Main production: determining the composition of costs

The production process is a technological cycle for the creation, development, and assembly of finished products at an enterprise.

The totality of all costs associated with the production and sale of finished products forms its cost. The main production can be described as follows. Organizations carrying out production activities determine the cost of manufactured products. To account for the total amounts of such expenses, account 20 is used, the transactions for which we have collected in one table. It is applied in accordance with the chart of accounts approved by Order of the Ministry of Finance of the Russian Federation No. 94n dated October 31, 2000.

Primary production costs are costs that relate to the production of certain types of goods, works or services directly related to the main activity of the enterprise. Such costs can be direct or indirect.

Direct costs include the costs of purchasing raw materials and supplies involved in the manufacture of goods in a broad sense, remuneration for workers, damage from defects, depreciation, etc.

Indirect costs include costs associated with maintenance, administration and control of the production process.

It turns out that accounting account 20 for dummies is “Main production”, which reflects all production and general business costs of the organization.

At the “Main production” the following costs are taken into account:

- production of industrial and agricultural products;

- carrying out construction, installation, dismantling, geological exploration and design and survey work;

- provision of communication and transportation services;

- carrying out R&D work - research and development work;

- maintenance, operation and repair of highways, etc.

What counts in the 20 count?

Account 20 is used to account for the following costs:

- production of products from agricultural and industrial enterprises, as well as subsidiary farms;

- costs of repair work, maintenance of cars and other vehicles;

- costs of organizations providing transport services;

- costs of construction, installation and design and survey work;

- costs of performing research and development work;

- costs of catering organizations;

- salaries of key and administrative personnel;

- depreciation of production equipment;

- amounts of payments for renting premises and paying for utilities;

- other expenses related to the activities of the production enterprise.

Debit 20 reflects all direct costs associated with the manufacture of products (performance of work and provision of services), costs of auxiliary production, indirect costs, as well as losses from defects. Credit 20 reflects the amount of the actual cost of goods, the production of which has already been completed, or work performed and services rendered.

Counting scheme 20

When determining the type of account 20 - whether it is active or passive - you need to understand the following: since the company cannot consume more raw materials and materials than it was written off for, therefore, debit turnover on the account. 20 will always be more credit. And this means that the count. 20 - active. Balance (remaining) according to account. 20 at the end of the month reflects the amount of work in progress costs.

Basic cost structure

Account 20 accumulates the following types of costs:

- material, which are aimed at purchasing materials, raw materials, supplies, equipment, etc., necessary in the production process;

- wages and social needs - costs that go towards wages and insurance premiums for workers and other persons involved in production;

- depreciation - deduction for wear and tear of fixed assets that are directly involved in the manufacturing process;

- other costs, which include travel expenses, shortages identified within the limits of natural loss, deferred costs, etc.

In order for an accountant to be able to include indirect costs in the cost of each unit of goods manufactured, work performed or service rendered, these costs must be distributed. An enterprise has the right to independently choose one indicator of cost distribution, for example, the value of inventory assets used in the process of manufacturing goods.

Costs recorded in accounting account 20 should be written off to the standard (planned) or actual cost of manufactured products.

Account postings 20

All transactions performed under debit 20 show the accrual, reflection and accounting of the cost of all materials and costs of manufacturing products.

Typical wiring

The correspondence with Section 1 reflects the inclusion of depreciation costs in the cost of production:

- Dt20 Kt02 - for products used in primary production and trade;

- Dt20 Kt04 - for depreciation of intangible assets;

- Dt20 Kt08 - construction costs are reflected.

Correspondence with Section 2 reflects the write-off of the cost of materials:

- Dt20 Kt10 - the cost of materials written off for main production is taken into account;

- Dt20 Kt11 - write-off of the cost of animals for the main production is taken into account;

- Dt20 Kt16 - writing off the amount of deviations in the cost of materials.

