Putin's child benefits

Putin’s child benefits are one of the options for financial support for those families who receive low incomes. They are especially significant during the period when the mother is at home and cannot earn money, but only receives child benefits.

Payments upon birth of a child →

The money is sent to the bank card or account of the mother or father if the woman died or was deprived of parental rights. In 2022 and 2022, it was possible to receive benefits only for children who have not yet turned 1.5 years old. But since 2020, the conditions have changed: money is issued before reaching the age of 3. Personal income tax is not collected from Putin's payments. Not all families receive presidential payments, but only some, subject to certain conditions.

Certificate of income

One of the main documents on the list for recognizing a low-income family is the income certificate in question for the last 3 months. What is it for?

The main purpose of the document is to confirm the existence of work activity, indicating a specific address, name, position held, and amount of earnings.

Since legislative acts do not provide for a strict document form, the form of the certificate depends on the purpose - when requesting it, the employee should clarify which department and under what circumstances it is required. To receive child benefits, a certificate is submitted to Social Security or the subsidy department of the municipality or district.

From the date of request for a certificate, the accounting department or human resources department or office management department are required to issue it within 3 days. In appearance, the certificate is similar to the familiar 2-NDFL form.

Who receives funds from the budget?

The following will be able to apply for Putin’s benefits in 2022:

- Citizens of the Russian Federation who live in the country.

- Families in which the child was born after January 1, 2022. Adopted children after the established date are also taken into account.

- Legal guardians can also receive payments if biological parents or adoptive parents die, have their adoption annulled, or are deprived of parental rights.

- The child must also be a citizen of the Russian Federation. This requirement may be confusing, for example, if both parents are foreigners, but the child was born in Russia. In this case, the child cannot apply for Russian citizenship, therefore, the parents will not be paid benefits.

- Families where the average income of all members, calculated per person, does not exceed two subsistence minimums in 2022. In 2018-2019, payments were given only with incomes up to 1.5 monthly subsistence minimum, now the list of applicants has been expanded.

In the case where there were children from a previous marriage, the order of birth of the children in relation to the mother is taken into account. If a man has two children from a previous marriage, and a third child from his current wife, then the family can claim payments if this is the woman’s first child.

When adopting a child, it is not necessary that his date of birth be after January 1, 2022. It is only enough that at the time of applying for payments he is not yet 3 years old.

What is the calculation procedure

Regulatory acts (44-FZ, government decree No. 512) provide a single formula for calculating whether a family is low-income in 2022:

SD = D / KM / ChS,

Where:

- SD - average per capita income;

- D - revenue receipts;

- KM - number of months;

- ES - number of family members.

To calculate the Putin benefit from 3 to 7 years, 12 months of income are taken; Do not start counting the period immediately, but six months before the date of filing the application for payment. Some regional social payments are calculated based on income for 3 or 6 months.

Income per family member should not exceed the regional subsistence level in force in the second quarter of the year preceding the calculations. For example, the regional authorities of the Moscow region determined what the income for a family of 3 people should be to receive a subsidy - 13,115 rubles for each person.

Each benefit is regulated by a separate regulatory act. New Putin payments are regulated by government decree No. 384 of March 31, 2020.

This standard provides the procedure for correctly calculating family income to receive benefits from 3 to 7 years for low-income citizens:

- Determine the amount of income for 12 months.

- Calculate the average by dividing the resulting sum by 12.

- Divide the amount received by the number of family members and compare the final figure with the regional cost of living.

Calculation of income for assignment of payments

To understand whether you can receive Putin benefits for your first or second child, you need to calculate the average monthly income of the entire family. To do this, add up the salaries, benefits, scholarships and other income of all family members and divide by the number of people in the family.

For calculations, take 12 months before submitting your application. Consider all types of income before taxes. When calculating income, add up the income of the following family members:

- parents or guardians of the child;

- spouses of parents of a child under 18 years of age;

- minor children.

When calculating income, do not take into account:

- those who are in prison at the time of filing the application;

- those who, by court decision, are undergoing compulsory treatment;

- parents who have been deprived of their rights to a child;

- those who are fully supported by the state.

When calculating, consider:

- Rewards for work: bonuses, compensation.

- Social payments: pensions, benefits, scholarships.

