Classification

Costs can be private or public. They will be private if this indicator relates to a specific company. Social costs are an indicator that applies to the entire society. The following basic forms of enterprise costs are also distinguished:

- Permanent . Expenses within one production cycle. They can be calculated for each of the production cycles, the length of which is determined by the enterprise independently.

- Variables _ Full costs transferred to the finished product.

- Are common . Costs within one production stage.

In order to find out the overall indicator, you need to add up the constant and variable indicators.

Depending on the type of product, its complexity, the type and nature of the organization of production, enterprises use the following basic methods of accounting and calculating the actual cost of products, such as standard, distribution and custom. Methods for calculating the cost of products make it possible to study the process of formation of the cost of specific types of products, compare actual costs with planned ones, compare production costs for a specific type of product with the costs of competitors' products, justify prices for products, and make decisions on the manufacture of profitable types of products. Learn more about calculation methods

Costs and their properties

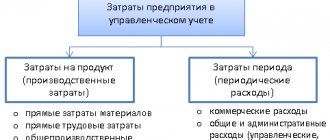

The cost sharing in question is used in management and accounting. Product costs are costs that form the cost of production products. They are directly determined by the technological nuances of production and sales of products, are material, and are subject to inventory.

Periodic costs of a non-production nature; their inventory is impossible. They are “tied” not to the manufacture of products, but to the period during which they took place, and directly affect the amount of profit, bypassing the inventory stage.

From the above, the properties of two types of costs follow:

- product costs exist in the presence of production activities, but are practically absent if production is suspended or curtailed;

- costs for the period are present, even if there is no production and there are no costs for the product; they can be considered as losses of the reporting period.

Opportunity Cost

This group combines a number of indicators.

Accounting and economic costs

Accounting costs (AC) are the costs of resources used by the enterprise. The calculations include the actual prices at which the resources were purchased. BI are equal to explicit costs. Economic costs (EI) are the cost of products and services generated by the most optimal alternative use of resources. EI is equal to the sum of explicit and implicit costs. BI and EI can be either equal or different.

Explicit and implicit costs

Explicit costs (EC) are calculated based on the amount of company spending on external resources. External resources refer to reserves that do not belong to the enterprise. For example, a company has to purchase raw materials from a third-party supplier. The list of nuclear weapons includes:

- Salary to employees.

- Purchase or rental of equipment and premises.

- Transport expenses.

- Communal payments.

- Acquisition of resources.

- Depositing funds into banking institutions and insurance companies.

Implicit costs (ICOs) are costs that take into account the cost of internal resources. Essentially, this is alternative spending. These may include:

- The profit that an enterprise would receive if internal resources were used more efficiently.

- The profit that would appear when investing capital in another area.

The NI factor is no less important than the NI factor.

Returnable and sunk costs

There are two definitions of sunk costs: broad and narrow. In the first meaning, these are expenses that the company cannot recover upon completion of its activities. For example, the company invested in registration and printing of advertising leaflets. All these costs cannot be returned, because the manager will not collect and sell leaflets to receive funds back. This indicator can be considered the enterprise’s payment for entering the market. It is impossible to avoid them. In a narrow sense, sunk costs are spending on resources that have no alternative use.

Refundable costs are those expenses that can be partially or fully refunded. For example, at the beginning of its work, the company purchased office space and office equipment. When the company ends its existence, all these objects can be sold. You can even get some benefit from selling the premises.

Two types of expenses

Currently, the cost of producing a product contains two types of expenses.

Direct production costs. Such costs are always associated with the manufacturing process of the product. Most often, there is no need to carry out additional calculations to determine them.

Manufacturing overhead. Such costs cannot be determined directly. Each organization has to calculate them in a separate order.

Examples of direct production costs included in the cost of production:

- The amount of costs for the purchase of raw materials.

- Costs of purchasing components for the product.

- Costs of paying wages to personnel.

- Motivational payments to employees.

- Equipment repair costs.

Examples of manufacturing overhead costs included in the initial cost of production:

- Purchase of auxiliary raw materials.

