The procedure for calculating depreciation of fixed assets in accounting

Depreciation involves the gradual inclusion in expenses of the cost of fixed assets, which is a significant amount for any organization.

Fixed assets can participate in generating income for a long time and have a long service life. Depreciation of fixed assets must be calculated for all groups. But some of the property does not need to be depreciated:

- if the initial cost is within the limits of the maximum value not exceeding 40,000 rubles. (clause 5 of PBU 6/01) (if these objects are accepted for accounting as inventories);

- if the object is on the list of property for which depreciation is not accrued (clause 17 of PBU 6/01).

Read about non-depreciable fixed assets in the material “Rules for calculating depreciation of non-current assets”.

PBU 6/01 is the main document that establishes the rules for calculating depreciation of fixed assets in accounting. When accepting for accounting for each individual object, the organization determines the depreciation procedure based on PBU 6/01 and fixes the parameters: the method of calculating depreciation of fixed assets , and their useful life.

Read about the basic rules for calculating depreciation of fixed assets in the already familiar material “Rules for calculating depreciation of non-current assets.”

Accounting Features

The value of the asset reflected in the company's accounting records may be greater than the price transferred to the seller.

When forming the initial cost of an object, it is permissible to include expenses for services and work related to the acquisition of property. Accounting account 08 should accumulate all the company’s costs that were incurred in the process of acquiring, installing and launching fixed assets, intangible assets and other profitable investments. These costs are called investments in non-current assets. Such norms are regulated in Order No. 94n. In order to organize reliable and complete accounting, the company has the right to provide additional detail. For example: account 08-03 “Construction of fixed assets” or 08-08 “Performance of research, development and technological work”, etc.

IMPORTANT!

Opening all of the above accounts is not necessary. The organization independently determines which subaccounts to account 08 are necessary for accounting. The choice made by the company should be reflected in the company's accounting policies.

Please note that accounting must be carried out in the context of each asset or asset.

Let's first figure out what is taken into account on account 08 in accounting by debit:

- the price of the item paid to the seller;

- other expenses associated with the acquisition and creation of property, for example, consulting services, transport delivery, installation and commissioning services.

In other words, the debit of the account determines the initial cost of fixed assets or intangible assets.

Now let’s determine what is reflected in account 08 in the accounting for the loan.

Account 08 is credited when acquired or created property is accepted for accounting. That is, when the object is completely ready for operation, its generated initial cost is written off as a debit to the corresponding accounting account. For example, when accepting fixed assets for accounting, we debit the account. 01, when registering intangible assets - account. 04.

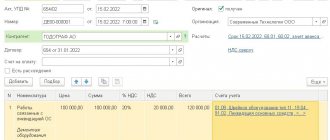

Example of calculating depreciation of fixed assets

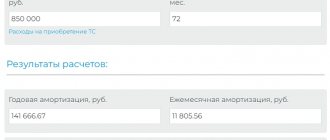

Let's look at an example of how to calculate depreciation of fixed assets in practice.

Example

In January 2022, the organization accepted the facility into operation with an initial cost of 72,000 rubles. The fixed useful life is 3 years (36 months).

The linear depreciation method chosen by the organization provides for the following calculation of the annual depreciation amount: 72,000 × 1 / 3 = 24,000. Here 1/3 is the depreciation rate. It is calculated based on the specified number of years of operation. In fact, the annual amount can be obtained by simply dividing the cost by the number of years; in practice, this is how the calculation is made.

The monthly depreciation amount is equal to the result of dividing the annual amount by the number of months in the year: 24,000 / 12 = 2,000. Or, which is equivalent, the result of dividing the original cost by the number of months of use: 72,000 / 36.

Tangible assets on the balance sheet

Non-current assets are reflected in section I of the balance sheet as follows:

- “Intangible assets” (line 1110);

- “Results of research and development” (line 1120);

- “Intangible search assets” (line 1130);

- “Material Search Assets” (line 1140);

- “Fixed assets” (line 1150);

- “Profitable investments in material assets” (line 1160);

- “Financial investments” (line 1170);

- “Deferred tax assets” (line 1180);

- "Other" (line 1190).