- Payments to successors of persons who are insured in the compulsory pension insurance system.

- Material allowances for military personnel and other permanent payments.

Don't count monetary support the government provides during emergencies or natural disasters.

Compare the amount received per person with the cost of living. Each region has its own PM indicator, one for Magadan, and another for Voronezh. The amount of Putin’s benefit is one subsistence minimum for the region of residence. It is transferred monthly to your account or bank card within a specified period.

For example, for a family of 4 people in the Magadan region, with an annual income of 300 thousand rubles, the benefit for the first child will be 21,052 rubles. When paying benefits for the second, the same amount will be deducted from maternity capital funds. If a family lives in the Voronezh region under the same conditions, then the monthly amount will be only 9,190 rubles per month.

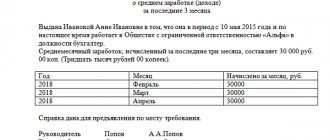

Certificate 2-NDFL for Putin’s payments

2-NDFL is a standard form on which an individual entrepreneur or organization records the amount of payments made to their employees, as well as the amount of tax withheld and transferred.

This is an official document that must be issued and signed by an authorized person.

Falsifying a certificate is punishable by law and can lead to the bearer being brought to administrative or even criminal liability.

IMPORTANT! If an employee pays alimony, it is deducted from the available amount of income when calculating.

There is also a list of income not subject to personal income tax (Article 217 of the Tax Code of the Russian Federation). They are not considered income of an individual and therefore are not taken into account in this certificate.

These include:

- maternity payments;

- payments to the employee in case of dismissal (3 months' salary is paid);

- one-time financial assistance at the birth of a baby in the amount of up to 50,000 rubles.

Both working parents need to order the following certificate: each of them from their places of employment.

Then, when calculating the average income, they will need to add up the resulting amounts.

If you change employer within 12 months, you need to take 2NDFL from both places of work.

If for some reason this is not possible, you can obtain the document in the city archive or on the Federal Tax Service website in the taxpayer’s personal account.

Documents for processing payments

To apply for Putin's child benefits you will need:

- Birth or adoption certificate of a child. Any other document that can confirm the possibility of receiving money is also suitable.

- Passports of father and mother.

- A document that confirms the citizenship of the parents and their child.

- Certificates of parents' income. It is necessary to provide complete information about income for 12 months, including pensions, scholarships and other social benefits.

- Bank account details to which the money will then be transferred or a plastic card.

- Certificate of family composition.

- Marriage certificate, if available.

These are the main documents, but depending on the specific situation, other evidence may be needed. Also keep in mind that all benefits and other payments in the form of government support are paid to cards in the MIR payment system. Therefore, if you have a Visa, MasterCard or any other international payment system, then you need another card in the NPS.

Documents for applying for benefits

Before preparing a package of basic documentation, the average family income from all sources of income is calculated. According to federal law, average per capita earnings are calculated for the last 12 months, after which it is compared with the cost of living for the second quarter of the previous year.

The total earnings are divided by exactly 12 months, and then the resulting amount is divided by the total number of family members. Family members are considered to be mother, father and child. In single-parent families, the number of family members is smaller, which is reflected in the calculation formula.

Documents are submitted before the child turns one and a half years old. The parent or guardian draws up an application: basic documents and consent to the processing of personal data are attached to it.

It is mandatory to provide identification cards for all family members, a birth certificate for the first-born or second child. If the certificates are submitted by a guardian, you will need to certify the act of appointing the individual as a guardian. Bank details and income certificate - her data are entered into the application without corrections.

For the first child

To receive financial assistance for the first-born, every month the applicant submits certificates to the Social Protection Department in the locality where he lives with the baby.

The standard package includes: a written application, passports of the mother and father; in case of divorce, a divorce certificate is additionally provided. If one of the parents has died, a confirmation form must be provided.

The list of documents also includes:

- birth certificate of the first baby with Russian citizenship;

- certificates confirming the income of all family members;

- details of the bank account where the funds will be credited;

- the applicant’s identity card and other certificates, if the payment is processed by a trustee and not by the parent or guardian himself;

- court order if the spouse or one of the parents is deprived of parental rights.

Additional payments vary in each region, and there is no uniform subsidy in the country. The amount varies from 8-9 thousand rubles to 25 thousand rubles per month. The applicant has the right to submit documents at any multifunctional center or on the State Services website.

