What applies to transport costs?

The range of potential options is quite wide - in this case, the specifics, as a rule, are determined by the profile of the enterprise.

For example, an organization conducts production activities, producing various types of equipment, raw materials or products for subsequent sale to wholesale and retail customers. This means that when concluding a contract, one of the issues discussed is the delivery of goods, the costs of which may fall on both the seller and the buyer. The conditions depend on the agreements between the parties, the financial aspects of the transaction, the availability of the necessary logistics capacities and other factors. The main thing is that each unit produced must go through a full product distribution cycle, ultimately reaching the end consumer - either directly or through a retailer.

In addition, production requires certain resources supplied by third parties - in which case the costs of transporting the products must also be reflected in official accounts. If you ask the question: the costs of transportation costs - what are these costs, then we can say that they include all procurement operations for the movement of sold and purchased goods, equipment or raw materials, and are supplemented by items directly related to the provision of these processes.

The more significant the amount spent during the reporting period, the more attention is paid to it by both the organization’s management and the inspection services. In this regard, correct accounting, which reflects all related activities, is of particular importance. It is worth noting that it is a fairly common practice when the costs of transport services for the delivery of goods from the supplier to the buyer (essentially paid at his expense) are included in the price - this is important to take into account when making decisions on providing client discounts, since without optimizing the cost in First of all, margins suffer, to compensate for which a significant increase in quantitative sales volume is required. A comprehensive analysis allows you to identify sources of unnecessary expenses and reduce them without compromising operational activities. So, for example, if an organization owns its own fleet of vehicles, but the vehicles on its balance sheet are used quite rarely - which does not eliminate the need for their periodic maintenance - it is recommended to disband the division and hire a third-party company to perform irregular logistics tasks.

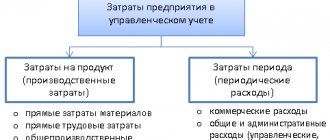

What are indirect and direct transport costs in trade

They are divided in accordance with Article 318 of the Tax Code of Russia. The former are reflected in full and immediately in the process of making expenses, the latter are included in the cost price, but they can only be confirmed when the product/service is sold.

The nature of their occurrence is clearly visible in the following table:

| Direct | Indirect |

| For the purchase of raw materials and other materials, then used to manufacture objects or provide services, and/or form them, or are a mandatory factor for their appearance. | Other amounts, not counting non-operating amounts, contributed by taxpayers for the reporting period. |

| To order components, subsequently used for installation, or semi-finished products, subsequently further processed. | |

| For the salaries of employees directly involved in the process of producing goods and providing services. | |

| Associated costs for insurance - pension, social, pregnancy, disability, industrial accidents and occupational diseases. | |

| Depreciation payments received from the turnover of fixed assets aimed at manufacturing products or providing services. |

When talking about how to take into account transport costs in trade, you need to remember the following points:

- Direct payments should be attributed to the current month only when selling those goods or services in the price of which they are included.

- Indirect expenses are reflected in the reporting period in full, regardless of the date of the actual sale of the item or the completion of any work.

In cases where certain types of costs are carried out with predetermined restrictions - according to goals - the basis for accrual must be determined on an accrual basis. If we are talking about voluntary insurance - analyzing the validity periods of concluded contracts and focusing on the dates of their entry into force.

To what account should transport costs and costs associated with the movement of fixed assets be attributed?

In accordance with the provisions established within the eighth paragraph of the Rules defining the accounting procedure, this category of expenses is equated to the acquisition or creation of products by the enterprise. This approach applies to the following types of OS:

- Created directly by the organization.

- Purchased on the basis of an appropriate agreement (including in relation to barter-type agreements, when mutual settlements do not involve the transfer of funds).

- Received free of charge.

All of the above options for transportation costs in the accounting policy are considered as capital investments, which actually increase the base cost of commodity units. For reflection, the corresponding debit accounts are used, and within the framework of correspondence, expense accounts are used.

It is important to consider that this procedure is not relevant for all situations. Thus, expenses associated with the movement of objects within the territory of an enterprise that do not require installation work for subsequent operation are classified as production. This is true not only for vehicles, but also for various types of equipment, including large equipment used in construction work - from excavators and bulldozers to concrete mixers and rollers for laying asphalt. In the case of transportation of equipment that involves installation and dismantling, the costs incurred are considered as operating costs.

