Since 2014, there has been a mandatory procedure for pre-trial settlement of tax disputes (including disputes related to taxpayers’ disagreement with decisions of tax authorities based on the results of tax audits, acts of tax authorities of a non-regulatory nature and the actions or inactions of its officials). Let us outline the main stages of pre-trial appeal.

Thanks to the Federal Law of July 2, 2013 No. 153-FZ, from January 1, 2014, a pre-trial appeal procedure has been in effect for the entire category of tax disputes.

EXAMPLE

The decision contested by the taxpayer was made by the tax inspectorate on February 18, 2013, and handed over to the taxpayer’s representative on February 20, 2013.

Consequently, the contested decision enters into legal force within a month from the date of delivery, that is, March 20, 2013. In this case, the taxpayer can file an appeal with a higher tax authority before March 20, 2013, or a complaint against the decision that has entered into legal force inspectorate by 02/18/2014. The taxpayer sent the complaint by postage with declared value on 12/11/2014.

Thus, the taxpayer violated the deadline for appealing the inspector’s decision, established by the provisions of Article 139 of the Tax Code of the Russian Federation. Taking into account the above, as well as the absence of a request from the taxpayer to restore the missed deadline for filing a complaint, the Moscow Office of the Federal Tax Service of Russia left the complaint without consideration (decision of the Moscow Arbitration Court dated 05/07/2015 No. A40-211031/2014).

The absence of reasons to restore the deadline may serve as a basis for refusing to satisfy the application at a court hearing in the court of first instance, since by virtue of clause 1 of Article 115 of the Arbitration Procedure Code of the Russian Federation, persons participating in the case lose the right to perform procedural actions with the expiration of procedural deadlines.

Valid reasons for missing a deadline include circumstances of an objective nature that are independent of the applicant, that are beyond his control, provided that he observes the degree of care and diligence that was required of him in order to comply with the established procedure (decision of the Autonomous District Court of the Yamalo-Nenets Autonomous Okrug dated January 30, 2015 No. A81-6309/2014).

In this case, the courts may recognize the missed deadline as valid due to the insignificance of its violation, and also if a similar decision has previously been challenged (decision of the Administrative Court of the Krasnodar Territory dated January 25, 2016 No. A32-30739/2015).

The procedure for pre-trial settlement of a tax dispute

The taxpayer has the right to challenge any decision of the tax authority both in form and content. The process of challenging decisions of tax authorities is possible not only by going to court. The law provides for two procedures: judicial and extrajudicial. Which one should you give preference to? Seems to be pre-trial. This is due to time, physical and financial costs. Moreover, a claim for violation of the procedure for adopting any tax act is impossible without filing a pre-trial claim.

So, the taxpayer decided to settle the dispute out of court. Let's consider what actions a person needs to take in this case:

- Initially, it is necessary to analyze the received document - order a tax analysis now to get a complete picture of the situation that has arisen. Establish the basis for the adoption of the act, the reason for additional charges, penalties or fines. Find out why the tax inspector did not take into account the taxpayer’s arguments, did not apply tax benefits, or did not take into account certain expenses of the enterprise. And only then begin the task of pre-trial settlement of the tax dispute.

- File a complaint or appeal (hereinafter referred to as the complaint). An appeal is filed against a decision of the tax authority, which has not entered into force. Such a decision comes into force after 1 month from the date of delivery to the taxpayer. A complaint is simply filed against a decision of the relevant body that has entered into legal force. The period for filing such a complaint is 1 year.

- Next, you need to file a complaint against the decision to a higher tax authority, through the body where the taxpayer is registered.

- After filing a complaint with the tax authority with which the taxpayer is registered, it will be sent to a higher authority within 3 working days. The higher authority must make a decision on the relevant complaint of the person. This is the last link in the procedure for pre-trial settlement of a dispute with the tax authorities.

- After a decision is made by a higher tax authority, it must be delivered or forwarded to the person who filed the complaint within 3 business days from the date of adoption.

- In case of unsatisfactory results of the pre-trial settlement of the dispute, the taxpayer has the right to go to court with the help of the Law Office “Katsailidi and Partners”.

By appealing the decision of the tax authority through the appeal procedure, the taxpayer actually extends the period for the entry into force of the decision of the tax authority, which will come into force only after a decision is made based on the results of consideration of the appeal.

