What reports can be submitted through the Federal Tax Service website?

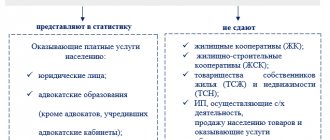

The official service on the Federal Tax Service website will allow you to submit the following reports electronically:

- income tax returns, simplified taxation system, unified agricultural tax;

- calculation of insurance premiums;

- 6-NDFL and 3-NDFL;

- property tax declaration;

- accounting statements.

The VAT return is the only tax report that cannot be submitted in this way (clause 1.7 of the Procedure for submitting tax and accounting reports in electronic form through the website of the Federal Tax Service of Russia). This can only be done through an electronic document management (EDF) operator, so individual entrepreneurs and organizations on OSNO will in any case have to additionally enter into an agreement with the operator.

You cannot submit reports to other regulatory authorities through the Federal Tax Service service. It will not be possible to report on Form 4-FSS, transfer SZV-M and SZV-TD to the Pension Fund, submit reports to statistics, Rosprirodnadzor and other departments. This opportunity is only available when working through special services of each regulatory authority or through the service of an EDF operator, for example Kontur.Extern.

Submit electronic reports via the Internet. Extern gives you 14 days for free!

Declarations for other taxes

In addition to the most common taxes and tax returns discussed above, there are less common taxes and tax returns for which a small number of organizations and enterprises are recognized as payers. The obligation to file these tax returns depends on the assets, activities and tax regime of the organization. All types of taxes, as well as the obligations for their payment, are enshrined in the Tax Code of the Russian Federation.

Declarations for other taxes (transport, water, land...). In addition to the most common taxes and tax returns discussed above, there are less common taxes and tax returns for which a small number of organizations and enterprises are recognized as payers. The obligation to file these tax returns depends on the assets, activities and tax regime of the organization. All types of taxes, as well as the obligations for their payment, are enshrined in the Tax Code of the Russian Federation.

Who is suitable for reporting to the Federal Tax Service?

The Federal Tax Service service is designed for organizations and entrepreneurs under special tax regimes. Almost all of them will be able to work in the service for free.

The following categories will not be able to report through the Federal Tax Service website:

- organizations and entrepreneurs on OSNO who submit a VAT return (clause 1.7 of the Procedure);

- foreign organizations that pay the “Google tax” (clause 8 of Article 174.2 of the Tax Code of the Russian Federation);

- largest taxpayers (clause 1.2 of the Procedure);

- accounting service providers and other representatives (clause 1.2 of the Procedure) - except in cases where they have direct access to the taxpayer’s personal account.

In addition, there are technical requirements for the computer from which you will submit reports. The operating system must be at least Microsoft Windows XP or Mac OS X 10.9; the crypto provider must support the algorithms of GOST 34.10-2001 and GOST 28147-89, and it must be possible to work with an electronic signature through a browser.

Excise tax declaration

Excise tax is a tax imposed on certain types of goods and included in the cost of these goods. Goods subject to this tax are called excisable. These include alcohol, tobacco, cars, gasoline, medicines, perfumes, etc.

Payers of this tax are organizations and entrepreneurs selling or producing excisable goods. The full list of excise tax objects is enshrined in Article 182 of the Tax Code.

The tax return for excise taxes (except for tobacco products) is filled out and submitted in the form KND 1151084, for excise taxes on tobacco products in the form 1151074. These declarations reflect the tax base and the amount of excise duty payable. The declaration and payment of tax must be submitted monthly, no later than the 25th day of the month following the reporting month.

How to submit reports through the Federal Tax Service website

To submit reports, you will need an enhanced qualified electronic signature. It must be obtained from the Federal Tax Service certification center or from its authorized representatives. This is conditionally free, you will only need to buy a token (the medium on which the signature will be downloaded) and a CryptoPro license, without which the signature certificate will not work.

After receiving the electronic signature, register on the Federal Tax Service website as an organization or entrepreneur. Follow the link and select the desired certificate from the list, then scroll down to the “Login” button and fill out the profile with your information.

Next, activate your email, register an electronic signature certificate and receive a subscriber ID. Information about the completion of registration and assignment of an identifier will appear in your personal account. After this, the subscriber code will need to be specified in the “Organization Information” section.

If problems arise during the process of independently installing an electronic signature certificate or setting up CIPF, you will have to contact your system administrator or a paid consultation. Technical support from the Federal Tax Service only helps with work in the service.

After this, you can begin preparing and submitting reports. Follow the algorithm.

Step 1. “Pack” the report in a shipping container

You can generate a report in your accounting program or in the free Federal Tax Service program “Legal Taxpayer”. But before submission, the report must be packed in a transport container - encrypted according to the requirements of the Federal Tax Service and signed with a qualified electronic signature (CES). This is only possible through the “Legal Taxpayer” program.

During the encryption process, follow the algorithm:

Upload the generated report to “Taxpayer Legal Entity” → Click the “Upload shipping container for the portal” button → Select a folder for downloading → Copy and paste the taxpayer ID → Select a certificate to sign → Create a container.

Important!

“Legal Taxpayer” needs regular updates. You have to track them yourself and install them manually.”

Accounting statements: what, how and when we hand over

The standard set of accounting reports includes:

- balance;

- income statement;

- reports: on changes in capital;

- about cash flow;

- on the intended use of the funds received;

If you are a small business, an NGO, or operate within the framework of the Skolkovo project and are not subject to mandatory audit, traditional reporting can be replaced with simplified reporting.

We tell you how to do this in the article..

Pros and cons of the Federal Tax Service

An important advantage of the Federal Tax Service is the ability to submit almost all reports for free. To do this, you only need an electronic signature and a means of cryptographic protection.