Current assets occupy the following positions in the balance sheet:

- "Inventory" (line 1210);

- "VAT" (line 1220);

- “Accounts receivable” (line 1230);

- “Financial investments (line 1240);

- “Cash and cash equivalents” (line 1250);

- "Other" (line 1260).

Main purchasing methods:

Depreciation of fixed assets has been accrued - how to reflect the entries in accounting?

Depreciation amounts are accumulated on the credit of account 02. The account in the debit of the entry depends on the characteristics of the activity in which the object is operated.

| Wiring | Object in use |

| Dt 20, 23, 25 Kt 02 | In the main production, auxiliary, general production workshops |

| Dt 26 Kt 02 | For management purposes |

| Dt 29 Kt 02 | In service farms |

| Dt 44 Kt 02 | In trading and procurement activities For the purpose of selling products in production activities |

| Dt 91 Kt 02 | In other activities |

Depreciation of fixed assets on the balance sheet

The balance sheet form does not provide a separate line for the amount of depreciation accrued as of the reporting date. But this amount participates in the formation of the line indicator 1150 as a regulating value. Namely, to reflect how the indicator in the net valuation is formed for the specified line: the original cost reduced by the amount of accumulated depreciation. The book value of the asset is equal to the difference between the balance of account 01 and the balance of account 02.

In this case, information on depreciation, including accrued, retired, accumulated as of the reporting date, is deciphered by groups of objects and provided to users of the statements in the notes to the balance sheet.

The following disclosure requirements in reporting are established:

- clause 35 of PBU 4/99 (order of the Ministry of Finance of the Russian Federation dated July 6, 1999 No. 43n),

- clause 49 of the regulations on accounting (order of the Ministry of Finance of the Russian Federation dated July 29, 1998 No. 34n),

- clause 32 of PBU 6/01 (order of the Ministry of Finance of the Russian Federation dated March 30, 2001 No. 26n).

Accumulated depreciation

Definition 2

Accumulated depreciation represents the total cost of assets allocated as depreciation expense in a period. Accumulated depreciation is an account of assets that, at the closing balance, reduces the balance of the related assets.

Finished works on a similar topic

Course work Accumulated depreciation and its accounting 480 ₽ Abstract Accumulated depreciation and its accounting 230 ₽ Test work Accumulated depreciation and its accounting 220 ₽

Receive completed work or specialist advice on your educational project Find out the cost

This account should not be used for valuation methods, but is used for distribution methods.

The value of long-lived assets, such as the value of buildings, may fluctuate according to market conditions. In this case, depreciation is not intended to track this value, but is driven by the need to gradually move the amount of assets as expenses into the income statement.

Thus, accumulated depreciation reflects the portion of the depreciable cost allocated over past periods.

The amount of accumulated depreciation is systematically increased, and the carrying amount reflects the assets being disposed of and subject to distribution in the future (at the end of the expected life) of objects. The cost of these objects includes the estimated liquidation value.

Depreciation of fixed assets in 2018-2019 in tax accounting

The procedure for accounting depreciation in 2018-2019 has not changed. However, in 2016, changes affected tax accounting. Thus, the Law of June 8, 2015 No. 150-FZ (clauses 7–8 of Article 5) introduced amendments to Art. 256, 257 Tax Code of the Russian Federation. They consist in increasing the value of property that is not classified as depreciable.

Previously, this figure was equal to 40,000 rubles. and corresponded to a similar limit in accounting. Now the amount in the Tax Code of the Russian Federation has been increased to 100,000 rubles. The new rules apply only to property put into operation from January 1, 2016. For other objects costing over 40,000 and up to 100,000 rubles, which were already in operation before this date, no adjustment is required in the form of writing off the remaining cost.