Attention: watch the video about appealing a tax decision and the participation of a lawyer in a tax audit. Subscribe to the YouTube channel to receive free advice on taxes and other issues through comments on videos:

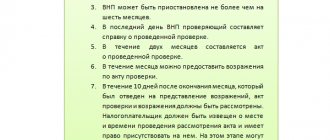

The time frame for consideration of complaints by a higher tax authority also depends on the type of complaint

Thus, complaints against decisions made as a result of tax audits are considered within one month from the date of their receipt. But under certain circumstances (for example, if there is a need to obtain additional information from lower tax authorities), this review period can be extended by the head (deputy head) of the tax authority by no more than one month.

For other complaints, decisions are made by the tax authority within 15 working days from the date of their receipt. In this case, the period for extending the consideration of such a complaint is no more than 15 working days, and the grounds for the extension are the same as for considering complaints regarding tax audits (paragraph 2, clause 6, article 140 of the Tax Code of the Russian Federation).

A complaint against a decision or other act of a non-normative nature adopted by a higher tax authority based on the results of consideration of the applicant’s complaint may be filed with the Federal Tax Service of the Russian Federation within three months from the date of such decision on the complaint.

Criteria and classification of tax disputes

Depending on which of the participants began to dispute a certain issue in the relationship between the parties, tax conflicts are divided into those that arose on the initiative of:

- agents paying obligatory budget payments or fees;

- customs structures or the Federal Tax Service.

Based on the basis (subject), types of disputes are distinguished:

- about the obligations and rights of the parties involved in tax relations (disputed);

- on the legality of using a regulatory document relating to taxes (fees), inaction or unlawful actions of authorized persons.

Based on the amounts charged, conflicts are divided into those related to:

- direct type deductions, their calculation and payments;

- indirect payments, their calculation and transfer.

The subject of the requirements may be a statement about:

- recognizing the actions of the controlling structure as inconsistent with the law;

- disagreement with the refusal of the supervisory authority to return amounts transferred in excess;

- providing measures;

- recognition (based on the results of the audit) of the actions of the Federal Tax Service as illegal;

- accrual of interest for delays in transferring funds from the budget.

According to the method of resolving the situation, they are divided into:

- subject to judicial investigation (in a court of general jurisdiction, arbitration, constitutional);

- resolved by administrative (pre-trial) procedure.

We object to new evidence

Sometimes tax officials present new evidence during legal proceedings that was not previously available during a tax audit. The company has the right to object to their inclusion in the case materials. In court proceedings, only the evidence that was obtained at the stage of tax control and audit, that is, before the tax inspectorate makes a decision, can be presented.

Important! Under such circumstances, the taxpayer himself will not be able to present new evidence in court. Therefore, it is necessary to select and submit documents that are truly relevant to the case and were reviewed by the tax office before the trial.

However, the law does not prohibit the presentation of new evidence in court if it really influences the outcome of the case and helps the court make the right decision. The court can either accept or reject them, and this depends directly on the judges. As judicial practice shows, this issue is quite controversial, and therefore both options are possible during the proceedings.

Let's sum it up

As you can see, there are no particular difficulties in the pre-trial consideration of tax disputes on the territory of the Russian Federation. The main thing in this procedure is a competent approach and full compliance with legal regulations. In general, pre-trial resolution of conflicts in the field of taxation is implemented in 5 simple stages:

- Analysis of the problem that has arisen with the determination of the further vector of actions to resolve the dispute.

- Drawing up a complaint, its execution and submission.

- Pending review of submitted papers.

- Obtaining a verdict based on the results of resolving a tax dispute in a pre-trial manner.

- Implementation of the decision of higher officials or appealing it in court or other government agencies.

Summarizing the discussion of the topic of today's article, we can state that there is no need to be afraid of pre-trial settlement of tax conflicts, since this procedure is clearly regulated by the legislation of the Russian Federation. Moreover, when implementing it in accordance with the article cited today, one should not doubt the success of the appeal procedure, of course, if there are real violations on the part of the tax authorities. We hope that the material presented was useful to you and provided answers to your questions. Good luck resolving tax disputes!

On pre-trial resolution of conflicts with the Federal Tax Service:

When can you go to court?

Any individual or legal entity who disagrees with non-normative acts, actions or decisions of officials has the right to file a claim against the tax inspectorate. If the tax inspectorate unlawfully creates obstacles to business activity, this may also be the subject of a lawsuit.

