The VAT return submitted by an enterprise is a source of information for the tax authorities about the amount of calculated tax and deductions. During the inspection, inspectors check the correctness of filling, completeness of calculations, and the reliability of the information provided. One of the indicators reflected in the tax return and monitored by the tax office is the specific weight of the deduction. For Russian cities, the Federal Tax Service has established safe values for this indicator. The average statistical threshold for VAT deduction in Russia is 87.9%. Inspectors pay attention to enterprises that indicate a high proportion of deductions, because this is considered serious evidence that the enterprise has a weak tax burden. And the problem becomes the reason for sending a request to the organization to provide explanations, and then the reason for ordering an on-site inspection. In order to remove suspicions from the organization regarding the legality and legality of transactions carried out in accounting and tax accounting, it is recommended to promptly provide inspectors with an explanatory note about the reason that provoked the increase in the share. Some accountants act proactively and, without waiting for requirements from the inspection, attach to each VAT return a letter of reference about the level of the share of VAT deductions and indicate what share of profit deductions in the organization for the reporting period, and give the necessary explanations.

What is the share of VAT deductions?

The activities of any organization are constantly monitored by the authorities of the Federal Tax Service of Russia. The tax inspectorate pays special attention to compliance with the limit values of many indicators (and there are about forty of them), since they are often the ones that indicate gross violations in accounting.

However, the greatest attention is still paid to the criteria related to the calculation and payment of VAT, in particular to the amount deducted from the tax base for the final calculation of the tax. The specified deduction should not exceed predetermined limits, which are set as a percentage of the amount of this tax. This limitation is called the specific weight of the VAT deduction.

Situations when you need to write explanations about the high share of tax deductions for VAT

In 2007, the Federal Tax Service established parameters by which payers can assess the risk of a tax audit. One of these parameters is the excess of the share of deductions from existing standards. One of the parameters is reducing the tax burden.

The tax office may send a letter demanding an explanation of the reason for the discrepancy between the load and the average value. If the refund share exceeds 89%, there is also a risk that tax authorities will raise questions.

A high percentage of base decline is considered to be more than 89% per year. On average, the share of deductions in Russia is 88%. The safe interest parameter is quite conditional. It is difficult to know in advance which share will not raise questions from inspectors. You can calculate the approximate share indicator using a special formula - you need to divide the indicators of line 190 by the indicator of line 118 in section 3 of the declaration.

An explanation of the excess return share can be drawn up in any form. It is necessary to show the circumstances why the workload has significantly decreased, and provide primary documents if necessary. To avoid sanctions from tax authorities, explanations should be provided in a timely manner.

What is the share of VAT for organizations and individual entrepreneurs?

The share for organizations and entrepreneurs is calculated for each individual and depends on the size of the tax base and the region of registration of the entrepreneur or enterprise. It can also be influenced by indicators such as the scope of activity or business profitability.

Important ! For each region, the ratio of the possible deduction to the tax base may be different. However, in the Russian Federation on average as of January 1, 2022 it was 88.06%.

Safe share of VAT deduction: what is it?

A similar term denotes the percentage of VAT deductions to the amount of accrued tax, reflecting the amount by which the enterprise reduces the amount of VAT payable and, most importantly, to which the Federal Tax Service will be loyal.

The large share of VAT deductions in the declaration is one of the main criteria for conducting an on-site tax audit. This criterion was developed by tax authorities so that taxpayers can independently calculate the amount of deductions and assess the risks of initiating an audit by the Federal Tax Service. It is enshrined in clause 3 of Appendix 2 to the order of the Federal Tax Service No. MM-3-06/333 dated May 30, 2007. A share of 89% or higher of the VAT accrued for the previous 4 quarters is considered high. This indicator is indicated in the order of the Federal Tax Service No. MM-3-2/467 dated October 14, 2008 and so far its size has not changed.

Regional authorities may set different amounts for the share of VAT deductions, since this average value does not take into account many factors, for example, the specifics of production, industry characteristics, seasonality of business and even distance from the center. Safe shares of VAT deductions vary significantly by region, so it is important to refer to current statistics periodically published on the websites of the Federal Tax Service. These statistics were last updated as of 06/01/2020, prior to 02/01/2020. In Moscow, the safe share of VAT deductions for the 1st quarter of 2022 was 89%, for the 2nd quarter – 89.8%. Data on this indicator for the 3rd quarter of 2022 have not yet been published.

What are the consequences of exceeding the share of VAT deductions for organizations and individual entrepreneurs?

With a high proportion of the VAT deduction, the amount of this tax approaches zero, which is regarded by the tax authorities as a violation of the established criterion. In this regard, the tax inspector may demand clarification or call the head of the organization or entrepreneur personally to the territorial body of the Federal Tax Service. Representatives of the tax service may also come with an inspection.

