Commission trading in 1C: Accounting - accounting with the principal

Published 09.09.2019 11:06 Author: Administrator More and more companies have recently encountered commission trading. With the current abundance in the market, it becomes more difficult to sell your goods, and small retail companies sometimes find it difficult to purchase the required quantity of products due to a lack of working capital. Therefore, such transactions are very profitable for both the principal and the commission agent. They are formalized by commission agreements, which set out all the rights and obligations of the parties. In one of the previous articles, we looked at the accounting of commission trade transactions with a commission agent, and now we will tell you about the accounting of goods transferred to the commission agent (agent) with the consignor.

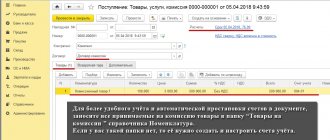

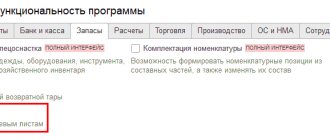

Let's start with the initial setup of the program. Go to the “Administration” section, the “Functionality” submenu and on the “Trade” tab, check the “Sale of goods or services through commission agents (agents)”. After the program is correctly configured, the document “Report of the commission agent (agent) on sales” will appear in the “Sales” section, and in contracts with counterparties a new view will appear: “With the commission agent (agent) for sale.”

Now let's move on to reflecting the fact of transfer of commission goods to the agent. Let us recall that in such a transaction the principal remains the copyright holder of the goods, therefore the transfer of goods is formalized by posting Dt 45.01 Kt 41.01.

To create it in the 1C: Accounting program, you need to create the document “Sales (goods, services, commission)” in the “Sales” section. An important detail responsible for the correct reflection of the transaction is the agreement with the commission agent.

In addition to the type of agreement, you also need to choose the method for calculating the commission, which is specified in the commission agreement.

In the program you can choose one of three types of remuneration calculation:

- percentage of the sale amount,

- percentage of the difference between sales and receipts,

- not calculated.

In our example, we will use the calculation as a percentage of the sale amount. For a more convenient calculation, let’s set the percentage equal to 10 and save the agreement.

Let's return to reflecting the transfer of goods to commission. In the tabular part of the document “Sales (goods, services, commission)”, select an item with the type “Goods”. We check the accounting accounts at the end of the line and post the document. The transfer of goods from the consignor to the commission agent is documented by a waybill TORG-12, which can be printed by clicking on the “Print” button.

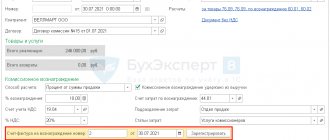

After selling the goods to the buyer and receiving a report from the commission agent, enter the “Report of the commission agent (agent) on sales.” This can be done on the basis of the “Sales” document or created in the “Sales” section.

On the “Main” tab, follow the hyperlink of the accounting accounts and change 62.01 to 76.09.

The “Sales” tab displays the goods sold and also indicates the invoice date.

Attention! The “Invoice” column, highlighted in red in the figure, will be filled in automatically after posting the document.

If the agent did not sell all the goods and he wants to return some of the goods, then the “Returns” tab is filled in.

The “Cash” tab indicates the payment received by the commission agent from the buyer. On the “Advanced” tab, you can specify the Consignee and Shipper, if they are different from the Supplier and Buyer.

The completed document will generate account movements:

Dt 90.02.1 Kt 45.01 for the amount of cost of goods sold

Dt 76.09 Kt 90.01.1 for the amount of revenue

Dt 90.03 Kt 68.02 for the amount of VAT on sales of goods

Dt 60.01 Kt 76.09 for the amount of commission including VAT

Dt 44.01 Kt 60.01 for the amount of commission without VAT

Dt 19.04 Kt 60.01 VAT on commission

When issuing a certificate of completion of work for his agency services, the commission agent also issues an invoice. We register it in the footer of the document “Report of the commission agent (agent) on sales” on the “Main” tab.

Let's return to the issued invoice. The program registered it at the time of the “Commissioner's Report”. In order to print a document, you need to click on the “Go to the hierarchical list of related documents” button, or go to the “Sales” - “Invoices issued” section. This invoice will appear in the Sales Book.

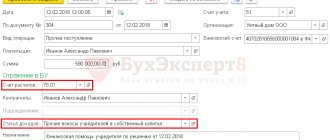

The easiest way to check the commission agent’s debt is by generating a balance sheet for account 76.09, as in the figure below:

The last stage of the transaction is to receive the difference between the sale amount and the commission agent's remuneration into the bank account. In our example, it is most convenient to enter a cash receipt document based on the “Report of the commission agent (agent) on sales.”

