01.07.2019

0

685

4 min.

Paying taxes is an obligation that applies to every employed member of society. The existing system of collecting fees is a product of gratuitous contributions by individuals and organizations to ensure the functionality of the state, municipalities and the maintenance of disabled categories of citizens. Employees who decide to quit often ask their employer the question: is compensation for vacation subject to an insurance premium or not?

For officially employed people, the employer automatically makes monthly contributions to the inspectorate. Taxable income includes salary, bonuses and vacation payments, work on holidays and overtime, sick leave, compensation for unused vacation upon dismissal.

Legislative norms

The algorithm for calculating the tax liability is carried out in the manner specified in Article 139 of the Labor Code, using the method of calculating average earnings for 1 day.

The calculation and deadlines for payment of income tax are carried out according to the basic standards given in Chapter 23 of the Tax Code.

Tariffs, amounts, periods of accrual and payment of mandatory insurance contributions are determined in Chapter 34 of the Tax Code.

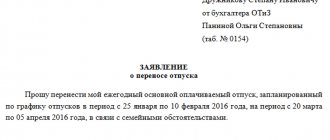

In what cases is compensation for vacation provided without dismissal?

According to the Labor Code, each employee who has worked for the company for 1 year is entitled to at least 28 days of paid leave annually.

But in practice, few workers, especially in medium-sized and large companies, manage to take all 28 days off in a year. There can be many reasons: there was no desire, the manager did not let me go due to high workload, etc. For all possible reasons, the consequences are the same. Art. 126 of the Labor Code of the Russian Federation allows the company, instead of vacation days that the employee does not want to use, to pay him monetary compensation.

IMPORTANT! In Art. 126 of the Labor Code of the Russian Federation enshrines the right of the company’s management, and not the obligation, so the final decision on the issue in any case will remain with the organization.

However, the company does not always have the right to accommodate an employee who wants to receive money in exchange for certain vacation days. The Labor Code of the Russian Federation establishes a special list of persons who must be provided with leave, and not compensation replacing it. Such persons include (Article 126 of the Labor Code of the Russian Federation):

- pregnant women;

- minors (under 18 years of age);

- persons who work in conditions considered harmful or dangerous;

- employees who were exposed to radiation as a result of the accident at the Chernobyl nuclear power plant (letter of the Ministry of Labor of the Russian Federation dated March 26, 2014 No. 13-7/B-234).

NOTE! For persons working in harmful or dangerous conditions, one exception is established: only the minimum additional leave, which is 7 days, cannot be replaced with a cash payment. This means that if, for example, an employee has the right by law to 10 days of additional leave, then only instead of 3 days of such leave can money be paid.

If the employee does not fall into any of the listed categories, the company may, at his request, replace the vacation with a cash payment.

But the following is important here: you can pay money only in lieu of those days that exceed the 28 days of vacation that an employee is entitled to per year. This rule applies to vacation for each year separately. The parts of vacation not taken for different years in the amount of no more than 28 days are not summed up for the purpose of calculating compensation.

A situation similar to the above is when an employee decides to quit without taking the full vacation allotted to him. Can he then count on compensation?

For more details, see the article “Calculation of compensation for unused vacation according to the Labor Code of the Russian Federation .

Example

The employee did not take advantage of vacation during 2022; he had 28 days left. In 2022, a similar situation repeated itself. Neither in 2020 nor in 2022 did the total number of vacation days for an employee exceed (calculated separately for each year) 28 days. Therefore, the employee cannot count on replacing the 2020-2021 vacation with a cash payment.

The question arises: in what cases can one demand compensation for vacation left over from past years of work in the company? Only if the employee has the right to extended or additional leave (for example, disabled workers, etc.).

IMPORTANT! Even if the employing company is not obliged to provide increased leave to an employee due to the direct requirements of the Labor Code of the Russian Federation, it has the right to do this independently by securing such leave in the local regulatory legal acts (for example, upon reaching a certain number of years of work experience in the company, the employee’s leave increases by some amount of days).

Types of payments that are tax-free upon dismissal

A separate section of the Tax Code (clause 1, subclause 2 of Article 422) sets out events when payments accrued to workers are not subject to mandatory insurance contributions. These include, in particular:

- severance pay

- average monthly salary upon dismissal

Amounts not exceeding 3 times the employee’s average earnings are not included in the tax calculation. (For workers in the northern regions, the limit is increased to six average wages).

As for CCW, it is emphasized: all payments are calculated on a general basis.