Important ! Exceeding the percentage ratio of the deduction to VAT is one of the indicators that the Federal Tax Service pays attention to when compiling a list of candidates for an on-site inspection. However, violation of this restriction is significant only if other indicators are also violated.

It should be noted that not only exceeding the established values may be of interest to tax authorities. They may also consider the percentage of the deduction to be too low to be suspicious. Therefore, organizations and entrepreneurs who want to reduce the attention of tax authorities in this way risk, on the contrary, attracting unnecessary interest.

Explanation to the tax office about the high share of tax deductions for VAT

There are objective reasons for the high share of VAT deductions, but explanations and options for how to write the document should be considered in advance. A properly written explanation allows you to avoid sanctions and fines. The explanation to the tax office is drawn up in writing.

The procedure for requesting and providing an explanation is reflected in the letter from the Federal Tax Service of Russia. A covering letter can be attached to the text of the explanations. If the company does not provide the document in a timely manner or the contents do not satisfy the inspectors, a summons to the commission is possible.

An example of an explanation for a requirement

Typically, an explanation to the tax office about a high share is required if the deduction exceeds the average data for reducing the base for the region. Before drawing up a document with explanations, it is recommended that you familiarize yourself with the design examples.

It is necessary to establish what factors caused the share to increase. Many firms transfer deductions to future periods in order to comply with the standard, despite the fact that it is not considered mandatory for the payer. The possibility of transfer is provided for in Article 172 of the current Tax Code, but only those indicators that are displayed in Article 171 can be transferred.

Due to the discrepancy between the invoices in the company's purchase book, which are reflected in the ASK VAT database, the counterparty's tax return, questions arise from the tax service. Then you need to compose a response, indicate the request number and date, the reasons for the discrepancies, and display the articles based on which the actions were taken.

A violation is the transfer of the indicator from the advance payment, travel deductions, returns from the buyer acting as a tax agent, and returns on property that was received as a contribution to capital.

Often, demands are made to provide an answer if the purchase book contains a spent advance payment, the statute of limitations of which is three years. In this case, the response with explanations reflects when the advance payment was received, when the products were shipped, and whether the period of 3 years applies for claiming VAT for deduction in a particular case.

Often, requests arise in situations where the supplier of the first-level counterparty and other links does not submit documentation in a timely manner. Refusal to reduce the tax base often occurs if a company abuses the rights in Article 54 of the Tax Code. Compensation may be denied if the person deliberately distorted the facts in the reporting, the transaction is not related to the implementation of tasks, but was carried out with the aim of minimizing payments, the contractor is recognized as fictitious. But in the absence of evidence from the tax service of coordination of the actions of the applicant and counterparties, the claims can be challenged in court.

The discrepancy between the SF numbers displayed in the ASC database and the numbers that were submitted for desk audit is not always a reason for refusing deductions. According to Article 169 of the Tax Code, shortcomings that do not prevent tax officials from identifying the seller and buyer, the name of goods and other data during an audit are not grounds for refusing to accept tax indicators for deduction. If such a situation arises, tax authorities may require clarification or corrections to the SF number.

What to do if the specific gravity of the deduction is exceeded?

First of all, in order to know whether the deduction amount is higher than necessary and to prepare for the application of measures to your organization by the tax authorities, you need to calculate its specific weight. For the calculation, you can use the VAT return, namely its third section. It contains the following lines:

- VAT deductible – line 190;

- VAT accrued – line 118.

So, the specific gravity value is found using the following formula:

VAT deductible: VAT accrued * 100%.

To trace the trend, it is advisable to calculate the share for the last several periods.

When indicating a deduction for value added tax above the average value, it is necessary to prepare for the fact that the tax office will require explanations by sending a corresponding request or by calling the taxpayer to give explanations in person. Therefore, you should prepare in advance, namely:

- Collect documents confirming the right to a deduction and its amount;

- Prepare documents for the representative of the organization on his powers.

We calculate the share of deductions

In different regions, indicators can be either higher or lower than 89%. Let us calculate, for example, the indicator of the safe share of deductions in the Vladimir region. It is 85.55% (138,633,101: 162,037,843). As you can see, it turned out to be lower than the federal figure (85.55% < 89%).

You will also need an indicator for the company. To determine it, you need to make calculations based on declarations for the last four quarters: add up the amount of accrued VAT, add up the amount of deductions, divide the total amount of deductions by the total amount of accrued VAT.

This way you will determine the share of deductions in the total amount of calculated VAT for four quarters. It needs to be compared with the share of deductions established by the Federal Tax Service of the Russian Federation, as well as with the indicator for your region.