The correspondence with Section 3 reflects the inclusion in the cost of other types of expenses:

- Dt20 Kt20 - intra-production turnover of products;

- Dt20 Kt21 - transfer of self-made semi-finished products to the main production;

- Dt20 Kt23 - inclusion in the cost price of the cost of services of auxiliary production;

- Dt20 Kt25 - inclusion of overhead costs in the cost of production;

- Dt20 Kt26 - inclusion of general business expenses in the cost of production;

- Dt20 Kt28 - inclusion in the cost of losses from defects;

- Dt20 Kt29 - inclusion in the cost of production the cost of services of service industries and farms.

Correspondence with Section 4 occurs as follows:

- Dt20 Kt40 - write-off of planned cost;

- Dt20 Kt41 - transfer to the main production of goods purchased for sale;

- Dt20 Kt43 - supply of finished products for the needs of the main production.

Correspondence with Section 6 occurs as follows:

- Dt20 Kt60 - payment to third parties for services provided for the main production;

- Dt20 Kt68 - inclusion of taxes and fees in the budget in the cost of production;

- Dt20 Kt69 - calculation of insurance premiums for employees of the main production;

- Dt20 Kt70 - payroll;

- Dt20 Kt71 - payment of expenses of accountable persons for the needs of the main production;

- Dt20 Kt73 - inclusion of compensation for wear and tear of personal property in the cost of production;

- Dt20 Kt75 - contribution of the main production costs by the founders of the enterprise;

- Dt20 Kt76 - inclusion of insurance costs in the cost price;

- Dt20 Kt79 - inclusion of separate production costs in the cost price.

Correspondence with Section 8 occurs as follows:

- Dt20 Kt94 - inclusion in the cost price of the amount of identified shortages for various reasons (from damage to property, based on inventory results);

- Dt20 Kt96 - accrual from the cost of production of amounts to the reserve for future expenses (for repairs, vacation pay).

Note! Entries for credit 20 reflect the receipt of materials, waste, and finished products from the main production.

The relationship with Section 2 reflects the return of materials and supplies from main production:

- Dt10 Kt20 - taking into account unused materials and waste.

- Dt11 Kt20 - increase in the cost of animals due to weight gain.

Correspondence with Section 3 accounts occurs as follows:

- Dt21 Kt20 - receipt of self-made semi-finished products from the main production;

- Dt28 Kt20 - reflection of losses in the cost of irreparable defective products.

Correspondence with Section 4 accounts:

- Dt40 Kt20 - write-off of the actual cost of manufactured products;

- Dt43 Kt20 - posting of finished products.

Capitalization of finished products

The relationship with the accounts of Section 6 reflects:

- Dt76 Kt20 - reduction in the cost of work in progress;

- Dt79 Kt20 - performance of work by the main production.

Correspondence with Section 8 occurs as follows:

- Dt90 Kt20 - write-off of actual cost;

- Dt91 Kt20 - write-off of works or services of the main production;

- Dt94 Kt20 - reflection of the amounts of shortage of work in progress identified during the inventory process;

- Dt99 Kt20 - the costs of the main production are attributed to the losses of the enterprise.

Subaccounts and analytics

The main production - count 20 - is active. Synthetic and analytical accounting is carried out on it. Sub-accounts are opened depending on the specifics of the activity and industry of the organization. Analytical accounting is carried out by type of costs of products that the enterprise produces, or by structural divisions of the enterprise.

The credit of account 20 reflects the write-off of the full cost of finished products, the debit serves to take into account the total amount of all costs for the production of industrial products.

Accounting on account 20 “Main production” can also be carried out using subaccounts:

- 20.1 - crop production. It is intended to reflect costs and output of crop products, including accounting for horticultural products and growing seedlings.

- 20.2 - livestock farming. Data on costs and output of livestock products are reflected here. Analytics of livestock products is carried out by types and groups of animals and poultry, as well as by established types of costs.