Regulatory regulation

The Labor Code of the Russian Federation reflects the need to receive compensation for unused vacation if an employee quits (Article 127)

Decree of the Government of the Russian Federation dated December 24, 2007 N 922 determines the sequence for calculating the average salary as the basis for calculating vacation pay

Ch. 34 of the Tax Code of the Russian Federation is devoted to insurance contributions to extra-budgetary funds

Federal Law No. 255-FZ dated December 29, 2006 regulates social insurance issues

Federal Law No. 167-FZ dated December 15, 2001 determines the procedure for paying pension contributions

Federal Law No. 125-FZ of July 24, 1998 regulates accident insurance

Rules “On regular and additional leaves” (dated April 30, 1930 N 169) Art. 28-30 are used within the framework that does not contradict the current Labor Code of the Russian Federation

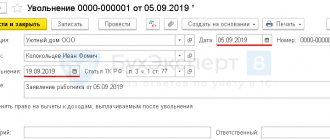

Features of documenting compensation

The standard form T-61 helps to accurately and conveniently calculate the CNO upon dismissal. On its front side all the required data about the employee and the number of “unfilled” vacation days are indicated. On the reverse side, in sequential columns, the full amount of tax liability, tax withholdings and the final amount to be paid to the resigned employee are calculated.

Is compensation for unused vacation calculated upon dismissal in 2022?

In practice, situations often arise when an employee does not have time to take all the paid leave due to him under the Labor Code.

And if such an employee suddenly decides to leave the company, the question will arise: what to do with the unused part of the vacation? Should I take the remaining days off or can I receive monetary compensation for them? In addition, does the reason for which the employment contract was terminated matter? And how will compensation for unused vacation be calculated upon dismissal? The Labor Code of the Russian Federation clearly answers: the employer must pay the former employee compensation for unpaid vacation upon dismissal, i.e. for each unused day.

Attention! An employee’s right to calculate compensation for unused vacation and its payment upon dismissal does not depend on the basis on which the employment contract was terminated (letter of Rostrud dated July 2, 2009 No. 1917-6-1).

Amount of compensation provided

To calculate the amount of compensation payment, the following steps are performed:

- The number of vacation days that the employee did not take off is determined. The Labor Code stipulates that he must be compensated for all vacation days, regardless of the length of the period when he was not on vacation (3, 5, 7 years). The standard amount of leave an employee is entitled to in one year is 28 days. For some employees (for example, those working in hazardous industries, without limiting the length of the working day, minors working in the northern regions), additional leaves are provided, also subject to monetary compensation, in case of non-use.

Note. If an employee has not taken vacation for less than a full year, the compensation payment is calculated in proportion to the period worked.

- For example, a worker (who does not have additional preferential leave) has not completed 1 year and 4 months of leave. For each month he is entitled to (28/12) 2.33 vacation days. In total, the employee is accrued CCW for 37 days (2.33 x 4 days + 28).

- If the resigning employee worked for less than half a month, this period is not taken into account.

- The average earnings of 1 day are determined for the 12 calendar months worked preceding the payment (periods of temporary disability are excluded) on the basis of Regulation 922.

- The total amount of compensation accrual is determined.

- Calculation of personal income tax and insurance contributions from vacation compensation is carried out.

To simplify the calculation procedure and check it correctly, you can use an electronic calculator from the Internet.

How to calculate vacation compensation upon dismissal

After the organization is convinced of the need for payment, it faces the question: how to calculate compensation for unused vacation?

In accordance with the general rule, an employee who decides to leave the company has the right to receive monetary compensation for unused vacation in proportion to the total months worked in the company for which these days were accrued (clause 28 of the Vacation Rules, approved by the People's Commissariat of Labor of the USSR on April 30, 1930 No. 169, hereinafter referred to as the Rules).

However, if an employee decides to leave his previous place of work not of his own free will, but due to the occurrence of the circumstances listed in clause 28 of the Rules (for example, there was a reduction in staff), then the employer will have to pay him compensation in the amount of the full year worked , but only on condition that such an employee managed to work in the company from 5½ to 11 months (clause 28 of the Rules).

IMPORTANT! The above rule applies only if the employee has not worked for the company for a whole year. Otherwise, upon dismissal, compensation for unused vacation will be calculated according to the general procedure, i.e., in proportion to the time worked.

Other employees (who left the company not due to circumstances specified in clause 28 of the Rules) can also count on full compensation (as for a whole year), but only if on the date of leaving the organization they managed to work for 11 months, but did not complete the full year.

Typical mistakes when calculating contributions

Accountants often include excessive amounts when calculating average daily earnings (for example, they include in the total salary for the last 12 months one-time bonuses that are not provided for in the Regulations on Remuneration in force at the enterprise).

