dismissal of the employee (here sick leave will not be paid in full, but only 60%).

Read more about sick pay after dismissal here.

What document is needed to confirm work experience?

After a person gets an official job for the first time, he is issued a work book and becomes insured against possible illness. Therefore, the main document confirming the employee’s length of service is the work book. However, if the employee’s length of service is not recorded in it for some reason, then the following are used as verification documents:

- employment contracts;

- certificates of experience issued by the employer;

- extracts from orders;

- personal accounts, payroll statements;

- references from archives;

- documents from the Social Insurance Fund on payment of insurance premiums;

- other documents.

The full list of documents is contained in the order of the Ministry of Labor “On approval of the rules for calculating and confirming insurance experience...” dated 09.09.2020 No. 585n.

The established periods included in the insurance period are summed up, and the result is the total length of service used to calculate sick leave. Temporary non-working pauses between employment with different business entities do not relate to the insurance period and are not taken into account when calculating it.

Certain time periods used to determine length of service should be highlighted, these include:

- work on the basis of an employment contract;

- various categories of public service, including military, municipal, etc.;

- other activities in which the person was insured for the period of illness.

Sick leave payment

So, now it’s time to figure out whether weekends are included in sick leave?

According to current legislation, the employee’s direct employer pays only the first 3 days of sick leave from their own payroll fund. Other days, including holidays and weekends, are paid from the Social Insurance Fund, but only if the employee regularly makes contributions there. These are almost all people who work on a “white” salary.

As a result, the question of whether weekends are included in sick leave can only be answered in the affirmative. The temporary disability certificate must be paid in full and all calendar days are taken into account, not work shifts.

From what period does the payment of benefits for caring for a sick relative change?

You can receive 100% sick leave with over 8 years of experience not only when the document is issued directly to the sick employee. Also, this amount of benefit is provided in a situation where the document is drawn up while caring for a sick family member.

ConsultantPlus experts told us how to calculate and pay for sick leave to care for a sick family member. Get free trial access to the system and see recommendations.

It should be taken into account that if care was provided for a child undergoing inpatient treatment or for another family member, then sick pay is calculated depending on the length of service. If care took place for a child undergoing outpatient treatment, then 100% payment for sick leave in 2021-2022 (the percentage of payment in this case is determined by length of service) is carried out only for the first 10 days of illness, and the remaining days of illness - in the amount 50% of average earnings.

Regarding payment of sick leave for child care, read the material “How sick leave is paid for child care .

In addition, during maternity leave, 100% sick leave is paid, length of service is not taken into account. Read about the amount of maternity benefits here.

NOTE! Payment for sick leave involves inclusion in the calculation of the entire period of illness, which is specified in this document. However, it should be noted that some days may be excluded from this period, for example, if on these days the employee took vacation at his own expense / study leave or the period of illness occurred during a period of downtime.

New procedure for calculating sick leave in 2022

From April 1, sick leave for a full month of incapacity must be no lower than the federal minimum wage, taking into account regional coefficients, regardless of the employee’s insurance coverage and actual earnings. This is established by Federal Law No. 104-FZ of 04/01/2020. This procedure is valid until the end of 2022. In 2022, the federal minimum wage is 12,130 rubles.

This is how you now need to calculate temporary disability benefits.

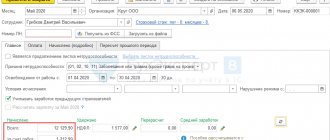

- Calculate how many calendar days are due for payment. To do this, look at what date and date there was a release from work. If there are non-working days during this period, they are also paid. Pay attention to the codes in the “Reason of disability” cells - this determines how many days of sick leave you need to pay. For example, “01” means illness; the employee must be paid benefits for all days of illness. “09” is caring for a sick family member, and here, depending on the additional information on the sheet, there will be restrictions on the number of days. Decoding of the codes can be found on the back of the sick leave.

