Many companies know first-hand about past losses. In 2022, the Federal Tax Service for the first time publicly announced statistics on company losses and was surprised by the scale of the problem: every fifth Russian company showed losses in 2022, and before taxes. Another 27% of companies ended the year at zero, and only slightly more than half made a profit. How to take into account losses from previous years - details in our article.

In 2016, the tax secrecy regime was lifted in Russia and the published statistics became a revelation for many. In particular, regarding the issue of financial results of Russian business. According to data for 2017, out of 2.5 million Russian companies (enterprises whose tax reporting remained classified as “secret” were not taken into account), 19% of companies showed losses. This conclusion was made by the Federal Tax Service based on the financial statements of organizations.

19% of Russian companies showed losses in 2022.

What is the reason for such “massive” loss? Are so many companies really crippled by the crisis, inept management, unreliable suppliers, etc.? It is difficult to answer unequivocally, since one must also take into account the fact that a loss in the current period may indicate serious investment expenses incurred by the company, which it plans to compensate in future tax periods.

A loss in reporting is an almost guaranteed inspection by the Federal Tax Service. A loss is a mandatory criterion for ordering an audit; the tax information system automatically generates a request for an explanation of the loss, and it will have to be documented.

According to most experts, a loss is appropriate to report if the company intends to reduce income tax in future tax periods by the amount of the resulting loss. In the Tax Code of the Russian Federation, a separate article No. 283 “Carrying forward losses to the future” is devoted to this.

Sign up now with a 50% discount.

What is the procedure for accounting for losses: latest explanations from the Ministry of Finance.

According to the definition of the Tax Code, a loss is a negative difference between income and expenses in a given reporting (tax) period.

According to the Tax Code, losses can be compensated in subsequent tax periods in which the company made a profit. Past losses may reduce your current tax basis by being deducted from profits.

In the summer of 2022, the Ministry of Finance of the Russian Federation, in Letter dated June 28, 2021 No. 03-03-06/1/50650, explained the procedure for accounting for losses of previous years. It focuses on the fact that the income tax base is not the company’s income, but rather profit: the difference between income and expenses for the corresponding period. The letter from the Ministry of Finance clarified that profit should be determined on an accrual basis from the beginning of the year. Losses are subtracted from profits already generated.

How to calculate profit?

Profit is defined as the difference between the income received, reduced by the amount of expenses incurred, without taking into account the accumulated loss.

Source: Letter of the Ministry of Finance dated June 28, 2021 No. 03-03-06/1/50650.

According to the Tax Code, a tax loss received in the current tax period can be carried forward to the next period. It can be transferred either in full or divided into several future periods.

Transfer of losses in case of special liability situations

If the tax period (year) ended with a loss for the taxpayer, the tax base for income tax is recognized as equal to zero, and the tax payable is also equal to zero (clause 8 of Article 274 of the Tax Code of the Russian Federation).

But this is not the end of the history of the tax period; the loss can be carried forward to the future (Article 283 of the Tax Code of the Russian Federation). Previously, we already talked about the special rules for recognizing losses from certain transactions and activities (article “Classification of losses”), established by Articles 264.1, 268.1, 274, 275.1, 275.2, 278.1, 278.2, 280, 304 of the Tax Code of the Russian Federation. This should be taken into account when reducing the current tax base, determined in the general manner, for losses of previous periods (clause 1 of Article 283 of the Tax Code of the Russian Federation).

For example, losses received from the activities of service industries and farms (OPH), from transactions with securities that are not traded on the organized market, are not taken into account when determining the total tax base, but reduce the tax base for similar types of activities.

Losses received from activities taxed at a rate of 0% cannot be carried forward to the future (paragraph 2, clause 1, article 283 of the Tax Code of the Russian Federation):

– educational or medical activities (clause 1.1 of Article 284 of the Tax Code of the Russian Federation);

– activities of agricultural producers and fisheries organizations (clause 1.3 of Article 284 of the Tax Code of the Russian Federation);

– the sphere of social services for citizens (clause 1.9 of Article 284 of the Tax Code of the Russian Federation);

– activities of participants in innovation (clause 5.1 of Article 284 of the Tax Code of the Russian Federation), etc.

