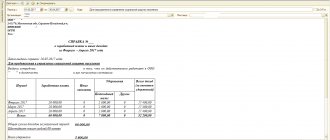

What payments are included in the calculation of vacation pay in 2020-2021? According to current labor legislation,

What are other expenses? The concept of “other expenses” is spelled out in the same chapter of the PBU, but

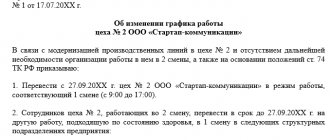

Why do you need an order to change the work schedule? The document in question is necessary to ensure legality

Many companies know first-hand about past losses. In 2022, the Federal Tax Service for the first time

07/01/2019 0 685 4 min. Paying taxes is an obligation that applies to every employed person.

Is it mandatory to warn about illness? By law, if an employee is absent for more than four hours, the employer

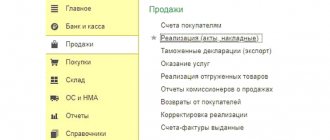

Commission trading in 1C: Accounting - accounting with the principal Published 09.09.2019 11:06 Author: Administrator

What is UTII? The single tax on imputed income is a special tax regime that

Four times a year, reports are sent to the insurer in Form 4-FSS. For this purpose, electronic

Putin's child benefits Putin's child benefits are one of the options for financial support