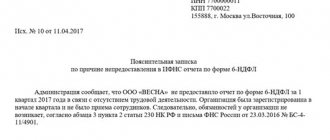

How to correctly draw up explanations when the amount of VAT deductions has been exceeded?

On the Internet you can easily find an answer to the tax authority’s demand for an explanation of the high share of VAT deductions. However, the time spent searching for a template can be saved, since such a response does not require strict adherence to the form: it can be compiled in free form. As part of this article, we will provide an approximate plan for writing a response, which will give an idea of how to give an explanation to the Federal Tax Service in connection with the excess of the specific weight of the tax deduction.

So, in a written response to a request for clarification, you must indicate which specific requirement you are responding to. Next, you must inform that you analyzed the documents confirming the size of the tax base and deductions. If any inaccuracies are identified, write about them. If there were none, report that no such were identified. Next, write about whether you consider it necessary to submit an updated VAT return to the Federal Tax Service:

- Errors are identified - there are reasons, support them with an adjusted declaration;

- No shortcomings were identified - no reason.

Next, describe the situation that served to increase this indicator with references to supporting documents and legislative acts.

At the end, you say that you consider yourself a law-abiding taxpayer.

Criteria for selecting companies for inspection

Depending on the subject of the camera room, applicants for it may be companies whose VAT declarations:

1) contain errors and contradictions with information from documents available to the Federal Tax Service (declarations are subject to automated verification based on control ratios - Letter of the Federal Tax Service of Russia dated July 16, 2013 No. AS-4-2/12705 );

2) tax benefits are declared ( clause 6 of article 88 of the Tax Code of the Russian Federation ). One of the most frequent requests from tax authorities during a desk tax audit is the request for documents on preferential transactions reflected in the VAT return in section 7 “Transactions not subject to taxation.” (Recall that the right to request documents within the framework of the “camera chamber” regarding preferential transactions can be exercised by the tax authorities in a situation where the applied benefit is intended only for a certain category of persons - clause 14 of the Resolution of the Plenum of the Supreme Arbitration Court of the Russian Federation dated May 30, 2014 No. 33 , resolution AS UO dated 02.24.2015 No. F09-579/15 in case No. A71-6132/2014 , dated 02.17.2015 No. F09-10024/14 in case No. A60-21098/2014 , dated 05.23.2014 No. F09-5197/12 in case No. A60-32962/2011 );

3) the amount of VAT for reimbursement has been presented ( clause 8 of Article 88 of the Tax Code of the Russian Federation , Letter of the Federal Tax Service of Russia dated September 16, 2015 No. SD-4-15/16337 );

4) contradictions and inconsistencies have been identified that indicate an understatement of the amount of VAT to be paid or an overstatement of the amount of VAT to be reimbursed;

5) mandatory documents that must be submitted simultaneously with the declaration are not attached ( clause 7, article 88 of the Tax Code of the Russian Federation ).

Having received an electronic request or notification from the tax office, the accountant must send a confirmation in response. Otherwise, the inspectors have a legal basis to block the bank account ( clauses 1 and 11 of Article 76 of the Tax Code of the Russian Federation ).

Tax authorities have the right to send a request for a desk audit within three months from the date of submission of the declaration (calculation), except for cases where the request is sent as part of additional tax control measures (in this case, tax authorities can send it outside the three-month period). The company has the right not to comply with the demands of tax authorities sent outside the three-month period of a desk audit ( clause 11, clause 1, article 21 , clause 2, article 88 , clause 1, article 93 of the Tax Code of the Russian Federation ).

However, companies should keep in mind that failure to provide explanations does not prevent the continuation of the tax audit ( Clause 5 of Article 88 of the Tax Code of the Russian Federation ). When a tax authority detects tax violations, a tax audit report is drawn up ( Clause 1, Article 100 of the Tax Code of the Russian Federation ).

The company must submit clarifications or make corrections to the submitted declaration within five working days after the date of receipt of the request ( clause 3 of Article 88 of the Tax Code of the Russian Federation ). And the company is given ten working days to submit documents after receiving a request for them from the Federal Tax Service.

In the case of a desk audit of the VAT return, explanations must be submitted in electronic form in the format approved by the Federal Tax Service ( clause 3 of Article 88 of the Tax Code of the Russian Federation , Letter of the Federal Tax Service of Russia dated January 11, 2018 No. AS-4-15 / [email protected] ). If you do not draw up an explanation or submit it at the wrong time, the company may be fined 5,000 rubles, and if the violation is repeated within a year, 20,000 rubles. ( Article 129.1 of the Tax Code of the Russian Federation ).

Here are the most popular requirements of tax authorities regarding requests for documents and explanations on declared VAT deductions.