Losses carry forward rules

1) The loss can be carried forward to an unlimited number of subsequent tax periods (clause 2 of Article 283 of the Tax Code of the Russian Federation), however, for the period 2017-2021. the limit for reducing the tax base is 50% (clause 2.1 of Article 283 of the Tax Code of the Russian Federation). There are exceptions to this rule: organizations whose profits are taxed at a reduced rate (Articles 284, 288.1 of the Tax Code of the Russian Federation) - residents of special economic zones (SEZs), territories of priority socio-economic development (PSED) - can reduce their current profits with losses from past ones periods to zero;

2) The loss of the previous tax period can be recognized already in the current reporting period, without waiting for the end of the year;

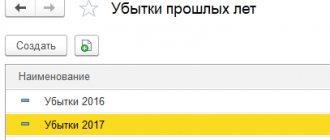

3) Losses must be transferred in the order in which they were received (clause 3 of Article 283 of the Tax Code of the Russian Federation), for example, if for the organization the years 2019 and 2022 are unprofitable, and in 2022 there is a profit, then the profit of 2021 will be reduced for the loss of 2022, and then recognize the loss of 2020;

4) Documentary evidence of losses received is mandatory! (clause 4 of article 283 of the Tax Code of the Russian Federation). Keep supporting documents for another 5 years after the loss is fully accounted for tax purposes;

5) Losses received when applying special tax regimes do not reduce the tax base for income tax.

Sequencing

1) Determine whether there is a loss. A loss is a negative difference between income and expenses that are taken into account when calculating income tax (clause 8 of Article 274 of the Tax Code of the Russian Federation);

2) Check the restrictions and conditions of loss carryover. There must be a profit in the period to which the loss is planned to be carried forward;

3) Check the availability of supporting documents. Tax registers and other analytical documents (accounting statements, etc.) are not enough; primary documents are needed (see Resolution of the Presidium of the Supreme Arbitration Court of the Russian Federation dated July 24, 2012 No. 3546/12). Even if the period of receipt of the loss was studied by inspectors during a documentary tax audit, this is not a reason not to preserve documents on the formation of the loss (letter of the Ministry of Finance dated May 25, 2012 No. 03-03-06/1/278);

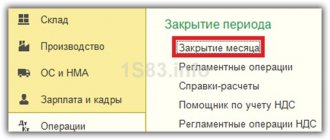

4) Reflect the decrease in the current tax base for the loss of previous years in the income tax return (Federal Tax Order No. ММВ-7-3/ [email protected] , as amended on September 11, 2020). The loss based on the results for the current tax period and the carry forward loss received in previous tax periods should be reflected in the declaration in Sheet 02 “Tax calculation” and Appendix No. 4 to Sheet 02 “Calculation of the amount of loss or part of the loss that reduces the tax base.”

Example

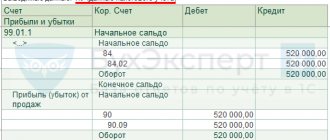

Based on the results of the previous year (2020), the company incurred a loss of RUB 790,440.

At the end of the tax period (2021), the tax base amounted to 1,000,000 rubles.

| Indicators | Line code | Amount in rubles |

| Balance of uncarried loss at the beginning of the tax period | 010 | 790 440 |

| Including for 2022 | 040 | 790 440 |

| Tax base for the reporting (tax) period, line 100 of Sheet 02 | 140 | 1 000 000 |

| The amount of loss or part of a loss that reduces the tax base for the reporting (tax) period – total | 150 | 500 000 *** |

| Balance of uncarried loss at the end of the reporting (tax) period - total | 160 | 290 440 |

*** – transferred to line 110 of Sheet 02

Several stories from judicial practice

Determination of the IC on economic disputes of the Supreme Court of the Russian Federation dated September 30, 2019 No. 305-ES19-9969 in case No. A40-24375/2017

: The taxpayer claimed to deduct losses from previous years, but provided only tax registers and balance sheets in support. The court noted that primary documents are needed to confirm losses, while a remark was made to the tax authority regarding insufficient demands on the taxpayer during the study of the financial result - the controllers did not request primary documents. The case has been transferred for a new trial. A similar decision is contained in the Ruling of the Supreme Court of the Russian Federation dated October 13, 2020 No. 303-ES20-14984 in case No. A80-05/2019 - to confirm losses there must be both registers and primary documents.

Ruling of the Supreme Court of the Russian Federation dated December 31, 2019 No. 302-ES19-25173 in case No. A19-23124/2018:

The losses of previous years declared by the taxpayer amounted to 48 million rubles. However, the primary documents were not presented, since, according to the taxpayer, the disputed expenses had already been verified earlier during a documentary audit. The court made a categorical decision: previously conducted tax audits are not a reason not to preserve primary documents; recognition of losses was refused.

P stopping the AS of the Moscow District dated July 27, 2016 No. F05-10202/16 in case No. A40-35739/2015

: During the on-site inspection, an additional 5 million rubles were accrued. income tax. The taxpayer tried to present documents confirming losses in previous tax periods in order to reduce additional charges. But the court decided that in order to recognize losses from previous years, it is not enough to present supporting documents; they must first be reflected in the income tax return. A similar decision under similar circumstances was made by the Moscow District Court of July 23, 2020 No. F05-7878/20 in case No. A40-166657/2019.

Conclusion: it is possible to recognize losses from previous years in current periods, but subject to all the conditions established by the Tax Code of the Russian Federation.

reporting submission of reports

Send

Stammer

Tweet

Share

Share

You can only compensate up to 50% of current profits annually. And so on until 2024.