We check the settlement account and post the document. This completes the accounting of commission trade transactions for the principal. I wish you ease in repelling such operations!

Author of the article: Alina Kalendzhan

Did you like the article? Subscribe to the newsletter for new materials

Add a comment

Comments

0 #33 Elena 02/10/2022 20:01 Good afternoon! Please tell me, everything is clear regarding the accounting of goods, but what if I transfer a car (fixed asset) under a commission agreement? I select in the “Products” tab, it doesn’t allow me to select a car, because... is listed on account 01. Do I need intermediate wiring or am I doing something wrong?

Quote

0 #32 Alina Kalendzhan 01/24/2022 17:25 I quote Elena:

Good afternoon But what if the principal transfers services, not goods? Those. We don’t have purchased goods on account 41 to transfer/sell them? How then to build accounting in 1C? All the examples on the Internet are only with goods, unfortunately. I tried to follow the steps of your article, but at the Implementation step: goods, works, services, when I select a counterparty (I have completed all the program settings, including the contract), the Services tab immediately disappears, only Goods remain, i.e. e. It is not possible to implement the service in this section, tell me where is the error? And perhaps you have a suitable article? Thank you in advance!

Good afternoon.

The sale of services is no different from goods. On the Products tab, you need to select services instead of goods, unless, of course, this is commission trading and not an agent interaction scheme. Quote 0 #31 Elena 01/19/2022 04:07 Good afternoon! But what if the principal transfers services, not goods? Those. We don’t have purchased goods on account 41 to transfer/sell them? How then to build accounting in 1C? All the examples on the Internet are only with goods, unfortunately. I tried to follow the steps of your article, but at the Implementation step: goods, works, services, when I select a counterparty (I have completed all the program settings, including the contract), the Services tab immediately disappears, only Goods remain, i.e. e. I can’t implement the service in this section, please tell me where the error is? And perhaps you have a suitable article? Thank you in advance!

Quote

0 #30 Alina Kalendzhan 12/07/2021 19:58 I quote Evgeniy:

Good afternoon. We are a consignor and sell goods through marketplaces. Is it possible to keep records in 1C retail basic? And how to configure it correctly

Good afternoon.

Unfortunately no. I would recommend either 1C: Trade Management or 1C: Enterprise Accounting. Quote 0 #29 Alina Kalendzhan 12/07/2021 19:57 I quote Evgeniy:

Good afternoon, in the 1c retail program it is basic, it is possible to keep such records. There, as far as we understand, commission trading is only possible, i.e. for the commission agents. We are the principal.

Good afternoon.

Unfortunately, in 1C: Retail there is only commission agent functionality. Quote 0 #28 Evgenia 12/05/2021 18:50 Good afternoon. We are a consignor and sell goods through marketplaces. Is it possible to keep records in 1C retail basic? And how to configure it correctly

Quote

0 #27 Evgenia 12/05/2021 18:47 Good afternoon, in the 1c program retail is basic, it is possible to keep such records. There, as far as we understand, commission trading is only possible, i.e. for the commission agents. We are the principal.

Quote

0 #26 Irina Plotnikova 10/28/2021 03:06 I quote Elena:

Good afternoon! An organization (OSNO) sells an operating system (car) to an individual under a commission agreement with an organization (USNO “income”) that has a cash register. How can the seller reflect this operation in the program?

Elena, good afternoon.

Do we understand correctly that due to your lack of a cash register, you are carrying out a three-way transaction? Maybe it's worth renting a cash register for the duration of the transaction? Sberbank, for example, rents out cash registers for very little money for the period you need. Quote 0 #25 Elena 10.22.2021 16:44 Good afternoon! An organization (OSNO) sells an operating system (car) to an individual under a commission agreement with an organization (US NO “income”) that has a cash register. How can the seller reflect this operation in the program?

Quote

+2 #24 Alina Kalendzhan 08/20/2021 02:17 I quote Svetlana:

Good afternoon Tell me, I was re-billed for freight forwarding services. The act was drawn up from the commission agent, and in the invoice they indicated the original seller from whom they are rebilling us the service as the seller. This is right? And how can I distribute this in 1c?

Good afternoon.

You received the service from the person you paid. Accordingly, you enter the documents into the database from the commission agent. There is no need to indicate the principal anywhere. Quote 0 #23 Svetlana 08.16.2021 13:43 Good afternoon! Tell me, I was re-billed for transport and expedition services. The act was drawn up from the commission agent, and in the invoice they indicated the original seller from whom they are rebilling us the service as the seller. This is right? And how can I distribute this in 1c?