- Costs associated with adaptation and training of personnel.

- Depreciation expenses.

- Utility costs.

- Costs for maintaining equipment and the building itself.

- Costs for renting equipment, buildings, etc.

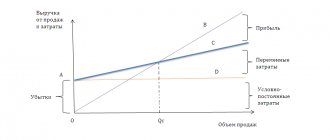

Fixed and variable costs

Over the short term, one part of the resources will remain unchanged, while the other will be adjusted in order to reduce or increase total output. Short-term expenses can be constant or variable. Fixed costs are those expenses that are not affected by the volume of goods produced by the enterprise. These are the costs of fixed production factors. They include the following costs:

- Payment of interest accrued as part of lending at a banking institution.

- Depreciation charges.

- Interest payment on bonds.

- Salary of the head of the enterprise.

- Payment for rent of premises and equipment.

- Insurance charges.

Variable costs are expenses that depend on the volume of goods produced. They are considered the costs of variable factors. Includes the following costs:

- Salary to employees.

- Transportation costs.

- Expenses on electricity necessary to ensure the functioning of the enterprise.

- Costs of raw materials and materials.

It is recommended to monitor the dynamics of variable costs, as they reflect the efficiency of the enterprise. For example, as the optimal scale of a company’s operations increases, transportation costs increase. More carriers need to be hired for the increased volume of products. Raw materials must be promptly transported to headquarters. All this increases transport costs, which immediately affects variable costs.

Cost accounting by function

This cost accounting system is used by organizations that produce a large range of products in different batches.

The essence of the method is the correlation of costs with certain functions that are carried out in the interests of production and sale of a particular type of product. Hello Guest! Offer from "Clerk"

Online professional retraining “Accountant on the simplified tax system” with a diploma for 250 academic hours . Learn everything new to avoid mistakes. Online training for 2 months, the stream starts on March 15.

Sign up

Cost planning

Analysis and planning of expected expenses is mandatory for every enterprise. Determining the amount of costs allows you to find ways to reduce costs, which is important for reducing the cost of manufactured products, as well as the cost at which they are offered to customers. Cost reduction is necessary to achieve goals such as:

- Increasing the attractiveness of the company's products.

- Increasing the competitiveness of the company.

- Rational use of available resources.

- Increased profit growth.

- Optimization of production processes.

- Increasing the profitability of the company.

You can reduce enterprise costs in the following ways:

- Staff reduction.

- Optimization of work processes.

- Purchasing new equipment that will make production less expensive.

- Purchasing raw materials at a lower cost, searching for profitable offers from suppliers.

- Transferring a number of employees to freelance work.

- By moving the enterprise to a relatively small building with a lower rental cost.

The goal of cost reduction is to reduce the cost of production without compromising its quality. This rule is extremely important, since it is almost always possible to reduce costs by reducing the quality of the product, but this will not benefit the enterprise.

IMPORTANT! Costs need to be planned taking into account the results of previous calculations. The planned cost level must be realistic. Setting minimum values that cannot be met is pointless. As an example, you need to take the approximate indicator of past periods.

Process method

It is used in enterprises that operate in continuous mode. The classic version of the process method is used in industries with a mass type of production, which is characterized by:

- short production cycle;

- the presence of a single characteristic for all products;

- limited range of products;

- complete absence or insignificant volumes of semi-finished products and work in progress.

Examples of such production are the extractive industries, transport and energy.

The object of cost accounting and calculation is the final product. Such enterprises require large investments to continue operating in the future, as well as to maintain current production. Investments are risky. The simplest type of mass production is represented by energy enterprises and is characterized by the absence of stocks of finished products. In such cases, a simple one-step cost calculation method is used. The unit cost of production is determined by dividing the total cost for the period by the number of units produced during this period:

C=Z/X

where C is the cost per unit of production, rub.; Z—total costs for the period; X - number of units of production (pieces, km, etc.)

There are a small number of businesses that meet the four basic requirements. For them, a simple two-stage calculation method is used, which involves separating production and non-production costs in accounting. Production costs are charged to all finished products produced, and non-production costs are considered period costs and are charged to products sold.

