Tax deduction codes: table description

Let's consider frequently used tax deduction codes when filling out the 2-NDFL certificate (from 2022, instead of the 2-NDFL certificate, an application is filled out as part of the 6-NDFL calculation):

- 126 - code that is indicated when providing a standard deduction for a child under 18 years of age or a full-time student under 24 years of age in the amount of 1,400 rubles.

- 127 - standard deduction in the same amount provided for the 2nd child.

- 311 - property deduction for the purchase of housing, if the employee has expressed a desire to receive this deduction through the employer.

- 320 - social deduction for employee expenses on their own training.

- 321 - social tax for children's education.

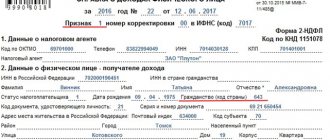

ATTENTION! If an employee has brought several notifications, for example, about the right to property and social deductions, a separate page of the 2-NDFL certificate is filled out for each of them. On the second and subsequent pages, only the fields “TIN”, “KPP”, “Page”, “Certificate number”, “Reporting year”, “Characteristic”, “Adjustment number”, “Submitted to the tax authority (code)” are filled in. “Notification type code”, “Notification number”, “Date of issue of the notification” and “Code of the tax authority that issued the notification”.

What if the employee did not receive the benefit?

It happens that the employee did not know that he was entitled to any personal income tax benefit. It is likely that he either was not informed about this or did not provide documents in a timely manner. In this case, he can return the amount he overpaid to the tax authorities.

To do this, you need to provide a package of documents to the tax service. Deduction codes 126 and 127 in the 3-NDFL declaration will also have to be indicated if suitable deductions are made under this value.

It is also necessary to take a certificate from your place of work in form 2-NDFL, as well as copies of the children’s birth certificates, and, if necessary, a certificate from their place of study. It is worth remembering that you can only return amounts for the last three years. That is, in 2022 you can receive money for 2014, 2015, 2016.

Deduction codes 126 and 127 will appear in the declaration automatically if you specify them in a specific tab in the program provided by the Tax Service website. If the return is carried out over several years, then several declarations will have to be drawn up, separately for each year.

What are tax deduction codes for?

The tax deduction code is a digital code. A deduction is an amount that, if there are documented grounds, can be reasonably deducted from the tax base, thereby reducing not only it, but also the amount of tax accrued from this base.

The deduction code is required when filling out Appendix No. 1 to the calculation of 6-NDFL, an employee:

- a tax agent reporting form on the payment of income and the amount of tax withheld from it;

- tax agent reporting form on unwithheld tax on income paid;

- a document confirming the amount and types of income received by the taxpayer at the place of work, and the amount of personal income tax paid by him when applying to various authorities (for example, for a new job, to the Federal Tax Service, bank).

Find out whether the deduction code should be indicated in the application for its receipt from the sample compiled by ConsultantPlus experts, having received trial access to the system.

List of documents required to apply for a child benefit

A standard deduction for children is issued by a tax agent for an employee, subject to writing an appropriate application and providing a certain package of documents. Knowing that some employees have children does not oblige the landlord to apply this basis for reducing the tax base; supporting documents are needed. Why? Because a tax deduction can be issued not only through the employer, but also through the Federal Tax Service or, for example, the second spouse receives a double deduction. To avoid illegal situations, confirmation of the right to reduce the amount of personal income tax for minors is required.

The application is written in free form, addressed to the manager, indicating the basis for the deduction, the full name of the children and the year of their birth.

The following package of documents is attached to the form:

- taxpayer passport;

- children's birth certificate or passport if they are over 14 years old;

- documents confirming the disability group;

- papers on adoption (adoption, guardianship, trusteeship)

- Students require a certificate from the dean's office confirming this fact.

The employer may require additional official documents, for example, to certify that the minor lives with the applicant.

At the same time, according to the letter from the Federal Tax Service, re-submission of documents if the situation in the family has not changed is not required. In most cases, the landlord only requests a document for the child and an application.

Which deduction table is used in 2021-2022?