Quote

0 #22 Nadezhda 06.25.2021 16:58 I quote Alina Kalendzhan:

I quote Nadezhda: Good afternoon. I’m sitting reading articles and I’m completely confused. We recently opened an Ozone pickup point. It turns out that we are commission agents, OZONE is the committent, if I understand correctly. This is my first time encountering this and trying to figure it out. So, orders are brought to us from OZON according to the acceptance certificate, that is, this is our delivery (we create a receipt), then clients come and pick up the parcels (we do the sales? Right? Program 1c Enterprise 8.3. At the end of the month we make a report to the consignor, an invoice and an act for month Correct me if I misunderstand.

Good afternoon.

There is another article for you on our website, search for the word marketplace. It describes in detail the algorithm for working with trading platforms ozone, wildberry, etc. Thank you, I’ll definitely take a look today.....how good that I came across you in the vast world of the Internet. Quote +1 #21 Alina Kalendzhan 06/23/2021 04:32 Quote Nadezhda:

Good afternoon. I’m sitting reading articles and I’m completely confused. We recently opened an Ozone pickup point. It turns out that we are commission agents, OZONE is the committent, if I understand correctly. This is my first time encountering this and trying to figure it out. So, orders are brought to us from OZON according to the acceptance certificate, that is, this is our delivery (we create a receipt), then clients come and pick up the parcels (we do the sales? Right? Program 1c Enterprise 8.3. At the end of the month we make a report to the consignor, an invoice and an act for month Correct me if I misunderstand.

Good afternoon.

There is another article for you on our website, search for the word marketplace. It describes in detail the algorithm for working with trading platforms ozone, wildberry, etc. Quote 0 #20 Nadezhda 06/18/2021 19:11 Good afternoon. I’m sitting reading articles and I’m completely confused. We recently opened an Ozone pickup point. It turns out that we are commission agents, OZONE is the committent, if I understand correctly. This is my first time encountering this and trying to figure it out. So, orders are brought to us from OZON according to the acceptance certificate, that is, this is our delivery (we create a receipt) then clients come and pick up the parcels (we do the sales? Right? Program 1c Enterprise 8.3. At the end of the month we make a report to the consignor, an invoice and an act for month Correct me if I misunderstand.

Quote

0 #19 Evgeny 06/09/2021 02:28 Alina, thanks for the comment, I read this article. There was a question about receipt of payment for services. When paying for the order, the buyer also pays for the delivery service. For example: the delivery cost is indicated on the website as 100 rubles (the amount was paid by the buyer), the real delivery cost is 150 rubles. (We pay 50 rubles from our company). Tell me how to correctly carry out the service in 1C. I quote Alina Kalendzhan:

I quote Evgeniy: Good evening, Alina! Thank you for the article. Please tell me the wiring. We work through a commission agent. We offer products for sale through the marketplace. After receiving an order from the buyer, we independently form (collect) the order, register it with the delivery service (SDEK), and send it to the buyer at the specified address. After the buyer receives the order, we receive payment. Questions: -what postings should be used when shipping goods; how to additionally indicate delivery costs (70% is paid by the buyer himself, 30% by us); — how to correctly enter data on consumables (packaging, etc.)

Good afternoon.

I recommend that you consider our article “Working with marketplaces”, the wiring is described in detail there, and the example is similar to yours. Quote 0 #18 Alina Kalendzhan 06/08/2021 17:16 I quote Evgeniy:

Good evening, Alina! Thank you for the article. Please tell me the wiring. We work through a commission agent. We offer products for sale through the marketplace. After receiving an order from the buyer, we independently form (collect) the order, register it with the delivery service (SDEK), and send it to the buyer at the specified address. After the buyer receives the order, we receive payment. Questions: -what postings should be used when shipping goods; how to additionally indicate delivery costs (70% is paid by the buyer himself, 30% by us); — how to correctly enter data on consumables (packaging, etc.)

Good afternoon.

I recommend that you consider our article “Working with marketplaces”, the wiring is described in detail there, and the example is similar to yours. Quote 0 #17 Alina Kalendzhan 06/08/2021 17:15 I quote Darim:

Good afternoon, Alina! I have the same question as Svetlana: “Good afternoon! Everything is clear about the goods. My situation is different. We sell tours through a commission agent. How to reflect in accounting the sale of services for the sale of vouchers through documents? We also provide the service

Good afternoon.