An incorrect result of calculating average earnings for 1 day using a chain reaction leads to:

- to incorrect calculation of the amount of tax liability, personal income tax, mandatory contributions to insurance funds

- incorrect accrual leads to a distortion of the amounts of gross expenses when determining the corporate profit tax in the reporting period

Another oversight may be a misunderstanding or inattention when determining the date of transfer of mandatory payments to the relevant budgets, or failure to include accruals in periodically provided reports.

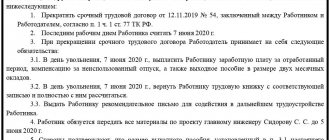

What payments are due upon dismissal?

On the last day of work, as a general rule, regardless of the reason for the employee’s dismissal, he must be paid:

- all due wages on the day of dismissal,

- compensation for missed vacation days.

When terminating an employment contract due to staff reduction, liquidation of an organization, often when terminating an employment contract by agreement of the parties, in addition to the above payments, the quitter is paid severance pay. In addition, if an employee is laid off, he is entitled to retained earnings for the duration of his employment.

Amounts and calculation of taxes with examples

The retired engineer Golovin, on the date of dismissal, did not use one full basic vacation of 28 days, two additional ones for irregular working hours (3 days x 2) and 4 days for the subsequent partial year. His average daily earnings were calculated to be 2,216 rubles. Let's calculate the amount of compensation payments to Golovin and calculate the mandatory payments:

- compensation amount = (28 + 6 + 4) x 2216 = 84,208 rubles

- amount of personal income tax = 84,208 x 13% / 100% = 10,947.04 rubles

- pension insurance contribution = 84,208 x 22% / 100% = 18,525.76 rubles

- temporary disability insurance = 84,208 x 2.9% / 100% = 2,442.03 rubles

- from accidents and industrial injuries (occupational risk class - XYIII) = 84,208 x 2.3% / 100% = 1,936.78 rubles

- medical insurance = 84,208 x 5.1% / 100% = 4,294.61 rubles

We remind you that all accrued payments are due on the day the worker's compensation is paid.

At first glance, the process of determining the correct amount of CCW for a resigning employee does not present much difficulty. In fact, the only error in calculating the amount of compensation entails the need to correct mandatory deductions, payments and reports, requiring large additional labor costs and moral efforts for accounting workers.

Top

Write your question in the form below

How to calculate compensation for unused vacation upon dismissal, if the vacation is additional

There are often situations where an employee who has decided to leave the company did not have time to take not only his annual leave, but also did not take advantage of the days of additional leave.

Such leave is provided to the employee under a collective agreement. For example, a collective agreement may stipulate that upon reaching a certain length of service in the company, an additional few days of vacation are granted.

In such a situation, it is important to remember that days of additional leave must be compensated in accordance with the general procedure (described above), i.e., as if these were days of regular annual leave. This conclusion follows from Art. 127 of the Labor Code of the Russian Federation, which states that when an employee is dismissed, the employer must compensate him (in monetary terms) for all unused vacations.

Therefore, when calculating compensation for unused vacation upon dismissal in 2022, it is important to strictly follow the general procedure described above.

We described in detail about compensation for unused vacation without dismissal here.

In addition to compensation for missed vacation, the employer is obliged to pay the employee wages. Find out how to calculate it correctly here.

Types of insurance premiums

Several insurance premiums have been allocated. Each of them deserves special attention:

- Insurance premiums against accidents and occupational diseases. These deductions are also called “injury” contributions. Transferred by the employer to the Social Insurance Fund (SIF). Their rate is related to the danger of professional activity and can range from 0.2 to 8.5%, depending on which of the 32 risk groups the organization’s activities belong to. Every year, before April 15, organizations submit information to the Social Insurance Fund on approval of the type of economic activity. The FSS confirms with a notification the tariff, according to OKVED, or assigns its own if there is more than one type of activity and the organization did not submit an application on time.

- Pension insurance (contributions from the Pension Fund of the Russian Federation). There is a limit on the base for accrual for an employee. It is calculated for each employee separately, from the beginning of the calendar year. Until this limit is reached, a rate of 22% applies. If the employee’s annual income turns out to be higher, then the pension contribution rate above this amount will be 10%.

- Social insurance in case of temporary disability and maternity. It is the system of maternity contributions that allows the employer to subsequently compensate maternity payments to employees from the budget by offsetting the payment of current contributions or reimbursement in monetary terms to the organization’s account.

- Insurance contributions to the Federal Compulsory Medical Insurance Fund (FFOMS) are stable and amount to 5.1%.