For the second, third child

For the second and subsequent children, payment is made from maternity capital. The documents submitted are similar to those for applying for a subsidy for the first-born. The applicant applies to the Pension Fund at the place of registration with a certificate for maternal capital.

If the documents were submitted correctly and the information was verified by the relevant authorities, the first amount will be transferred by the 26th of the current month. Parents must extend the payment after a year has passed from the date of submission of the initial package. The procedure is necessary so that the state is aware that the family still needs additional material resources for a second child.

What does the application for payments contain?

In your application for presidential benefits, please indicate:

- name of the competent organization to which the documents were sent;

- FULL NAME;

- passport details;

- data on the presence of citizenship of the Russian Federation;

- SNILS;

- residential address, telephone number;

- information about the child: name, date of birth, order, citizenship;

- if you cannot submit documents yourself, another person can do this, then you need to additionally enter the details of an authorized representative;

- information about whether the child’s parents or guardians were deprived of their rights to him;

- information about whether crimes have been committed against the child;

- list of documents attached to the application.

After filling out the data, put the date and your handwritten signature.

Where to apply for benefits

The organization to which you need to submit an application with documents depends on the situation:

| Situation | Where to apply |

| If you want to receive payments for the first child who was born in your family or whom you adopted | Social authorities protection or to a multifunctional center |

| If you have had or adopted a second child | PFR branch at your residence address or at the MFC |

| If you had two or more children at the same time | One application to the territorial department of social services. protection, and the other - to the Pension Fund department |

Moreover, if twins are born, then the Pension Fund can apply not only for Putin’s payments, but also for a maternity capital certificate. You can also submit an application not in person, but through the Russian Post. But for this you need to have all the papers certified by a notary.

Keep in mind that you need to collect documents as soon as possible; some certificates are valid for 1 month. If you are late, payments may be refused. It takes a month to review the documents, after which a notification of the decision is received. If it is positive, then soon the money will begin to be transferred to the account number specified in the application.

What payments are included in the calculation?

The list of payments included in the calculation of average earnings is given in clause 2 of the Procedure. This includes salaries, bonuses, rewards, additional payments, payments related to working conditions, and so on. The list remains open, since the law allows the inclusion of other types of money transfers in accordance with the company’s current remuneration systems.

As we said above, only the payments listed in clause 4 of the Procedure should be excluded: travel and vacation pay, sickness benefits, pregnancy benefits, child care benefits, etc. All payments and compensations not related to wages, such as food payments, are also excluded.

There are additional rules for accounting for bonuses, which depend on their type:

- Monthly bonuses - we take into account one bonus for each indicator. For example, if two bonuses are awarded for fulfilling a sales target within a month, then we take the larger of the two into account.

- Quarterly or semi-annual bonuses - one bonus for each indicator in the amount of a monthly part for each month of the billing period.

- Annual - 1/12 for each month included in the billing period.

If there was a salary increase during or after the billing period, then previous payments in the billing period must be indexed.

Why are payments denied?

Among the most common reasons why employees of competent authorities refuse to assign payments are:

- Misleading or providing erroneous information.

- Lack of one or more required certificates.

- The child was born earlier than the established date.

- The applicant was deprived of parental rights at the time of his application.

- The average income for each family member exceeds the established figure.

Payment may be refused if it is discovered that you are trying to get money through fraudulent means and are providing deliberately false information.

Governor's payments for children

Financial support is provided not only by the state, but also by the authorities of individual regions. Such payments for a child are called gubernatorial payments. In most cases, gubernatorial benefits are paid for the second child. But in some regions such payment is not prescribed at all.

The rules for calculating gubernatorial benefits are also different: in some regions it is a fixed amount, while in others it is tied to the minimum wage. On average, the amount varies from 1 thousand to 10 thousand rubles. Find out the categories of citizens who can receive gubernatorial payments separately for your region of residence. To do this, contact the social authorities. protection or to the local administration.