The algorithm of actions is the same. If your travel voucher forms are listed as goods on your balance sheet, then do everything according to the article. If not, then no transfer occurs and the Commission Agent’s Sales Report is immediately entered. Postings in it will be to the debit of account 60.01 and the credit of account 62.01 - for the amount of remuneration withheld by the agent; on the debit of account 62.01 and the credit of account 90.01.1 - for the amount of proceeds from the sale of vouchers; on the debit of account 26 and the credit of account 60.01 - for the amount of the agent’s remuneration. Quote 0 #16 Evgeny 06/07/2021 02:15 Good evening, Alina! Thank you for the article. Please tell me the wiring. We work through a commission agent. We offer products for sale through the marketplace. After receiving an order from the buyer, we independently form (collect) the order, register it with the delivery service (SDEK), and send it to the buyer at the specified address. After the buyer receives the order, we receive payment. Questions: -what postings should be used when shipping goods; how to additionally indicate delivery costs (70% is paid by the buyer himself, 30% by us); — how to correctly enter data on consumables (packaging, etc.)

Quote

0 #15 Darima 05.29.2021 09:27 Good afternoon, Alina! I have the same question as Svetlana: “Good afternoon! Everything is clear about the goods. My situation is different. We sell tours through a commission agent. How to reflect in accounting the sale of services for the sale of vouchers through documents? We also provide the service

Quote

0 #14 Oksana 03/18/2021 02:03 I quote Anna Fomina:

Good afternoon. The committing organization, after processing the documents, the commission goes to KUDiR as income. Could this be possible?

We also get it as income, because we do not pay for the remuneration, but there is a mutual offset, so we receive the amount according to the report minus the remuneration.

If you do not have a credit, then uncheck the “withheld from proceeds” checkbox in the commission agent’s report Quote 0 #13 Alina Kalendzhan 02/09/2021 05:21 Quote Anna Fomina:

Good afternoon. The committing organization, after processing the documents, the commission goes to KUDiR as income. Could this be possible?

Good afternoon.

It shouldn't at all. Commissions are expenses of the principal, not income. The only thing that comes to mind is: maybe your expenses doubled somewhere and the program compensated for it with income. Make a selection in KUDiR for this counterparty and analyze. Quote 0 #12 Anna Fomina 02/03/2021 19:44 Good afternoon. After completing the documents, the paying organization receives the commission fee and enters the KUDiR as income. Could this be possible?

Quote

+1 #11 Alina Kalendzhan 11/19/2020 02:44 I quote Natalya:

Good afternoon Tell me if we transfer the goods to a commission and the commission agent sells it at different prices (promotions and discounts) not specifically for deliveries, but arbitrarily for different goods from the supply. That is, we see real prices only in reports and there are many different products, what to do with this?

Good afternoon.

What exactly is the question? You transfer goods at one price, and he sells them at another. Reflect sales prices in the report. In the contract with the commission agent there is such a setting option as the difference between the sale and purchase prices. Quote 0 #10 Alina Kalendzhan 11/19/2020 02:42 Quote Tatyana:

Good afternoon. And if the commission agent issues another document for the services provided for the delivery and storage of goods and deducts the amount from the commission agent’s report. How to formalize it so that the total amount to be transferred matches the commission agent’s report + delivery. If all amounts include VAT, or all amounts exclude VAT, then they can be combined and called “Sales commission agent services.” And indicate the total amount in the report. Good afternoon. Where is the amount for delivery reflected in the commission agent’s report? Does it add to the commission? Thank you.

Good afternoon.

If the VAT rate is the same for everything, then it can be combined with remuneration; there is no separate line for delivery in the report. If the rates are different, then delivery must be entered in a separate act for services, but in the mutual settlement accounts indicate invoice 76.09. Then the balance at 76.09 will show the real picture. Quote 0 Natalya 11/16/2020 16:45 Good afternoon! Tell me if we transfer the goods to a commission and the commission agent sells it at different prices (promotions and discounts) not specifically for deliveries, but arbitrarily for different goods from the supply. That is, we see real prices only in reports and there are many different products, what to do with this?

Quote

0 Tatyana 06.11.2020 14:07 Good afternoon. And if the commission agent issues another document for the services provided for the delivery and storage of goods and deducts the amount from the commission agent’s report. How to formalize it so that the total amount to be transferred coincides with the commission agent’s report + up to the rate. If all amounts include VAT, or all amounts exclude VAT, then they can be combined and called “Sales commission agent services.” And indicate the total amount in the report. Good afternoon. Where is the amount for delivery reflected in the commission agent’s report? Does it add to the commission? Thank you.