As we already know, in accounting the amount is 40,000 rubles. represents the upper limit on the cost of non-depreciable assets. In this case, in order to decide on classifying property as fixed assets, an organization can:

- select the maximum limit amount in the accounting policy;

- choose an amount less than this limit;

- take into account objects with a cost less than the limit as part of the inventory;

- do not set a limit by depreciating all objects of any value accounted for as fixed assets.

In tax accounting, the amount of 100,000 rubles is a cost limit that determines the recognition (or non-recognition) of an object as part of depreciable property. Items valued up to this limit are not considered depreciable property. Their full cost at the time the objects are accepted for accounting is written off as material expenses in accordance with subparagraph. 3 p. 1 art. 254 Tax Code of the Russian Federation.

At the same time, the legislator in the same sub-clause. 3 p. 1 art. 254 of the Tax Code of the Russian Federation provides the opportunity to include these amounts in expenses not at once in full, but by distributing the amount over a time interval greater than one reporting period. The period for progressive recognition of expenses is determined as the expected useful life. This is an action similar to accounting depreciation, which allows you to “stretch” the accounting of the cost of non-depreciable property in material expenses.

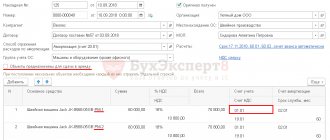

Reflection in accounting and tax accounting

An asset purchased by an organization with a price of over 40,000 rubles is accepted for accounting from the moment of transfer of ownership and formation of the initial value of the object. In tax accounting, the operating system is recorded after its commissioning.

In a commercial organization, according to PBU 6/01, depreciation in accounting and tax accounting begins with the month that follows the month the fixed asset was put into operation. As a basis document, the organization has the right to use the commissioning act in any form:

In accounting and tax accounting, different methods are used to calculate the depreciation of fixed assets and intangible assets. In tax accounting, only linear and nonlinear methods are used.

The following methods of calculating depreciation in accounting are acceptable:

- linear method;

- reducing balance method;

- taking into account the sum of the numbers of years of service life;

- calculation method is proportional to the volume of products sold.

The methods used in accounting and tax accounting for calculating depreciation of fixed assets and intangible assets must be fixed in the accounting policies of the organization.

Depreciation ceases when the asset's useful life expires or when it is disposed of for other reasons (for example, sale). The accumulated amount is not reflected in the balance sheet items, but is used when forming the residual value of fixed assets or intangible assets. The residual value of an object is equal to the difference between its original cost and the amount of accumulated depreciation.

When do differences arise according to PBU 18/02?

A question that worries many accountants. But it is reasonable to approach it taking into account the benefits of taxation on property and profits.

For clarity, we have compiled the following table.

| Cost of objects | Expenses in accounting | Expenses in tax accounting | |

| Including the cost of property at one time in expenses | Gradual inclusion of property value in expenses | ||

| ≤ 40,000 rub. | Objects are not accounted for as inventories, but are depreciated as part of fixed assets | There are differences according to PBU 18/02 | There are no differences according to PBU 18/02 |

| > 40,000 rub. ≤ 100,000 rub. | Depreciation of fixed assets | There are differences according to PBU 18/02 | There are no differences according to PBU 18/02 |

| > 100,000 rub. | Depreciation of fixed assets | Impossible | There are no differences according to PBU 18/02 |

IMPORTANT! The choice in favor of not reflecting differences according to PBU 18/02 does not always entail a reduction in the complexity of accounting. From the point of view of tax reduction, it is often more profitable for an organization to use the right to a one-time attribution of the cost of objects to expenses in both accounting and tax accounting.

Results

When deciding how depreciation of fixed assets will be calculated in 2018-2019, the organization has the right to choose: reducing the labor intensity of accounting or the absence of differences according to PBU 18/02.

At the same time, it is reasonable to make a decision also from the point of view of reducing tax expenses. This, in particular, is facilitated by the use of the right to immediately attribute the cost of objects to expenses. You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.