- Calculate your average daily earnings as usual. To do this, divide the employee’s earnings for the billing period (in general, these are the two previous calendar years) by 730 and adjust them taking into account the length of service: less than 5 years - 60% of average earnings; 5-8 years -80%; 8 or more years - 100%. If the employee’s insurance coverage is less than 6 months, the benefit is calculated based on the minimum wage.

- Calculate the daily allowance based on the minimum wage, taking into account the regional coefficient (if there is one) - divide the minimum wage by the number of calendar days in the month in which the sick leave falls. So, if the sick leave is in July, then divide by 31. If the sick leave falls on more than one month, you need to calculate it separately for each month.

- Compare the daily allowance from the average salary and from the minimum wage and choose the highest value. Multiply it by the number of calendar days of illness.

Let's look at examples of how to calculate temporary disability benefits.

Full time employee

The employee was on sick leave from 06/22/2020 to 06/26/2020. His insurance experience is 7 years. Over the previous two years, he earned 344,560 rubles.

Average daily earnings are 344,560 / 730 = 472 rubles.

Taking into account the length of service, the daily benefit amount is 472 * 80% = 377.60 rubles.

Now let’s calculate the daily allowance based on the minimum wage. Let's assume the company is located in an area that applies a regional salary coefficient of 1.2. Then you need to calculate based on the increased federal minimum wage. That is, 12,130 * 1.2 = 14,556 rubles. Let's divide it by the number of calendar days in June.

Daily allowance from the minimum wage = 14,556 / 30 = 485.20 rubles. Let's compare: 485.20 is more than 377.60 - which means that to calculate the benefit we take the amount calculated from the minimum wage.

For five days of illness, the employee will receive:

485.20 * 5 = 2,426 rubles.

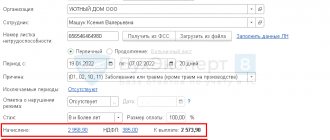

Part-timer

An external part-time worker hired at 0.5 rates was ill from June 15 to June 24, 2022. On the date of issue of the certificate of incapacity for work, he worked part-time for six months. Insurance experience - 4 years and 7 months. I did not provide a certificate of earnings from previous places of work, since I had not worked in the previous 2 years. In the locality, a regional salary coefficient of 1.3 is applied.

An employee can receive temporary disability benefits at one of the last places of work of his choice.

If he wants to receive it where he works part-time, he needs to bring a certificate from the main employer stating that the benefit was not assigned.

Since information about salaries for 2018-2019. no, then the average daily earnings are calculated from the minimum wage:

RUB 15,769* 24 months / 730 days = RUB 518.43

Since the part-time worker has a part-time job, we calculate the daily allowance based on a rate of 0.5:

518.43 * 0.5 = 259.22 rubles.

Until April 1, 2020, due to the employee’s short length of service, the benefit would have further decreased to 60% and amounted to 259.22 * 0.6 = 155.53 rubles, but according to the new law No. 104-FZ, sick leave cannot be lower than the federal minimum wage, taking into account regional coefficient. If the insured person works part-time, then the minimum wage benefit is calculated in proportion to the length of working time.

For 10 days of incapacity, the employee will receive:

259.22 * 10 = 2,592.2 rubles.

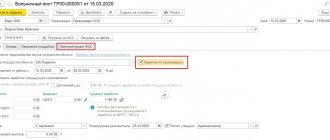

Sick leave for March-April

The certificate of incapacity for work was opened on March 27, and closed on April 5, 2020. The employee’s insurance experience is 10 years, place of work is primary, full-time, coefficients are not applied. Earnings for the previous two years - 275,600 rubles.

The benefit is calculated in two stages:

- Until 04/01/2020 - according to the old rules (No. 255-FZ).

- After 04/01/2020 - taking into account the new law No. 104-FZ.

Average daily earnings = 275,600 / 730 = 377.53 rubles.

Daily benefit amount for April = 12,130 / 30 = 404.33 rubles.

Let's compare: 377.53 is less than 404.33. This means that the amount calculated from the minimum wage will be included in the calculations. But only for part of the benefit for April, since the new rules were not yet in effect in March.