The time limit for filing a claim is limited. You have 3 months from the moment you became aware of a violation of rights and interests. After this period, the arbitration court will not accept the claim. In turn, the arbitration court must consider the application within 3 months after filing the claim, and not only consider it, but also make a definite decision. It may turn out that the decision of the court of first instance will not suit one of the parties. Then she can appeal it to the appellate court.

Actions of the company after the start of a tax audit

Before submitting the requested documents and information to the tax authority, they must be carefully analyzed, including for compliance with each other and with current legislation. This is precisely the main recommendation for preventing tax risks.

| Circumstances | Happening |

| The documents contain information that can lead to two conclusions, and they will ultimately be interpreted not in favor of the company. | The company claimed a VAT tax deduction by attaching waybills, waybills and traveling statements. The inspection found that the waybills do not contain information about the route and speedometer, the invoices are not supported by documents, and the date of compilation is not indicated in the statements. In this regard, the tax deduction was denied, and the court supported this position. |

| The evidence presented by the company is contradictory. | The company was assessed additional income tax. To justify the costs incurred, she provided a subcontract agreement, invoices, a certificate of the cost of work performed and expenses, as well as an acceptance certificate for work performed. However, the names of the works in the subcontractor’s work completion certificate were not included in the work completion certificate issued by the company to the general contractor. Also, the subcontract agreement was signed by an unidentified person, since the signatory had died by that time. The court decided that the documents were contradictory and the additional assessment was justified. |

Interrogations of officials

It is worth noting separately that when conducting an audit, interrogations of officials who may know information important for tax control are important. It is strictly unacceptable for employees to testify without prior preparation, and in certain cases, without legal support. Unconvincing testimony, as well as testimony from which it follows that officials cannot answer the questions posed, will play a cruel joke and, together with other evidence, will allow tax inspectors to conclude that a violation of the law was committed and an unjustified tax benefit was received.

During interrogations, a person acting as a witness is quite often subjected to psychological “pressure” and pressure. Tax authorities use intimidation methods and threaten criminal prosecution in case of refusal to testify or giving knowingly false testimony. One of the favorite techniques of inspectors is the promise to immediately transfer the inspection materials to the internal affairs authorities for a decision to initiate a criminal case.

To mitigate the pressure factor from the tax authority, preliminary preparation and legal support are necessary. In addition, this will allow employees to provide testimony that can most favorably influence the final decision.

This alternative method of proof, such as a lawyer’s survey, has long shown its effectiveness. It is a simulation of interrogations by tax authorities with all the tricks that are well known to experienced lawyers.

In what situations is the help of a tax lawyer needed?

Any business strives to reduce costs and increase income, and the taxation system plays a significant role in this. How not to overpay taxes, but also not raise questions from the Federal Tax Service? How to conduct business honestly, but at the same time make good money? In order to ensure the accuracy of tax reporting, entrepreneurs resort to audits. This method is good for preventing possible conflicts with the tax authorities, but what to do if problems have already arisen? If, according to your data, the amount of taxes is one, but the inspectorate charges another? How to behave if you are asked to provide documents and give explanations? The dialogue with the tax office does not always go in favor of the entrepreneur. The tax service has long turned into a supervisory and punitive body, and not an organization that promotes honest business. Automated systems easily identify shortcomings and tax evasion. If you are required to provide an explanation, it means that the Federal Tax Service has found grounds for this. In what situations is the help of a tax lawyer needed?

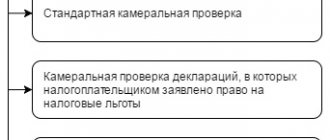

- You have received a notification about a desk or field inspection. How to prepare, how to behave during inspections? A specialist will provide instructions and accompany you during the inspectors’ visit.

- Discrepancies have been identified between your data and the data of the tax office. Here it is important to identify the reason for the discrepancies and collect evidence confirming the correctness of your numbers.

- Your company is being held liable for taxes. It is important to find out for what reasons and whether the strictly established procedure was followed.

- Problems arose with the use of BSO and CCT.

- You have been refused a refund of overpaid taxes or a VAT refund.

In most cases, accusations arise on the basis of cooperation with unscrupulous contractors. Tax authorities often mistake real companies for unscrupulous ones, which entails additional tax charges.