Federal Law No. 305-FZ dated July 2, 2021 “On Amendments to Parts One and Two of the Tax Code of the Russian Federation” extended until 2024 the 50% limitation on accounting for losses of previous years in the current period. The law will come into force in January 2022. According to the version of the Tax Code, valid until the end of 2022, this restriction will expire on December 31, 2021.

According to the rules in force in the Russian Federation, tax losses can be carried forward to future years until they are completely exhausted, but in each year old losses can cover no more than half of the current year’s profit. Let us remind you that you can reduce the income tax base for losses of previous years by no more than 50% for the period from January 1, 2022.

Why did the Ministry of Finance insist on extending this restriction, since its abolition could be an important measure to support business? The state is concerned about regional budgets and this restriction, according to the Ministry of Finance, will help ensure the balanced budgets of the constituent entities of the federation.

Conditions for transferring losses in Russia:

Carrying forward losses to previous periods is not possible,

transfer of losses to future periods - until exhaustion, but not more than 50% of the current year’s profit (for the period from 2022 to 2024).

It is important to note that the 50% limitation on accounting for last year’s losses only applies when calculating income tax starting from 2017. If an update is submitted for periods preceding 2017, for example, for 2014, then the amount of the transferred loss can be limited only by the amount of the profit itself received for the current period.

Carry forward of income tax losses: general restrictions

Tax loss is the negative difference between tax income and expenses, which are taken into account when calculating income tax (clause 8 of Article 274 of the Tax Code of the Russian Federation).

The resulting loss can be carried forward, that is, the taxable profit of the following reporting (tax) periods can be reduced by its amount.

The restrictions on the transfer of losses include, firstly, the fact that only profits taxed at a rate of 20% can be reduced (paragraph 1, clause 1, article 283 of the Tax Code of the Russian Federation).

There are other restrictions - on rates and on types of taxpayers.

Not everyone can bear the losses.

The 50 percent limit on the amount of loss to be written off is an obstacle set by the state. However, there are also barriers to transferring losses that cannot be crossed at all. Enterprises falling under these barriers are generally deprived of the right to carry forward losses to future tax periods.

Stop factors for loss carryover:

- 0% income tax rate during the period of loss,

- sale or sale in any other form of shares (participatory interests in the authorized capital), bonds of Russian organizations, investment shares of Russian companies,

- losses from participation in an investment partnership received in the tax period in which the taxpayer joined an investment partnership agreement previously concluded by other participants,

- changing the tax regime, being on the simplified tax system or unified agricultural tax during the period of receiving a loss, and switching to the general tax regime during the period of receiving a profit,

- write-off of losses to a participant in the Skolkovo project received during the period before he was exempt from taxation.

Loss and tax accrual

For the financial result to influence taxes, their calculation must depend on the profit of the business.

This condition is met under three tax regimes.

Under the general system (OSNO), the financial result of activities is subject to income tax. If there is no profit, then there is no tax.

Also, a loss under OSNO also affects VAT, but not as directly as in the case of income tax. The fact is that added value consists not only of the difference between revenue and costs, but also includes all expenses not subject to VAT. First of all, these are wages and insurance premiums accrued on it. Therefore, a company operating at a loss, in most cases, still pays VAT, only to a lesser extent than when making a profit.

There are also two special tax regimes under which profits are taxed on principles similar to OSNO.

The Unified Agricultural Tax (UST) and the tax under the simplified taxation system (STS) with the object “Revenue minus expenses” are calculated based on the difference between revenue and expenses.

The differences between them are as follows:

- Under the Unified Agricultural Tax, turnover is determined “by shipment,” and under the simplified tax system, “by payment.”

- Different tax rates: under the simplified tax system it is (excluding benefits) 15%, and under the unified agricultural tax – 6%.

- The simplified tax system provides for the so-called “minimum tax”, i.e. if the financial result is unprofitable or close to zero, the businessman will have to pay 1% of the proceeds. Under the unified agricultural tax there is no such thing and an agricultural producer operating at a loss does not pay this tax at all.

Under other “special regimes,” the tax amount does not depend on profit. Under the simplified tax system “Income”, it is calculated on the basis of revenue, without taking into account costs.

As for “imputation” and the patent system, in these cases the tax is not tied to business turnover at all. The basis for these special regimes are various “physical” indicators: number of employees, retail space, number of vehicles, etc.

Those. a businessman on an imputation or a patent can work for zero, make a loss, or not conduct business at all, but he remains obligated to pay tax.

Important!

The financial result of activities affects the fiscal burden under three tax regimes: OSNO, Unified Agricultural Tax and the simplified tax system “Income minus expenses”.

Next, we will consider what threatens a businessman operating at a loss, and what benefits he can derive from this situation.