- 20.3 - industrial production. This takes into account accounting information about the production and release of the results of the main production, preparation and development of production, etc. The actual cost is carried out under credit 20.3, and the balance at the end of the period for this sub-account (in accordance with analytical accounting data) indicates the cost indicator for work in progress industrial production.

- 20.4 - other main production and activities. Designed to accumulate accounting data for certain types of activities and for agricultural chemical organizations, machine-technological stations, and off-farm enterprises. This subaccount includes expenses for harvesting, transporting fertilizers, working with soils, protecting plants, improving land, operating costs for vehicles of MTS organizations and agricultural chemicals, etc. Accounting for the costs of maintaining cars, trucks and other special vehicles is carried out for each type separately.

Subaccounts

For account 20 the following recommended sub-accounts can be opened for the main activities of the enterprise:

- 20-01 “Crop production”. This takes into account the costs of crop production and its branches - horticulture, floriculture, growing seedlings.

- 20-02 “Livestock” - accounting for the costs of output from livestock farming and its industries - dairy and beef cattle breeding, sheep farming, fish farming, beekeeping, etc.

- 20-03 “Industrial production”. This subaccount reflects all direct costs associated with the manufacture of goods, preparation and development of production, other production costs, as well as production maintenance and management costs.

- 20-04 “Other main production” - cost accounting for other main activities of manufacturing enterprises.

Typical entries for the Main Production account

Let's present the key transactions for account 20 with comments in the table:

| accounting entry | the name of the operation |

| Dt 20 Kt 02, 10, 21, 60, 69, 70 | Write-off of costs directly related to the manufacture of GWS |

| Dt 20 Kt 23 | Write-off of auxiliary production costs |

| Dt 20 Kt 25, 26 | Write-off of indirect expenses |

| Closing 20 am | |

| Dt 28 Kt 20 | Defects in production taken into account |

| Dt 40 Kt 20 | The cost of finished products is taken into account in accordance with its standard cost |

| Dt 43 Kt 20 | The actual cost of GWS is reflected |

| Dt 90.2 Kt 20 | Manufactured GWS are sent for sale |

| Dt 91.2 Kt 20 | Canceled orders taken into account |

General running costs

Indirect costs associated with servicing the organization are displayed on account 26. These include:

- administration salary;

- social insurance contributions;

- communication costs;

- costs of maintaining security;

- administrative and management costs;

- depreciation of administrative operating systems;

- rental of office space, etc.

Expenses for the month are accumulated according to DT26. At the end of the month, these amounts are written off to account 20 in accounting or 90-2 in full.

Typical transactions for account 26 are presented in the form of a table.

| Operation | DT | CT |

| Accrued depreciation on fixed assets, intangible assets | 26 | 04, 02, 05 |

| Materials were transferred for general business needs | 10 | |

| Electricity costs included | 60 | |

| Salaries paid to workers involved in OS maintenance | 70 | |

| Insurance premiums accrued | 69 | |

| A vacation pay reserve has been created | 96 | |

| General production costs associated with auxiliary production were written off | 23 | 26 |

| General production costs associated with main production were written off | 20 | 26 |

Non-production organizations use account 26 to display information about operating expenses. Cost amounts at the end of the month are written off to DT90 “Sales”. Analytics for account 26 is carried out for each budget item, cost location, etc.

Cost Accounting Example

The company produces chairs. The cost structure is as follows:

- material costs - 150,000.00 rubles;

- salary - 250,000.00 rubles;

- depreciation—RUB 50,000.00;

- other costs - RUB 30,000.00.

Finished products in the amount of 1,500 pieces were shipped to the warehouse and received.

Let's calculate the cost of one product. Cost of one chair = (150,000 + 250,000 + 50,000 + 30,000) / 1500 = 320 rubles.