Benefit for March = 377.53 rubles. * 5 days = 1,887.65 rubles.

Benefit for April = 404.33 rubles. * 5 days = 2022.65 rubles.

For 10 days of illness, the employee will receive 3,909.30 rubles.

Results

Based on the above, we conclude that sick leave is paid at the rate of 100% if the experience is 8 years or more, and it must have official documentary confirmation. In connection with pregnancy and childbirth, sick leave is always paid 100%, the length of service does not matter.

Read about the nuances that affect both the determination of the length of service and the use of coefficients for calculating benefits depending on its duration here.

Sources:

- Federal Law of December 29, 2006 N 255-FZ “On compulsory social insurance in case of temporary disability and in connection with maternity”

- Order of the Ministry of Health and Social Development of Russia dated February 6, 2007 N 91

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

Reasons for reducing the amount of sick leave

The grounds for reducing the amount of temporary disability benefits are:

- violation by the insured person without good reason during the period of temporary disability of the regime prescribed by the attending physician;

- failure of the insured person to appear without good reason at the appointed time for a medical examination or for a medical and social examination;

- illness or injury resulting from alcohol, drug, toxic intoxication or actions related to such intoxication.

Thus, if there are one or more of the listed grounds, sick leave is paid to the insured person in an amount not exceeding the minimum wage established by federal law for a full calendar month.

Deadlines for payment (payment) of sick leave from the Social Insurance Fund until 2021

If the employer was located in a constituent entity of the Russian Federation in which the FSS pilot project was not operating, then in cases provided for by law, the fund paid the employee sick leave funds within 10 calendar days from the date of receipt directly from him or through the MFC of the necessary documents:

- statements (according to Appendix No. 1 to the regulations, approved by order of the Ministry of Labor and Social Protection of Russia dated May 6, 2014 No. 290n);

- sick leave;

- certificates of earnings (according to Appendix No. 1 to the order of the Ministry of Labor of the Russian Federation dated April 30, 2013 No. 182n);

- documents certifying insurance experience (according to the rules approved by order of the Ministry of Health and Social Development of the Russian Federation dated February 6, 2007 No. 91):

- other documents listed in clause 13 of the regulations approved by order No. 290n.

If the employing company was located in the region in which the Social Insurance Fund pilot project is being implemented, then sick leave payment - the timing of benefit payment - consisted of the following periods:

1. The period during which the employer is obliged to transfer to the local Social Insurance Fund the necessary data about an employee who went on sick leave is 5 calendar days.

2. The period of verification of documents by the Social Insurance Fund and payment of sick leave is 10 calendar days.

Thus, the total period for paying sick leave in 2022 in the regions of the FSS pilot project could have a longer duration (up to 15 calendar days).

Minimum wage 2022 for calculating sick leave

According to the rules for calculating sick leave in 2022, the minimum wage that is current on the date of illness in the current year is used. This means that the minimum wage values for previous years are no longer needed. If the amount of disability benefits is determined based on the employee’s earnings, then his income for the previous two years will be required.

For more information on the conditions for applying the minimum wage calculation, see the article “What is the minimum wage for calculating sick leave.”

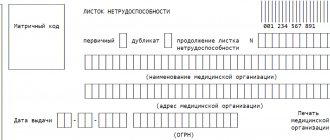

When calculating sick leave in 2022, every employer wants to be sure whether the certificate of incapacity for work is drawn up correctly. It is now impossible to directly check the sheet, since it has been issued only electronically since 2022. Therefore, as a general rule, sick leave will have to be accepted as is. But if you have doubts about the validity of the calculations, you can complain about the medical institution to the Social Insurance Fund - on the basis of a new procedure approved by order No. 1090n dated November 23, 2021.

If the enterprise has at its disposal a paper sick leave issued in 2022, then work with such a document should be carried out taking into account recent clarifications from the Social Insurance Fund.

Find out more about the new procedure for FSS inspections of medical institutions in special material available in the ConsultantPlus system. Get a free trial.