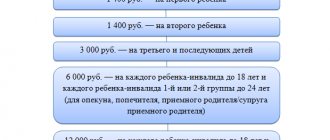

The legislation regulates certain types of income of citizens, which are deducted from the total amount for taxation. Tax

Modern industry is actively developing, involving ever newer and more advanced technologies. At the same time, in order to

What reports can be submitted through the Federal Tax Service website? The official service on the Federal Tax Service website will allow you to

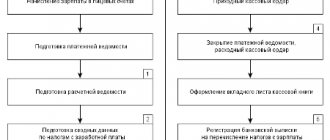

Salaries in accounting: basic operations Payroll accounting is carried out within the framework of the following

What applies to transport costs? The range of potential options is quite wide - in this case

What expenses are considered direct? Art. 318 of the Tax Code refers to direct expenses: Costs,

Who needs to obtain a license In Article 12 of the Law “On Licensing of Certain Types of Activities” dated

Tax benefits for pensioners According to the Tax Code of the Russian Federation and in connection with the increase

Note! The UTII tax regime has been abolished since 2021 in all regions. For UTII payers

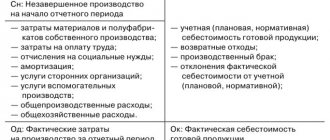

Main production: determine the composition of costs The production process is a technological cycle for the creation, development,