But the free service also has disadvantages:

- It is not possible to submit a VAT return or send reports to other regulatory authorities.

- The tax office will not be able to send you requests through the Federal Tax Service. But if you are required to submit declarations (calculations) electronically, inspectors must be provided with this opportunity by concluding an agreement with the EDF operator (clause 5.1 of Article 23 of the Tax Code of the Russian Federation).

- Not suitable for major taxpayers, outsourced accountants and representatives.

- The user is forced to independently deal with registration, installing a certificate and setting up cryptographic protection.

- Preparing a report is a labor-intensive process. It will not be possible to send information without first encrypting it in a transport container.

- The Legal Entity Taxpayer program must be regularly updated independently.

- The report is sent automatically without the possibility of preliminary checking for errors and final editing. The control relationships between different reports are also not checked before sending; the refusal to accept will come from the Federal Tax Service after the check.

- Notifications about the status of reports appear only on the portal; additional messages are not provided by mail or SMS.

- Technical support only helps with questions regarding service performance and does not answer other questions, such as filling out report forms.

How to submit tax reports?

Reports to the tax office can be submitted in person or through a representative, and can also be sent by mail or via the Internet. By the way, the latter option is preferred by an increasing number of individual entrepreneurs and LLCs. The advantages are obvious: there is no need to stand in queues, wasting time, install special programs for preparing reports, you can submit reports and declarations at any time of the day.

The ability to send tax reports via the Internet is provided in the online accounting “My Business”.

By becoming a user of the service, you will not look for options on how to submit a report to the tax office for free - after free registration in “My Business”, you will be able to learn how to submit reports to the tax office yourself. It is important that this does not take much time, and you will be sure that everything is done correctly and the order is not broken.

Reporting to the Federal Tax Service through an EDI operator

More comfortable conditions when working with reporting can be obtained through an EDF operator. The most important thing is that Extern allows you to report to all regulatory authorities: Federal Tax Service, Social Insurance Fund, Pension Fund of Russia, Rosstat, RAR, RPN, Central Bank.

To work with Extern you will also need an electronic signature. It can be obtained by connecting to Extern. The CryptoPro license, which is needed to work in the service, will already be embedded in the electronic signature key, so you will not have to spend additional money. An electronic signature obtained from the Federal Tax Service or any accredited certification center is also suitable for working on Externa.

The service is configured automatically through the diagnostic portal; you don’t have to do anything. To fill out information about your company, just enter the TIN - the information will be downloaded from the Unified State Register of Legal Entities (USRIP).

After this, you can start filling out reports. Follow the algorithm.

Step 1. Select and fill out the form

In the menu on the left, select which authority you want to submit the report to and select the appropriate preparation method - download a ready-made report from a file or fill out a form in the system.

It is convenient to fill out reports in the system:

- required fields are highlighted;

- some data is filled in automatically or based on past reports;

- for some fields there are reference books of values (period, code in SZV-TD, etc.);

- The order of filling and hints for the fields are provided.

When you finish filling out the report, click the “Save and Close” button.

Step 2: Check and submit report

Before sending, each report must undergo mandatory verification. If the service finds errors, they will need to be corrected before sending the report. Warnings may also appear during the scan; if you are confident that the data is correct, there is no need to correct them.

To send the report, select “Proceed to Send” and electronically sign it.

Step 3. Wait for confirmation of receipt and input

After sending the report, a “Date Confirmation” is generated - this is the time that is considered the date of submission of the report. Then all that remains is to wait for the inspection to accept the report. For each stage, you will receive a notification in the service and in another convenient way: by SMS, email, in the application.

The service notifies you about the following stages:

- Report delivered → notification of receipt.

- The report is accepted → receipt.

- The report is uploaded to the tax authority database → notification of entry.

- The report was not submitted → notification of refusal (it indicates what to correct in order for the report to be accepted).

All sent reports are stored in the service. They can be downloaded, adjusted, or used as a basis for preparing a new report at any time.

Submit electronic reports via the Internet. Extern gives you 14 days for free!

Advantages of working through Extern

- Extern is configured automatically through a special diagnostic portal . You don't have to figure out what you need to work in Externa - just run the diagnostic service and it will prepare your computer.

- To add your company or organizations under service, you do not need to enter details manually . Basic company details are automatically filled in using an extract from the Unified State Register of Legal Entities. You just need to indicate your Taxpayer Identification Number (TIN) and checkpoint and check the data.

- Proxy reporting and working with multiple organizations. In Externa, reports can be sent and signed not by the manager himself, but by his authorized representative. In addition, you can work with several organizations at once in one list and send an unlimited number of reports in bulk.

- Working with reports . Extern can be used separately or integrated with 1C and reported directly from the service. Before sending, all reports undergo an automatic check, which helps correct errors and pass automated control by the Federal Tax Service.

- Notices and Comments on Disclaimers . The service will notify you of each change in report status, received requirement or fine via SMS, mail or in the application. If an admission refusal is received from the regulatory authority, expert comments will help to understand the reason and quickly correct the report.

- Working with requirements . The external consultant sorts requests by urgency and helps track the dates by which tax authorities need to respond to requests. For each request, letters and documents sent in response to it are saved.

- Reconciliation with the tax office . You can independently send requests for budget reconciliation through Extern - the request is filled out once, and then only the period being checked will need to be changed. If reconciliation is needed regularly, automatic sending of requests is available once a week.

- Free services . Extern additionally provides access to the reference and legal system Normative, a service for checking counterparties, automatic reconciliation of invoices with counterparties, free webinars and expert articles.

Working through an EDF operator, you will receive a high-quality service that covers all the needs of an accountant: it allows you to submit reports on time and without errors, communicate with regulatory authorities, systematize work with requirements and check with the Federal Tax Service.