The entries to be reflected in accounting will be as follows:

- Dt 20 Kt 10 - write-off of material costs in the amount of 150,000 rubles;

- Dt 20 Kt 70 - write-off of labor costs in the amount of 250,000 rubles;

- Dt 20 Kt 02 - write-off of depreciation (50,000 rubles);

- Dt 20 Kt 60, 97, 23, 25, 26 - write-off of other costs (30,000 rubles);

- Dt 43 Kt 20 - write-off of the cost of products in the amount of 480,000 rubles.

Accounting for production costs when releasing products

The expenses of an enterprise engaged in the production of products are, as a rule, standardized. The company sets its own standards based on the technology used and economic and statistical calculations. If an enterprise does not have the opportunity to develop technologically sound standards, then standardization is carried out based on actual costs. In this case, the standard is usually taken as the average cost per unit of production. In order for the application of standards to be effective, established standards must be periodically analyzed, corrected, and supplemented.

Starting from 2022, the enterprise’s inventory and work in progress must be taken into account according to the new Federal Accounting Standard 5/2019 “Inventories”. PBU 5/01 has become invalid. You can check whether you have taken into account all the norms of the standard using the Guide from ConsultantPlus. If you do not have access to this legal system, trial demo access is available for free.

To determine the planned and actual production costs, product cost calculations or cost calculations are compiled. In such calculations, the value of all types of direct and indirect costs per unit of production is established. Indirect costs are distributed in one of the following ways:

- by distributing indirect costs in proportion to material costs;

- by distributing indirect costs in proportion to the wages of key production personnel;

- distribution of indirect costs in proportion to production costs.

IMPORTANT! Expenses collected on account 26 may not be distributed to main production. In this case, accounting in the main production will be carried out at a reduced cost (direct production costs only). Then the amounts accumulated in the indirect costs account must be attributed directly to the cost of sales by posting Dt 90.2 Kt 26. Which method of accounting for production costs is chosen is necessarily recorded in the accounting policy of the enterprise.

Production costs include:

- materials for production;

- labor costs;

- costs for compulsory social insurance of production personnel;

- depreciation of production assets;

- other costs;

- costs of auxiliary production.

The cost items indicated above (except for the costs of auxiliary production), in accordance with clause 8 of PBU 10/99, form a grouping of expenses from ordinary activities by type of cost. The last point of the above classification may or may not be included in production costs by an enterprise. The adopted accounting method must be reflected in the accounting policy.

How to classify production cost items can be found here: “Classification of production cost items.”

Closing an account

Closing is carried out at the end of the reporting month or upon the end of the production period or cycle. Often the 20 account has no balance, that is, it is reset to zero. If a debit balance has formed for “Main Production”, then it will reflect the value of work in progress as of a specific date. This balance is carried forward to the beginning of the next reporting period. Closing account 20 can be carried out for certain types of goods, works or services produced, and for other analytical registers the balance will be reflected in the form of work in progress.

Closing can be done in one of the following ways:

- straight;

- intermediate;

- direct sales of released products.

The closing methodology and cost allocation basis are prescribed in the accounting policy and cannot be changed or canceled during the reporting period.

Here is a brief instruction on how to close a 20 account using the direct method. During the reporting period or production cycle, there is no accurate information about the price of the product. Production results are reflected at deemed cost. You can take into account prices at planned cost, but accounting at actual cost during the reporting period is not allowed. After its completion, the accountant will already know the amount of the actual cost, after which the appropriate adjustment will be made to close the 20th account.

Auxiliary production

Account 23 is used to summarize information about auxiliary costs:

- service by types of energy;

- fare;

- OS repair;

- production of tools, building parts, structures.

DT23 reflects expenses directly related to the release of goods, indirect costs and losses from defects. In this case, the following transactions are generated:

- DT23KT10 – materials written off for auxiliary production.

- DT23KT70 – the wages of production workers are taken into account.

- DT23KT69 – insurance premiums have been calculated.

- DT23KT25, 26 – indirect costs are taken into account.