The last time adjustments to the table of deductions were made by order of the Federal Tax Service of Russia dated September 28, 2021 No. ED-7-11 / [email protected] The following changes occurred in it:

- added code 280 - bet amount, which reduces the amount of winnings;

- added code 323 - the cost of medicines purchased by the taxpayer;

- code 324 has been changed - cost of medical services;

- added code 329 - fitness expenses;

- “WWII home front workers” was added to code 507;

- added code 511 - deductions from income in the form of winnings;

- code 512 has been added - a deduction from the amounts of financial assistance provided by an organization carrying out educational activities in basic professional educational programs.

Structure of the new table of deduction codes

The table of deduction codes consists of 14 sections named by types of deductions, and 1 additional code 620, which includes other types of deductions not listed in the table.

The sequence of sections and numbering of codes in them is as follows:

- standard deductions under Art. 218 Tax Code of the Russian Federation - codes 104, 105,126–149;

- reducing the base according to Art. 214.1 Tax Code of the Russian Federation - codes 201–203, 205–210;

- reducing the base according to Art. 214.3 Tax Code of the Russian Federation - codes 211, 213;

- reducing the base according to Art. 214.4 Tax Code of the Russian Federation - codes 215–220; 222–241;

- reducing the base according to Art. 214.7 Tax Code of the Russian Federation - code 280;

- reducing the base according to Art. 214.9 Tax Code of the Russian Federation - codes 250–252;

- property deductions under Art. 220 Tax Code of the Russian Federation - codes 311, 312;

- social according to clause 2 p. 1 art. 219 Tax Code of the Russian Federation - codes 320, 321;

- social according to clause 3 p. 1 art. 219 Tax Code of the Russian Federation - codes 323–326;

- social according to clause 4 paragraphs 1 art. 219 Tax Code of the Russian Federation - code 327;

- social according to clause 5 p. 1 art. 219 Tax Code of the Russian Federation - codes 328;

- professional deductions under Art. 221 Tax Code of the Russian Federation - codes 403–405;

- deductions for non-taxable income under Art. 217 Tax Code of the Russian Federation - codes 501–512;

- reducing the base according to Art. 214 Tax Code of the Russian Federation - code 601;

- investment deductions under Art. 219.1 Tax Code of the Russian Federation - code 618-619;

- other deductions - code 620.

The table ends with 5 notes referring to the document details on the basis of which social deductions should be applied.

Standard deduction codes 104, 105, 126–149 in the 2-NDFL certificate

These deduction codes, which give the employee the right to a personal deduction either due to special merits or because he has children, are most often included in the 2-NDFL certificate. In the new table, those that have been used since 2012 are kept unchanged. They are divided into the following groups:

- codes 104 and 105 - personal deductions in the amount of 500 rubles. and 3,000 rubles, provided to a person who has special services to the country (combatants, liquidators of accidents at nuclear facilities, holders of state awards);

- deduction codes 126, 127, 128 - presented to parents, spouse of a parent, adoptive parent for the 1st, 2nd, 3rd (and subsequent) children under the age of 18 years or up to 24 years old if the child is studying;

- code 129 - for a deduction provided to the parent, spouse of the parent, adoptive parent, who is supporting a child under the age of 18 years or up to 24 years old, if the child is a disabled person of group I or II;

- codes 130, 131, 132 - deductions for a child under 18 years of age or up to 24 years of age if the child is studying; deductions are submitted to the guardian, trustee, adoptive parent, spouse of the adoptive parent;

- code 133 - for a deduction for a guardian, trustee, foster parent, spouse of a foster parent who is supporting a child under the age of 18 or under 24 years if the child is a disabled person of group I or II;

- codes 134, 136, 138 - double deduction presented to the only parent, adoptive parent for the 1st, 2nd, 3rd (and each subsequent) child under the age of 18 years or up to 24 years old if the child is studying;

- codes 135, 137, 139 - double deduction presented to the sole guardian, trustee, foster parent, adoptive parent for the 1st, 2nd, 3rd child under the age of 18 years or up to 24 years old if the child is studying;

- code 140 - for a double deduction provided to the only parent, the adoptive parent, who is supporting a child under the age of 18 or up to 24 years, if the child is a disabled person of group I or II;

- code 141 - double deduction provided to the sole guardian, trustee, foster parent who is supporting a child under the age of 18 or up to 24 years if the child is a disabled person of group I or II;