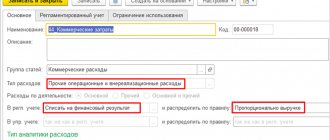

Distribution of transport costs in accounting

When maintaining it, goods are considered as inventories (that is, existing inventories) of the company. Therefore, you need to work with them in accordance with PBU 5/01, focusing primarily on point No. 6, and it states that any costs for collecting and transporting materials to the point of their direct use can be included in the real cost of production. As a result, the latter can be systematically accumulated under the guise of procurement and acquisition in account 15, and when new batches arrive, it can be transferred to account 41, or immediately formed there, which is quite convenient in practice.

Often, sellers use the same machines to both bring released items to the warehouse and ship them to customers. In such cases, costs are more difficult to separate - it is advisable to reflect them on the 44th account in general. The alternative is to sort by any important criterion, as long as it is economically justified, but it will also need to be followed in other issues of organizational policy.

Now let’s talk about how to separate transportation costs and procurement costs when maintaining accounting for a non-trading organization. The procedure is described in detail in the guidelines for reflecting the MPZ. And their 221st paragraph sets the following rules:

- The surplus sent to the structural unit involved in sales is credited to the 41st account and is accounted for according to its actual cost.

- Products purchased for subsequent resale by special departments of such a company are reflected in the 44th account in accordance with paragraph 223 of MU.

Multidisciplinary companies operating in several areas at once usually have their own delivery service. The costs that she incurs are recorded in the documents as “Auxiliary production”, which is reflected in the 23rd line. And from there, if we mean services, they, at actual cost, go to the debit of the 20th, 29th, 44th and 90th accounts, based on any base that is well-founded economically. The main thing is to consolidate this point in the accounting policy.

The most frequently used option is in accordance with paragraph 2.18 of the Roskomtorg MU: the amount of products sold per month at the end of the reporting period goes to “Others”. The balance is the cost of items not sold by this date.

Ready-made solutions for all areas

Stores

Mobility, accuracy and speed of counting goods on the sales floor and in the warehouse will allow you not to lose days of sales during inventory and when receiving goods.

To learn more

Warehouses

Speed up your warehouse employees' work with mobile automation. Eliminate errors in receiving, shipping, inventory and movement of goods forever.

To learn more

Marking

Mandatory labeling of goods is an opportunity for each organization to 100% exclude the acceptance of counterfeit goods into its warehouse and track the supply chain from the manufacturer.

To learn more

E-commerce

Speed, accuracy of acceptance and shipment of goods in the warehouse is the cornerstone in the E-commerce business. Start using modern, more efficient mobile tools.

To learn more

Institutions

Increase the accuracy of accounting for the organization’s property, the level of control over the safety and movement of each item. Mobile accounting will reduce the likelihood of theft and natural losses.

To learn more

Production

Increase the efficiency of your manufacturing enterprise by introducing mobile automation for inventory accounting.

To learn more

RFID

The first ready-made solution in Russia for tracking goods using RFID tags at each stage of the supply chain.

To learn more

EGAIS

Eliminate errors in comparing and reading excise duty stamps for alcoholic beverages using mobile accounting tools.

To learn more

Certification for partners

Obtaining certified Cleverence partner status will allow your company to reach a new level of problem solving at your clients’ enterprises.

To learn more

Inventory

Use modern mobile tools to carry out product inventory. Increase the speed and accuracy of your business process.

To learn more

Mobile automation

Use modern mobile tools to account for goods and fixed assets in your enterprise. Completely abandon accounting “on paper”.

Learn more Show all automation solutions

Re-setting the TR

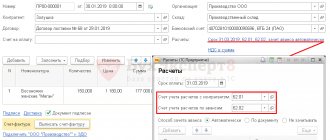

In this case, we consider the features of accounting in situations where transport costs for the delivery and transportation of goods (products) to the buyer are associated with the services of third-party organizations - these are the so-called logistics intermediaries. After all planned work has been fully implemented, an invoice for payment is issued to the client. The procedure is associated with tax risks, which makes it important to correctly reflect it in the financial statements. If necessary, the conditions for compensation for emerging expenses can be fixed within the framework of an agreement defining the main provisions of cooperation between companies.