- DT23KT28 – losses from defects are written off.

KT23 reflects the actual cost of production. These amounts are then written off to account 20 in accounting, subaccounts “Crop production” (20-1), “Livestock production” (20-2), “Industrial production” (20-3), “Other production” (20-4). Account balance 23 reflects the cost of the work in progress. Analytics is carried out by type of production.

Cost Allocation

The accountant needs to keep analytical accounting on account 20 by type of product.

Costs related to several types of products (indirect costs) must be allocated to be included in the cost of each unit of output. The organization can independently determine the indicator in proportion to which the distribution of expenses will be made. This indicator can be the volume (cost) of materials and raw materials used in the production of a particular type of product, or the amount of wages of workers employed in production.

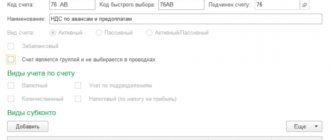

Displaying both types of expenses in accounting

The table “Settings for reflecting and writing off expenses in accounting” (below) contains settings for both types of expenses in accounting, which are located in the “Main/Accounting policies” section.

Figure 3. Accounting policy settings

Table. “Settings for reflecting and writing off costs in accounting”

Commercial structures whose business is based on services to manufacturers check the box next to “Performing work/providing services...” to set up “Costs are written off” according to one of the options:

- “Excluding revenue”: from Kt 20 to Dt 90.02, i.e. even if there is no turnover on account 90.01.

- “Taking into account all revenue”: from Kt 20 to Dt account 90.02 in the context of item groupings for which it was.

- “Taking into account revenue only from production services”: can be written off after registration of the issue through an act of services rendered.

Figure 4. “Performance of work, provision of services to customers” and the “Costs are written off” setting

Manufacturers themselves must mark the execution as “Product release”.

Figure 5. “Product output”

After these steps, a set of switches “General expenses are included” will become available:

- “Into the cost of sales (direct costing).” KR with Kt 26 will be written off in Dt 90.08/Management expenses.

Figure 6 “In the cost of sales (direct costing)”

Figure 7. Postings for writing off financial assets using the direct costing method - “In the cost of products, works, services” requires a transition to “Methods for the distribution of indirect expenses” and the establishment of a posting rule, according to which general business expenses from 26 will be distributed according to item groupings to 20 and 23. This is due to the fact that indirect expenses accounts do not have subaccounts "Nomenklatura Group".

Figure 8. Raman diversity methods

Figure 9 Methods for distributing general production and general expenses

Figure 10 Setting up the CD diversity rule

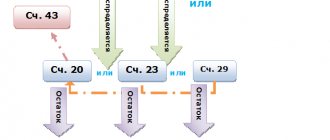

Thus, indirect expenses from Kt 26 will be written off to Dt of direct accounts - 20 or 23 (in the second case, at the end of the month, additional expenses will be automatically written off to Dt 20, and then from Kt 20 to 40 or 43).

Figure 11 Postings for writing off PR to the cost of production

If account 25 is used to display indirect expenses in a manufacturing company, then you need to establish a rule for posting them on direct accounts using the link to the posting methods discussed above. According to the accounting methodology, from 25 they are posted to Dt 20 or 23. Similarly, in the case of distribution to 23, at the end of the month the costs will automatically be written off to Dt 20, and then closed at 40 or 43.

Figure 12 General scheme for closing Account 20/23/25/26 for a production organization

That is, when closing the month, indirect expenses are first written off from Kt 26 to Dt 90.08 (in case of write-off using the direct costing method) or from Kt 26 to Dt 20 or 23 (according to the posting rules, if any have been established). Costs from 25 will be written off in Dt 20 or 23 according to the redistribution rules. Direct items are written off by item groups to cost.

Free expert consultation

Anna Vikulina

Head of 1C support department

Thank you for your request!

A 1C specialist will contact you within 15 minutes.