- codes 142, 144, 146 - double deductions for the 1st, 2nd, 3rd (and subsequent) children under the age of 18 years or 24 years old if the child is studying; such deductions are presented to one of the parents of their choice on the basis of an application for the refusal of the second parent to receive a tax deduction;

- codes 143, 145, 147 - double deductions for the 1st, 2nd, 3rd (and subsequent) children under the age of 18 years or 24 years old if the child is studying; deductions are presented to one of the adoptive parents of their choice on the basis of a statement of refusal of the second adoptive parent to receive a tax deduction;

- code 148 - double deduction for a disabled child under the age of 18 or a student under the age of 24 who is a group I or II disabled person, which is presented to one of the parents of their choice on the basis of an application for the second parent’s refusal to receive a tax deduction;

- code 149 - double deduction for a disabled child under the age of 18 or a student under the age of 24 who is a group I or II disabled person, who is presented to one of the adoptive parents of their choice on the basis of an application for the refusal of the second adoptive parent to receive a tax deduction .

For all the deductions to which a taxpayer with children is entitled, read the article “Tax deductions for children in 2022 (personal income tax, etc.) .

If you find it difficult to provide a deduction to an employee in a particular situation, use free access to ConsultantPlus and go to the Ready Solution.

Property deduction codes

There are 2 main types of property deductions related to the purchase of housing, which, with permission obtained from the Federal Tax Service, can be fully used at work:

- code 311 - deduction for direct expenses on the purchase or construction of housing;

- code 312 - deduction for interest paid for a mortgage related to the acquisition of housing, which also takes into account interest paid when refinancing mortgage loans.

To learn how to get a deduction for an apartment purchased with a mortgage, read the material “Tax deduction when purchasing an apartment with a mortgage (nuances)” .

Social deduction codes

Since 2016, in a manner similar to the provision of property deductions (with a permit issued by the Federal Tax Service after checking documents confirming the right to deduction), it is possible to receive social deductions at the place of work. Their codes have not changed:

- code 320 - deduction for expenses for own education or full-time education of a sister (brother) under the age of 24;

- code 321 - deduction for expenses for full-time education of children (including foster children or wards) under the age of 24 years;

- code 324 - deduction for medical expenses for yourself, your spouse, parents or children (including adopted or warded children) under the age of 18;

- code 325 - deduction for contributions paid for voluntary health insurance for oneself, spouse, parents or children (including adopted or warded) under the age of 18;

- code 326 - deduction for expenses for expensive treatment;

- code 327 - deduction for expenses on paying contributions to non-state pension funds or under long-term voluntary life insurance contracts for yourself, your family members, close relatives;

- code 328 - deduction for additionally paid by the taxpayer savings contributions to the Pension Fund.

See also “Documents for obtaining a tax deduction for treatment” and “Application for a personal income tax refund for education - sample and form.”

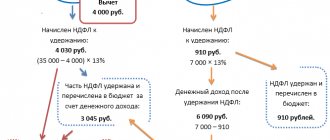

How can you calculate your tax?

If an employee wants to check his tax himself, then he must know how to calculate it correctly. In general, the entire amount of his salary is multiplied by thirteen percent or by 0.13.

However, if an employee has the right to a tax deduction and has provided a full package of documents, then he should not be taxed on the entire amount of his salary, but only part of it.

Deduction codes 126 and 127 assume, for example, that an employee who has a first or second minor child has the right to a deduction in the amount of 1,400 rubles. If there are two children, then the amount doubles. However, it is necessary to bring all documents for children on time. Otherwise, the lost amounts will have to be returned through the tax authorities and only for a certain period.

Deduction codes for non-taxable income

Deductions for non-taxable income have not changed. However, they also appear in the 2-NDFL certificate quite often, so it makes sense to recall their list:

- codes 501 and 502 - deductions for the value of gifts given at work and prizes received at competitions;

- codes 503 and 504 - deductions for payment of financial assistance to employees and reimbursement of the cost of medicines;

- code 505 - deduction for prizes received as a result of participation in promotional events;

- code 506 - deduction for financial assistance paid to a disabled person by a public organization of disabled people;

- code 507 - deduction for financial assistance or gift given to a WWII participant;

- code 508 - deduction for financial assistance at the birth (adoption) of a child.