Quote

+1 Galina Mikhailovna Rozhkova 10.21.2020 19:55 Thank you very much for the article!!!! It was very useful. Without you, I would have had a long and painful time getting to everything.

Quote

0 Alina Kalendzhan 10.10.2020 16:35 I quote Natalya:

Good afternoon. And if the commission agent issues another document for the services provided for the delivery and storage of goods and deducts the amount from the commission agent’s report. How to formalize it so that the total amount to be transferred matches the commission agent’s report + delivery.

Good afternoon.

If all amounts include VAT, or all amounts exclude VAT, then they can be combined and called “Sales commission agent services.” And indicate the total amount in the report. Quote 0 Natalya 10/09/2020 19:04 Good afternoon. And if the commission agent issues another document for the services provided for the delivery and storage of goods and deducts the amount from the commission agent’s report. How to formalize it so that the total amount to be transferred coincides with the commission agent’s report + up to the rate.

Quote

+1 Alina Kalendzhan 09/07/2020 13:43 I quote Elena:

Good afternoon And if the goods are sold by a commission agent for export for foreign currency. In this case, the tax base for the committent must be formed according to VAT at the rate on the date of shipment, and according to profit on the date of arrival of the car, taking into account advances that are not revalued. How can this be implemented in 1C by the Principal?

Good afternoon.

The question is not a simple one, so it must be considered individually, taking into account many nuances. There will most likely be a lot of manual wiring. Quote 0 Elena 09/04/2020 16:33 Good afternoon! And if the goods are sold by a commission agent for export for foreign currency. In this case, the tax base for the committent must be formed according to VAT at the rate on the date of shipment, and according to profit on the date of arrival of the car, taking into account advances that are not revalued. How can this be implemented in 1C by the Principal?

Quote

0 Alina Kalendzhan 08.18.2020 13:22 I quote Svetlana:

Good afternoon Everything is clear about the goods. My situation is different. We sell tours through a commission agent. How to reflect in accounting the sale of travel voucher services through documents?

Good afternoon.

Why is a ticket not a product? You buy it and transfer it to the agent for further sale. If you meant that you independently provide travel services, and an agent is looking for clients for you, then such services are drawn up with a standard act of completion and are entered into the program in the section “Purchases” - “Receipts (acts, invoices). Quote +1 Svetlana 08/07/2020 13:25 Good afternoon! Everything is clear about the goods. My situation is different. We sell tours through a commission agent. How to reflect in accounting the sale of travel voucher services through documents?

Quote

Update list of comments

JComments

Sales of goods on commission

Let's consider the process of preparing implementation documents. From the main menu, go to “Sales-Sales (acts, invoices)”.

Fig.6 Sales of goods on commission

A list of implementation documents opens. Using the “+Implementation” button, we create a new document. Select “Goods, services, commission” as its type. We fill in its details:

- Number – we set the date ourselves, the number is assigned automatically;

- Counterparty – Buyer;

- Agreement – indicate “With the buyer in rubles”;

- The organization is our organization;

- Warehouse – Main warehouse;

- Bank account – indicate ours;

- Settlements – accounts for accounting settlements with the counterparty.

In the tabular section we indicate the goods for sale, the amounts, and the value added tax rate. Please pay attention to the accounting account, it is required 004.01.

Fig.7 Pay attention to the accounting account, this is required 004.01

We post the document and control the postings. We see the debit of goods from off-balance sheet account 004.01, as well as the fact of the sale of goods.

Fig.8 We post the document, control the postings

Commissioner's report

The commission agent is obliged to regularly provide a report to the principal (principal) about the goods sold. The deadlines for submitting the report are not fixed by law, but they are prescribed in the contract. If the volumes of goods are large, then it is convenient to report monthly; in addition, the principal is interested in monthly reports in order to timely and correctly calculate VAT. If the principal is not a VAT payer, then any period for reporting can be established.

You can develop a report form yourself or use a ready-made one, for example, from the Internet.

At first glance, mediation agreements may seem a little confusing. There are many characters: agent, principal, principal, commission agent, buyers. But if you look at it, it turns out that working under a mediation agreement is much simpler and more convenient, it’s easier to keep records, and there are many more advantages than disadvantages. This explains the popularity of this type of business activity. Now you have figured out what a committent and a principal are, and you will no longer confuse these concepts with each other.