C = Zpr /Hgp + Znepr /Hrp

where Zpr - production costs; Xgp - the number of units of finished products produced during the period; Znepr - non-production costs of the period; Khrp - the number of units of products sold during the period.

This option for calculating cost allows you to determine the cost of products sold and estimate the inventories of products manufactured in a given period, but unsold.

The one- and two-stage costing method is used in those calculations where the technological process is organized as a continuous activity with a short production cycle. If the technological process is organized in the form of a chain of separate stages, technologically and organizationally isolated, production at individual stages can be carried out at different rhythms, then there are remnants of semi-finished products when transferred from one department to another.

The impact of cost on work efficiency

As an analysis of actual practice shows, an organization may often have additional expense items that affect the cost of finished products. It all depends on the specifics of the enterprise’s activities. In practice, it is customary to analyze all cost items to find ways to reduce costs and increase the profitability of the finished product.

If we consider the structure of costs for the production of goods, then they are all grouped in the budget in separate items. Moreover, each expense item has its own share in the overall structure of expenses associated with the production of goods. By analyzing such items, it is possible to identify those items whose amounts can be reduced without compromising the quality of the product.

It is important to understand that the cost of goods may change each reporting period. This indicator is influenced by many internal and external factors of the enterprise, for example, the economic and political situation in the country, the volume of raw materials reserves of the enterprise, and so on. Therefore, the concept of actual cost, that is, calculated for a given point in time, has been introduced into practice.

Calculating the initial cost of a product is the most important process for any manufacturing organization, which affects the degree to which strategic goals are achieved and the efficiency of the organization as a whole.

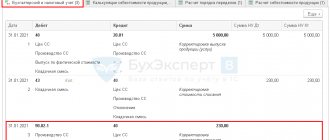

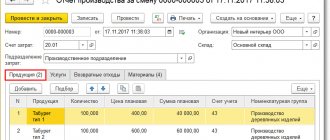

An example of calculating production costs in the Finoko service

The first row of the table in our example reflects the production cost of Product No. 1. The indicator is obtained by adding direct costs for materials (types A, B and C), direct costs for payroll, the amount of insurance and general production costs.

That is, in our example, the cost of Product No. 1 in January will be 483,263.45 rubles = (10560 + 34650 + 44000 + 132000 + 39864 + 222189.45).

Costs for each of the three types of materials are derived from the budget of direct costs for materials as the product of volumes, consumption rates and cost of materials.

For example, in the first month for Product No. 1, the direct costs of material A will be 10,560 rubles = (550x0.4x48).

Payroll costs are taken from the corresponding budget. Insurance is taken at the level of 30.2% of labor costs. That is, in January for Product No. 1 their value will be 39,864 rubles (0.302 × 132000).

Manufacturing overhead costs are distributed in proportion to labor costs for each product. In our case, for January for Product No. 1, this figure will be equal to 219,840.93 rubles = (767,777.81 × 132,000/461,000).

In our example, only general production costs can be classified as fixed costs. They are also distributed according to the shares of direct labor costs. For example, in January for Product No. 1 this figure will be 198,661.96 rubles = (96,3811.84 x 132,000/461,000).

Variable costs are calculated as the difference between total and fixed costs. In January, for Product No. 1, this value will be equal to 282,252.97 rubles (480,914.93 - 198,661.96).

The cost of producing a unit of output is derived from the ratio of total costs to output. So in the first month the indicator for Product No. 1 will be 864.95 rubles/unit = (480,914.93 / 556).

Specific variable costs are obtained by dividing variable costs by volume. That is, for January for Product No. 1 this figure will be 507.65 rubles/unit = (282,252.97 / 556).

The report also includes such analytical indicators as the share of production costs in revenue and total costs. These are, respectively, lines four and five in our example. The share of such expenses in revenue for January is 53.49% = ((480,914.93 + 683,700.25 + 596,569.63) ×100 / 3,292,500).