Posting examples

Let's consider the possible options in more detail.

Transport costs are included in the product price

The enterprise CJSC Amethyst purchased equipment with a total cost of 531 thousand rubles, including VAT in the amount of 81 thousand. The amount of logistics costs amounted to 29.5 thousand, respectively, VAT - 4500. Based on the accounting policy of the organization, these expenses are attributed to the cost of goods units, which necessitates the use of count 15.

In accordance with the provisions of paragraph 6 of the Accounting Rules (PBU 5/01), transportation costs can be taken into account within the actual cost value written off through account 41. It is carried out as follows:

| Debit | Credit | Amount, thousand rubles | Document | Description |

| 15 | 60 | 450 | TORG-12, entrance. s/f | Purchase price |

| 19 | 60 | 81 | VAT | |

| 15 | 60 | 25 | Shipping | |

| 19 | 60 | 4,5 | Per. VAT | |

| 41 | 15 | 475 | Fact. price |

Transport costs for delivery of goods are considered costs associated with sales.

Izumrud LLC made a purchase for 413 thousand rubles, including VAT 63,000. Transportation cost 20 thousand 60 rubles, including tax 3,060, and, in accordance with the company’s policy, as well as paragraph 13 of PBU 5/01, was categorized as selling expenses. To form the cost price, 41 invoices must be used, as well as basic entries for calculating the tax levy.

Products are shipped through a freight forwarding company.

JSC Diamant enters into a deal for the supply of a batch of manufactured products, assuming delivery obligations. The contract is valued at 885 thousand rubles, including value added tax in the amount of 135 thousand. To organize transportation, a logistics intermediary is involved, who undertakes to fulfill the order within the appointed time frame. In accordance with the terms of the agreement, the sender must pay the carrier 35.4 thousand, including VAT 5.4 thousand rubles. How to include transport costs in the cost of goods and register a write-off in tax accounting? The algorithm looks like this:

| Debit | Credit | Amount, thousand rubles | The document that serves as the basis | Description |

| 62 | 90.01 | 885 | TORG-12, outcome. s/f, TTN 1-T | Receipt of working capital |

| 90.03 | 68.02 | 135 | VAT on sales price | |

| 90.02 | 41 | 885 | Write-off of commercial products | |

| 44.01 | 60 | 30 | Agreement for the provision of logistics services, Certificate of completion of work, TN, TTN, TORG-12 | Shipping costs |

| 19.04 | 60 | 5,4 | Received invoice | Input VAT issued by the logistician |

| 51 | 62 | 885 | Extract | Payment, shipment |

| 60 | 51 | 35,4 | Payment, transportation | |

| 90.07.01 | 44.01 | 30 | Buh. reference | Write-off of transportation expenses |

| 68 | 19 | 5,4 | Book of purchases | VAT for deduction |

TZR when purchasing materials

We have already said above that TZR are included in the actual cost of materials.

Important! Explanations from ConsultantPlus Expenses for the delivery of materials and other supplies to the organization are included in the TZR if they are paid separately from the contract price of the purchased supplies. They are taken into account in one of the following ways: directly in the actual cost of inventories, as part of variances, or, if the organization is trading, in selling expenses. The costs of delivering inventories to customers are not included in the inventory. They are accounted for as sales expenses in account 44 “Sales expenses”. Read more about how procurement and warehouse costs can be taken into account in K+. Trial access is free.

For accounting purposes, the company must choose one of the following methods and include it in the accounting policy of the enterprise.

- The 15th account “Procurement and acquisition of materials” is used for reflection.

In addition to the mentioned 15th account, with this method and when applying accounting prices, the 16th account “Deviation in the cost of material assets” is also used. Reference prices can be taken from the following categories:

- negotiated prices (they should not take into account associated costs for procurement and delivery);

- prices in force in previous periods;

- planned prices;

- average prices valid for a certain group of inventories.