5 / 5 ( 1 voice )

about the author

Klavdiya Treskova is an expert in the field of financial literacy and investment. Higher education in economics. More than 15 years of experience in banking. He regularly improves his qualifications and takes courses in finance and investments, which is confirmed by certificates from the Bank of Russia, the Association for the Development of Financial Literacy, Netology and other educational platforms. Collaborates with Sravni.ru, Tinkoff Investments, GPB Investments and other financial publications. [email protected]

Is this article useful? Not really

Help us find out how much this article helped you. If something is missing or the information is not accurate, please report it below in the comments or write to us by email

Comments: 11

Your comment (question) If you have questions about this article, you can tell us. Our team consists of only experienced experts and specialists with specialized education. We will try to help you in this topic:

Author of the article: Klavdiya Treskova

Consultant, author Popovich Anna

Financial author Olga Pikhotskaya

- Olya

01/25/2022 at 18:52 hello, tell me, in order to receive Putin's cards under 3 years of age, the mother and child must be registered at the same place of residence

Reply ↓ Anna Popovich

01/26/2022 at 17:40Dear Olya, yes, the law allows you to apply for child benefits at the permanent place of residence indicated in the passport as the place of registration, and at the place of actual residence of the applicant and the child (Article 2 of the Law “On monthly payments to families with children”).

Reply ↓

11.11.2021 at 17:45

Good afternoon. Tell me about Putin’s child benefits. Can they refuse if one of the spouses submitted a 2nd personal income tax certificate but there were no deductions for it in some months?

But at the same time, he was listed in the accrual company: January February March June July August September October December in 2022 accruals were made to you: February September October

Reply ↓

- Anna Popovich

11.11.2021 at 22:39

Dear Sergey, no, this is not a reason for refusal.

Reply ↓

08/14/2021 at 03:22

Hello, we were denied presidential payments due to the fact that we do not have permanent registration, but have temporary registration, is this legal?

Reply ↓

- Anna Popovich

08/16/2021 at 18:36

Dear Irina, no, you have the right to receive payments at the place of stay where temporary registration was issued.

Reply ↓

06.16.2021 at 21:46

Good afternoon. My husband and I are in a civil marriage; our first child was born in March 2022. There is a certificate of paternity. Do I need a certificate from my dad’s work to receive Putin’s benefits and will the family’s income for 12 months be divided between all three of us?

Reply ↓

- Anna Popovich

06/17/2021 at 17:10

Dear Tatyana, the issue of including the child’s father in the family is controversial. When assigning payments, alimony will be taken into account accurately, but the father’s income will most likely not. This issue has not been resolved directly anywhere, contact your local social security authorities.

Reply ↓

Tatyana

06.18.2021 at 19:56

Thanks for the answer. Local social protection authorities refused to receive this benefit because... in our situation, dad is not officially a member of our family.

Reply ↓

06.06.2021 at 23:59

Hello, I quit my job, I’m registered at the employment center, my wife is on maternity leave, we have two children, what financial benefits can we now count on and where should we apply??

Reply ↓

- Anna Popovich

06/07/2021 at 15:46

Dear Alexander, your wife can count on receiving all payments that are not made at the expense of the employer. You can get advice from the social protection department of your locality.

Reply ↓

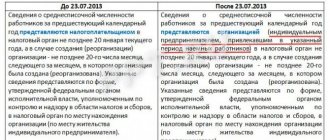

If you need a certificate for the last months

Often a 2-NDFL certificate is needed for the last period. For example, over the last 3, 6, 12 months. In this case, the document ordered on the public services portal will be irrelevant. For example, when applying for a loan, the bank asks for a certificate for the last six months. If you contact the social service to apply for benefits, they will also ask for a certificate for the last months or year.

In this case, it is better to contact the employer for the document, who calculates the personal income tax and pays it for the employee, providing reports to the Federal Tax Service for the year. The employer has information about the personal income tax paid and the employee’s earnings for any period during which he was employed.

In fact, ordering a document is simple; you need to contact the accounting department and fill out an application. Each organization has its own algorithm of actions. In one, you need to personally contact an accountant, in the other, you can submit an application remotely, for example, if your place of work and the accounting department are far from each other.

Depending on the method of application, the employee will receive a 2-NDFL certificate immediately or within a few days. The document is simple, the accountant simply indicates the period in the program, the system issues the document. All that remains is to print it out and certify it.

First, find out from the person requesting the certificate what period of validity is acceptable. In one case it may be a month, in another - 2 weeks.