- code 509 - deduction for income issued by products to an employee of an agricultural producer;

- code 510 - deduction for additional savings contributions to the Pension Fund of the Russian Federation paid by the employer for the taxpayer.

Legal grounds

It must be remembered that the type of certificate in question acts as an annex to the approved Order of the Federal Tax Service dated October 2015.

Every year, the tax authority makes various changes and additions to the document, which makes it necessary to study the Order for any adjustments, including the issue of amendments to the filling procedure and the BCC in particular.

If you use an outdated form, this may further affect the procedure for applying for a loan or the accuracy of filling out a tax return.

In the case of tax reporting for this year, the Federal Tax Authority approved the Order dated January 2022, which included amendments to the above Order.

At the same time, taking into account the amendments to the form in form 2-NDFL, they were approved late, which is why the inspectorate was forced to allow the filling out of income certificates not only using the new form, but also the old one.

In general, the amendments that were made to the document under consideration directly relate to the accounting service:

- as employers;

- as well as private entrepreneurs.

However, they may also be of interest to ordinary categories of taxpayers.

Investment deduction codes

The bulk of these deductions are associated with operations that have a fairly limited distribution. Their codes are used by professional participants in the securities market to compile 2-NDFL certificates. Most regular employers do not require these codes.

Among this group, only deduction code 601 for dividend income may be of interest to an ordinary employer. From January 2022, as noted above, a new investment deduction with code 619 was introduced.

Results

Deductions allow you to reduce the tax base for personal income tax. All deductions are encrypted with special codes, which are recorded in the 2-NDFL certificate. The last code update was at the end of 2022.

Sources:

- Order of the Federal Tax Service of Russia dated September 10, 2015 No. ММВ-7-11/ [email protected]

- Tax Code of the Russian Federation

- Order of the Federal Tax Service of Russia dated September 28, 2021 No. ED-7-11/ [email protected]

You can find more complete information on the topic in ConsultantPlus. Free trial access to the system for 2 days.

About the document

All employers are tax agents, as they pay personal income tax on the wages of their employees and report for them to the tax office. Personal income tax is a tax on personal income.

In addition, it is paid on all profits received: sales of real estate and other property, stocks and bonds, expensive gifts and inheritances received, lottery winnings.

Citizens must indicate all their income and expenses in a declaration (3-NDFL), submit it to the tax office and pay tax, which at the moment, depending on the type of income, can range from 13 to 35 percent.

For example, the rate on wages, dividends for residents of the Russian Federation, income of individual entrepreneurs on OSNO is 13%; on income from deposits, savings on interest on loans, prizes and winnings - 35%.

Information about income received at work and taxes paid on it can only be obtained by an individual from the employer. The accounting department issues a certificate of form 2-NDFL within three days after the employee submits the application.

Most often, persons apply for such a document in the following cases:

- to present it to credit institutions to confirm solvency;

- to apply for a tax deduction (for example, for parents of a student studying on a paid basis in government institutions);

- to present it to the court if the proceedings relate to labor disputes or alimony payments;

- to calculate old-age pension;

- to transfer information about income to a new employer (to determine income tax from the beginning of the year);

- in certain situations when applying for a visa (at some consulates);

- for calculating benefits at labor exchanges (salary for the last six months);

- Social protection authorities require a document to recognize a family as low-income and assign payments to it;

- to confirm your status to a guardian, trustee or adoptive parent.

A certificate is filled out on a specific form.

All amounts are indicated in rubles and kopecks (except for personal income tax). The document contains the details and name of the employer, full name of the employee, information about taxable income, income and tax deduction code.

The full amount of income, taxes and tax deductions for the billing period is also indicated.

Tax deductions are divided into groups:

- standard, available for victims of man-made and radiation disasters, Heroes of the USSR and the Russian Federation who participated in hostilities, parents, adoptive parents, etc.;

- property, rely on the purchase of real estate, sale of property, mortgage interest;

- social, provided for education, medicines and medical services;

- professional, they can be used to reduce income under the GPA (civil contract).

The standard deduction code is 126; in personal income tax certificate 2, like other codes, it is recorded in the fourth section.