In order to show what records are made when materials are received and written off, we will draw up the following table:

| The essence of the recording | Dt | CT |

| We record the cost of materials received based on the primary documents received from the partner (at purchase prices) | 15 | 60, 71, 76 |

| We record the technical requirements based on the primary documents received from the supplier (clause 85 of the guidelines) | 15 | 60, 71, 76 |

| We receive materials using discount prices | 10 | 15 |

| We write off the amount formed as a positive difference between the actual price and the accounting price | 16 | 15 |

| If a negative difference is formed, the entry will be reversed | 15 | 16 |

| We record the write-off of materials for production using the accounting price | 20, 23 | 10 |

| We record the difference between the actual and accounting value of the inventories transferred to the buyer, if this difference is positive. Otherwise, the same posting is reversed. | 20, 23 | 16 |

When forming the above table, in addition to those already described, the following accounts were used:

- 10th - “Materials”;

- 20th - “Main production”;

- 23rd - “Auxiliary production”;

- 60th - “Settlements with suppliers and contractors”;

- 71st - “Settlements with accountable persons”;

- 76th - “Settlements with various debtors and creditors.”

The formulas used to calculate the percentage of write-off of price deviations are as follows:

K = (Off0 + Off1) / (M0 + M1) × 100,

Where

K is the size of the deviation as a percentage;

Deviation0 - the size of the deviation at the beginning of the month (remainder);

Off1 - the size of the deviation accumulated during the month;

M0 - volume of materials at the beginning of the month in accounting prices;

M1 - volume of materials received during the month at accounting prices.

Off2 = K × M2,

Where

Off2 - the size of deviations that can be written off as expenses;

M2 is the volume of materials at accounting prices, which is written off as expenses.

- For reflection, a special sub-account is used on the 10th account “Materials”.

For such circumstances, we present the following tabular form for the records:

| The essence of the recording | Dt | CT |

| We reflect the cost of materials at purchase prices based on primary documents from the partner | 10 | 60, 71, 76 |

| We reflect the technical requirements on the basis of primary documents from the partner (clause 85 of the guidelines) | 10, sub-account “TZR” | 60, 71, 76 |

| We write off materials for production | 20, 23 | 10 |

| We write off inventory items in proportion to the cost of materials generated at the end of the month | 20, 23 | 10, sub-account “TZR” |

The above formulas can also be applied in this case. In this case, the selected calculation method should be approved in the accounting policy.

- TZR are directly included in the actual cost of materials.

This method is available only to those companies whose list of materials used is small and there are groups of materials that occupy a predominant volume in their total quantity. In other words, if the TRP falls on such inventories, then such expenses will be included in the cost of a unit of material.

Also look for information on materials accounting in the article “Accounting entries for materials accounting.”

How to take into account transport costs in tax accounting, see ConsultantPlus. Get free trial access to the system and go to the Ready-made solution.

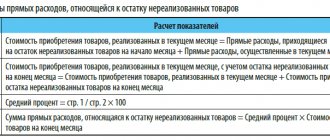

Calculation of TR in tax and accounting

Now let's look at the methods used for each type of cost.

Property acquisition costs

In such situations, expenses are considered by the legislator as falling into the direct category, which necessitates distribution between already sold and other products - instead of including the full amount in the cost structure. The provisions enshrined within Art. 320 of the Tax Code, provide for the use of an average indicator determined for a specific period, and also indicate how to calculate the percentage, calculate and write off transportation costs for the delivery of goods.

For calculation you will need to perform the following steps:

- Clarify the amount of costs in relation to unsold balances as of the starting date of the calendar period, as well as the total amount of sales.

- Determine the purchase price of the goods sold and the inventories available to the company.

- Calculate the average percentage, which is the ratio of total direct expenses and commodity value.

- Find the amount of costs related to balances, equal to the product of two factors: the found percentage and the actual balances at the end of the reporting time period.

It is important to consider that transportation costs include all direct costs associated with inventory that is the property of the organization. This category includes, among other things, objects that at the time of settlement are in the process of being transported to the final recipient.

Delivery of goods to customers

The specifics are directly related to the core activities of the enterprise. Firms specializing in production classify logistics as indirect material costs, which are an integral part of the work cycle. In turn, for companies engaged in commercial transactions, shipping costs are indirect - and trade transactions are processed accordingly. Without exception, all organizations that ship products are required to ensure the availability of goods and waybills.

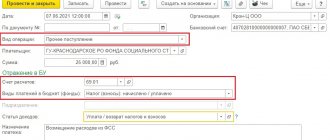

Costs associated with maintaining a vehicle fleet

This expense item combines such types of costs as:

- Purchase of fuels and lubricants.

- Purchase of components for repairs and scheduled maintenance.

- Vehicle insurance, as well as payment for parking spaces and fines for traffic violations.

Let's take a closer look at each of these points.

In the case of fuels and lubricants, as a rule, categories of technical regulations related to ensuring production or sales are applied. The exception is situations when costs are taken into account as direct - based on the corresponding letter from the Ministry of Finance of 2011. For example, accounting for transportation costs for delivery from a supplier using your own transport can be attributed to material costs - however, to write off fuel, you will also need to issue waybills.

The purchase of spare parts and the organization of repairs are operations related to indirect expenses and are subject to complete write-off within the reporting period during which they arose. Do not forget about the economic justification - maintenance designed to improve the performance of the car will be considered a reasonable necessity, while expensive, but useless from a functional point of view, tuning may give rise to questions from the tax authorities.

In the case of insurance, a mandatory condition is the presence of compulsory motor liability insurance. The costs associated with its execution are also considered indirect, and are included in equal shares in the structure of other technical regulations of the enterprise during the validity period of the concluded agreement. But the increase in transportation costs in connection with the acquisition of Casco, which is a voluntary option, will be considered within the category of other costs, and cannot be taken into account in situations where a simplified taxation system is applied.

Parking, cash and sales receipts are used as the basis for writing off expenses incurred when paying for a parking space - if it is not located on the territory owned by the organization. When registering a long-term lease, the basis document can also be an act on the provision of relevant services. In both cases, transportation costs are indirect, which under no circumstances can be considered administrative fines issued for violations of traffic rules. In case of non-compliance with the requirements of the traffic police, it is either collected from the entity guilty of committing the offense, or written off in a non-sales form - from the company’s own funds.

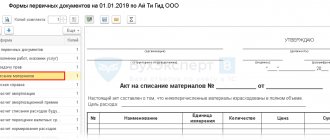

Primary documents confirming TR

Within the framework of contracts drawn up between manufacturers and trading enterprises, on the one hand, and logistics intermediaries, on the other, the Consignment Note serves as documentary evidence of the actual provision of services. According to the current standards, enshrined within the framework of paragraph 2 of Art. 785 of the Civil Code of the Russian Federation, as well as the ninth rule of government decree No. 272 of April 15, 2011, in situations where the contract does not otherwise provide, responsibility for drawing up the technical specifications rests with the sender.

To indicate the price and value, the TORG-12 consignment note is filled out, and the accounting document confirming the movement of goods and serving as confirmation when issuing an invoice for delivery is the consignment note (1-T), which looks like this.

Optimization of TR in accounting

Reducing cost items, which helps relieve a company of unnecessary financial burden, is usually the result of careful work by a qualified accountant. To achieve optimal performance, it is important not only to know in which account transport costs are taken into account and reflected, or how to calculate income tax, but also to correctly convey information about rising costs to the organization’s management. Unfortunately, as practice shows, the majority of ordinary accounting employees, even at large enterprises, do not have the appropriate skills or do not have the time, being forced to deal with everyday, although necessary, but monotonous tasks. As a result, mistakes are much more common than suggestions that improve business performance.

This situation can be avoided by automating routine processes, offered within the framework of solutions developed by Cleverence specialists.

The introduction of modern mobile technologies guarantees not only an increase in the accuracy of accounting, but also the provision of sufficient time necessary to find ways to optimize transportation costs and reduce costs. Number of impressions: 11346

Results

In trade organizations that use SST, the distribution of transportation costs is necessary to determine that part of the costs that can be written off to reduce income tax. Only the costs of transporting the goods to the place of storage (resale) are subject to distribution. The amount of transportation expenses written off to reduce income tax is determined based on the percentage ratio between sold and unsold goods. Other expenses (except for the cost of purchasing goods) are written off in full in the month they are incurred.

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.